eCommerce: Market Insights

India's Top Online Stores and Reasons for Their Success

Which online stores are taking the lead in India's burgeoning eCommerce market? What 5 factors do all of them have in common that contribute to India's outstanding growth? Here are the top 5 eCommerce players in India, according to our ECDB data.

June 10, 2024Download

Coming soon

Share

India's Top 5 Online Stores: Key Insights

Domestic Online Stores Dominate: India's top 5 eCommerce stores are all-Indian retailers. These include ajio.com, jiomart.com, reliancedigital.in, bigbasket.com, and croma.com. Three out of these five stores belong to Reliance Retail.

Success Factors: Universal reasons like the Covid-19 pandemic and geopolitical developments meet conditions specific to India, such as rural India's inclusion, improving benchmarks due to rising prosperity and global awareness of India's significance for the global market.

ECDB Benchmarks: Find out how India's cart abandonment and AOV have developed since 2020.

India is the world's 7th largest eCommerce market, with revenues predicted to reach US$105 billion by 2024. The largest product category by market share is Electronics, accounting for almost 24% of eCommerce revenues. Interestingly, India's top 5 eCommerce stores consist of homegrown players.

Find out about India's top 5 eCommerce stores and reasons accounting for their success.

India's Top 5 Stores: Ajio Takes the Lead

India operates within a closed ecosystem of domestic retailers that cater to the preferences and needs of consumers in the market. More specifically, below are the five online stores that sold most in Indian eCommerce in 2023:

Number one is AJIO, a fashion store launched by Reliance Industries in 2016. In 2023 ,it generated US$2.3 billion in online net sales.

Jiomart.com in second place is another subdivision of Reliance Retail. Jiomart offers a larger variety of products and follows the stated aim of delivering its products across the entire country. It thereby also reaches remote segments of India's population.

In third place is Reliance Digital, another subsidiary of Reliance Retail that sells Electronics & Media and Personal Care products.

BigBasket offers delivery of groceries and household essentials. It generated the fourth highest net sales in 2023, with US$921 million.

Finally, at number five is Croma, a domestic electronics shop that saw its eCommerce net sales skyrocket for the first time in 2022.

Here is why these 5 online stores stand out.

Factors for Online Store Success in India

Key factors driving the growth of top sellers in India range from changes in consumer habits to shifting development in international trade.

1. Changing Consumer Habits and Needs During Covid

Efforts to mitigate the effects of the pandemic in India led to changes in consumer habits that emphasized the need for quick delivery of essential goods such as food and household supplies, which were largely purchased in stores prior to Covid.

