How to Value an eCommerce Business

What Makes eCommerce Companies Valuable?

Total revenues, revenue growth, profits: ECDB shows how to value an eCommerce Business. Here is all you need to know about the value of a company.

Article by Nikolai Surminski | July 22, 2024Download

Coming soon

Share

How to Value an eCommerce Business:

Total Revenues and Growth: Investors see total revenues as crucial, with a 1% increase in revenues leading to a 1% increase in market capitalization. Revenue growth is even more valued, with a 1% increase boosting market cap by 1.9%.

Profitability: Higher operating profits positively impact market value, with a 1% profit increase resulting in a 0.7% rise in market capitalization, though growth potential is prioritized over current profits.

Global Presence: Companies with a strong international presence are valued higher, as reliance on the home market negatively impacts market capitalization by 5.5% for every 10% of revenues from the main country.

Product Categories: Companies focused on electronics, grocery, and DIY markets have significantly lower valuations, with reductions of 36.6%, 44.2%, and 54.4% respectively, due to competition, low margins, and operational challenges.

Some of the largest companies in the world operate in the eCommerce space. Apple Inc. (market capitalization of US$3.3 trillion), Amazon.com, Inc. (US$1.9 trillion) or Walmart Inc. (US$543.7 billion) are all among the most valuable companies in the world.

But what drives these massive valuations? We show you the most important factors in determining the value of eCommerce companies and what to look out for in the future.

