eCommerce: Market Insights

eCommerce in Greece: Digitization & Online Payment Strategies

Payment methods in Greek eCommerce show a clear trend towards credit cards, but the era of cash-based payments is not quite over. Find out about Greece's digital integration, what the payment landscape looks like, and what innovations consumers are looking for.

Article by Nadine Koutsou-Wehling | June 13, 2024

Digitization and Online Payment: Key Insights

Small Businesses Most Frequent: In Greece, 94.6% of all businesses are micro-businesses with fewer than 10 employees. This significantly impacts the available resources for technological innovation and digitization.

Digitization in Relation to EU Average: Greece is behind in every aspect of technological innovation integration, except for social media usage among enterprises.

Online Payments Landscape: Credit cards replaced cash as the most used payment method in Greek eCommerce. But consumer attitudes in the market show that online payments are among the most in-demand innovations for eCommerce.

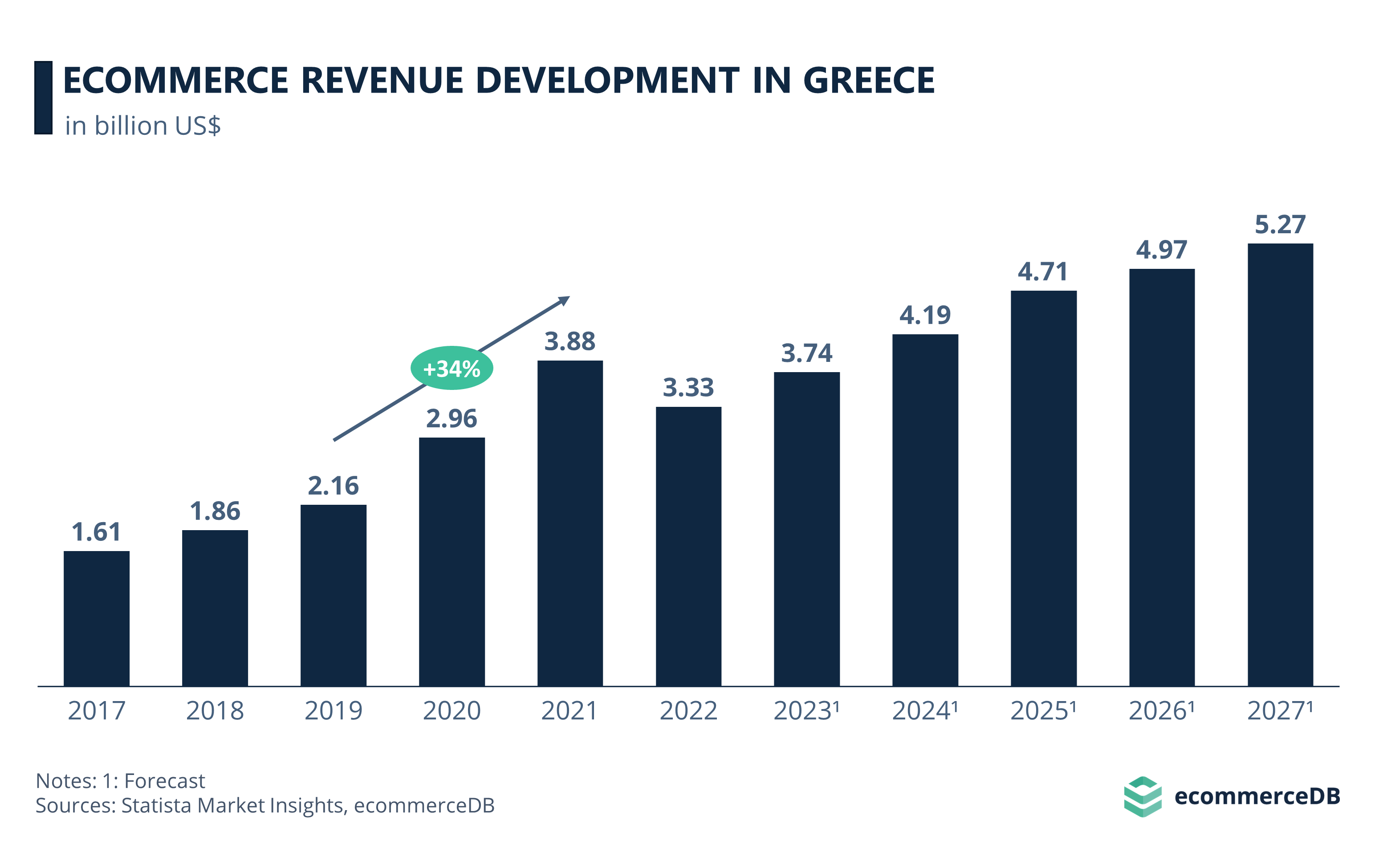

Greece has generated moderate eCommerce revenues over the years. Its eCommerce market has grown most notably during the pandemic, peaking temporarily at US$9.4 billion in 2021.

