eCommerce: Temu, Alibaba, Amazon, Pinduoduo, eBay

Amazon & Asian eCommerce: Marketplaces, Revenue, GMV & Forecasts

Can Asian marketplaces push out established platforms like Amazon or eBay? The instinctive answer feels like "no," doesn't it? However, these platforms are currently in a precarious position. While their numbers remain high, they are stagnating... meanwhile, Temu, TikTok Shop, and others are booming.

Article by Patrick Nowak | September 23, 2024Download

Coming soon

Share

Amazon & Asian eCommerce: Marketplaces, Revenue, GMV & Forecasts - Key Insights

Amazon's Growth Stagnation: While Amazon remains dominant with a $1.96 trillion valuation, its eCommerce growth has slowed to 4% in 2024.

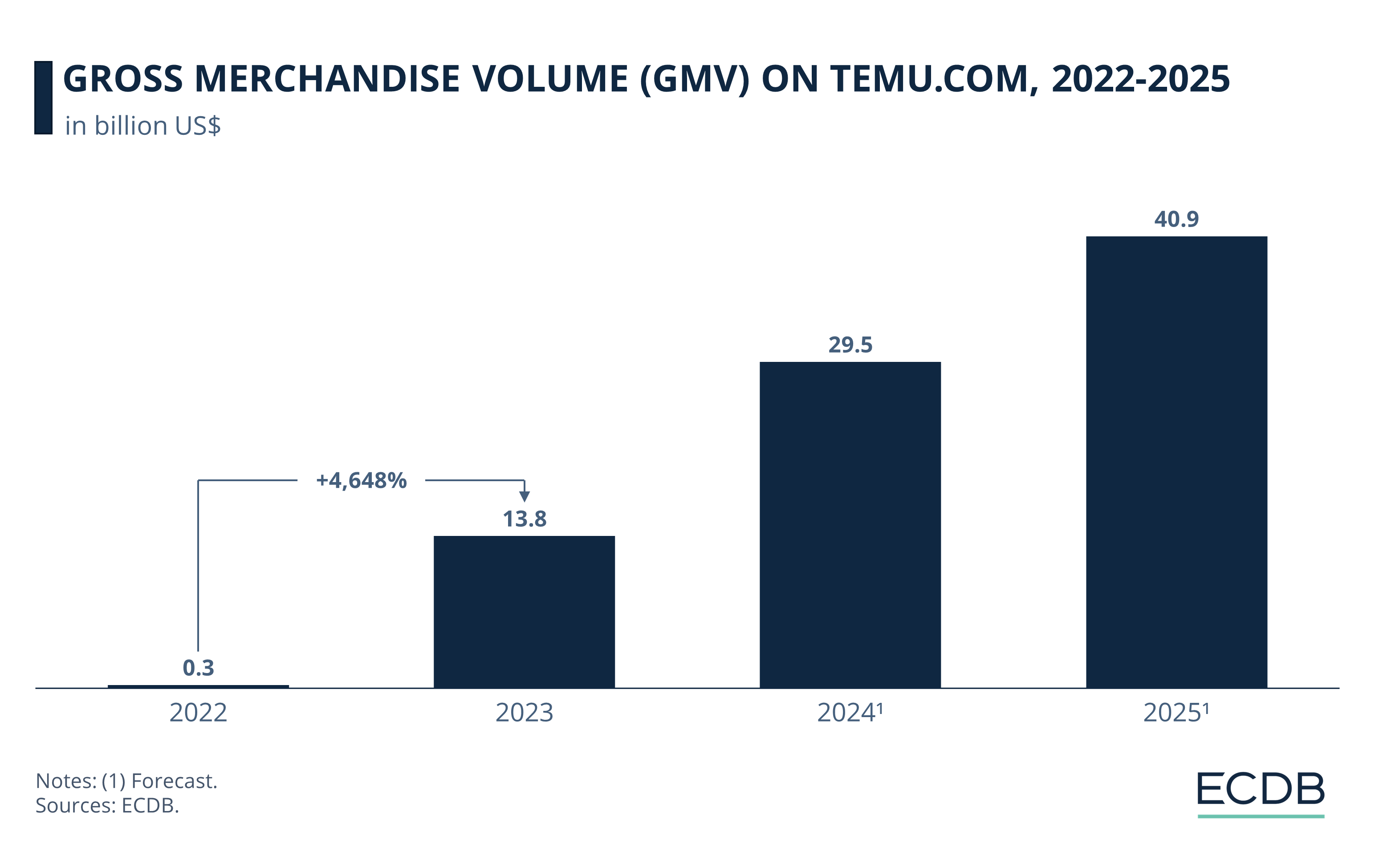

Asian Competitors: Platforms like Temu, TikTok Shop, and AliExpress are experiencing explosive growth, with Temu increasing by nearly 5,000% from 2022 to 2023.

