eCommerce: Japan

Japanese eCommerce: Consumer Trends, Revenue Development & Future Expectations

The eCommerce market of Japan succeeded in maintaining a unique balance between a strong online shopping sector and a popular offline tradition. Meanwhile, the country's revenues make it into the top 3 worldwide - what's the story behind these achievements?

Article by Cihan Uzunoglu | March 26, 2024Download

Coming soon

Share

Japanese eCommerce: Key Insights

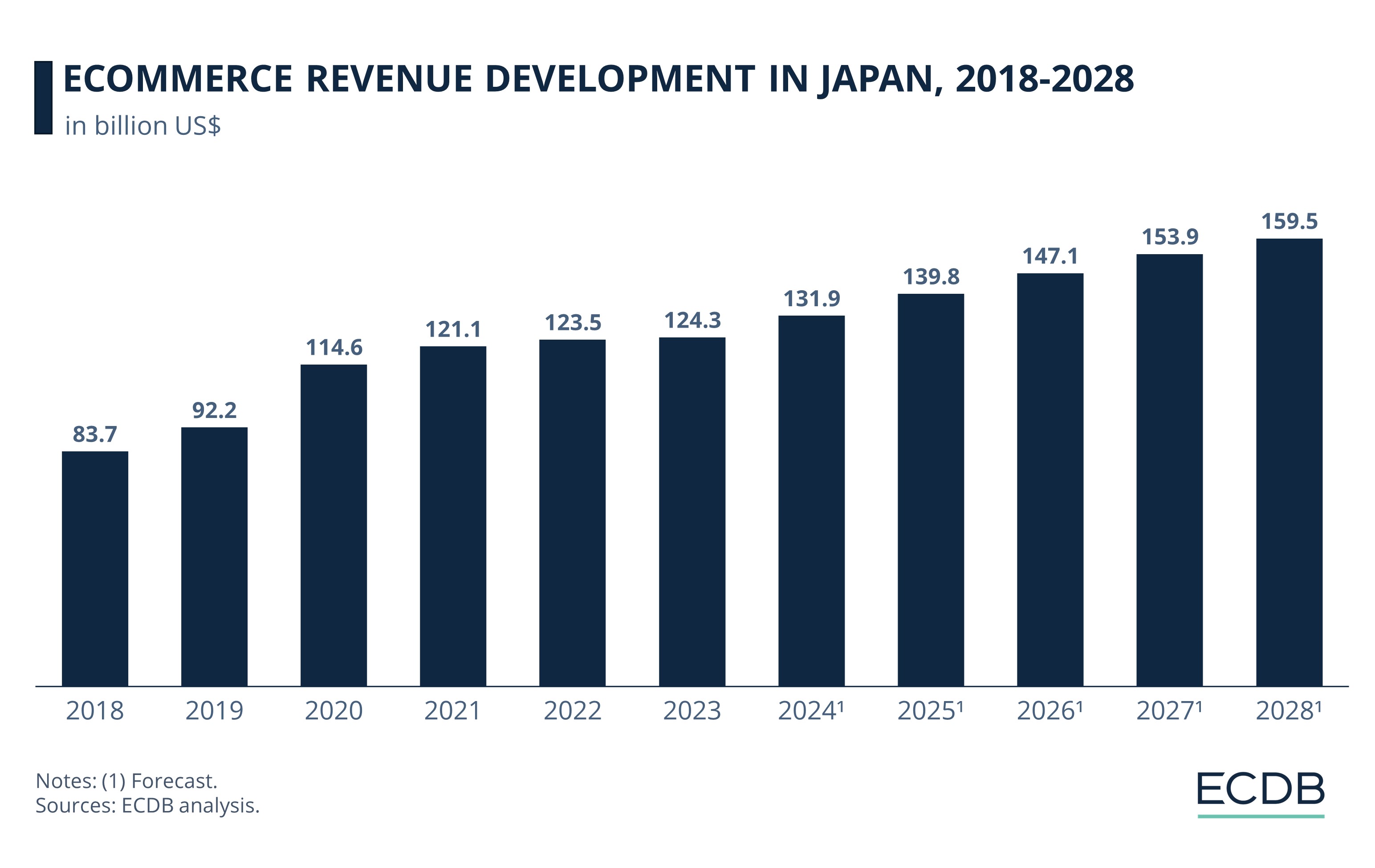

Japanese eCommerce Growth Trajectory: Japan's eCommerce sector is forecasted to grow steadily, reaching an estimated revenue of US$159.5 billion by 2028, with a compound annual growth rate (CAGR) of 4.9%.