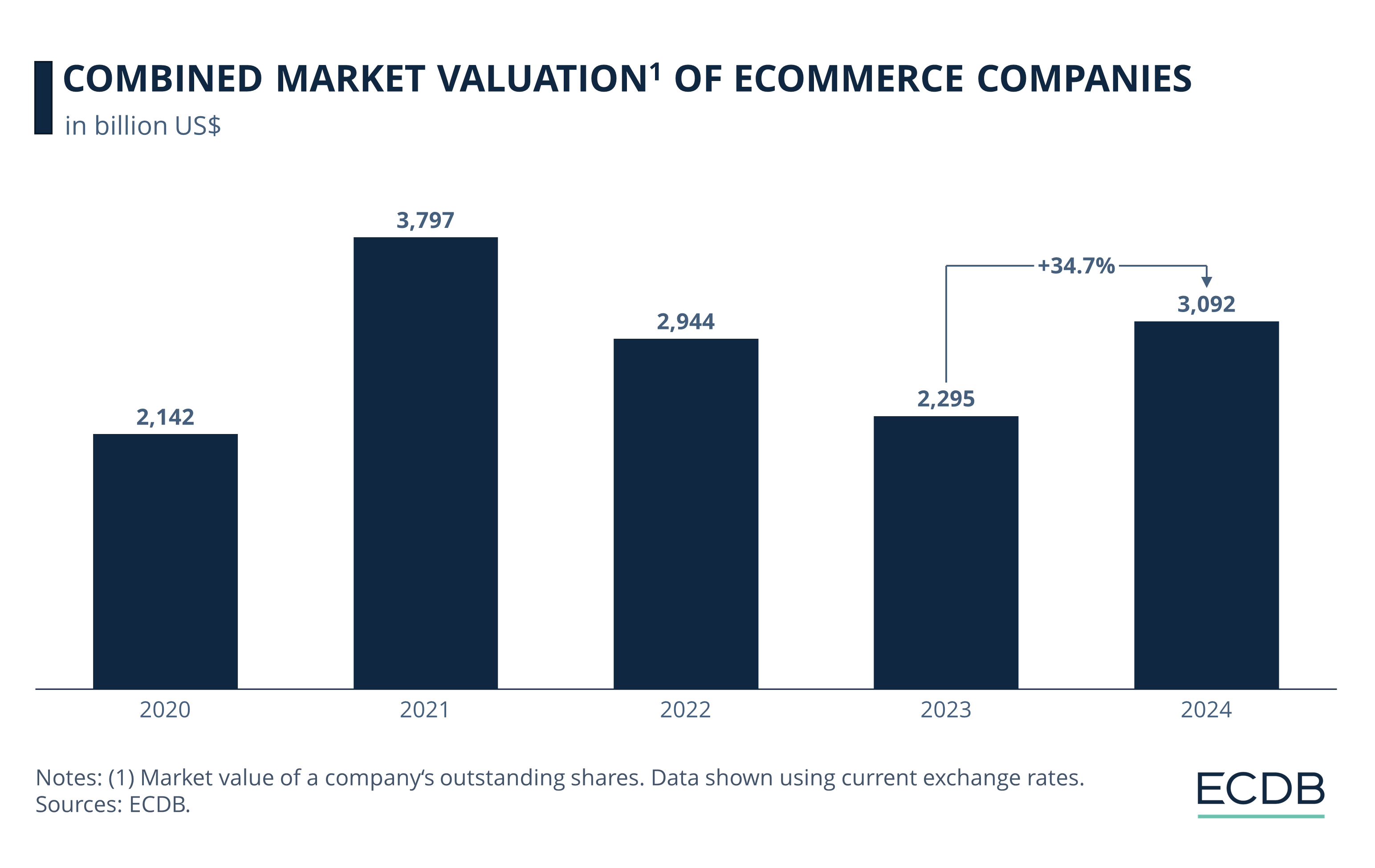

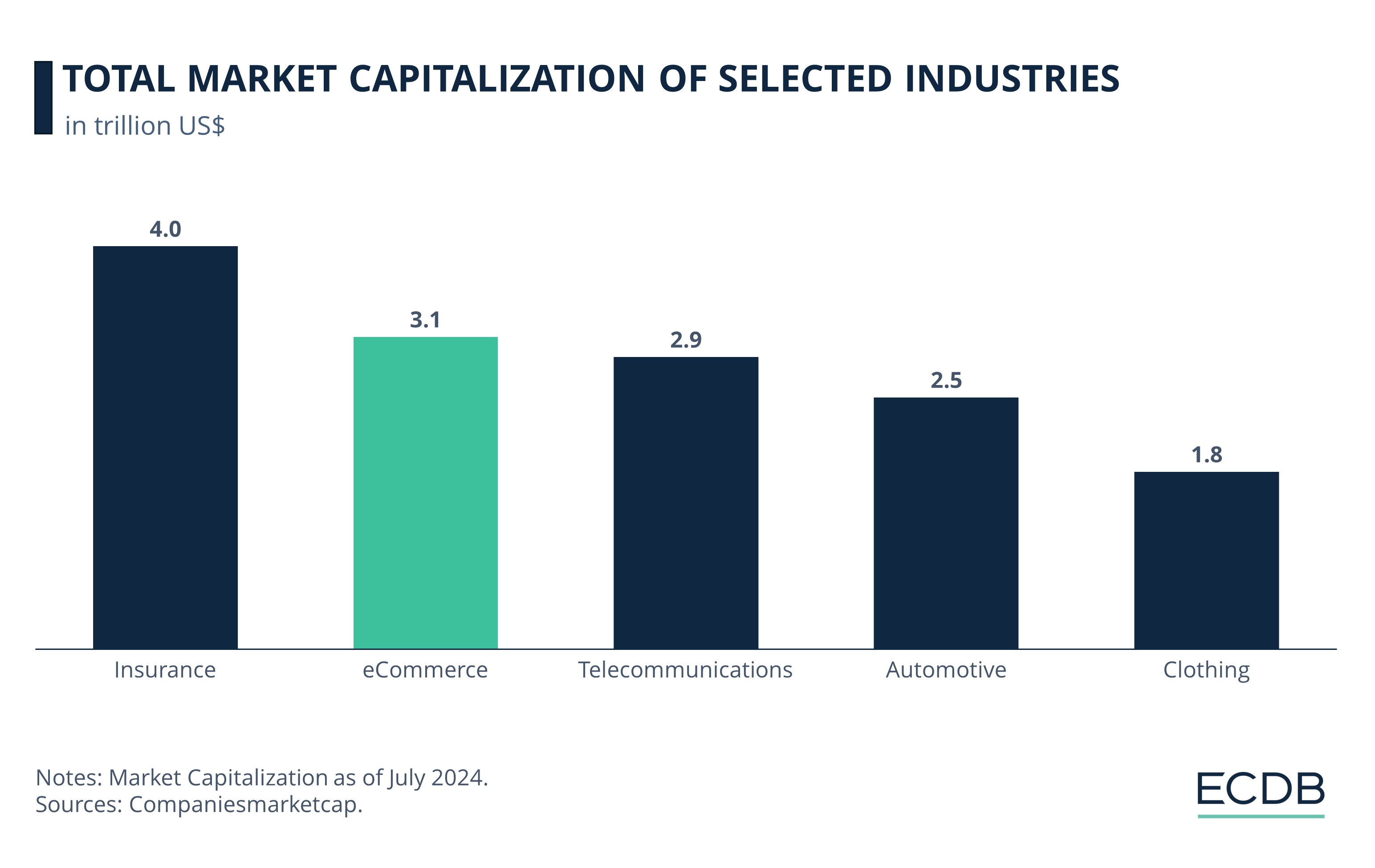

Global eCommerce Valuation Is Higher Than the GDP of Brazil or Italy

The combined valuation of public eCommerce companies is massive. Looking only at companies that generate the majority of their revenues through eCommerce, public companies have reached a combined market capitalization of more than US$3 Trillion. This far surpasses the valuation of other global industries such as the automotive industry , the telecommunication industry or the textile industry. For comparison, the industry’s market capitalization is higher than the GDP of entire countries like Brazil or Italy. And this does not even include massive eCommerce players such as Apple or Walmart for which digital retail is just a small segment.

While stock markets everywhere have had a great year, eCommerce companies fared particularly well. Compared to 2023, their combined market valuation has risen by 34.7%. This represents a break with the negative trend in previous years. 2022 and 2023 saw valuations decrease by 22% and 23% respectively as the eCommerce industry could not keep up the pace of the Covid years. Despite the significant rally in the first half of 2024, valuations have still not reached the historic levels of 2021.

