Luxury eCommerce: Markets By Region

Global Luxury Online Sales by Region: APAC, Americas & EMEA Markets

Which region is performing the best in the luxury goods eCommerce market? How has the online luxury market for personal goods developed between 2020 and 2022? Which countries are boosting the online sales of global luxury? The ECDB Luxury Report has the answers.

Article by Nashra Fatima | April 23, 2024Download

Coming soon

Share

Global Luxury Online Sales by Region: Key Insights

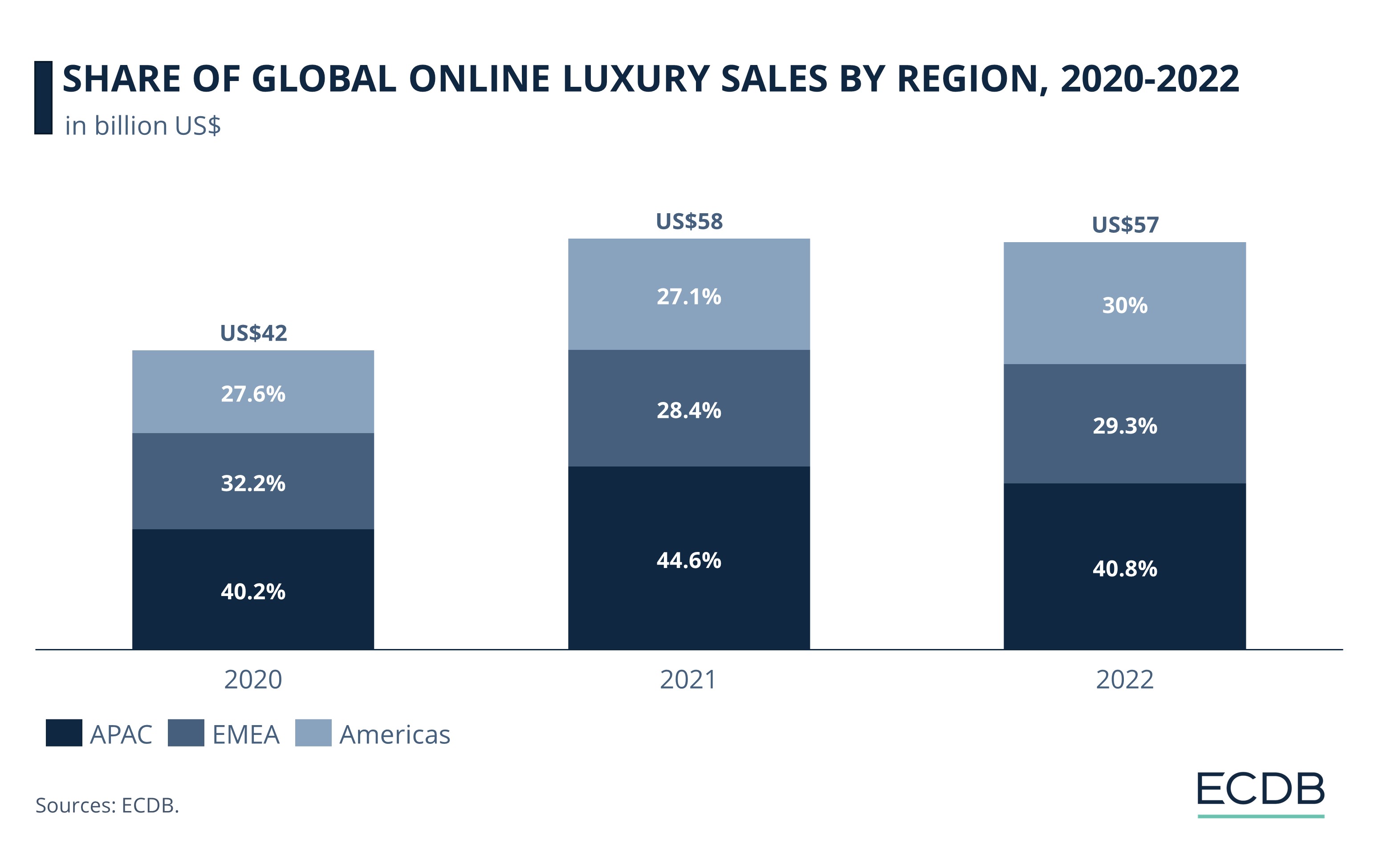

Regional Luxury Market Dynamics: APAC emerges as a leader in online luxury sales, followed closely by the Americas and EMEA, each region experiencing unique shifts in consumer behavior and market conditions.

APAC's Dominance: APAC claims 40% of online luxury sales in 2022, led by China and Japan, with emerging markets like South Korea and India driving growth.

Americas' Resilience: Despite economic challenges, the Americas, led by the United States, capture 30% of the luxury eCommerce market, showing resilience and growth prospects.

EMEA's Recovery: EMEA sees a rebound in online luxury sales as travel resumes and lockdowns ease, capturing 29.3% of the market share in 2022, despite facing challenges.

From 2020 through 2022, the luxury industry saw changes in its regional sales momentum. Government interventions, tourism restrictions, changing shopping behavior – all these factors spurred or constrained regional demand for luxury goods, both online and offline, over the three-year period.

Despite some slowdown, APAC (Asia Pacific) is the top contender in terms of the eCommerce sales share, owing to the sheer size of its affluent customer base. Yet other players are not watching from the sidelines, particularly as market conditions normalize.

Is revival afoot in the Americas and EMEA (Europe, Middle East, and Africa)? And how does APAC fare under policy deterrents in its largest market? We offer data-based insights into global luxury’s interesting regional developments in the eCommerce segment.