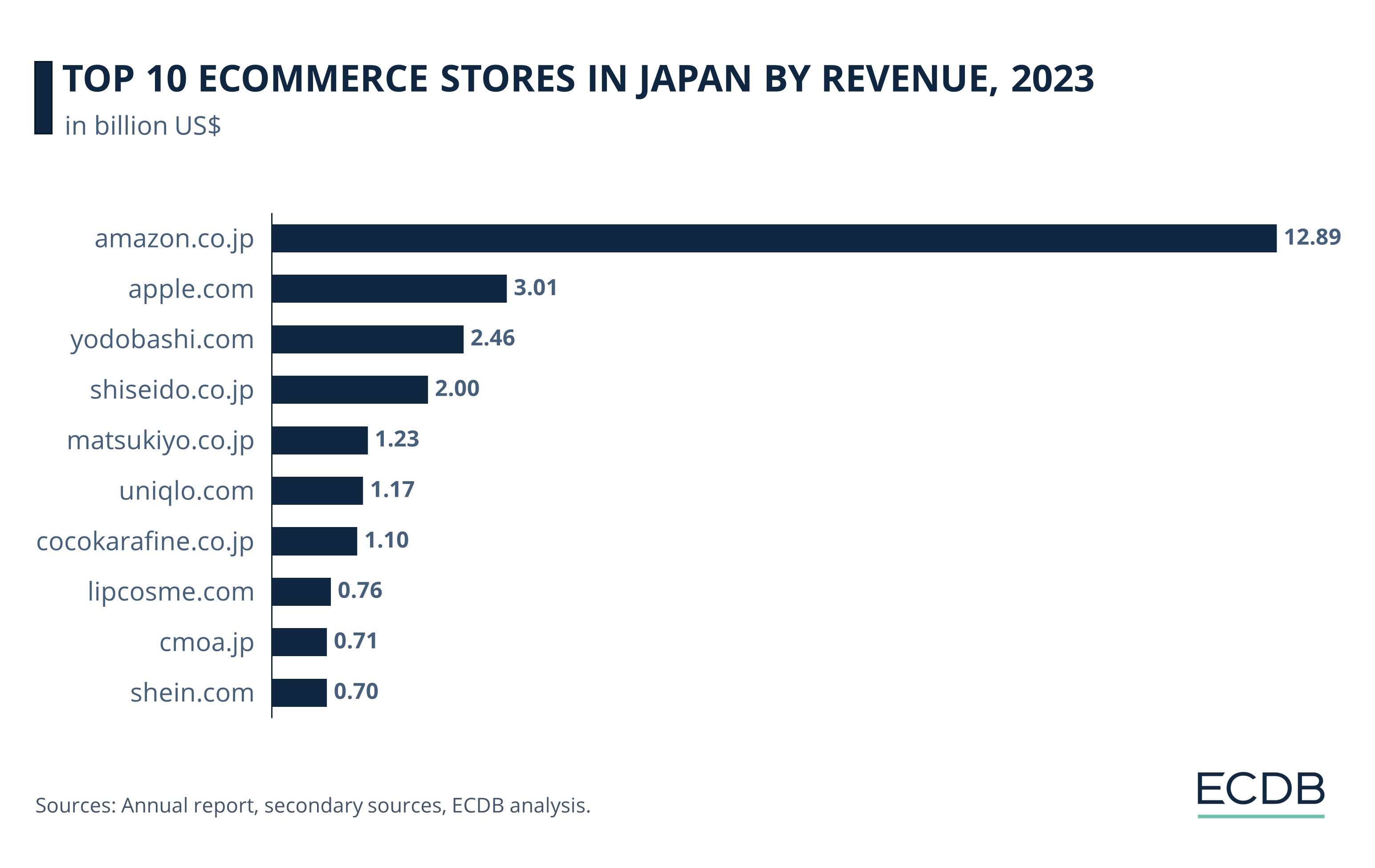

Top Online Retailers in Japan: Leading online retailers in Japan, including Amazon.co.jp, apple.com, and yodobashi.com, hold a significant market share, with Amazon.co.jp leading the pack with a revenue of US$12.9 billion in 2023.

Distinct Consumer Behavior: Japanese consumers balance online and in-store shopping, presenting challenges and opportunities for retailers.