Analysis of Hundreds of Companies Over Five Years

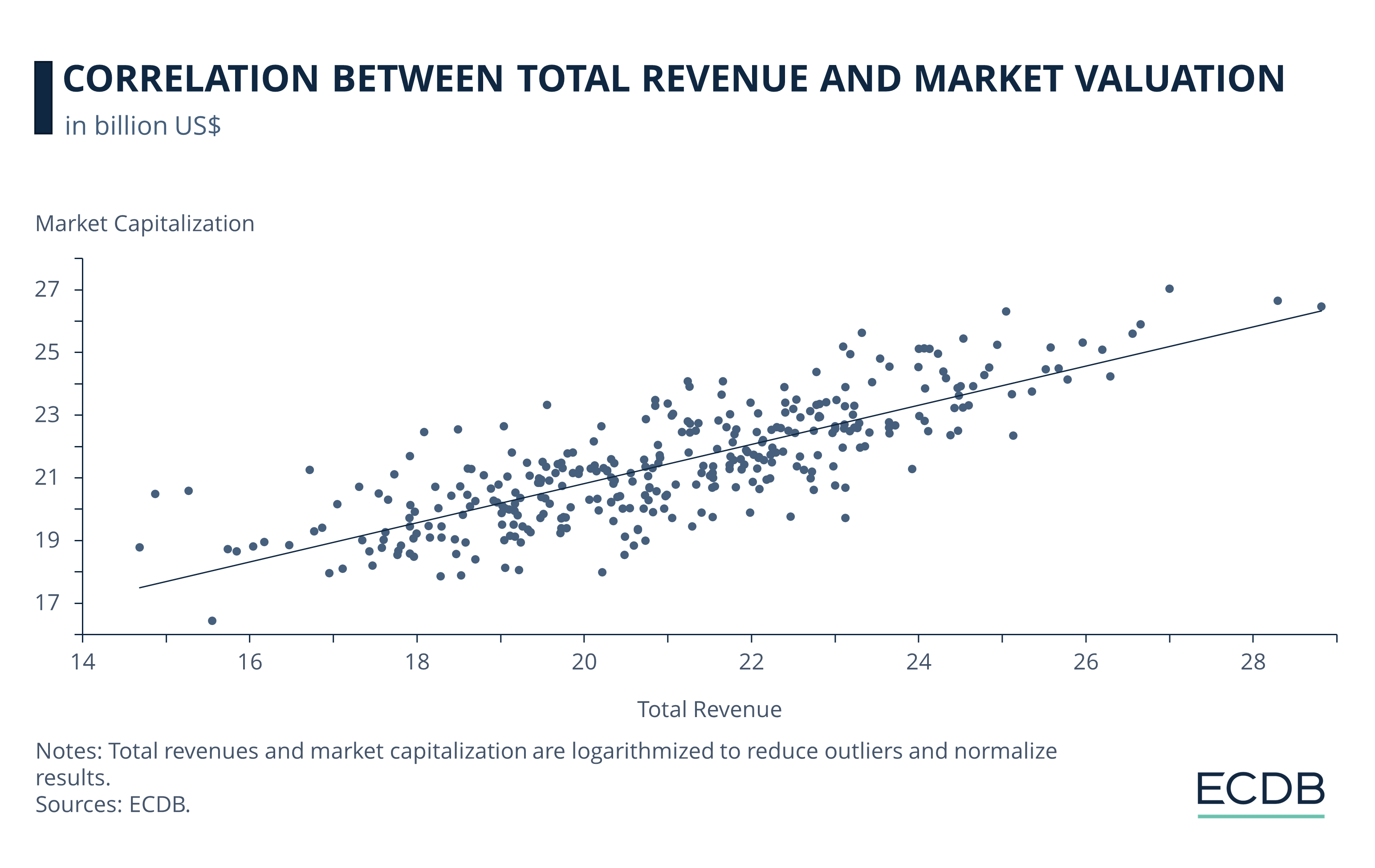

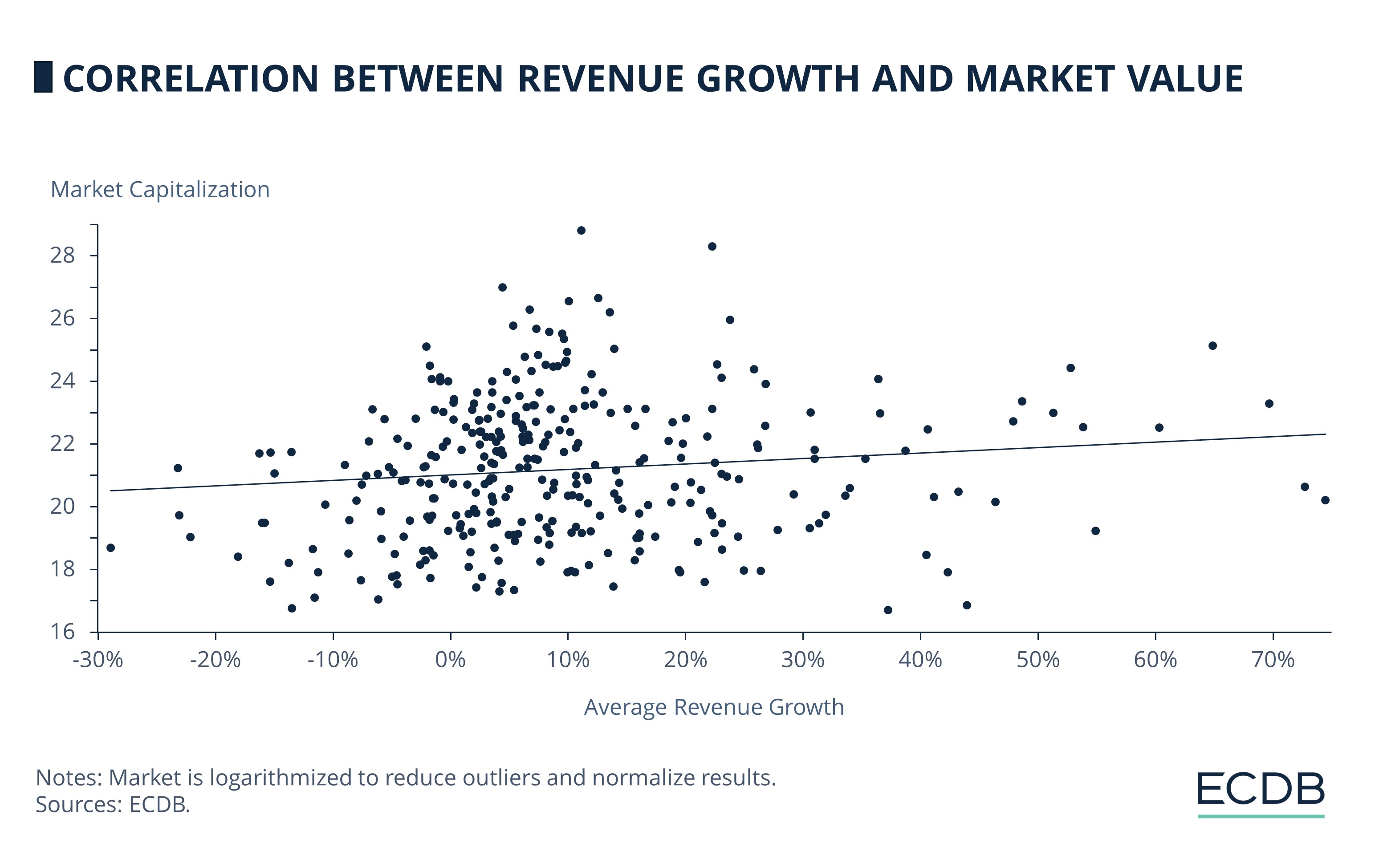

Using our unique database, we evaluated market capitalization and financial metrics of hundreds of public companies over a five-year period. Through statistical analysis, we found the factors that had the strongest impact on a company’s market valuation. All of these results can be interpreted as the direct effect of each specific metric if all other factors are unchanged.

Methodology For this analysis, we observe more than 200 public companies that generate more than 50% of their revenues through eCommerce over a timespan of five years. This does exclude larger companies such as Apple or Walmart and ensures a focus on the eCommerce space. To determine a company's value, we take market capitalization as a measure of valuation. We employ statistical regression models to derive results as well as various standardization and normalization methods to reduce outliers. Main product categories and home markets are defined as the market segment in which a company generates the highest share of revenue.

How to Value an eCommerce Business?

What makes eCommerce companies valuable? The answer is, it´s a mix of different factors.

1. Revenue Growth

Financial markets value revenue growth at a premium. Showing an additional 1% in revenue growth on average means an extra 1.9% in market capitalization. Investors expect rapid expansion and see strong revenue growth as an indicator of future success as well as a higher future earnings. The highly positive impact of continuously growing revenues shows that even after the Covid-fueled boom of 2020/21, eCommerce is still seen as a growth-focused market in which the caption of market share is essential.

2. Total Revenues

Data shows that investors see total revenues as one of the key determinants of a company’s value translating linearly into market capitalization. A 1% increase in total revenues leads to an average 1% increase in market valuation through proportional pricing multiples. High total revenues function both as a measure of business success in a competitive market and investor confidence due to past growth. Revenues are therefore a marker of a strong market position contributing to higher market cap.