APAC Leads the Path, Ahead of Americas and EMEA

In 2022, APAC was the front runner in global luxury’s online sales, with the Americas and EMEA trailing behind.

APAC accounted for 40.8% of the online luxury market in 2022. It is the largest region in luxury and is fragmented across multiple countries with different growth drivers. China and Japan are the key players in APAC; they continue to drive the region's online sales momentum, although changes due to closures and travel restrictions were observed. Emerging markets in countries such as South Korea, Thailand, and India, where a new generation of luxury consumers is coming of age, are also strengthening APAC's position on the global stage.

The Americas Region Remained Stable during COVID-19

The Americas, with the United States as its core market, ranks second among luxury regions in 2022. It took 30% of the total luxury eCommerce share. Although the region absorbed Covid shocks and remained stable from 2020 to 2022, the prohibitive cost of living and fear of recession could take a toll on luxury spending, particularly deterring domestic luxury consumers of the aspirational variety who are susceptible to economic headwinds.

Post-Pandemic Surge in EMEA

EMEA accounts for 29.3% of the total luxury eCommerce market in 2022, just behind the Americas. In recent years, consumer spending dipped due to the energy and cost of living crisis. In 2022, post-pandemic consumer confidence boosted online luxury shopping. In addition, intra-regional and international tourism is also supporting eCommerce luxury sales in EMEA, particularly in Europe, which is home to some of the most prestigious luxury companies.

Americas and EMEA's eCommerce Sales Rebound in 2022 as APAC’s Momentum Slows

The regional demand for high-end products has been disparate across various markets, which the online sales share by world region reflects. From 2020 to 2022, APAC has held the largest portion of global online sales. However, a year-by-year review shows that its share declined in 2022 as the Americas and EMEA gained ground.

Overall, APAC is the emerging center of luxury, claiming the largest share of the global luxury eCommerce market all through the pandemic years. 2020 was the year of strict lockdowns in major spending hubs such as China and Japan. In this period, 40.2% of the total online luxury sales still took place in this region. In 2021, affluent consumers indulged in spending their savings accumulated during the strict lockdowns. This was also the year when eCommerce in global luxury picked up. The pent-up demand fueled APAC's expansion, accounting for 44.6% of the luxury online market.

In 2022, however, the zero-covid policy derailed China's recovery and other regions experienced a resurgence in luxury spending. As a result, APAC's online market share, while still the largest, declined by nearly 4 percentage points to hit 40.8%. Going forward, the upturn in China and emerging luxury markets in South and Southeast Asia could help APAC regain lost momentum.

The Americas have been a consistent performer in the luxury sector, taking over a quarter of the market share during the pandemic. It accounted for 27.6% and 27.1% of luxury's total online sales in 2020 and 2021 respectively, demonstrating resilience to the disruptions caused by lockdowns. The region gained online shares in 2022 and accounted for 30% of the total luxury eCommerce market, thus outpacing EMEA for the first time in three years.

Within the Americas, the United States remains the largest luxury market. Even in the face of inflation, a well-to-do consumer base and investment opportunities available in the U.S. could help position the entire region as a resilient market capable of weathering economic headwinds and offering positive growth prospects.

EMEA Is Recovering from the Pandemic

EMEA (Europe, Middle East, and Africa) is the third-largest market for global luxury. It faced a challenging climate in 2021, as Covid forced consumer preferences to change, prompting brands to re-strategize in terms of their marketing and distribution strategies.

Reflecting the volatility, EMEA's market share dropped from 32.2% in 2020 to 28.4% in 2021. Luxury spending improved somewhat in 2022 as travel resumed and lockdowns were lifted. The reopening of stores, the resumption of tourism, and an increase in local consumption supported online luxury sales. As a result, the region captured 29.3% of the market, although it lost its second position in terms of online sales to the Americas.

With China on the tentative road to recovery, the Americas adjusting against inflationary pressures, and EMEA seeing enhanced consumer spending, we expect all luxury regions to perform well, although the online shopping trends may vary at the country level.

The Luxury eCommerce Market: Players & Category Insights 2023 – Available Now

Are you searching for an in-depth analysis of the online market for luxury goods? Order ECDB’s exclusive report on The Luxury eCommerce Market: Players and Category Insights 2023 here.

The study provides a comprehensive overview of the personal luxury market with a focus on eCommerce. Next to an in-depth market analysis, readers will learn about the impact of Covid on the global luxury market, regional dynamics, sales channels (Business-to-Business and Direct-to-Consumer), as well as insights into different product categories.

The study further features an exclusive list of 250 leading luxury brands, including detailed performance metrics and brand properties, such as exclusivity and brand positioning. All sales numbers are provided for 2020 to 2022.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Yoox Net-a-Porter Is Sold to Mytheresa by Richemont: What the Acquisition Means for the Online Luxury Brands

Yoox Net-a-Porter Is Sold to Mytheresa by Richemont: What the Acquisition Means for the Online Luxury Brands

Deep Dive

Cartier Business Strategy: Global Revenue, Ranking, Competitors

Cartier Business Strategy: Global Revenue, Ranking, Competitors

Deep Dive

Forbes Asia 100 To Watch 2024: 9 Retailers to Follow

Forbes Asia 100 To Watch 2024: 9 Retailers to Follow

Deep Dive

Luxury Goods Market: Revenue, Net Sales, Online & Offline Sales

Luxury Goods Market: Revenue, Net Sales, Online & Offline Sales

Deep Dive

Louis Vuitton Analysis: Net Sales, Online to Offline, B2B vs. D2C

Louis Vuitton Analysis: Net Sales, Online to Offline, B2B vs. D2C

Back to main topics