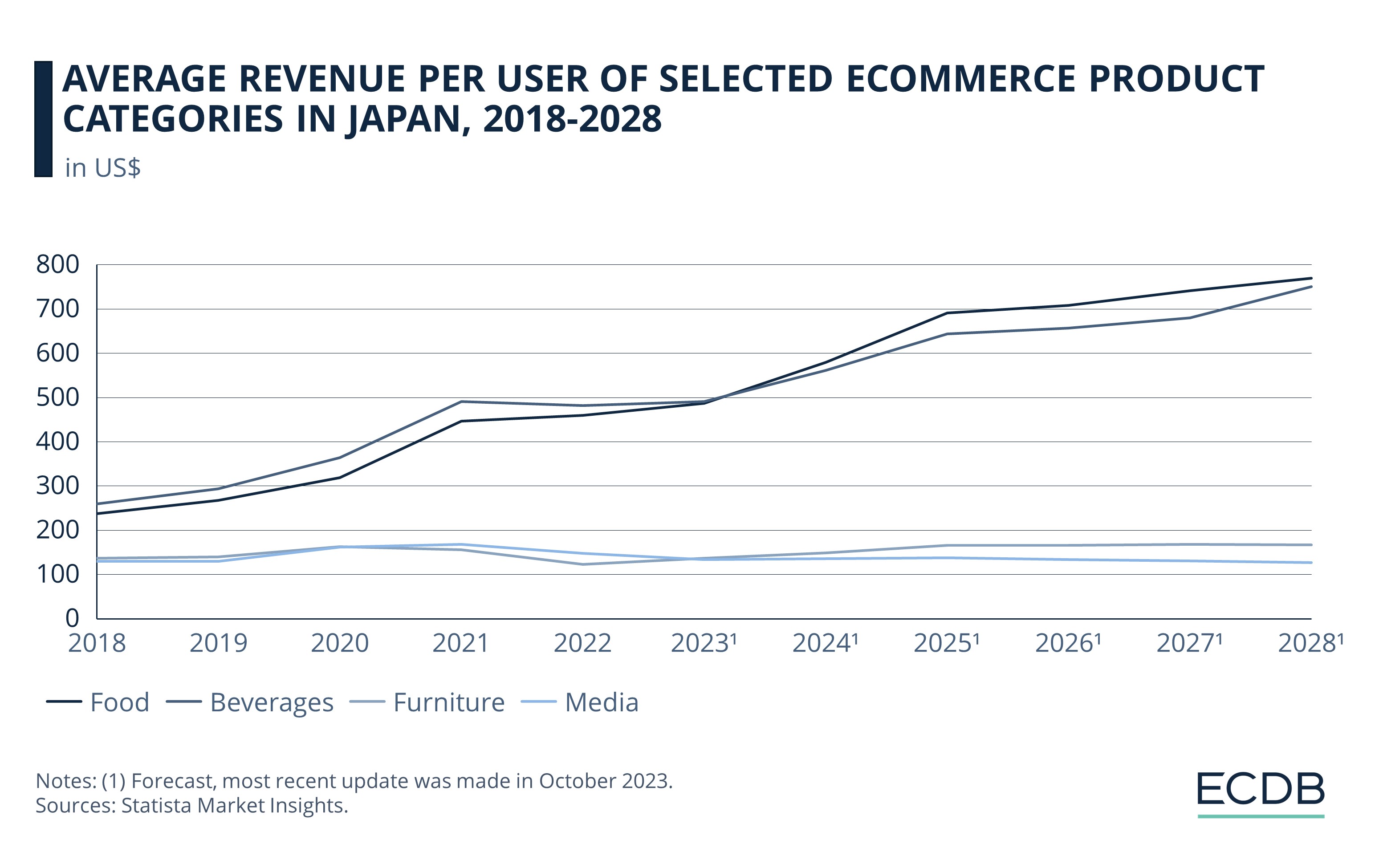

Online Food Segment: While Japan's food eCommerce segment shows steady growth, there's a notable increase in Average Revenue Per User (ARPU), especially in the online food delivery category.

Famous for its fine cuisine and rich culture, Japan is also well-known for its rapid industrialisation after the Second World War. The country is quick to adapt and yet knows how to preserve its traditional values - including in eCommerce.

The duality of a robust online marketplace alongside a vibrant offline shopping culture captures the essence of Japan's complex and rapidly evolving eCommerce sector. A sector where global giants like Amazon and Apple coexist with domestic players, in a landscape influenced as much by technological trends as by deeply ingrained cultural practices.

Japanese eCommerce is Expected to Reach US$203 billion in 2028 in Revenue

Japan ranks as the fifth biggest market in the global eCommerce sector, anticipated to generate around US$131.9 billion in revenue by 2024. The revenue in this sector is forecast to reach a compound annual growth rate (CAGR) of 4.9% between 2024 and 2028, leading to an estimated market size of US$159.5 billion by 2028.

With an expected increase of 6.2% in 2024, the Japanese eCommerce will contribute to the global growth rate of 10.4% in 2024. Like in Japan, global eCommerce sales are expected to increase over the next years.

As per 2023 figures, the leading online retailers in Japan's eCommerce sector include amazon.co.jp, apple.com, yodobashi.com, shiseido.co.jp, and matsukiyo.co.jp.

Amazon.co.jp dominates the scene with a revenue of US$12.9 billion for the year 2023. It is followed by apple.com, which posted sales of US$3 billion, and yodobashi.com with revenue of US$2.4 billion.