After a slowdown during the post-pandemic normalization period, its revenues are increasing again.

Find out about the state of digitization in Greek eCommerce, how prevalent online payments are, and what online store innovations consumers in Greece look forward to.

Greece's Economy Is Dominated by Micro-Businesses

Greece’s economic system is similar to Spain’s in the sense that 99.9% of all Greek enterprises are SMEs. An SME employs up to 250 people and has an annual turnover of less than €50 million. According to the OECD, there are 718,558 companies in Greece that fall into this category.

But that is not all – the majority of these companies are considered micro-enterprises with less than 10 employees (94.6%), making the Greek economy primarily characterized by small-scale enterprises. As larger companies tend to have more resources at their disposal to drive the implementation of newer technologies, this should alert to the fact that most Greek companies will not have ready-made solutions at hand for their digital development.

Around 18% of Greek Businesses Sell Online

Assessing the percentage of total businesses in a country that sell products online, Greece is at the lower end of the list.

Eurostat data indicates that Greek enterprises are quite far behind the EU average when it comes to eCommerce. Only 17.9% of all Greek businesses reported selling products online. The EU average is 22.8%.

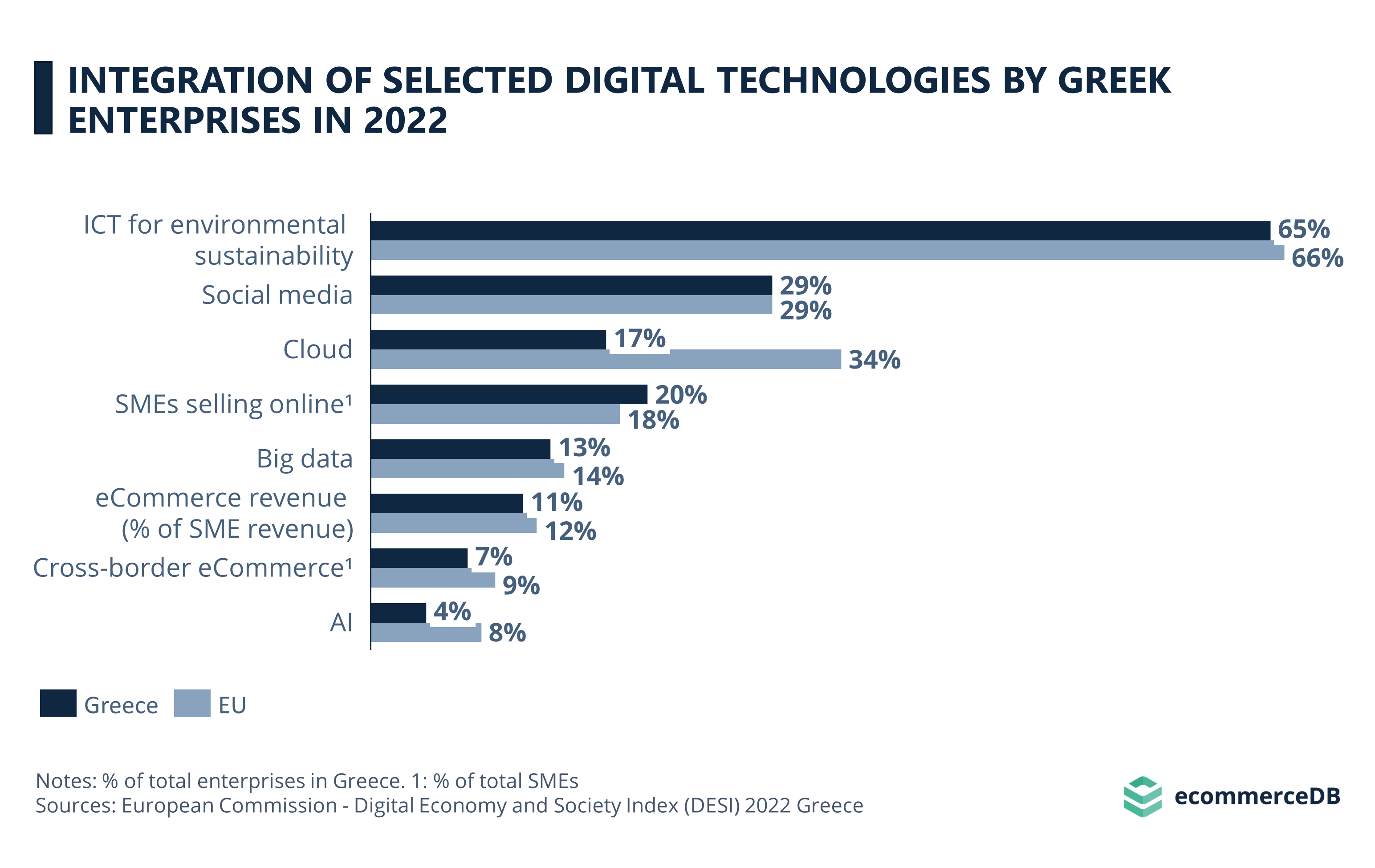

But the penetration of eCommerce businesses is only a first measure. The European Digital Economy and Society Index (DESI) measured the level of digital technology integration in Greek companies in 2022.

One Fifth of Greek SMEs Sell Their Products Online