Live & Social Commerce Trends: Asian platforms are leading in live and social commerce, areas where Amazon has been slow to innovate.

Future Threat Timeline: If current growth trends continue, competitors like AliExpress and TikTok Shop could surpass Amazon in market share by 2031 and 2033.

PDD Holdings & Marketing Power: PDD Holdings is pouring billions into marketing, leveraging platforms like Meta and Google.

At first glance, it seems unlikely that Asian marketplaces could displace established platforms like Amazon. However, the situation may be more precarious than it appears. While Amazon’s numbers remain strong, growth has stagnated. Meanwhile, platforms like Temu, TikTok Shop, and other Asian contenders are seeing remarkable growth.

Amazon, which began as an online bookstore in 1994, has grown into the world’s largest marketplace with a market value of $1.96 trillion and a gross merchandise volume (GMV) of $729 billion. This growth has been fueled by Amazon’s expansion into new business models like AWS, Whole Foods, and Twitch. However, the company’s recent pace of innovation appears to have slowed. Notably, Amazon seems to have overlooked trends like live commerce, social commerce, and deeper penetration into the Asian market.

Meanwhile, Asian competitors like Alibaba, Pinduoduo, and ByteDance are aggressively expanding into the Western market. Could they overtake Amazon and push it out of its "home" markets? It's a real possibility, as their growth trajectories indicate a brewing competition that shouldn't be dismissed as mere doomsaying.

Amazon & eBay: Traditional eCommerce Losing Steam

There’s no denying Amazon’s expansion into new sectors like AWS and Twitch is paying off, particularly as it faces competition from Chinese giants like Tencent, which dominate cloud and gaming in Asia. Yet, it’s clear that Amazon has scaled back its innovation efforts in traditional eCommerce.

Historically, Amazon’s attempts to expand into Asia have not been successful, and trends like live commerce and social commerce (key driver of growth in Asia) seem not to be Amazon’s top priority. This strategic hesitation could sideline Amazon, leaving the door open for Asian competitors like Alibaba, Pinduoduo, and ByteDance to take the lead. Is this prediction too extreme?