Rounding out the top 10, shiseido.co.jp comes in fourth place with revenue of US$2 billion. In fifth position stands matsukiyo.co.jp at US$1.2 billion, closely followed by uniqlo.com at US$1.2 billion, and cocokarafine.co.jp at US$1.1 billion. The narrow revenue gaps indicate intense competition for these spots.

Similarly, positions eight to ten are marked by a tight race: lipscosme.com stands at eighth place with US$756 million, slightly ahead of cmoa.jp's US$705 million and shein.com with a revenue of US$704 million.

Online Shopping Behavior in Japan

In an examination of global online spending habits, Japan emerges as an outlier within its digital commerce market.

According to an extensive report by Wunderman Thompson, containing survey data gathered from 18 countries around the world, Japan registers only 49% of its total spending online. This puts the country just above France, where 48% of all spending happens online. In contrast, Mexico leads the pack with 69% of all purchases conducted digitally, followed closely by Colombia at 66%.

Building on that note, a shift seems to be on the horizon for Japan's eCommerce market. The same report indicates that consumers in Japan, along with those in the Netherlands and South Africa, anticipate a significant movement towards online spending in the coming decade.

Specifically, these countries are expected to see a 12% swing from offline to online transactions. This suggests that, while Japan currently lags in the proportion of spending done online, it may be on the verge of a substantial transformation in consumer behavior.

Are Japanese Online Shoppers the Most Patient?

