eCommerce: Germany

New Zalando Campaign Aims to Transform Brand Identity: But Why?

One of Europe's largest fashion companies, Zalando, aims to solve a common dilemma: "What do I wear today?" Wearing Zalando only certainly helps solve that problem — and boosts the company’s net sales in the process.

Article by Patrick Nowak | September 11, 2024

New Zalando Campaign Aims to Transform Brand Identity: Key Insights

Willem Dafoe Leads the Charge: Zalando’s latest campaign, featuring Willem Dafoe in a stylish 30-second ad, aims to inspire fashion choices while highlighting the brand’s revamped identity.

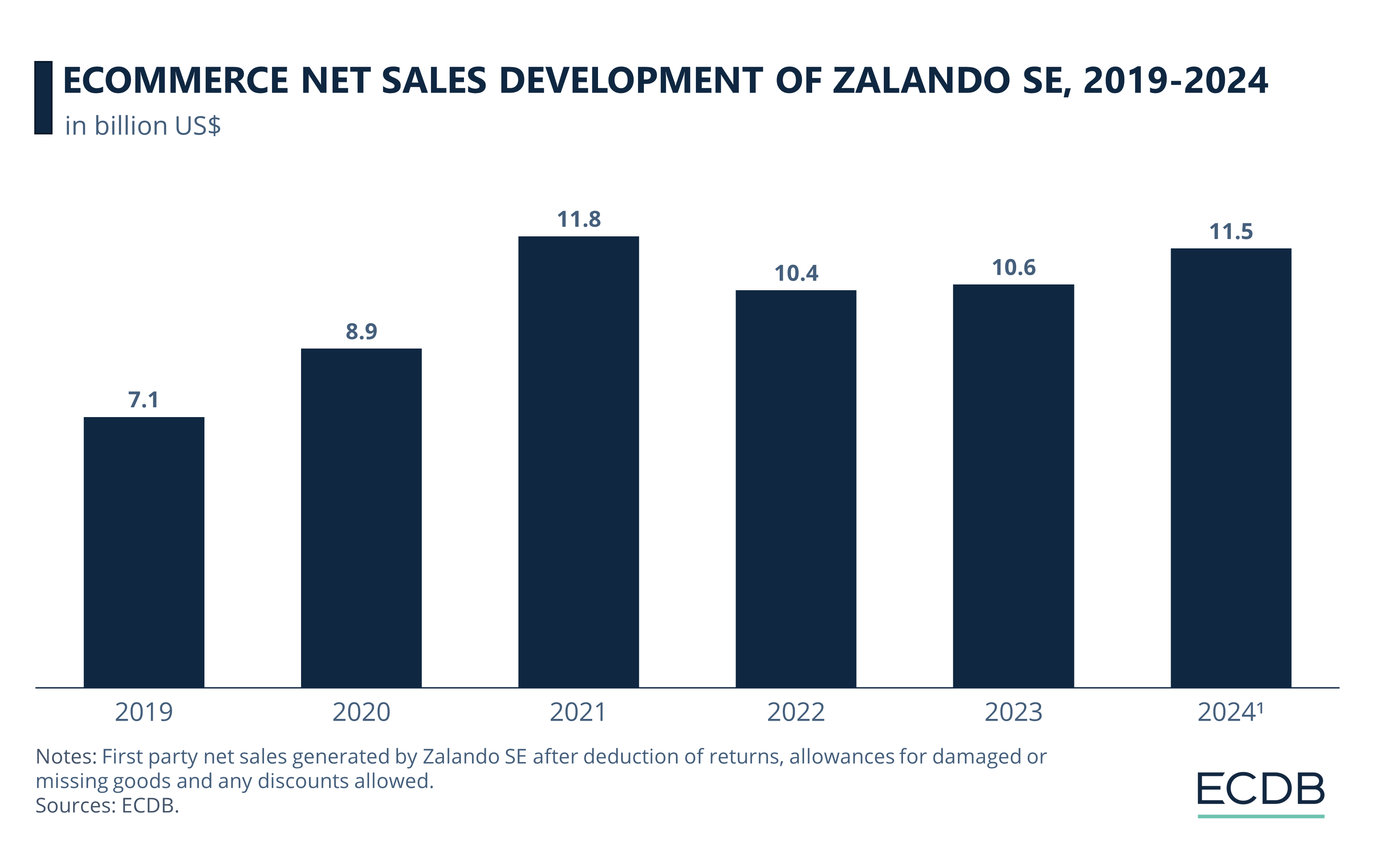

Rebounding from a Sales Dip: Despite a drop in revenue from US$11.9 billion in 2021 to US$10.5 billion in 2022, Zalando is projected to recover, with 2023 forecasts at US$11 billion.

Challenges Ahead in the UK Market: Zalando has faced a 10,7% decline in UK net sales, dropping from US$240 million to US$220 million, with an additional 3% decline expected in 2024. The new campaign is a strategic move to regain ground.

"What Do I Wear?" — that's a great question. Like many people, I ask myself this every day. Zalando’s answer? "Well, let a perfectly styled Willem Dafoe show you!" In a 30-second ad (crafted by the famous Wieden+Kennedy Amsterdam), the Hollywood star is the only one not agonizing over this daily dilemma. Everyone else in the subway? They're swiping through the Zalando app, hunting for their perfect outfit.

But let's be real: when a brand rolls out a rebrand, redesign, and splashes Hollywood stars all over a massive media campaign, it often means one thing — trouble. That being said, the data shows Zalando SE isn't exactly sinking. According to ECDB, while the company did take a hit, dropping from US$11.9 billion in 2021 to US$10.5 billion in 2022, it's slowly bouncing back, with projections of US$11 billion for this year.

Like this insight? It is based on our regularly updated rankings. With our retailer and country rankings, you can learn valuable information about your specific market. Our product category rankings and benchmarks allow you to see where various businesses are currently evolving. This information can aid in your decision-making, whether you are a business developer, shop owner, or CEO of a large eCommerce brand. Stay a step ahead of the market with ECDB.