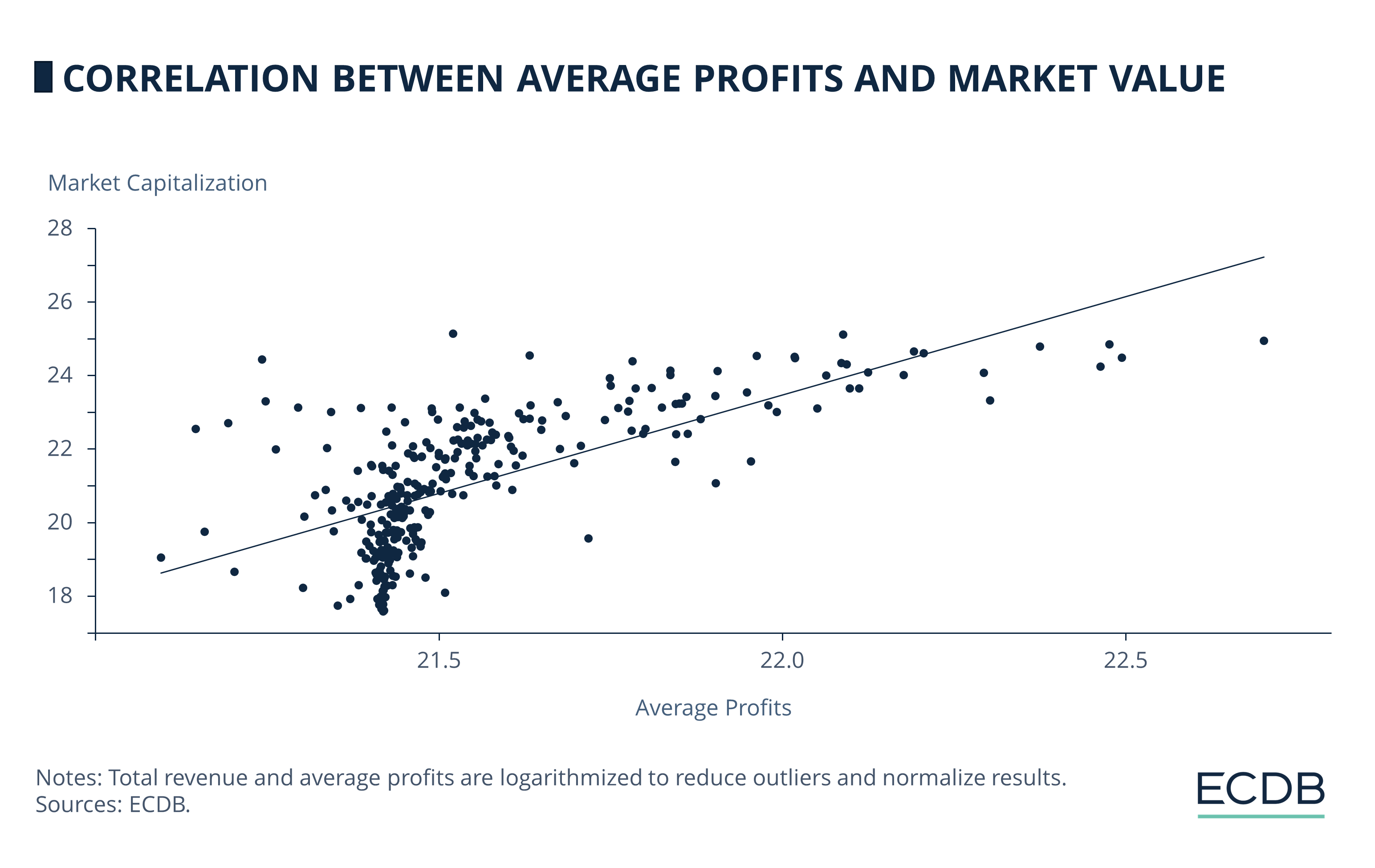

3. Profits

While not valued as highly as future growth, company profits still positively influence market capitalization. Operating profits that are 1% higher mean that a company’s valuation is on average 0.7% increased. This follows the standard understanding that a company’s value is the sum of its future cash flows set by profits. Current profits are therefore also a sign of future profitability while suggesting better financial health and operational efficiency. A lower impact compared to revenue growth shows that investors prioritize growth potential over current profitability as a better indicator of future market dominance and expansion opportunities.

4. Global Presence

Companies with an extensive international business are generally more valuable. Investors view heavy reliance on the home market negatively as market capitalization is on average 5.5% lower for each additional 10% in revenues generated in a company’s main country. Investors instead prefer a strong international presence for better growth potential. Concentration in one market exposes the company to specific risks while also suggesting that the company might have maximized its local market potential.