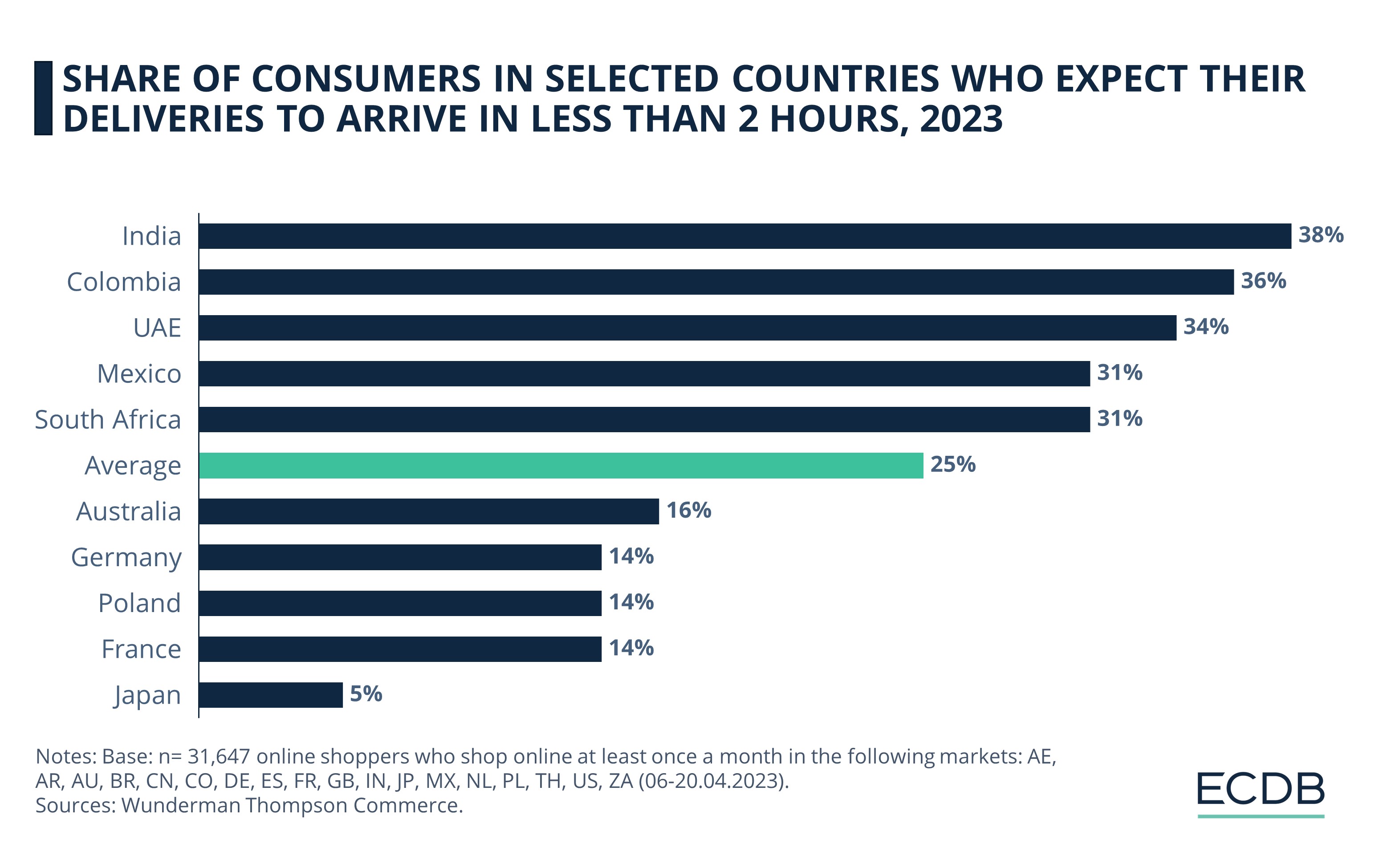

The same report by Wunderman Thompson shows that Japan has the lowest percentage when it comes to shoppers who will not shop with retailers, brands or marketplaces failing to match their expectations in the future. The country’s online shoppers are also highlighted as the most patient (or the least impatient) among the countries surveyed – impatience defined as expecting to have orders delivered in less than 2 hours.

The arguable patience of Japanese online shoppers also plays into the user experience. The Wunderman Thompson report points out that the country has the lowest percentage (38%) in terms of the share of online shoppers who want to get from inspiration to purchase as quickly as possible. In addition, it is important to underline the significant drop from the previous year, which stood at 66%.

