eCommerce: Fashion

Fashion eCommerce Market in Asia: The Market Could Hit US$1.1 Trillion By 2025

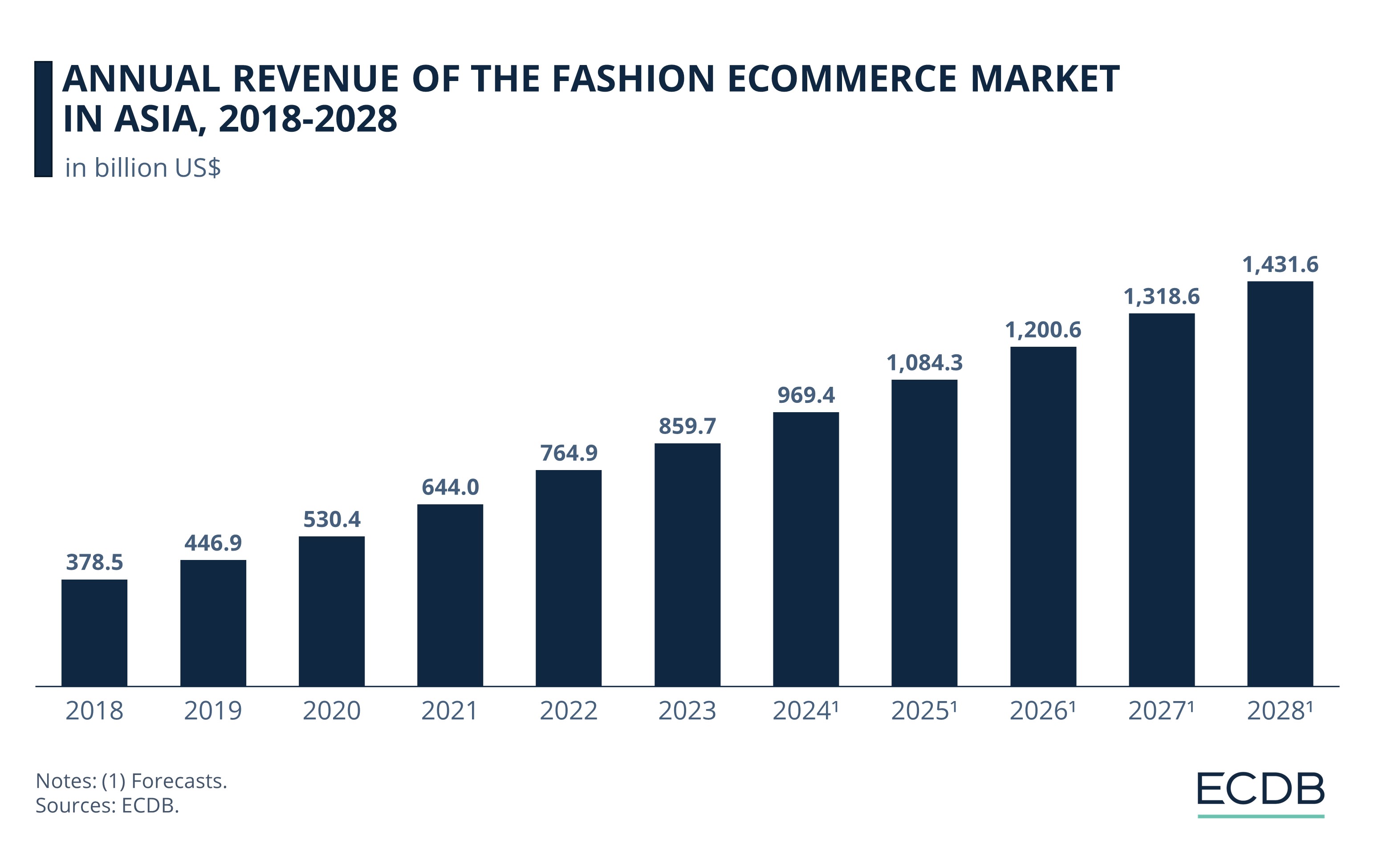

The market is expected to grow from US$859.7 billion in 2023 to US$1.1 trillion by 2025, demonstrating strong potential for expansion. What is driving this significant growth?

Article by Antonia Tönnies | May 02, 2024Download

Coming soon

Share

Fashion eCommerce Market in Asia: Key Insights

Growth Comeback of Asian Fashion eCommerce: The Asian fashion eCommerce market is on the rise again, driven by factors like urbanization and smartphone use.

Projected Increase: By 2025, the market could hit US$1.1 trillion, up from US$859.7 billion in 2023, showing strong potential for expansion.

Youth and Digitalization: Younger generations, especially Gen Z and Gen Y, are at the forefront of online fashion shopping, with the help of mobile commerce and AI assistants.

China Leads the Pack: China poses a significant challenge to competitors by controlling both fashion and overall eCommerce in Asia.

Leading Companies for Online Fashion in Asia: Major players like Alibaba, Rakuten, and Amazon shape the market, with competition expected to intensify as the industry grows toward the projected US$985 billion mark by 2030.

Since 2017, the global fashion sector in eCommerce has almost tripled in size, with revenues of US$1.3 trillion in 2023. A large portion of this revenue is generated on the Asian continent. In fact, over 60% of the global revenue in 2023 had been generated in Asia alone.