Digitization has become a pan-European effort, supported by several institutional development programs that provide grants, workshops and technology training to countries for the subsequent development of their digital capabilities.

Greece is one of the countries that needed to improve its digital penetration, especially considering the high proportion of SMEs operating in the country.

Greek enterprises are approaching the EU average of 66% in the use of ICT (Information and Communication Technology) for environmental sustainability, which can include paperless communication and saving energy costs through efficient, data-driven production.

When it comes to using social media to promote their business, Greek companies are in line with the EU average, with 29% of companies engaging on at least one platform.

The use of cloud services in Greece is at 15%, which is 19 percentage points below the EU average. However, with the expansion of Amazon Web Service (AWS) to Greece in 2021, this figure is likely to increase in the future.

Greece is below the EU average by 2 percentage points in the share of SMEs using eCommerce, at 17%.

Only 7% participate in cross-border eCommerce. This is slightly below the EU average of 9%, reflecting the general trend that SMEs tend to sell online within their home country.

In terms of big data usage and eCommerce revenue as a percentage of total SME revenue, Greek companies are almost in line with the EU average, only one percentage point behind. The divergence is more pronounced when it comes to AI adoption, with Greece at 3% compared to the EU average of 8%.

Beyond these newer innovations, there are existing digital technologies that add a layer of convenience, accessibility, and security to eCommerce.

In Greece, digital payments are quite common, but so are cash-based payments. Find out more on that below.

