eCommerce: Growth Trends

Fastest-Growing Online Stores by Net Sales Worldwide: Songmics Home Grew by Almost 4,000%

Which online stores had the highest growth rates in net sales worldwide? Considering only stores with eCommerce net sales over US$50 million, the results reveal common trends of companies that seek to increase their global reach. Here are the companies that outran all the others in 2023.

Article by Nadine Koutsou-Wehling | June 26, 2024Download

Coming soon

Share

Fastest-Growing Online Stores Worldwide: Key Insights

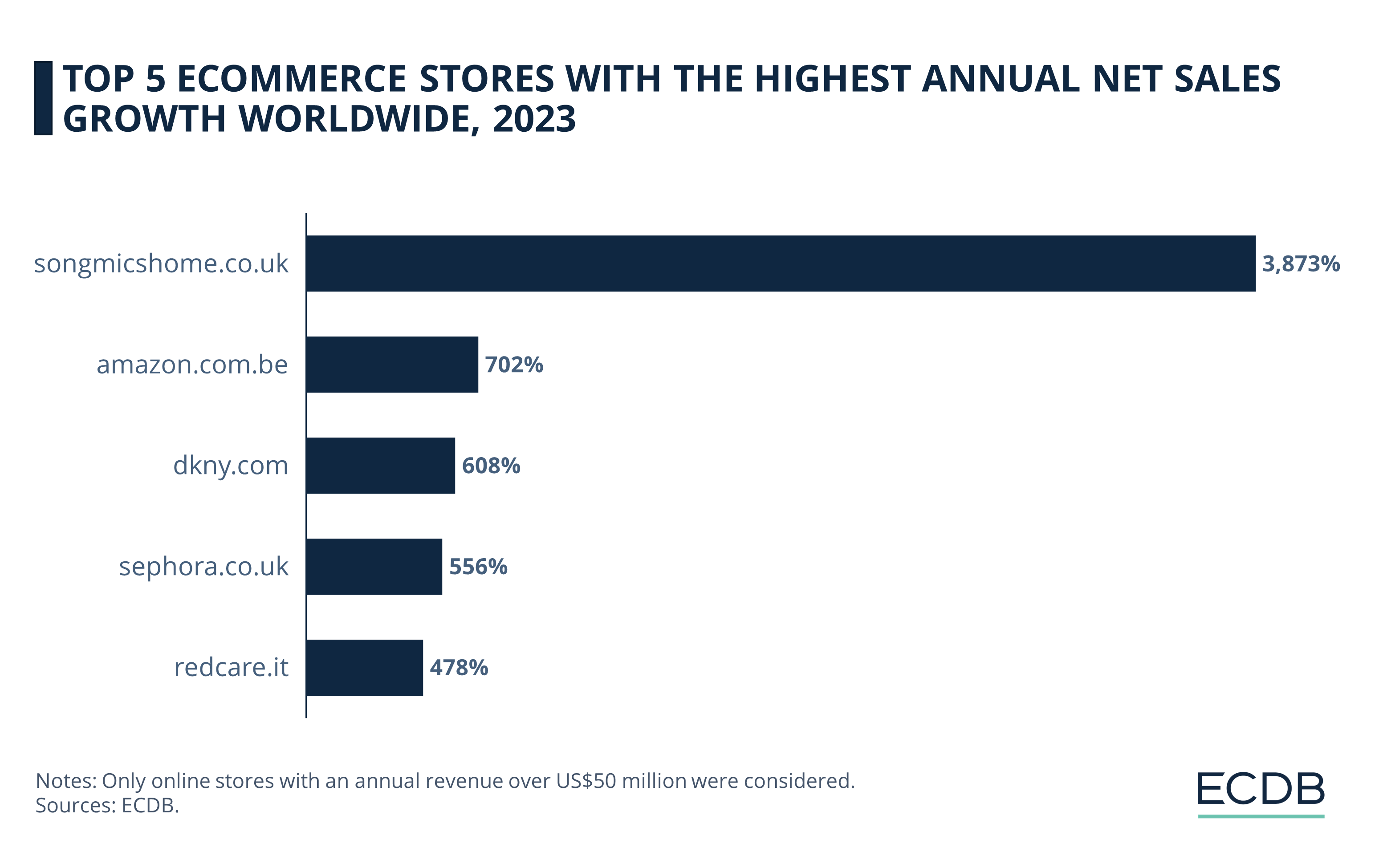

Top 5 Online Stores With Highest Annual Growth: Asian furniture & homeware online store Songmics Home had the highest annual growth with its UK domain in 2023, increasing revenues by 3,873% since 2022. The following stores on the list are further behind in growth rates, but still substantial, and include: amazon.com.be (702%), dkny.com (608%), sephora.co.uk (556%), and redcare.it (478%).

Regional Specification: Four of the stores on this list operate in Europe and one in the United States. All of these online stores belong to established retailers that expanded into new markets, therefore they were able to leverage existing infrastructure and know-how. This is mostly done through new regional domains that do not grow organically. Instead, they redirect existing traffic into new stores that than show sudden jumps in traffic.

Industry-Related Growth Factors: The fastest-growing store, songmicshome.co.uk, successfully uses gamification and deep discounting to offer attractive deals to consumers. Others in the top 5 use consumer trends to gain attention, such as Sephora with social media hypes or Redcare with the growing demand for online pharmacy products.

eCommerce is thriving: Global revenues are expected to exceed US$5 trillion this year. In recent insights, ECDB introduced the fastest-growing markets and product categories. The question now is: which online stores are leading the way in terms of eCommerce growth?

To answer, we selected the top 5 in the ECDB Store Ranking with annual eCommerce revenues over US$50 million. Are newer players or incumbents dominating? Let's find out.