In-Store Shopping: (Still) Big in Japan

The report goes on to explain why Japan consistently appears at or near the bottom of most of their survey tables.

Japanese consumers, it seems, are not disgruntled with their online shopping experiences. Instead, they relish the benefits of in-person shopping as well, desiring a balance between the two. Japan's robust offline retail landscape can be attributed to its high population density and a diversified range of shopping outlets, from supermarkets to drugstores. This convenience allows Japanese citizens to shop in-store every one to three days.

Moreover, for urgent purchases, local convenience stores offer quicker solutions than online delivery services. The decline in rapid online shopping, termed "compressed commerce" is also influenced by economic factors such as inflation and rising product costs, prompting consumers to be more judicious in their buying decisions.

Japanese eCommerce Market: What Can We Expect?

While the findings so far paint a nuanced picture of Japan's eCommerce behavior, it's critical to recognize that Japan, in fact, maintains its standing as the world's third largest eCommerce market.

Moreover, with an average expenditure of US$455 per item, Japanese consumers rank fifth globally in their willingness to spend on a single online product, according to the Wunderman Thompson report.

The rate of eCommerce adoption offers additional insights into Japan's retail future. According to Statista Market Insights, the penetration rate was 48.8% in 2018 and rose to51.1 % in the pre-pandemic year of 2019. The pandemic further accelerated this adoption, pushing the rate to 57.7% in 2020 and 68.5% in 2021. Although 2022 shows a modest growth to 73.5%, the trajectory remains upward, with forecasts predicting a penetration rate of 94.2% by 2028.

The Japanese eCommerce market presents an intricate, yet promising mixture of trends and behaviors. While it may have its own unique consumer quirks, the upward trajectory in online spending and digital adoption signals the market's robustness and adaptability.

Fast Growth in Online Food Purchases

The data from Statista Market Insights reveals an interesting dichotomy within the Japanese eCommerce market, particularly in the food segment. While the food segment's estimated revenue shows steady growth, it doesn't quite stand out when compared to other categories: the growth in estimated revenue for food is from US$18.69 billion in 2023 to US$37.58 billion in 2028. The percentage increase is notable but not significantly higher than other sectors such as Beauty & Personal Care, Fashion or Beverages.

However, the estimated Average Revenue Per User (ARPU) for the food segment paints a different picture. From 2023’s projected US$487.6, this figure jumps to US$769.6 in 2028. This is a considerably faster growth rate compared to the ARPU in other sectors.

There are several factors that could explain this. One plausible reason could be the introduction of premium or specialized food products in the online market. Consumers may be showing willingness to spend more per transaction on quality food items, driving the ARPU upwards.

Another explanation could be that while the market for food online is growing, it is doing so with a more modest increase in the number of users compared to other categories. In this scenario, existing users might be spending more, thereby lifting the ARPU, even though the total revenue growth is not radically different from other segments.

It is also worth noting that similar growth patterns in ARPU for the food segment are also expected in markets such as the United States and Germany. This could suggest a global trend or consumer behavior shift towards higher online spending on food products, possibly fueled by changing lifestyles or an increased focus on quality and convenience in food purchases.

Pandemic Accelerated Japan's Online Food Delivery Markets

Before the pandemic, online grocery shopping was uncommon in Japan due to a focus on fresh, quality produce. The market is now seeing a shift to online buying. Driven by dual-income households and less time for shopping, this change appears lasting.