Card Payments Lead Online Transactions in Greece

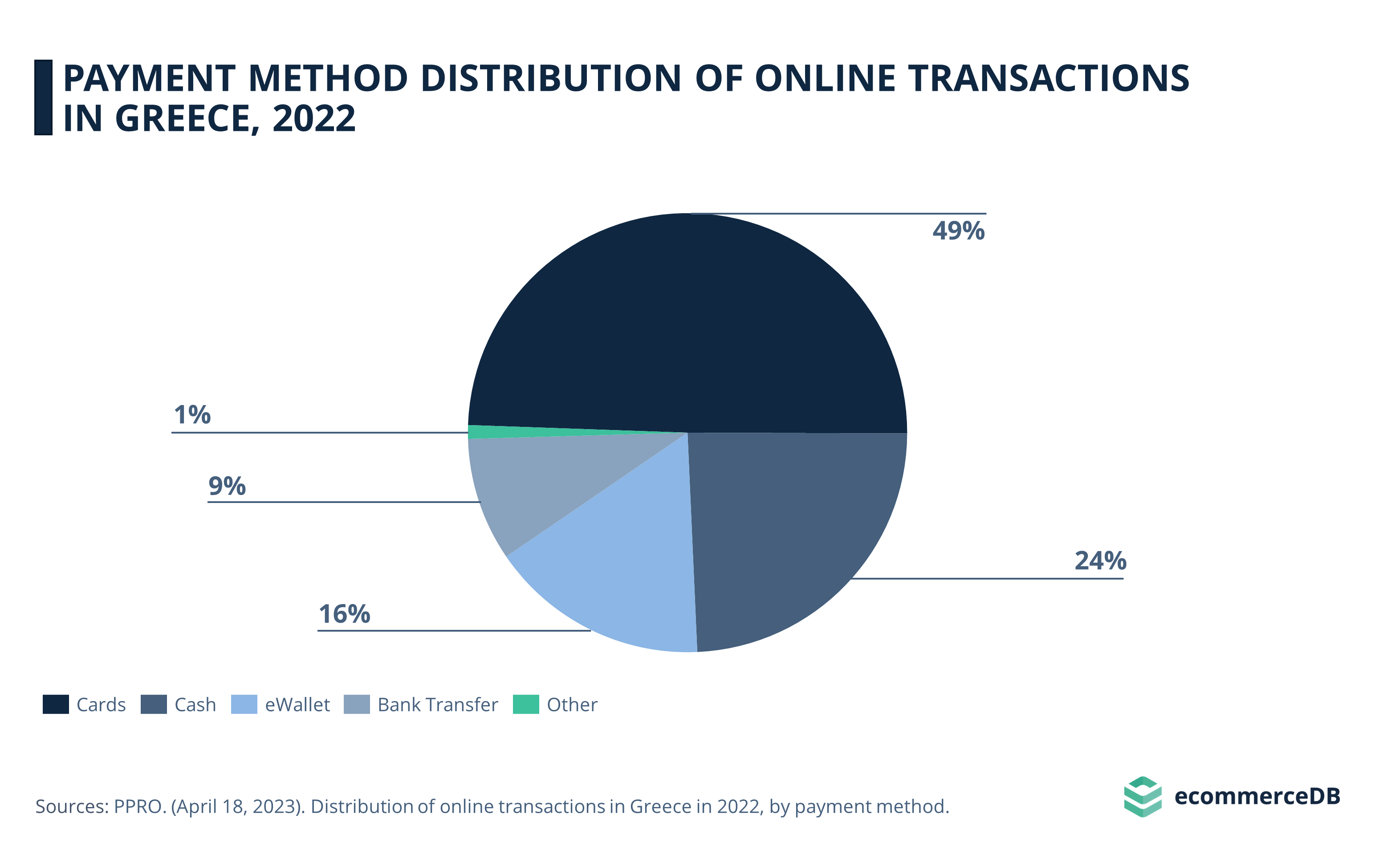

On the ECDB Markets section, you can learn about the top 5 payment providers in each eCommerce market. It is clear that online payments penetration is high, while eWallets are less prevalent:

Almost all online stores considered offer payment by credit card. MasterCard payments are available in 95.9% of stores and VISA in 95.6%.

Cash on Delivery follows, offered by 79.8% of eCommerce stores.

In fourth place is bank transfer, with 77.7%.

PayPal is the only eWallet provider among the top 5, but less prevalent. 62.7% of online stores allow online shoppers to pay their orders this way.

The pandemic highlighted the need for contactless payments amidst recommendations for social distancing. Prior to the pandemic, cash was the preferred payment method for day-to-day transactions in Greece, according to the European Central Bank (ECB).

Until this day, cash is the second most common payment method in Greece. But eWallets like PayPal are yet to make their mainstream entry. Many providers still emphasize cash over newer forms of payment like this.

Most Wanted Online Store Innovations in Greece

Greece still has some way to go in terms of online payments integration and overall digitization. But its consumers are already looking our for what comes next.

Here is what that means in more detail:

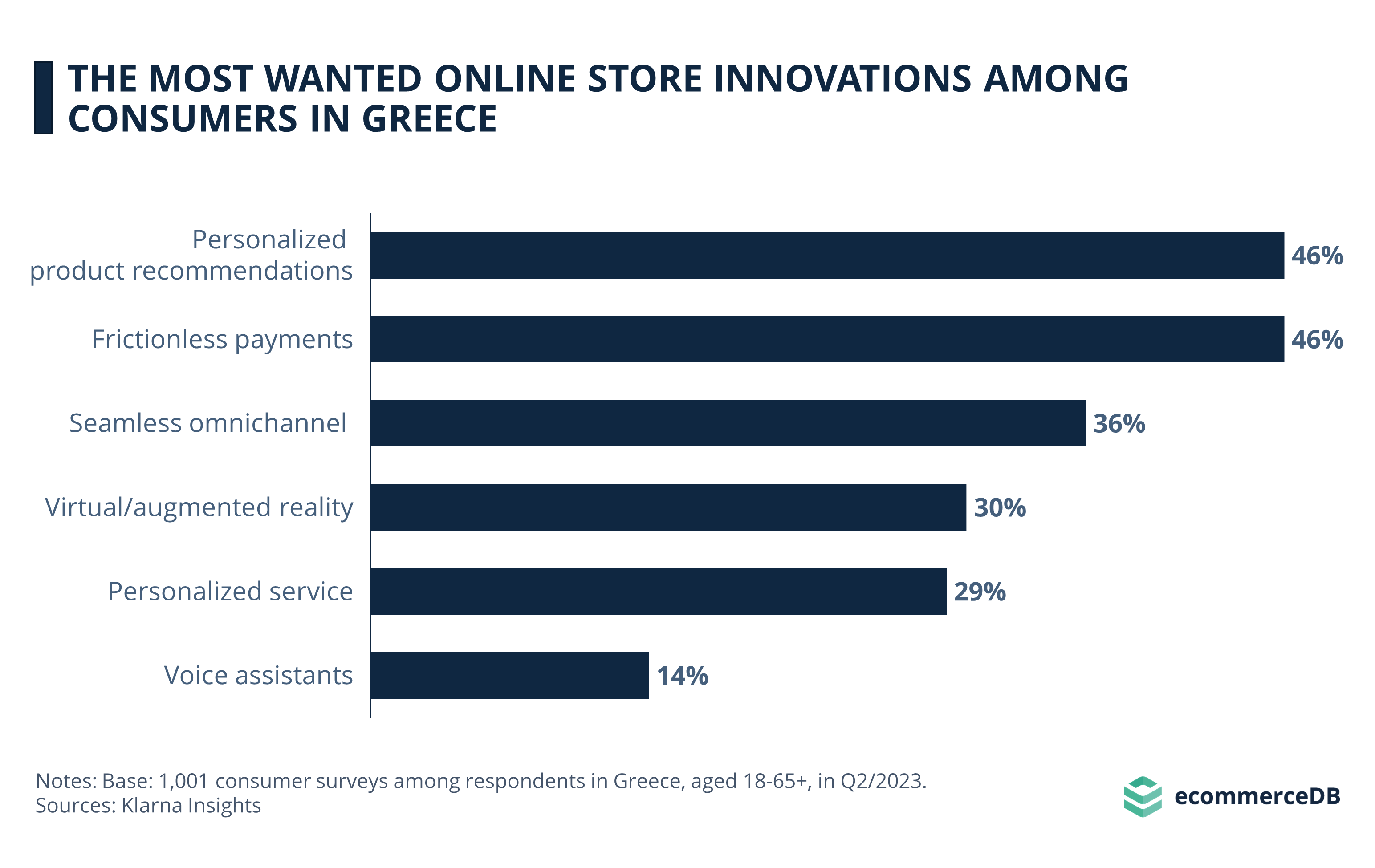

Frictionless payments are a priority for consumers in Greece, according to 46% of respondents to Klarna’s 2023 survey.

Personalized product recommendations were mentioned by an equal number of respondents (46%).

Following this are seamless omnichannel services (36%), virtual/augmented reality (30%), and a personalized service (29%).

Voice recognition technology was the least selected innovation, supporting the notion that consumers in Greece tend to be cautious about their privacy, as also seen in this insight on consumer preferences in Greek eCommerce.

Another feature of the Greek market is the preference for loyalty rewards. The ECB suggests that as merchants adopt digital payments in Greece, offering loyalty points for each completed transaction can be an effective way to incentivize Greek consumers to shop online.

Digitization & Payments: Wrap-Up

The Greek eCommerce market still has potential for growth. While eCommerce market revenues increased significantly during the pandemic and remained at a higher level in the years after, digital payments also became more prevalent. But the use of cash is still widespread.

eCommerce businesses looking to enter the market are well advised to consider common consumer demand for frictionless payments, use personalized recommendations and loyalty rewards.

Sources: Capital.gr - Digital Strategy Europe - ECB - EIT Digital - International Trade Organization - Klarna – OECD - PPRO

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Apple Pay or Google Pay? Finding Out Which FinTech Service Rules Europe

Apple Pay or Google Pay? Finding Out Which FinTech Service Rules Europe

Deep Dive

Klarna’s Impact Is Strongest in Sweden and Norway

Klarna’s Impact Is Strongest in Sweden and Norway

Deep Dive

eCommerce in Canada: Top Stores, Market Development & Trends

eCommerce in Canada: Top Stores, Market Development & Trends

Deep Dive

eCommerce Payments in China: Alipay, WeChat & Top Payment Methods

eCommerce Payments in China: Alipay, WeChat & Top Payment Methods

Deep Dive

Top Online Payment Methods: eWallets, Cards & Bank Transfer

Top Online Payment Methods: eWallets, Cards & Bank Transfer

Back to main topics