What Is an Online Store? What Growth Are We Referring to?

Online stores are in contrast to online marketplaces, which serve as a mediator between sellers and consumers. Online stores are the websites of sellers who offer their own products to shoppers. The metric of interest here is net sales.

Net sales present a clear picture of revenue by subtracting returns, allowances, and discounts. By tracking net sales over time, companies can identify trends, improve operational efficiency, and reduce costs. Net sales can also be used to set revenue targets and evaluate new initiatives. Finally, net sales support informed decision making and investment by assessing financial health and growth potential.

Top 5 eCommerce Stores in 2023

Here are the five stores that made the top list of fastest-growing eCommerce stores by online net sales in 2023.

Furniture & Homeware store songmicshome.co.uk ranks first, with an annual growth rate of 3,873% in 2023.

Amazon.com.be is in second place, with a year-on-year growth rate of 702%. This means that it grew approximately 8 times its 2022 value in one year.

DKNY.com follows with 608% growth in 2023.

Fourth is sephora.co.uk with a growth rate of 556%.

With an annual growth rate of 478%, redcare.it ranks fifth.

What factors are contributing to these high rates? A closer look reveals that the expansion and redirection of existing stores is the main reason.

Discover Our Data: Our frequently updated rankings provide essential insights to help your business thrive. Wondering which stores and companies are excelling in eCommerce? Interested in the top-performing categories? Find the answers in our rankings for companies, stores, and marketplaces. Stay competitive with ECDB.

1. Songmicshome.co.uk

Songmics Home is a Chinese company with subsidiaries around the world, specifically in core markets like the USA, Japan, Germany, and the UK. Its appeal lies in its value for money; its products are affordable and of fair quality.

The site uses gamification and deep discounts to lure customers, typical of platforms with Chinese origin. However, it is only in recent years that Songmics Home has shifted to a D2C focus, and revenues from its UK domain have soared in 2023:

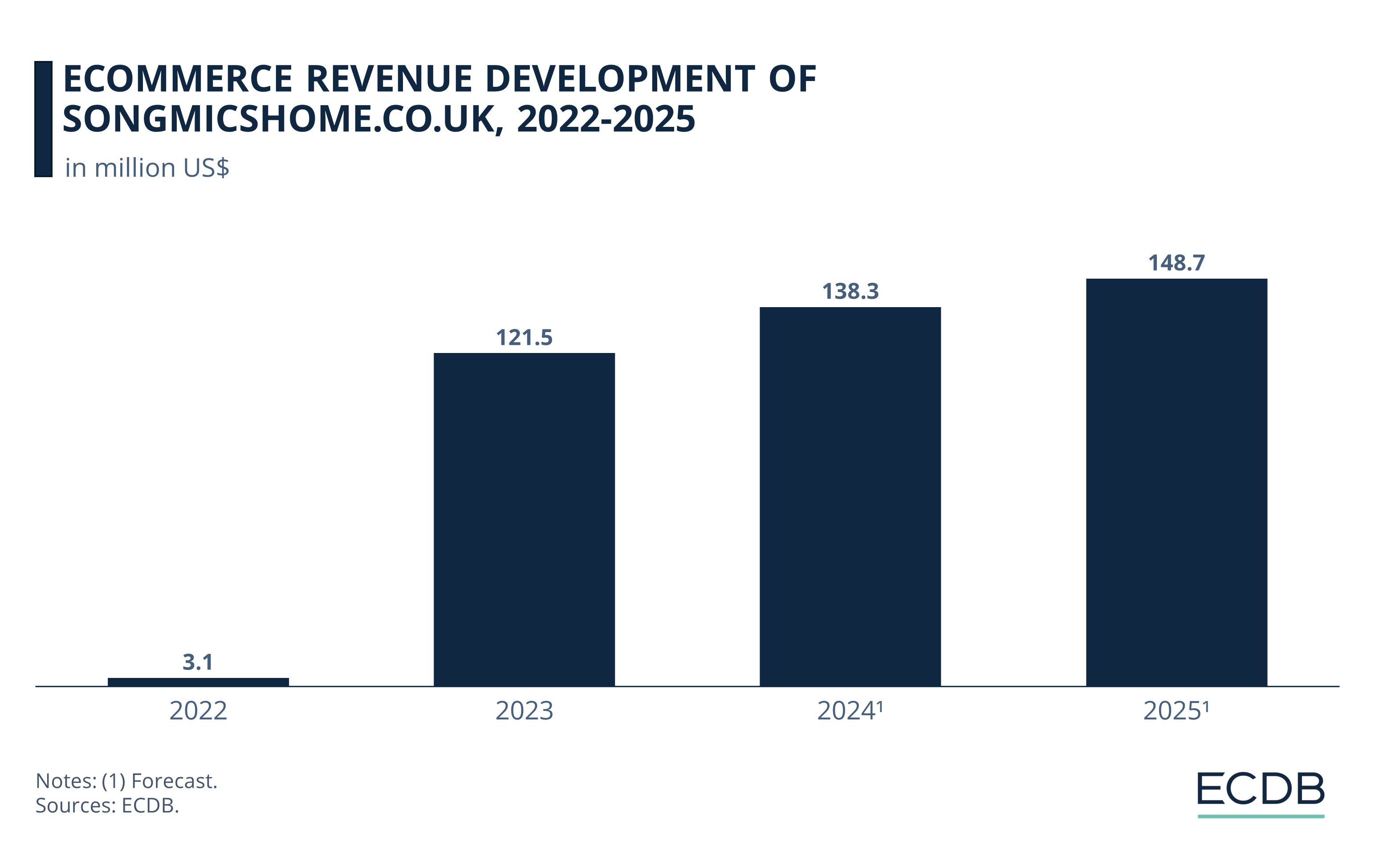

From just US$3.1 million in net sales in its first year 2022, revenues increased by 3,873% to reach US$121.5 million in 2023. Since this is the British skew of an existing store, this does not represent organic growth but instead a redirect of existing sales.

Growth is expected to remain positive, but continue at a moderate pace: By 2024, ECDB analysts expect revenues of US$138.3 million, followed by US$148.7 million in 2025.

Moving from the UK to Belgium, amazon.com.be has the second highest growth rates:

2. Amazon.com.be

Amazon’s Belgian domain launched in late 2022. Because it started in October, net sales of that year were low, but surged in 2023. This is how the 702% growth rate came about.