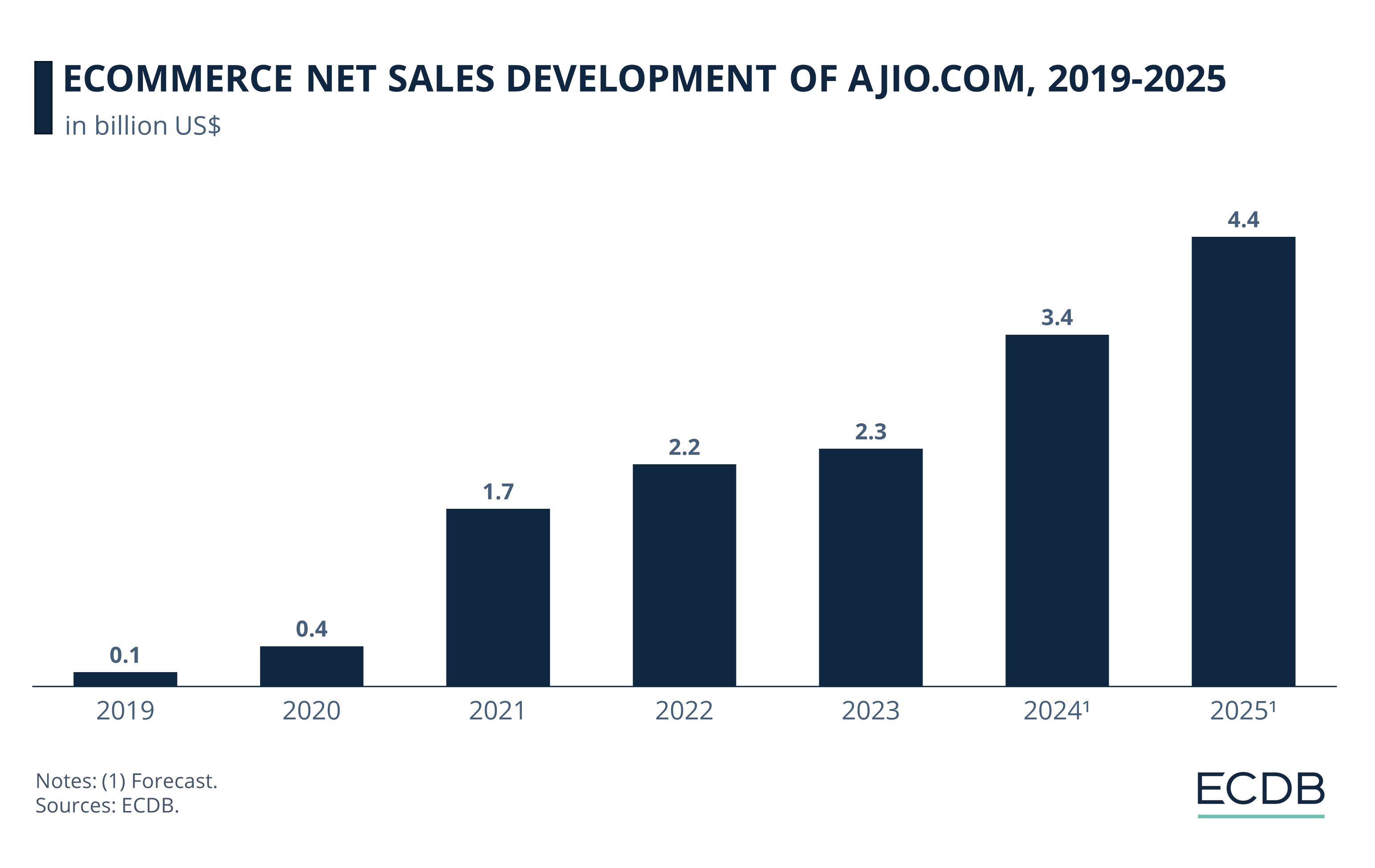

To avoid crowds and supply shortages, there has been a general increase in the online demand for these items, directly benefiting online grocer BigBasket, but also increasing the demand for fashion products by AJIO. As the number one eCommerce retailer in India, check out ajio.com's development over the past few years:

Clearly, the pandemic led to a surge in ajio.com's eCommerce revenue, which jumped from US$391 million in 2019 to US$1.7 billion in 2020. This represents a 340% increase.

The normalization period after the pandemic resulted in only a minor slowdown for ajio.com in 2023.

By 2024 and 2025, ECDB forecasts predict annual increases of 48% and 28%. This results in eCommerce net sales of US$3.4 billion and US$4.4 billion, respectively.

Apart from the universally applicable impact of the Covid-19 pandemic, there are also reasons specific to India's condition

2. Inclusion of Rural India Into the eCommerce Infrastructure

Online sellers were able to expand their customer base across the country as a larger portion of India’s rural population is now shopping online. As a result, a more diverse group of users in India are ordering a variety of products online and thereby take advantage of perks like home delivery and omnichannel services. Jiomart’s business strategy includes reaching these new customers, who are benefiting from India’s efforts to financially include these segments. This move improves economic inclusion and eCommerce growth.

3. Improving Market Benchmarks

As consumer expectations have changed, so had the demand for more flexible delivery options for items ordered online. AJIO, Jiomart, Reliance Digital, Big Basket and Croma not only offer express home delivery to their customers, but are also known for their hybrid delivery and pickup strategies that allow users to fit their online shopping habits into their personal schedules. With increasing consumer participation come higher revenues, which can be used to improve the user experience, product assortment, and machine learning capabilities to provide more suitable offers.

