eCommerce: Stocks

Walmart Sells JD.com Stake to "Focus on Walmart China"

Shares of JD.com dropped after Walmart confirmed it had sold its stake in the Chinese eCommerce giant.This move led to a 10% drop in its share price and raised doubts about whether JD.com can handle the changing market landscape.

Article by Patrick Nowak | September 09, 2024

Walmart Sells JD.com Stake to "Focus on Walmart China": Key Insights

Walmart Shifts Focus to China: The sale allows Walmart to concentrate on its China operations and reallocate capital to other priorities.

End of JD.com Partnership: Walmart’s $3.6 billion sale ends an eight-year partnership, though it plans to maintain a commercial relationship with JD.com.

In an interview with Investopedia, Walmart explained that the sale will allow the company "to focus on our strong China operations for Walmart China and Sam’s Club, and deploy capital towards other priorities." According to Bloomberg, Walmart raised approximately $3.6 billion from the sale.

While JD.com shares were affected, Walmart reiterated its commitment to maintaining a commercial relationship with JD, with a spokesperson stating, "JD has been a valued partner to us over the past 8 years, and we are committed to a continued commercial relationship with them." According to Bloomberg, Walmart raised approximately $3.6 billion from the sale.

JD.com Doubled Profits

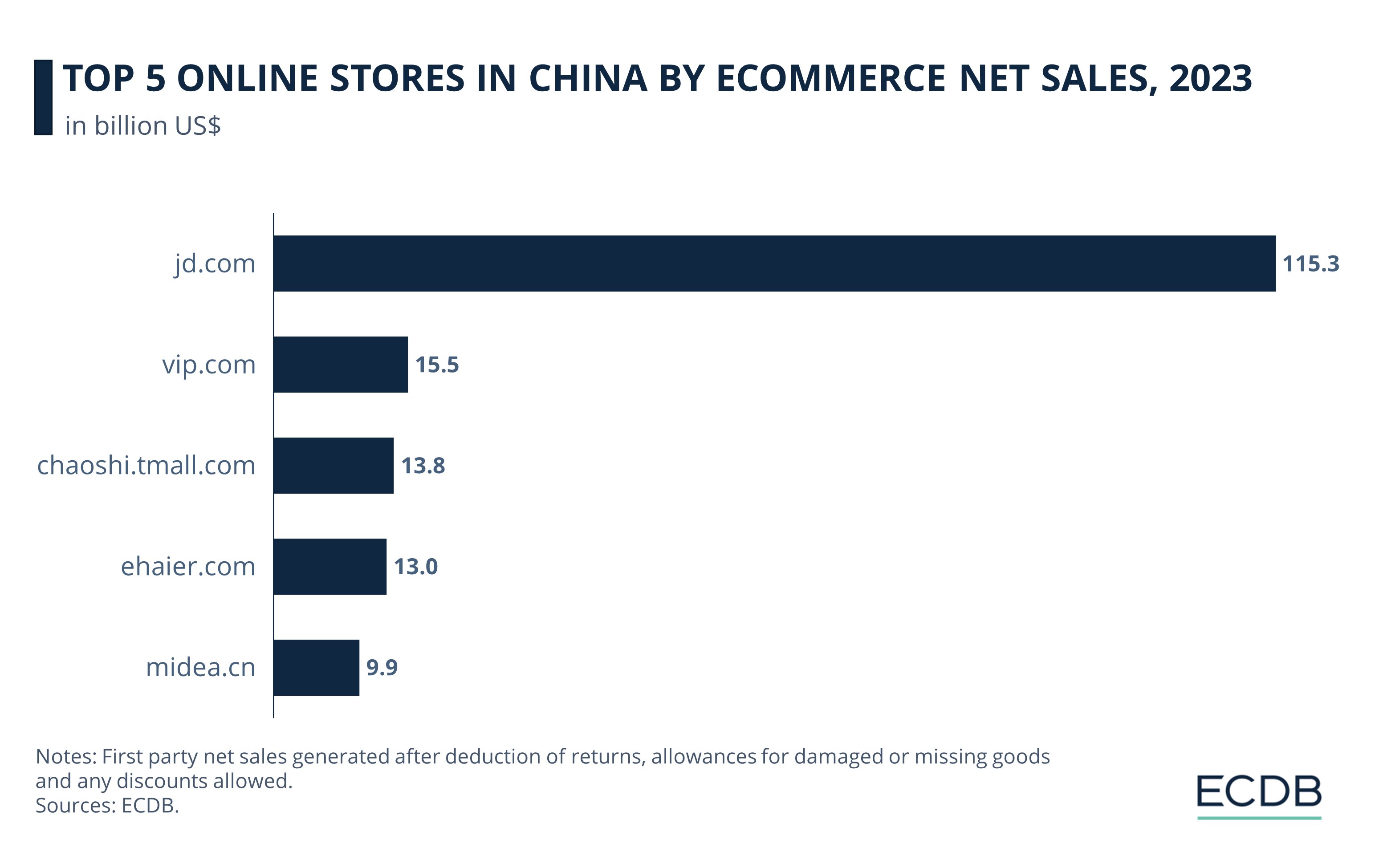

The sale of the stake follows JD.com's recent surprise announcement of a near doubling in its quarterly profits. Additionally, JD.com is by far the biggest online store in Greater China – but only in Greater China.

Walmart move led to a 10% drop in its share price and raised doubts about whether JD.com can handle the changing market landscape.

Like this insight? It is based on our regularly updated rankings. With our retailer and country rankings, you can learn valuable information about your specific market. Our product category rankings and benchmarks allow you to see where various businesses are currently evolving. This information can aid in your decision-making, whether you are a business developer, shop owner, or CEO of a large eCommerce brand. Stay a step ahead of the market with ECDB.

Consequences for JD.com

Walmart exit changes the game for JD.com. JD’s limited international reach puts it at a disadvantage compared to its competitors. The company’s strengths (its direct sales model and fast logistics) are now seen as expensive compared to rivals like Alibaba and PDD. JD.com is trying to stay competitive by lowering prices and expanding third-party sellers, but some analysts doubt these changes will lead to big growth quickly.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

ByteDance Is Big on Personal Care, Powered by Content on Douyin and TikTok Shop

ByteDance Is Big on Personal Care, Powered by Content on Douyin and TikTok Shop

Deep Dive

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Deep Dive

Online Shopping in China: Where Chinese Consumers Shop Online

Online Shopping in China: Where Chinese Consumers Shop Online

Deep Dive

Alibaba, Pinduoduo, JD.com Prepare For Singles’ Day Shopping Festival

Alibaba, Pinduoduo, JD.com Prepare For Singles’ Day Shopping Festival

Deep Dive

How Important is eCommerce for eCommerce Giants? Analysis of Alibaba, Amazon and JD.com

How Important is eCommerce for eCommerce Giants? Analysis of Alibaba, Amazon and JD.com

Back to main topics