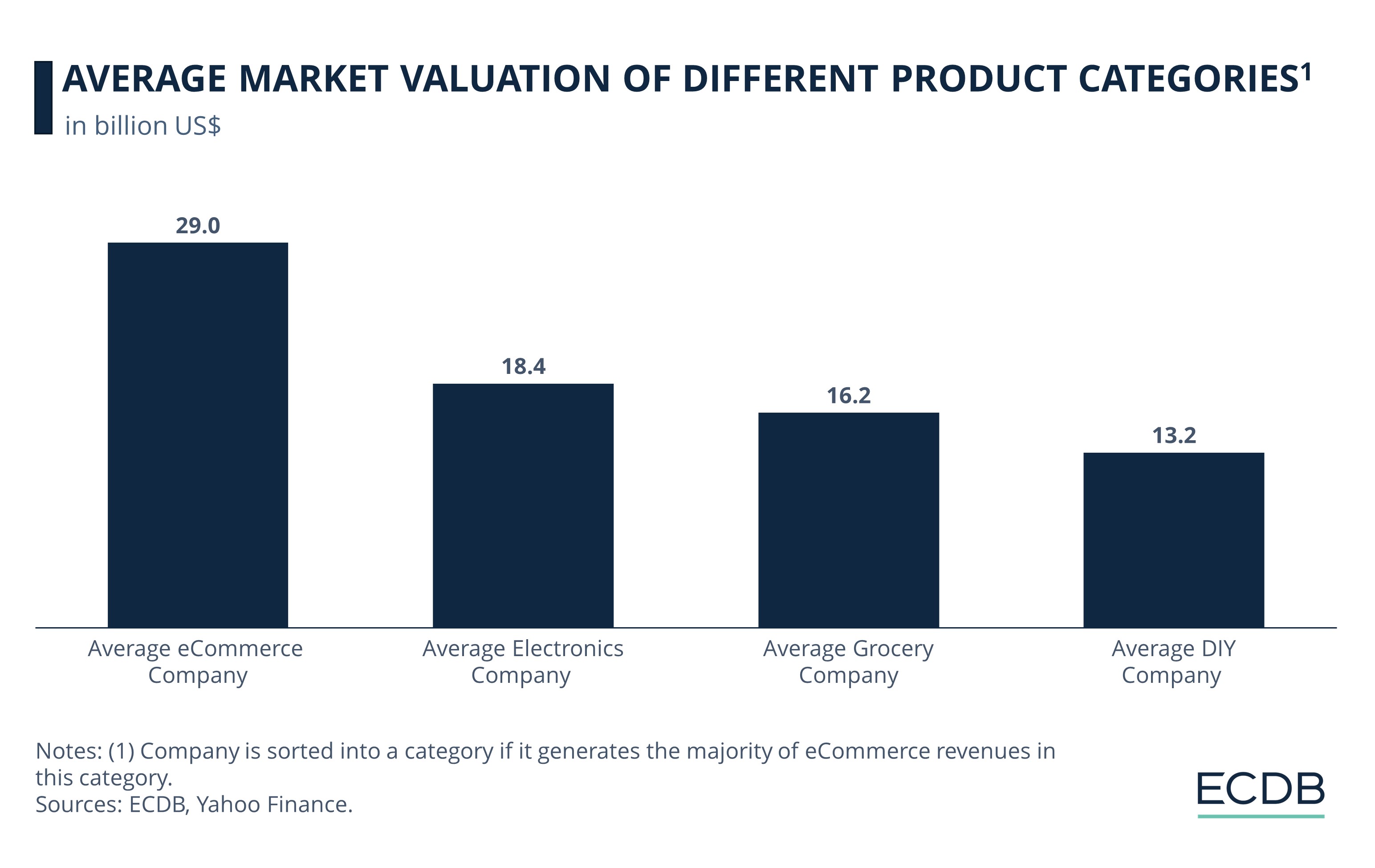

Some Product Categories Have Significantly Lower Market Capitalization

Looking at market capitalization, there are major differences depending on a company’s main category. As some categories are more competitive or tend to have lower margins, being mostly active in these markets can have a negative impact on the valuation of a business. This means that a company that generates the majority of eCommerce net sales in one of these product categories has a significantly lower valuation on average even if all other factors are similar to companies outside these categories.

1. DIY

Companies focusing on the DIY market have by far the lowest market capitalization. Just operating in the DIY space as the main field of business reduces market capitalization by 54.4% with all other factors being unchanged.

DIY businesses face logistical challenges with shipping bulky items increasing operational costs. Consumer spending in the DIY sector can be highly cyclical while its products have lower purchase frequencies compared to other categories limiting repeat business. The added revenue volatility acts as additional risk for investors.