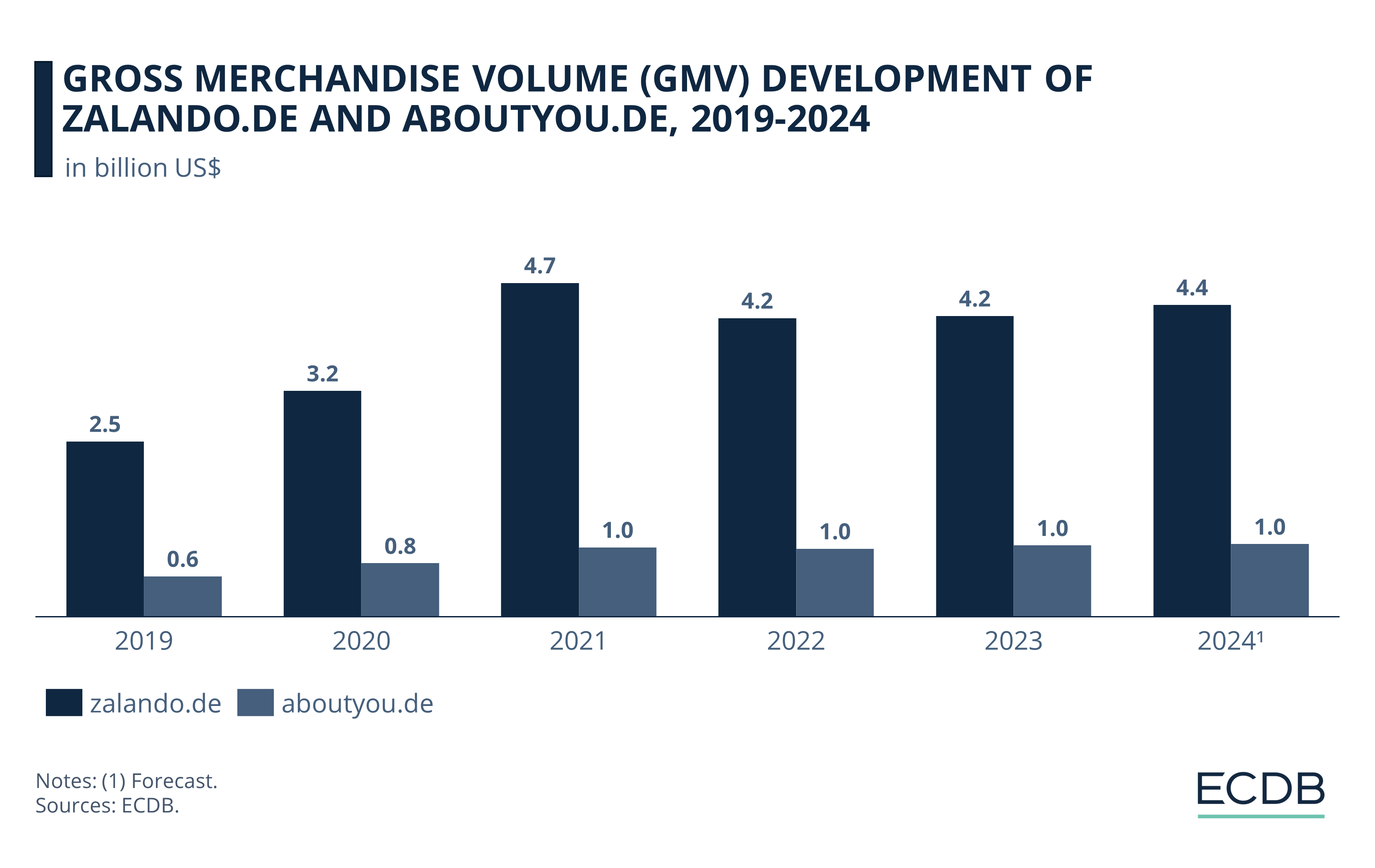

To put things into perspective, one of their biggest competitors, AboutYou.de, is still playing catch-up in Germany. Zalando’s Gross Merchandise Volume (GMV) is around US$4.4 billion, while AboutYou has been stuck at US$1 billion for the fourth year running.

The real fuss is about Zalando’s declining net sales in the United Kingdom. ECDB data shows that Zalando.co.uk has been slipping since 2022. In 2023, the company took a 10,7% hit, dropping from US$240 million to US$220 million in net sales. And the outlook isn't exactly bright: our data suggests they’re poised to lose another 3% in 2024.

It’s not catastrophic, but let’s just say the new media campaign seems like a smart way to try and regain some ground before things slide further. Because who can resist a fresh look and Willem Dafoe in an ad?

Zalando: "This evolution is all about style confidence"

“We are evolving our brand to play a greater role in our customers’ lives,“ Anne Pascual, senior vice president design, marketing and content at Zalando, said in a statement. “This evolution is all about style confidence and redefining how our customers connect with fashion and lifestyle.”

