eCommerce: Taobao and Tmall

Alibaba Stock Price Grows Amidst Merchant Fee Changes

Alibaba recently announced a 0.6% merchant service fee effective September 1, charged instead of its previously imposed annual fixed merchant fee. The news from the company led to an immediate rise in the stock price across all markets.

Article by Nadine Koutsou-Wehling | July 29, 2024Download

Coming soon

Share

Alibaba Stock Price Increase: Key Insights

Rising Merchant Fees: Alibaba recently announced changes to its merchant fees, which will become a 0.6% software service fee on seller transactions through its Tmall and Taobao eCommerce platforms, starting on September 1. Alibaba previously charged a fixed annual fee for product promotion and improvement. This fixed fee will be replaced by the new percentage-based surcharge.

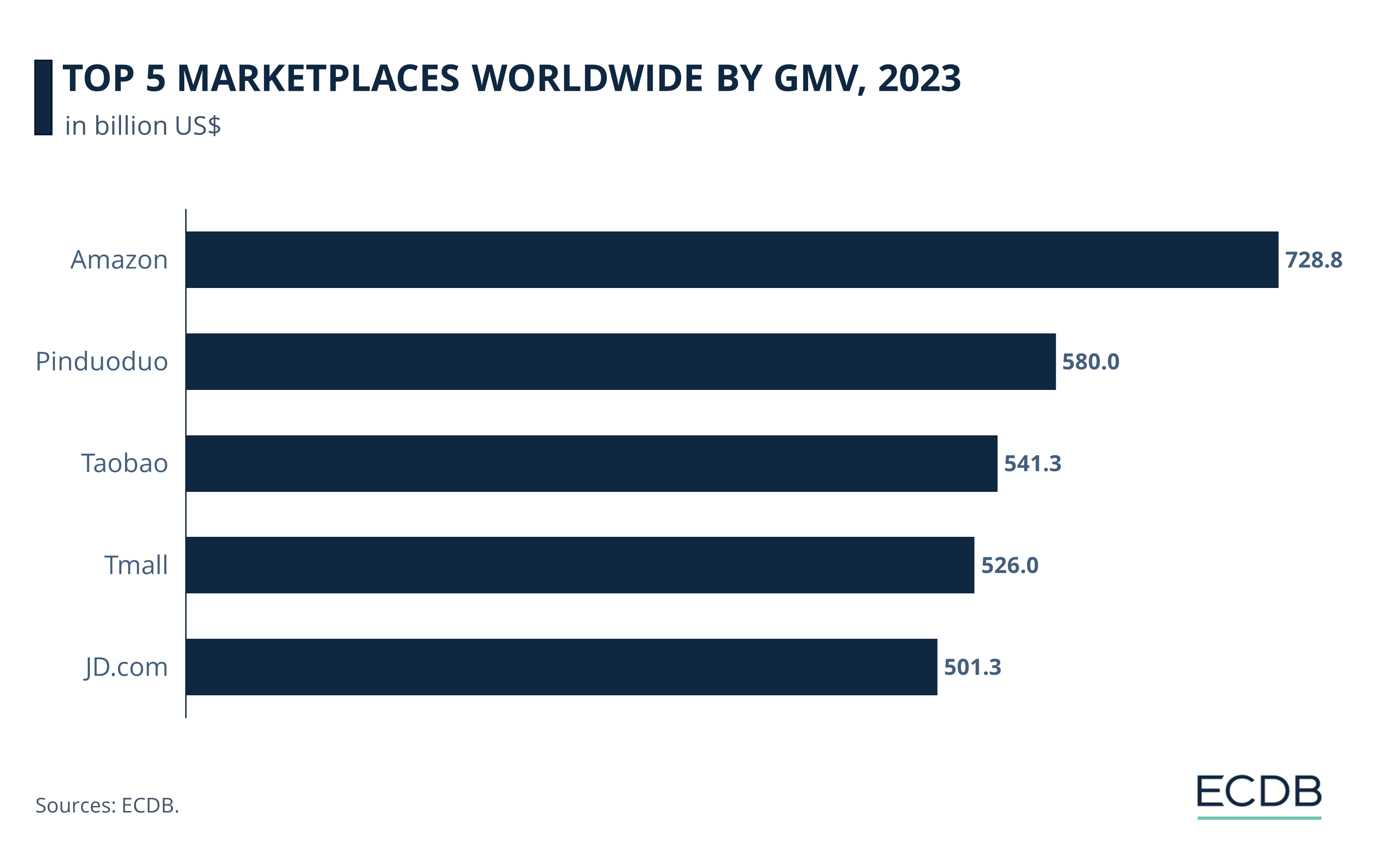

Drawing Level With Domestic Competitors: Alibaba thereby follows its direct competitors PDD Holdings, JD.com and ByteDance, to charge a GMV-based seller fee. Because Alibaba has significantly higher marketplace transactions across all of its combined platforms, a transaction-based merchant fee is expected to generate high revenues.

Alibaba's stock is rising in response to the company's announcement of an increase in merchant fees on the Tmall and Taobao eCommerce platforms. Starting in September 2024, Alibaba will charge a 0.6% software service fee on transactions for sellers who list their products on its online shopping platforms.

Why is Alibaba's move causing its stock price to increase?

Analysts expect Alibaba’s revenue from its core merchant management business to increase significantly. Previously, merchants paid Alibaba a fixed customer management fee to promote their products on Tmall and Taobao, allowing merchants to expand their product offerings to meet consumer preferences.

By charging merchants a percentage-based fee, Alibaba is now on par with its domestic competitors PDD Holdings, JD.com and ByteDance, which all charge sellers a similar GMV-based fee. With this fee update, Alibaba is well positioned among its direct competitors, all of which are among the top 5 marketplaces worldwide.

Some exceptions to the rule remain: Alibaba will likely waive the new merchant fee for very small sellers to create mutually beneficial conditions for all parties. In any case, the previous fixed fee will end with the introduction of the new one on September 1.

As Alibaba's combined GMV across its platforms is higher than that of its competitors, the fee adjustment is expected to boost Alibaba's revenues to new heights. Alibaba stock prices rose across all markets after the announcement. That shows investors are really confident that the decision will prove successful for Alibaba’s revenue development.

Sources: Bloomberg – Investing.com – Stockinvest – Yahoo!Finance

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

eCommerce Payments in China: Alipay, WeChat & Top Payment Methods

eCommerce Payments in China: Alipay, WeChat & Top Payment Methods

Deep Dive

Top eCommerce Companies by Market Cap 2024

Top eCommerce Companies by Market Cap 2024

Deep Dive

Tinaba Partners with Alipay+ to Launch European Super App

Tinaba Partners with Alipay+ to Launch European Super App

Deep Dive

Alibaba Leverages AI and Promotions to Boost Singles' Day Sales

Alibaba Leverages AI and Promotions to Boost Singles' Day Sales

Deep Dive

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Back to main topics