Naturally, Amazon offers the usual perks to lure consumers with its wide range of products, low prices and fast delivery. Before the launch of amazon.com.be, Belgian customers ordered from amazon.fr. Due to the company’s years of experience in eCommerce across the European continent and its high profile in the market, the launch in Belgium followed an expected positive surge in eCommerce activity. Both for its online marketplace, and online store, as seen below:

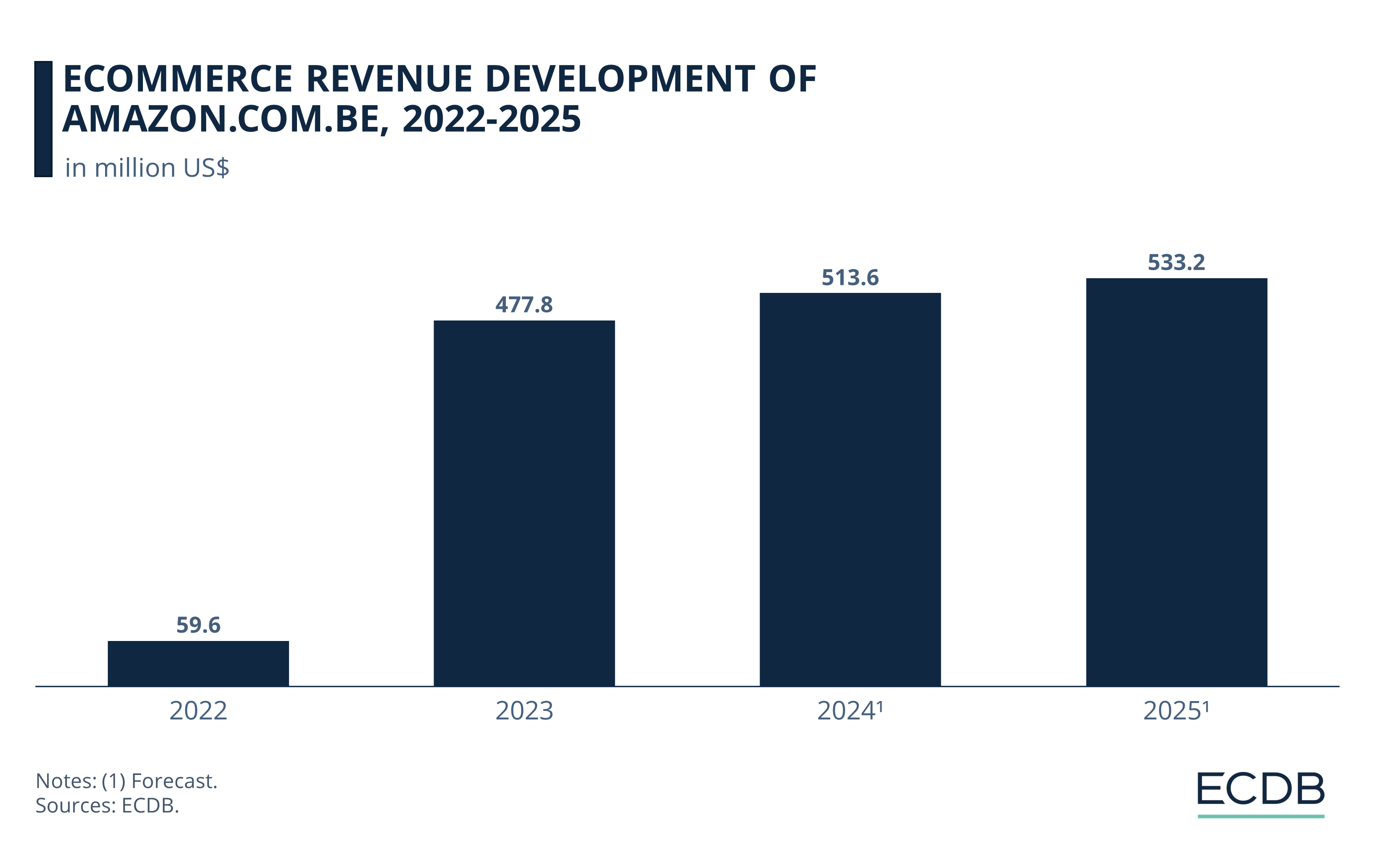

The launch year in 2022 generated eCommerce net sales of US$59.6 million.