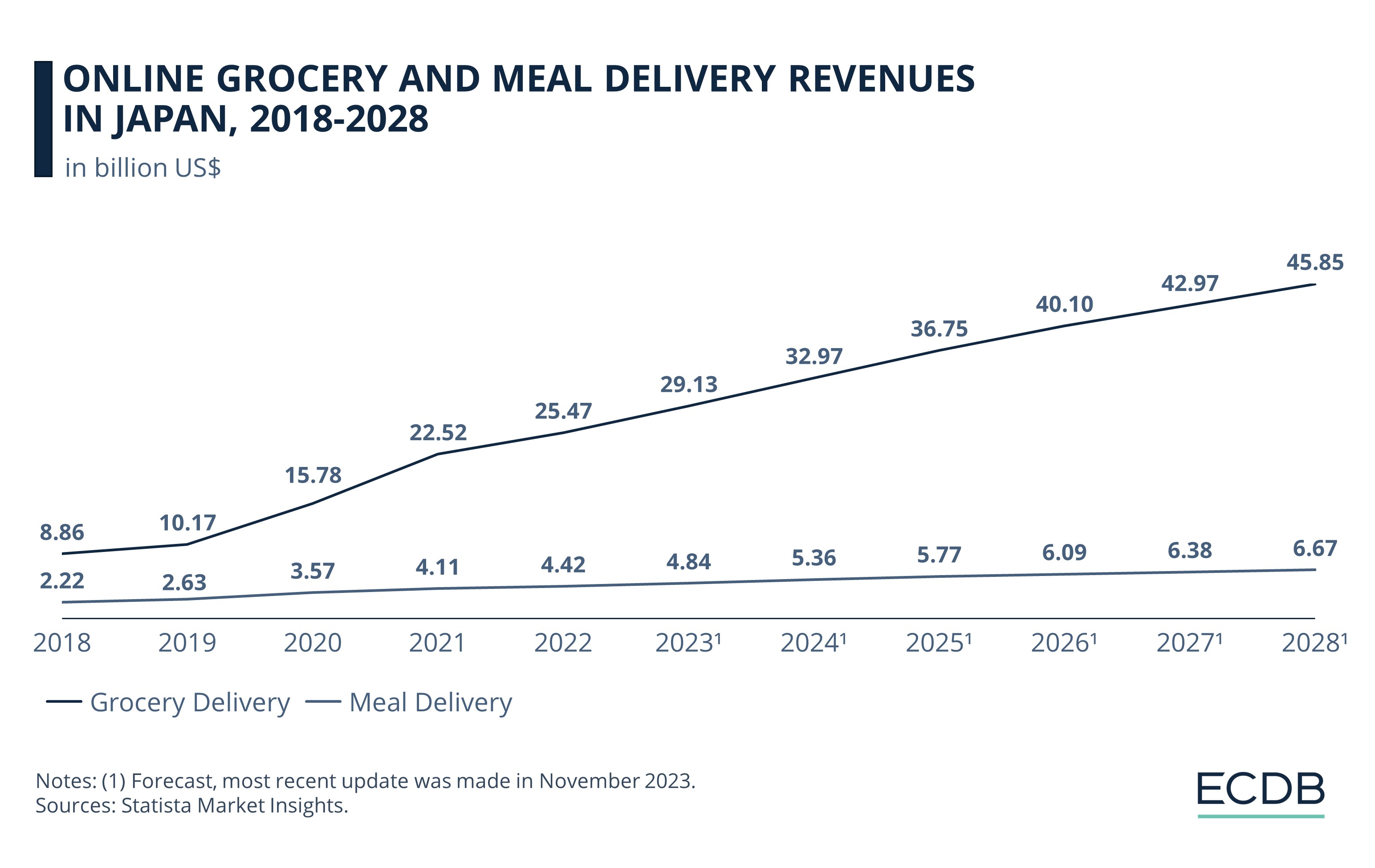

Statista Market Insights data indicates a significant surge in revenues for both online grocery and meal delivery between 2019 and 2021. In 2019, online grocery delivery was at US$10.17 billion and online meal delivery at US$2.63 billion. These figures leapt to US$22.52 billion and US$4.11 billion in 2021, driven by the pandemic. Post-2021, both sectors continue to grow steadily, though at a more moderated pace. Forecasts for the future are optimistic, with online grocery delivery expected to reach US$45.65 billion and meal delivery to hit US$6.67 billion in 2028.

Large retailers with technological capabilities stand to benefit, while smaller ones face challenges. However, there's room for brick-and-mortar stores to adopt features like click and collect. The pandemic has sped up this shift, aligning with a global rise in average revenue per user in the food segment.