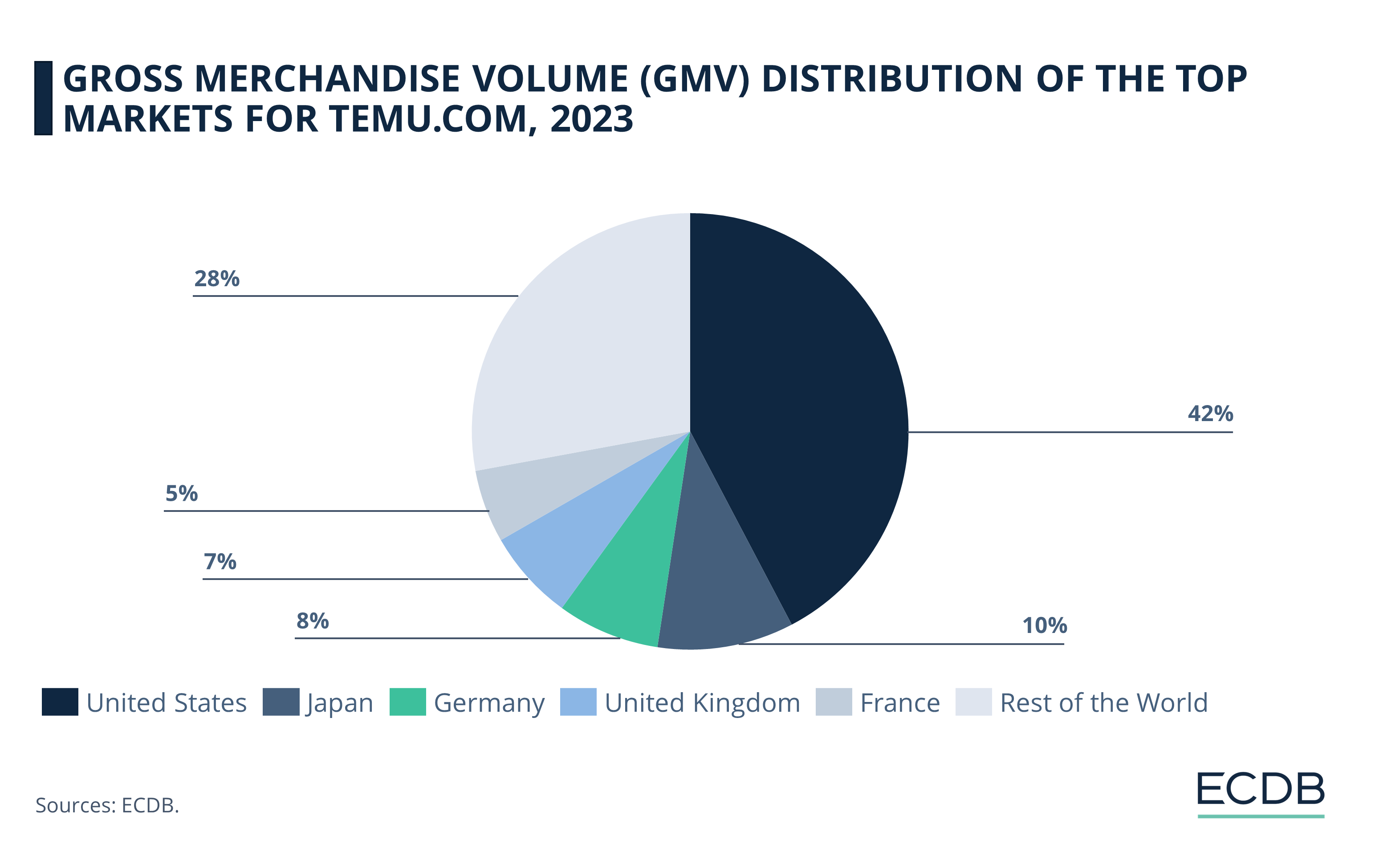

The new collection looks promising, but how will customers respond — especially with affordable alternatives from platforms like Temu and Shein? In the coming years, Chinese fast fashion brands will pose the biggest threat to companies like Zalando and AboutYou, which rely on customers who identify with brand loyalty.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

ByteDance Is Big on Personal Care, Powered by Content on Douyin and TikTok Shop

ByteDance Is Big on Personal Care, Powered by Content on Douyin and TikTok Shop

Deep Dive

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Deep Dive

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Kaspi to Acquire Stake in Hepsiburada, Expanding Presence in Turkey

Deep Dive

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Deep Dive

Wayfair’s Shopping Way Day: Analysis & Market Insights

Wayfair’s Shopping Way Day: Analysis & Market Insights

Back to main topics