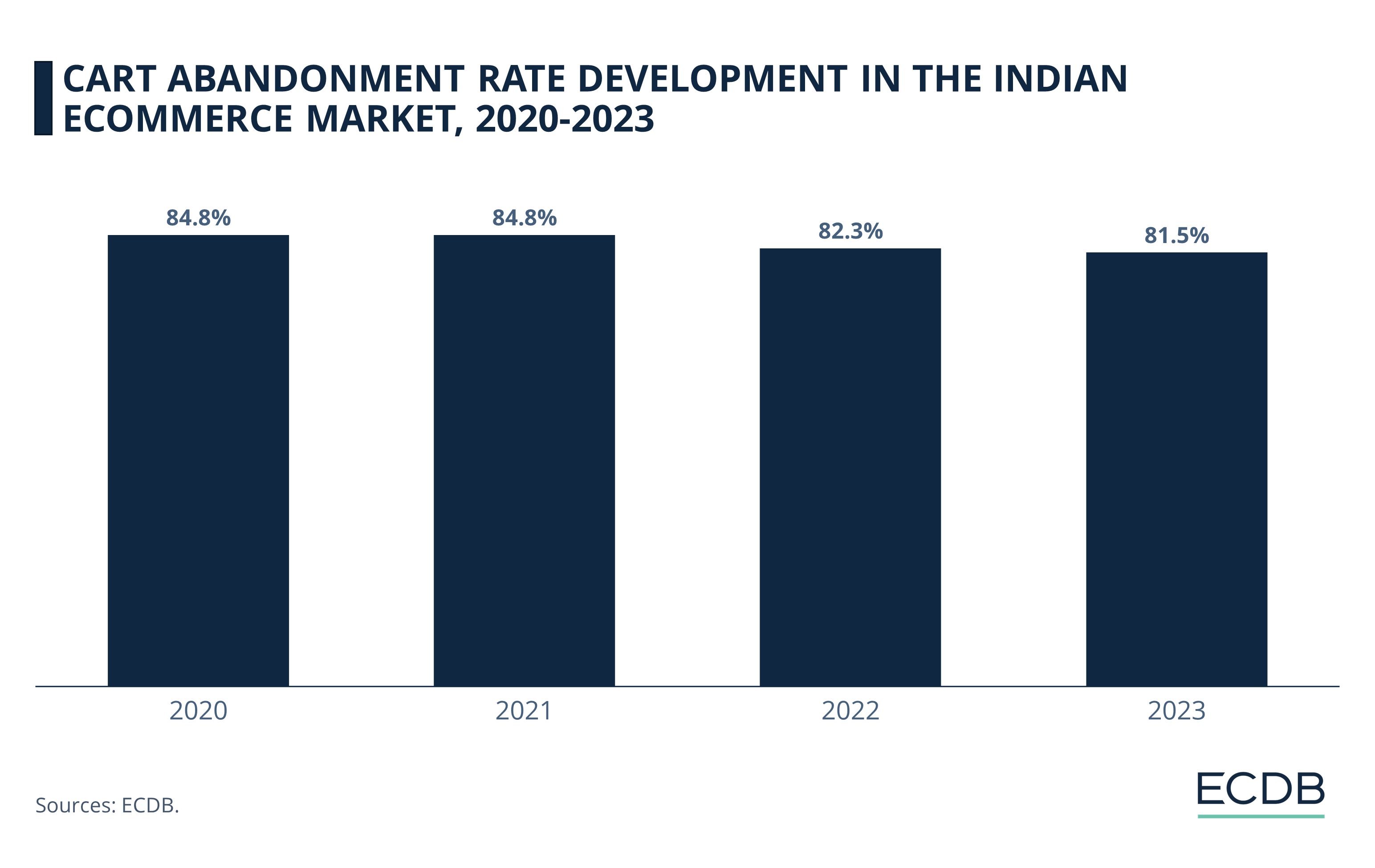

See what an amazing effect improvements of the online shopping experience have on the following benchmarks:

Since 2020, cart abandonment rates in India were reduced from 84.8% to 81.5% in 2023.