The Pressure from Temu, TikTok Shop, and AliExpress

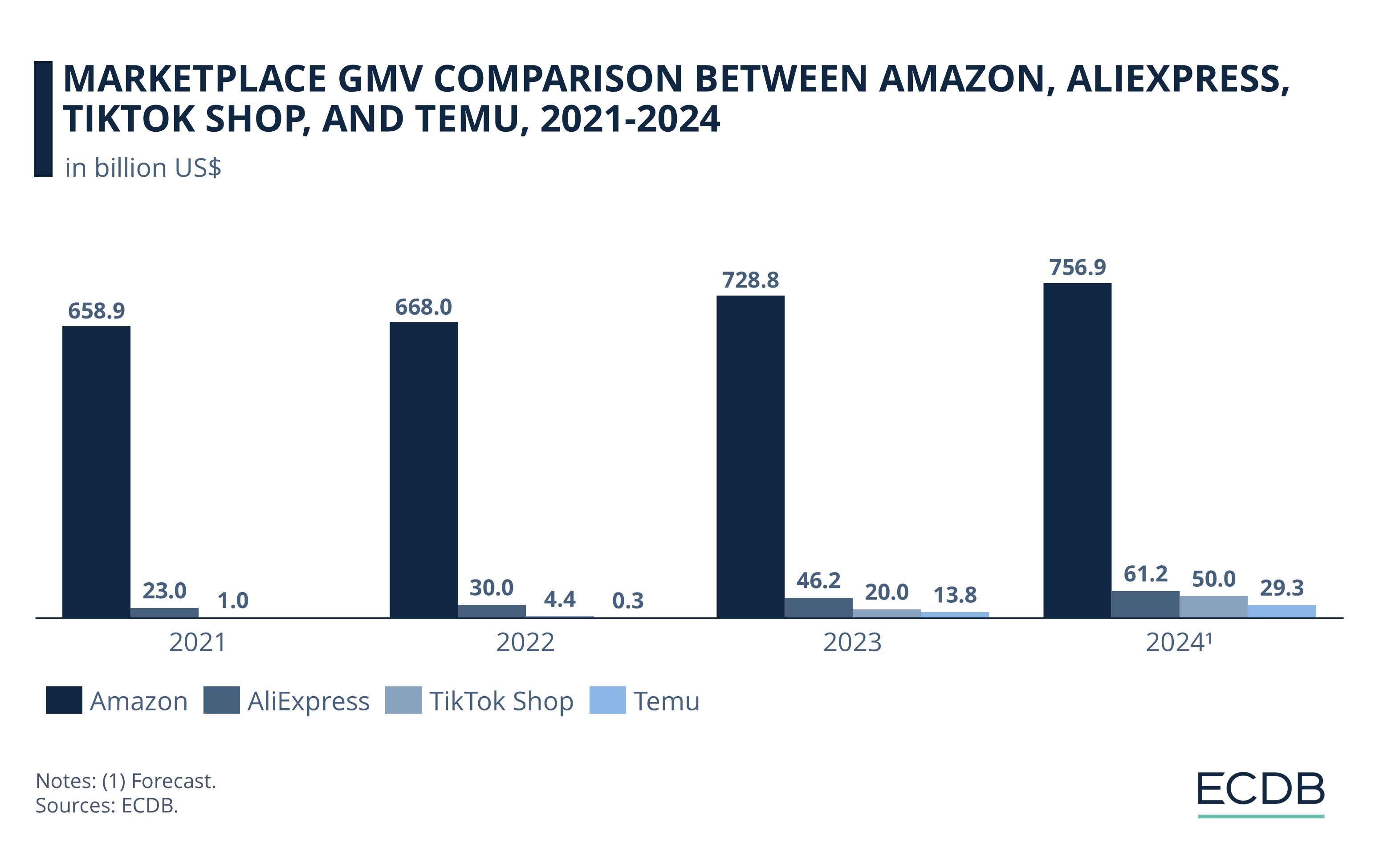

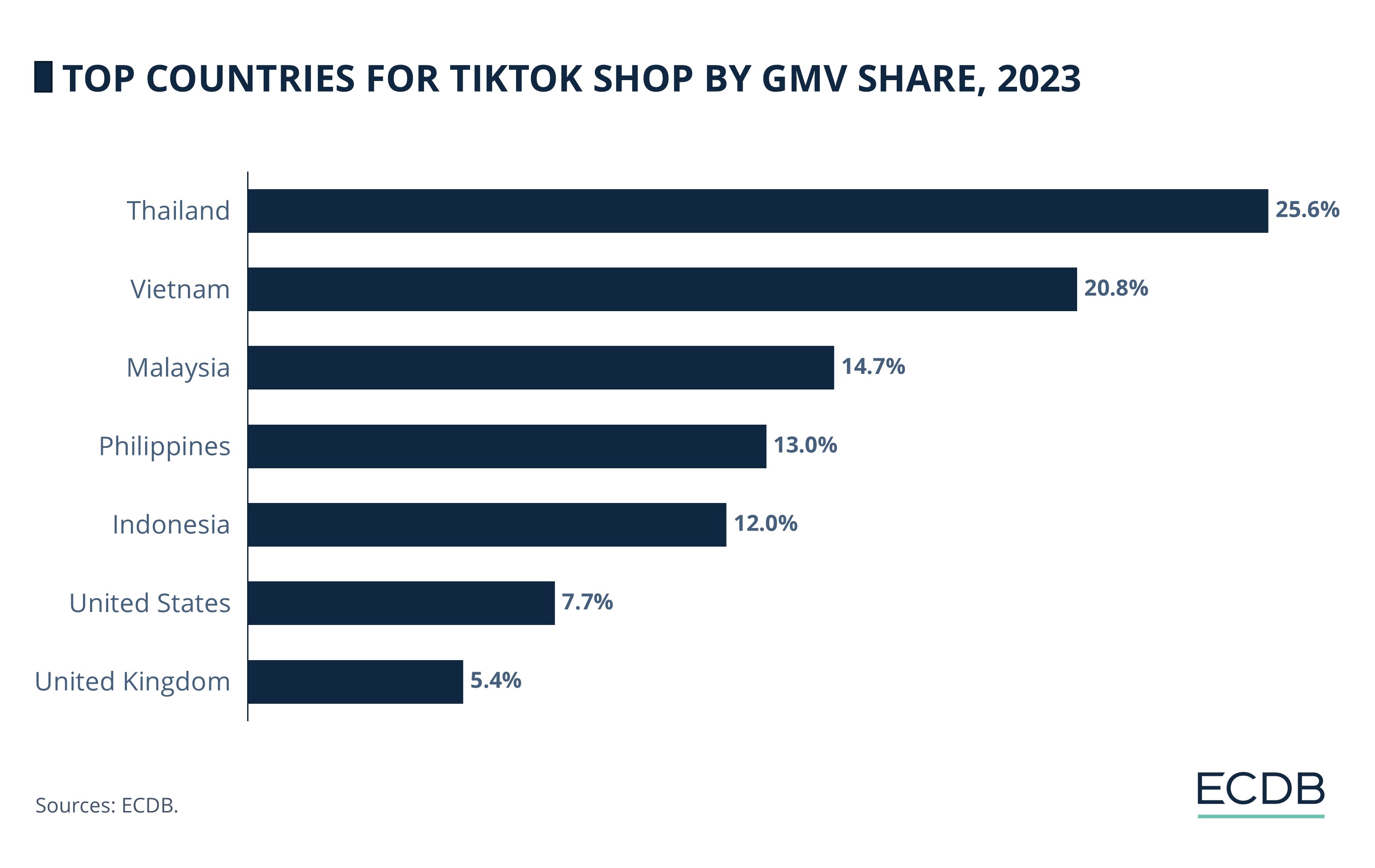

Platforms like TikTok Shop and AliExpress are already giving Amazon serious competition. Data from ECDB shows TikTok Shop grew by an astounding 355% in 2023, and another 150% growth is expected in 2024. AliExpress, Alibaba’s Western marketplace, grew by 54% in 2023, with 34% growth anticipated for 2024. Temu, launched only in Q3 2022, skyrocketed with a jaw-dropping 4,648% increase from 2022 to 2023, with projections of 113% growth in 2024.

Amazon simply can’t keep up with these growth rates. While Amazon saw a significant boost during the pandemic, its growth in 2023 was just 9%, with an expected 4% increase in 2024.

Asian eCommerce: Breaking Down the Numbers

In absolute terms, Amazon remains far ahead. In 2023, Amazon's GMV hit $729 billion, compared to AliExpress’ $46 billion, TikTok Shop’s $20 billion, and Temu’s $14 billion. So, where’s the risk?

Let’s run a simple calculation: If Amazon continues to grow by just 4% annually, while its competitors maintain a 50% growth rate (a conservative estimate), AliExpress could overtake Amazon by 2031. TikTok Shop could do so by 2033, and Temu by 2034. It’s not immediate, but it’s on the horizon.