The Japanese Online Food Delivery Scene

Japan's food delivery market is rife with both domestic players like Demae-can and Rakuten and foreign entrants like Uber Eats and DoorDash.

The prospects of these players depend on the evolution of consumer behavior in Japan. Is the shift towards food delivery a pandemic-induced anomaly, or is it indicative of a deeper change in dining patterns?

All competitors who want a piece of the pie must also confront the cultural factors at play. What works in the United States or Europe may require a different approach in Japan, where tradition often holds sway and where previous foreign businesses like Walmart and Tesco have faltered.

In 2022, Didi Global, the Chinese ride-hailing giant, winded down its food delivery arm, DiDi Food Japan, signaling a strategic retrenchment amid broader challenges. The Osaka-based food delivery venture had commenced operations in April 2020 and later expanded to nine prefectures in Japan.

Moreover, Didi is not alone in its retreat from the Japanese food delivery market. Germany's Delivery Hero also opted to sell its FoodPanda operations in Japan in December 2021. Although the pandemic provided a boost to the online food delivery sector, the high cost of customer acquisition has been a persistent issue for companies operating in this space.

The withdrawal of DiDi Food Japan from the market serves as a case study in the volatility of the online food delivery industry. While the demand for such services has increased, particularly during the pandemic, the challenges of maintaining a profitable operation have proven formidable.

Can Start-Ups Light the Fire of Digital Transformation in Japanese Restaurants?

Japan's online food sector is not just about large retailers and global delivery giants; it also presents fertile ground for start-ups and innovators. The story of Serkan Toso and Kaoro Joho illustrates this entrepreneurial spirit.

Both were managing food-centric start-ups — Tokyobyfood.com and Tablecross — aimed at helping foreigners discover Japanese cuisine and make restaurant reservations, respectively. In 2019, they merged their enterprises to form Tablecross Co Ltd, rebranded as byFood.com. This union has been profitable, securing US$2.24 million in Series A funding, with an eye on international expansion to markets like Taiwan, South Korea, and Thailand.

Their vision is to make byFood.com the go-to platform for food tourism in Japan, a country where, according to Toso, a remarkable 70% of travelers arrive mainly to savor its culinary offerings. However, there exists a gap between demand and supply. Only a fraction of restaurants in Japan offer online reservations. "Everything is so manual. Some restaurants are still using fax machines,” Toso observes. This chasm provides a significant opportunity for digital transformation in the restaurant sector, something byFood aims to address.

How YouTube Creators Influence Japanese Online Food Scene

As Japan's food scene adapts to the digital age and changing consumer behavior, YouTube has emerged as a surprising ally. YouTubers like Seiryu Sakoda of F-Area Ltd., with his mission-driven channel Japanese Food Craftsman, offer a lifeline to local eateries through English-subtitled documentaries. The success of Sakoda's channel even led to the opening of a second location for a hot dog shop he featured. Other creators, such as the virtual YouTuber OniGiri, aim to diversify content by showcasing different facets of Japanese cuisine.

These creators are more than just influencers; they are the new custodians of Japan's culinary heritage. Their reach extends beyond entertainment, affecting business sustainability and even contributing to cultural preservation. The platforms they use are becoming specialized hubs for Japanese culinary content, offering audiences around the world a virtual seat at Japan's culinary table.

This marks a significant pivot in Japan's online food sector, revealing how digitization is reshaping not just business models but also cultural narratives. Whether it's large retailers, delivery services, startups, or content creators, the common thread is innovation. As we move forward, these evolving platforms will likely continue to shape the future of food in Japan, offering new opportunities and challenges alike.

Sources: Wunderman Thompson - Asashi - Financial Times - Nikkei Asia - Delivery Hero - WiT - The Japan Times - Statista - ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Deep Dive

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

Deep Dive

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Deep Dive

eCommerce Market in China: A Maturing Market & Unsustainable Price Wars

eCommerce Market in China: A Maturing Market & Unsustainable Price Wars

Deep Dive

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Back to main topics