In 2023, this figure increased eightfold to US$477.8 million.

ECDB's projections for this year and next are for continued positive growth, but at a slower pace, with steady revenues of US$513.6 million and US$533.2 million.

Amazon’s entry into markets with existing infrastructure via its own domains reflects the company’s efforts to safeguard itself from possible scrutiny of its international portfolio. In line with the launch in Belgium came the launch of its Polish domain, followed by the Irish domain in 2024.

3. DKNY.com

DKNY, or Donna Karan New York, is an upscale fashion brand founded in 1984. It was bought by LVMH but then acquired by G-III Apparel Group, which also operates Calvin Klein and Tommy Hilfiger.

DKNY is primarily an offline brand and most of its online sales are generated through major marketplaces like Amazon, Macy’s or Zalando. Although the brand’s own domain, dkny.com, has existed for decades now, its online net sales have only recently taken off:

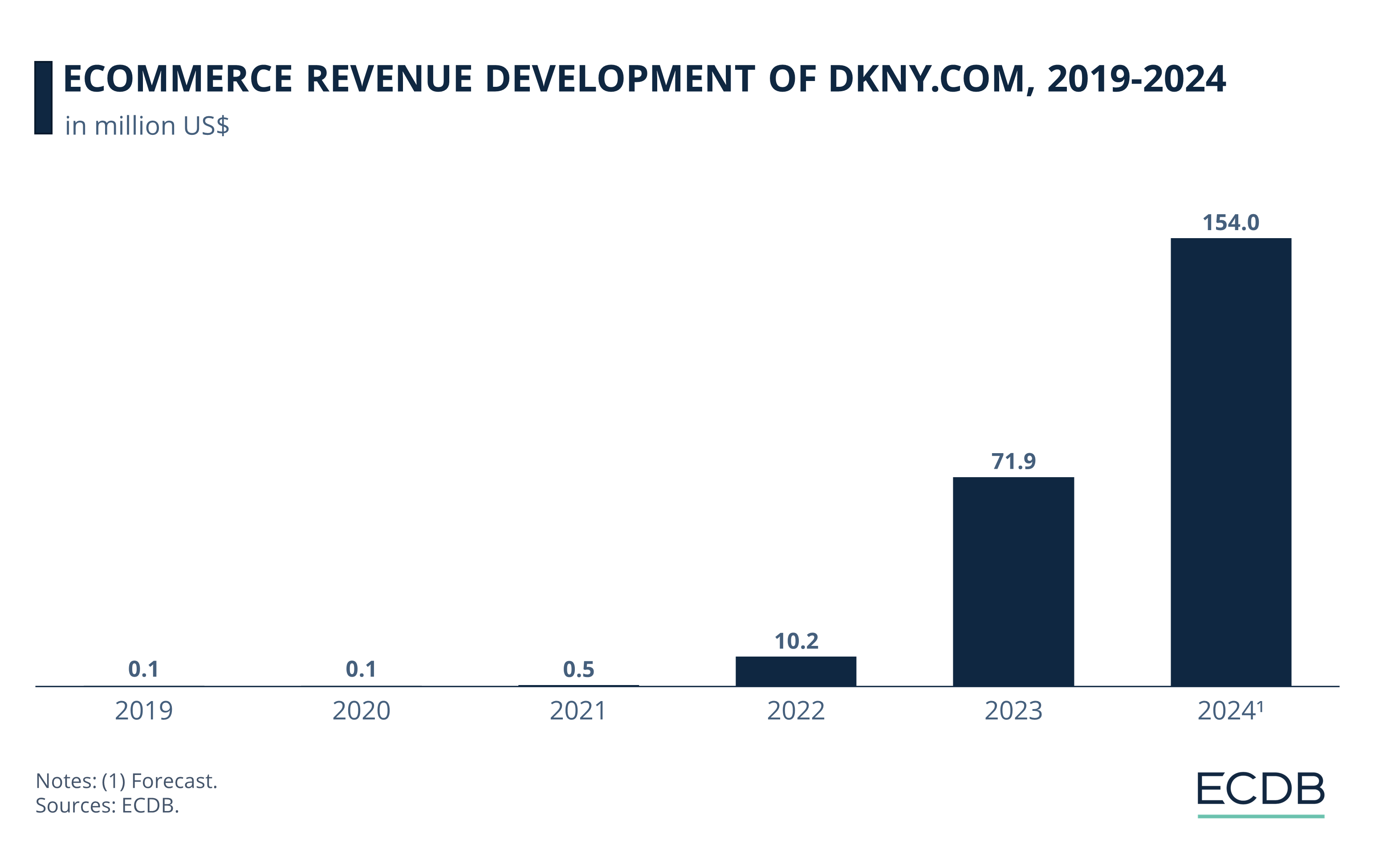

Until 2022, eCommerce revenues generated on dkny.com did not exceed US$1 million, with the highest figure being US$500,000 in 2021. This is likely related to the wholesale focus of the brand.

Since 2022, however, revenues started to pick up, first with US$10.2 million in online net sales and then with US$71.9 million in 2023. This led to a 608% growth rate in 2023.

Forecasts for 2024 predict this explosive growth path to continue, with an annual growth of 1,142%, reaching US$154 million.

The reasons for this sudden increase in revenue can be found in the shift to a D2C focus, which includes a repositioning of the brand into digital channels from its previous offline strategy, as well as selling through its own website.

While dkny.com generates its net sales exclusively in the U.S., the next store operates in the UK:

4. Sephora.co.uk

Sephora opened its UK domain in 2022, and the success of this platform is reflected in the explosive growth rates of eCommerce revenues. Sephora is performing well in the U.S. and its home country, France, where it is ranked third and first in the personal care eCommerce rankings, respectively. The UK is set to follow suit.

A boom in personal care and beauty products accounts for this fact, which is being fueled by social media trends. Content such as “get ready with me” videos and new product unboxings, as well as online make-up inspiration, are all contributing to the increased demand for beauty products in eCommerce.

Even the youngest users, those born in 2010 or later, known as Gen Alpha, are participating in this trend, which has been captured in the hashtag #sephorakids. So much the better for Sephora itself:

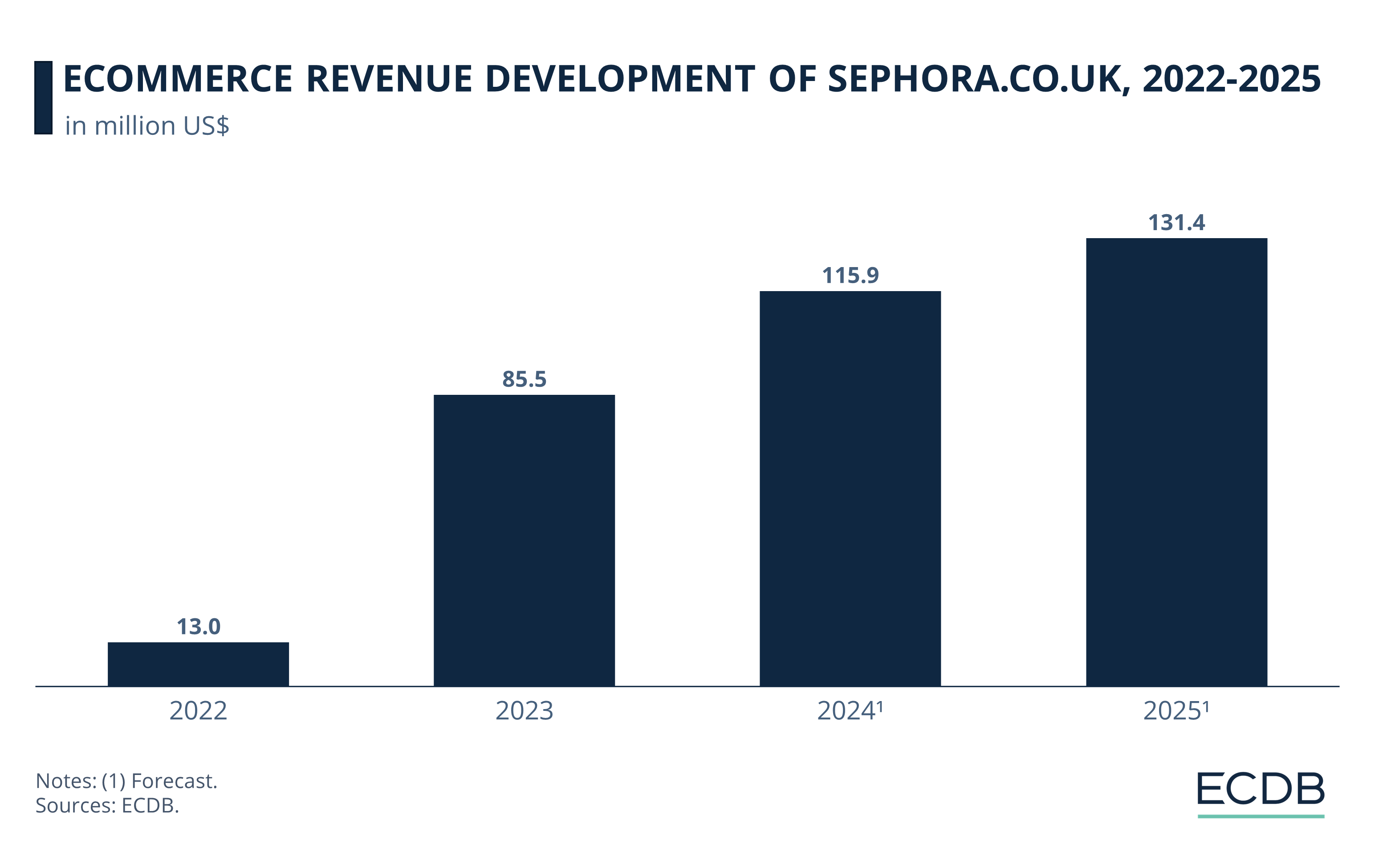

Prior to 2022, UK consumers received their Sephora products from sephora.com. In the launch year, sephora.co.uk generated US$13 million in online revenues.

The following year, revenues totaled US$85.5 million, with an annual growth rate of 556%.

Growth is projected to continue through 2024 and 2025, but at a more modest pace. This is reflected in online net sales of US$115.9 million and US$131.4 million, respectively.

Sephora's entry into the UK with its own domain is in line with the introduction of physical stores in the market. The strategy is expected to yield positive results: Sephora already ranks 27th in the personal care eCommerce ranking in 2023.

5. Redcare.it

Redcare Pharmacy is the health products conglomerate formerly known as Shop Apotheke. It is active in Europe, generating most of its revenues in Germany and Austria, but also in Belgium, Italy, Switzerland, France and the Netherlands.

With the launch of its Italian domain in 2022, Redcare is bringing the online pharmacy trend to Italy. Leveraging its experience in the distribution of healthcare products across Europe, Redcare is the leader in Italian healthcare eCommerce one year after its launch in 2023.