Despite China's ongoing deflationary trend, combined with governmental restrictions in recent years, the fashion eCommerce segment in Asia achieved a linear growth. A glance into the crystal ball reveals that the growth trend is set to explode.

The global fashion eCommerce is forecast to reach almost US$2 trillion in revenue by 2028 – where does the Asian market stand?

Asia’s Fashion eCommerce Market May Reach US$1 Trillion by 2025

The fashion eCommerce market in Asia is expected to continue its linear growth trend. The online shopping trend is so widespread that research firm Coherent Market Insights predicts it will grow from US$521 billion in 2023 to US$985 billion in 2030, at a CAGR of 9.5%.

Our data goes even further: The market will exceed US$1 trillion in 2025 and reach US$1.4 trillion in 2028. This represents 73% of the expected growth in global fashion eCommerce revenues.

According to the Coherent Market Insights Report, reasons for this growth trend may be the increasing urbanization in combination with a rising internet and smartphone penetration. As a result, the number of social commerce and mobile commerce users, which are enjoying increasing popularity in Asia, is soaring as well.

This trend is particularly strong in China, where sales are expected to reach US$6.2 trillion by 2028. The younger generations, namely Gen Z and Gen Y, who have grown up with the digitalization, use shopping opportunities for fashion more frequently than older generations.

With mobile commerce, or mCommerce, new clothes are just a few clicks away. Ultra-fast delivery and easy returns make the shopping experience even more convenient. There are also shopping assistants based on artificial intelligence (AI), that can tailor offers to the user and improve the customer experience.

China Leads by Far in Asian Fashion eCommerce

Unsurprisingly, Greater China occupies the top spot in the Fashion eCommerce ranking for Asia, with revenues of US$750 billion. In second place stands South Korea with US$26.8 billion, which corresponds to almost one-28th of the revenue in China.

With a smaller gap, Japan follows in third place with US$22.4 billion. Next in line ranks India in fourth with US$16.9 billion, followed closely by Indonesia at US$16.4 billion.

China not only leads in terms of fashion in the eCommerce industry, but also in general the eCommerce market in Asia, with a share of US$2.2 trillion in 2023. The country has managed to secure a monopoly-like position in the Asian region and is making it difficult for its competitors to even come close.

Top 6 Companies in the Asian Fashion eCommerce Market

There are six major eCommerce players in the Asian fashion market, including well-known global players, according to Coherent Market Insight:

Alibaba Group Holding, Ltd.: The Chinese public company is nationally focused with 32% of its activity revenue share in Fashion, operating marketplaces such as Tmall, Temu and AliExpress. In 2023, Alibaba reached a total activity revenue of US$1.1 trillion, making it the number one eCommerce company in the world.

Rakuten Group, Inc.: The company, which focuses its eCommerce activities to 36.3% on fashion, shrinks from US$30.7 billion in 2022 to US$28.8 billion in 2023 in eCommerce activity revenue, but still remains among the top companies in this ranking with its third-party marketplace Rakuten.

Amazon.com, Inc.: The player from the United States follows behind its biggest rival, Alibaba, with an eCommerce activity revenue of US$732.9 billion in 2023. Despite focusing only 6.8% of its activities on fashion and even failing in China, the company is part of the top six.

Global Fashion Group S.A.: With its hybrid marketplace Zalora, the company ranks among the top six fashion eCommerce players in Asia. In 2023, the company's eCommerce activities generated US$2.9 billion in revenue, with fashion (87.8%) as the main category.

Flipkart Pvt., Ltd.: The on India focused company concentrates to 31.3% on the fashion category and has reached an eCommerce activity revenue of US$32.9 billion in 2023. The company is 80% owned by Walmart, Inc.

Myntra Designs Pvt., Ltd.: The company's major foothold is also in the Indian market, with 67% of its US$7.3 billion in eCommerce sales coming from fashion. Back in 2014, the company was acquired by Flipkart, resulting in Walmart also owning some of this company.

All in all, these companies have established a strong presence in their markets. In light of the forecast mentioned earlier, it will be interesting to see how the companies in the fashion eCommerce industry will evolve.

Fashion eCommerce Market in Asia: Closing Thoughts

There is a growing global trend towards more environmentally friendly fashion consumption, such as recommerce. At the same time, the fashion industry continues to thrive on fast fashion, which is known for its negative environmental impact. This presents a paradox, but the situation isn't as contradictory as it seems. Consumers are increasingly demanding sustainability and are willing to purchase it, yet fast fashion remains popular.

Why is this the case?

Sustainability comes at a higher cost and is currently a privilege, while households with average (or lesser) incomes are not inclined to spend their money on what they consider extravagant fashion. In other words, for sustainability to become a more influential force in the fashion industry, it must become more affordable in the future.

Sources: TechCrunch – MediaNama – tagesschau.de – ECDB, secondary sources in the referenced articles.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Deep Dive

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Deep Dive

Shein Business Model: Growth Strategy, Audience, Marketing & Competition

Shein Business Model: Growth Strategy, Audience, Marketing & Competition

Deep Dive

Fanatics Launches New NHL Collection in Cooperation with Lululemon

Fanatics Launches New NHL Collection in Cooperation with Lululemon

Deep Dive

South Korean Online Fashion 2024: Revenue, Stores & Trends

South Korean Online Fashion 2024: Revenue, Stores & Trends

Back to main topics