PDD Holdings' Influence

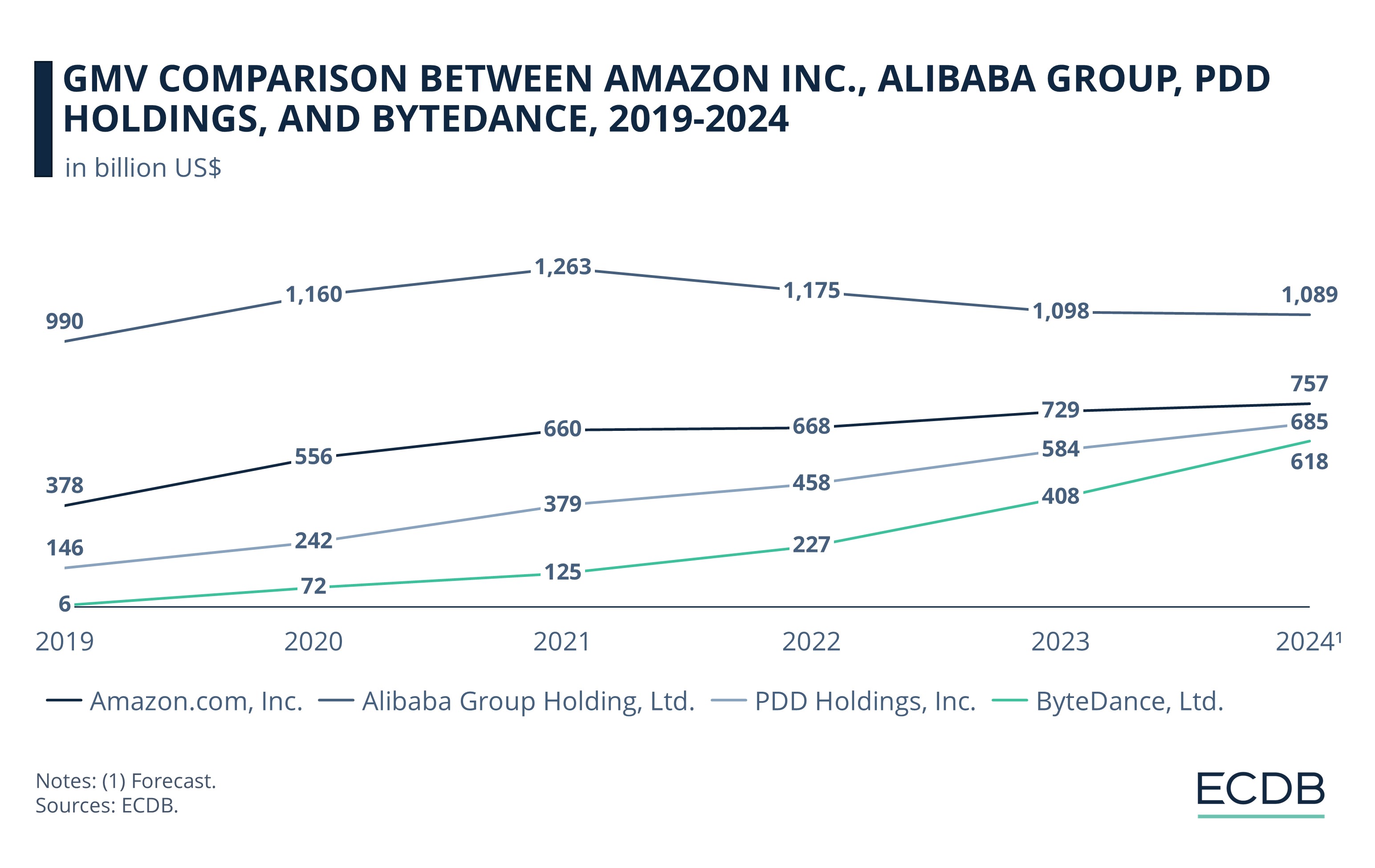

So, is Amazon really safe? Not necessarily. A look at the financial strength of these companies highlights the growing threat. Alibaba Group, which owns Taobao, Tmall, and AliExpress, had a GMV of $1.1 trillion in 2023—about $370 billion more than Amazon. And that’s after Alibaba’s own 6.5% decline that year.

This dominance in its home market gives Chinese giants the financial muscle to expand into Europe. While Alibaba isn’t heavily investing in AliExpress marketing, PDD Holdings, the parent company of Temu, is going all in. In Q4 2023, PDD spent around $3.75 billion on marketing, a 50% increase from the same quarter the previous year. Annually, PDD is likely spending at least $12 billion on marketing, with the bulk going to Meta (Facebook, Instagram) and Google.

Stay Competitive: Our constantly updated rankings provide you with the latest insights to improve your business strategy. Discover which stores and companies are at the top of the eCommerce world and which categories are driving the highest sales. Dive into our rankings for companies, stores, and marketplaces. Stay a step ahead in the market with ECDB.

By comparison, Amazon spent $44.4 billion on marketing in 2023, but with little to show in terms of growth.

Temu’s success in the U.S. and Europe underscores that these markets are more vulnerable than Asia is for Western platforms. While Amazon’s efforts to establish itself in Asia have failed, Temu’s user-friendly app, aggressive pricing, and catchy slogans have driven both sales and buzz in Western markets.

PDD Holdings, with a market value of $584 billion, still lags behind Amazon, but its 27.5% growth rate suggests it could quickly close the gap. Another leap forward, and Amazon could slip to third place globally.

The biggest growth, however, is coming from ByteDance (owners of Douyin and TikTok Shop), which saw an astonishing 79.5% increase in 2023, reaching a GMV of $408 billion. While still the smallest of the contenders, ByteDance may prove to be the most dangerous competitor.

Marketplace 3.0: The Future of Live & Social Commerce

If traditional advertising (think old-school market hawking) and modern marketplaces (like TikTok Shop) continue to converge, the competitive landscape could shift dramatically. A platform like TikTok Shop, if it becomes entrenched in Europe and the U.S., could cement its dominance in a way that leaves little room for competitors. For Meta and Google, this poses a significant challenge, as they stand to lose revenue from advertising in this new marketplace structure. Currently, the focus remains on Asia. But why should it stay that way?

Currently, the focus remains on Asia. But why should it stay that way?

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

eCommerce in Canada: Top Stores, Market Development & Trends

eCommerce in Canada: Top Stores, Market Development & Trends

Deep Dive

Top eCommerce Companies by Market Cap 2024

Top eCommerce Companies by Market Cap 2024

Deep Dive

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Online Shopping in the United States: Where Consumers Prefer to Shop Online

Deep Dive

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Back to main topics