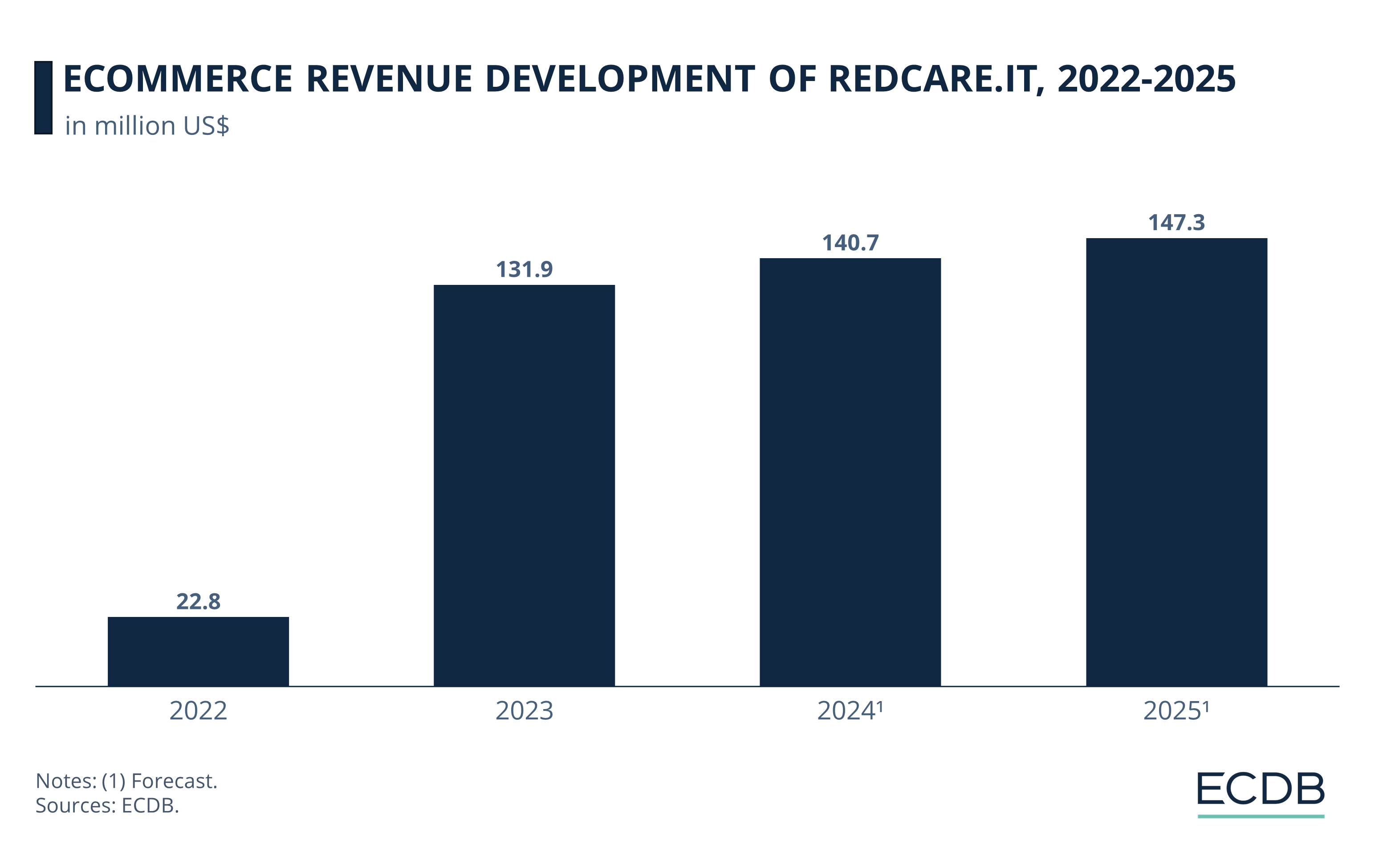

In its launch year 2022, redcare.it generated US$22.8 million in online revenues. The following year, it grew by 478% to US$131.9 million. This increase is another successful redirect to a new regional domain.

Forecasts for 2024 and 2025 expect revenues to stabilize at around US$145 million.

The health products online market in Italy has been quite unremarkable, with only small revenues from smaller players. In this market environment, amazon.it captured the largest online shares for health products. Redcare challenged that dominance and succeeded, thanks to its experience in European markets and a successful adaptation to the Italian market.

Fastest-Growing Online Stores: Wrap-Up

Looking only at online stores with more than US$50 million in annual revenue, the fastest-growing online stores by net sales in 2023 all operate in Europe or the United States: Two UK domains are represented by the Asian platform Songmics Home and Sephora, while other European markets include Belgium and Italy. DKNY is the only store in the top 5 ranking that operates in the U.S.

The list reflects regional specialization trends: Major players move away from cross-country stores and create specific stores for each country. This helps them to adapt to regional preferences and to better serve the needs of their target audiences.

Sources: Red Magazine – Vasagle

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Deep Dive

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Deep Dive

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Deep Dive

Wayfair’s Shopping Way Day: Analysis & Market Insights

Wayfair’s Shopping Way Day: Analysis & Market Insights

Deep Dive

Inside Apple Revenue: Latest Sales Figures and Key Insights

Inside Apple Revenue: Latest Sales Figures and Key Insights

Back to main topics