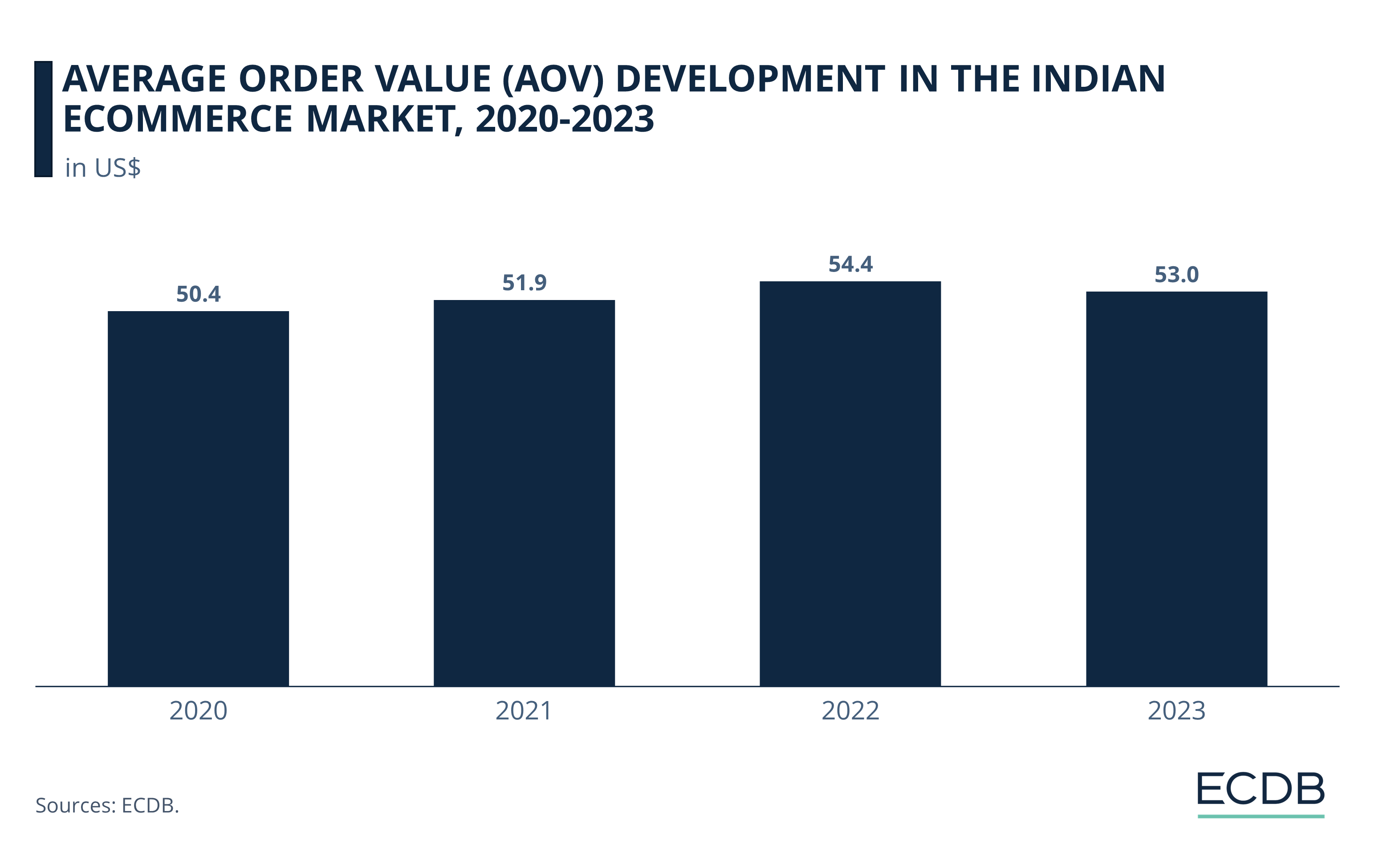

In contrast, the average order value (AOV) in Indian eCommerce increased over that period:

From an AOV of US$50.4 in 2020, it climbed to US$54.4 by 2022.

In 2023, AOV decreased slightly to US$53. However, this still represents a significant improvement since 2020.

Like this insight? It is based on our regularly updated rankings. With our retailer and country rankings, you can learn valuable information about your specific market. Our product category rankings and benchmarks allow you to see where various businesses are currently evolving. This information can aid in your decision-making, whether you are a business developer, shop owner, or CEO of a large eCommerce brand. Stay a step ahead of the market with ECDB.

A combination of improvement in infrastructure, a growing middle class, and larger eCommerce providers leads to the following: Growing global awareness and investor interest.

4. Increasing Investor Interest & Prosperity

Global eCommerce players like Amazon, Apple and Walmart are already present in Indian eCommerce, be it with an own domain or through subsidiaries. For instance, apple.com generates 0.7% of its eCommerce net sales in India, which represents about US$330 million in 2023. While amazon.in's online store was discontinued in 2020, it still operates its marketplace in the country and invests heavily in its tech workforce and infrastructure.

Most notable, however, is Flipkart, India's largest marketplace with a focus on fashion. Flipkart is owned by Walmart and therefore provides it with a valuable asset in the country.

5. Geopolitical Developments

In line with government efforts to reduce India’s dependence on Chinese electronics supplies, domestic and international distributors are turning to manufacturing facilities in India and neighboring regions to counter China’s monopoly in electronics manufacturing.

The goal is to establish India as a manufacturer as well as a distributor of goods and services domestically and internationally. This could benefit not only India’s economy, but also regional retailers and consumers, who could benefit from lower costs, as regionally produced goods eliminate import fees and prevent shortages due to global developments.

Classification Reveals Broader Trends

Companies with the highest net sales in Indian eCommerce have achieved their high rankings by responding to consumer needs, taking advantage of the improving eCommerce infrastructure, and benefiting from government and business efforts for India's domestic development.

Improving benchmarks reflect India's strong eCommerce revenue growth and further raise expectations for India's future development. The fact that India's top 5 eCommerce stores are domestic retailers emphasizes the importance of a strategy focused on India's unique conditions and common consumer preferences.

However, as evidenced by the entry of major international players such as Amazon, Apple, and Walmart, early participation in India's market growth is paying off due to geopolitical developments that point to a shifting power dynamic away from China.

Sources: Business Insider – Counterpoint – Economic Times of India – Financial Express – Reliance Digital: 1 2 – Times of India: 1 2 – Yo! Success

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Deep Dive

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

Deep Dive

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Deep Dive

eCommerce Market in China: A Maturing Market & Unsustainable Price Wars

eCommerce Market in China: A Maturing Market & Unsustainable Price Wars

Deep Dive

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Back to main topics