2. Grocery

The highly competitive nature of grocery eCommerce is also visible in its market valuation. Companies that generate a large share of net sales through grocery have a market capitalization that is on average 44.2% lower than similar non-grocery retailers.

Low profit margins driven by complex supply chains and the perishable nature of goods are one of the main reasons. There is also major competition, both from brick-and-mortar supermarkets and other grocery platforms, as providers are quick to enter or leave new markets. Even established global players like Getir have not been able to run a profitable business on grocery eCommerce, showing why investors value these companies more critically.

3. Electronics

Companies that generate the majority of their net sales with electronics have a market capitalization that is on average 36.6% lower all other factors being equal.

Especially consumer electronics are often subject to price wars squeezing already thin margins. The market is highly competitive, and retailers are reliant on a few key products making them vulnerable to market fluctuations and changing consumer preferences. This leads investors to assign lower valuations in the face of higher risk.

What Role Does eCommerce Play for Valuation?

But not all company metrics have an impact on market capitalization. Especially directly eCommerce-related KPIs such as eCommerce activity tend to not have a clear impact besides the obvious connection to total revenues. Over the entire data set with hundreds of public eCommerce companies, neither eCommerce net sales nor GMV have a significant impact on market valuation. This does not mean that a company's eCommerce business does not affect its market valuation or investor sentiment. This effect, however, is only noticeable on an individual basis and cannot be generalized over the selection of all eCommerce companies. There is also no noticeable impact if a company is active as a generalist (generating a significant share of net sales from multiple product categories) or mostly active in a single product category.

eCommerce Valuations: Closing Thoughts

Following the positive trend for stock markets around the globe, eCommerce companies have shown impressive growth in their market capitalization. Key factors explaining the high valuations include total revenues, past growth and financial profits. Market segments and global presence also have a significant impact on the value of eCommerce businesses. Understanding the drivers of market capitalization can help investors and companies alike to prioritize business segments and strategies that are most promising for future value propositions.

There are few signs that market valuations will stop growing in 2024. Year-end targets for almost all major stock indices have been raised following strong earnings and rising stock prices. eCommerce companies like Amazon.com, Inc. or Walmart, Inc. have all reached all-time highs in recent days.

We also don’t anticipate major shifts in most value determinants. Total revenues, growth and profits are among the most important financial indicators across all industries and are not going to lose their importance. Right now, revenue growth is still a bigger factor in determining growth than profitability. As the eCommerce industry continues to mature and see companies that manage to combine global expansion and high profits (e.g., PDD Holdings, Inc.), we can expect these two factors to continuously balance out. This will not happen in 2024, as the market is too hot right now. But with even the largest companies focusing on profitability, this is expected for the next years.

As different market segments evolve differently, there is potential for changing valuation patterns in the future. Despite low margins and major competition, the grocery market is currently the fastest growing eCommerce category. We can also see more established players, such as large supermarket chains, pushing into the market while many quick commerce providers continue to struggle. If this is an ongoing trend that coincides with more stable earnings, we can expect grocery companies to be priced at a lower discount.

The eCommerce market is also trending towards marketplace and platform business. Marketplace business is also inherently more profitable, making it more attractive for investors. As we expect this trend to continue, we also expect a significant premium for platform holders in the future. Most of the biggest online-first retailers such as Amazon, Pinduoduo or Alibaba either prioritize their third-party platform or do not engage in first-party eCommerce at all. These companies are also among the most-valuable eCommerce companies in the world. This trend also reinforces the importance of global presence and profitability, underlining existent value determinants.

Sources: ECDB - Yahoo Finance

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

eCommerce in Canada: Top Stores, Market Development & Trends

eCommerce in Canada: Top Stores, Market Development & Trends

Deep Dive

Top Online Stores in Europe: Amazon Accounts for 40% of Top 20's Sales

Top Online Stores in Europe: Amazon Accounts for 40% of Top 20's Sales

Deep Dive

Top eCommerce Companies by Market Cap 2024

Top eCommerce Companies by Market Cap 2024

Deep Dive

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Deep Dive

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Back to main topics