Market Insights

Global Online Jewelry & Watches Market: Growth Analysis, Top Online Stores, Industry Trends

The global Jewelry & Watches market has seen consistent growth, achieving revenues of US$87 billion in 2023. Will it keep expanding in the future? Discover insights into its market development, the top online stores, and trends.

Article by Cihan Uzunoglu | April 08, 2024Download

Coming soon

Share

Global Online Jewelry & Watches Market: Key Insights

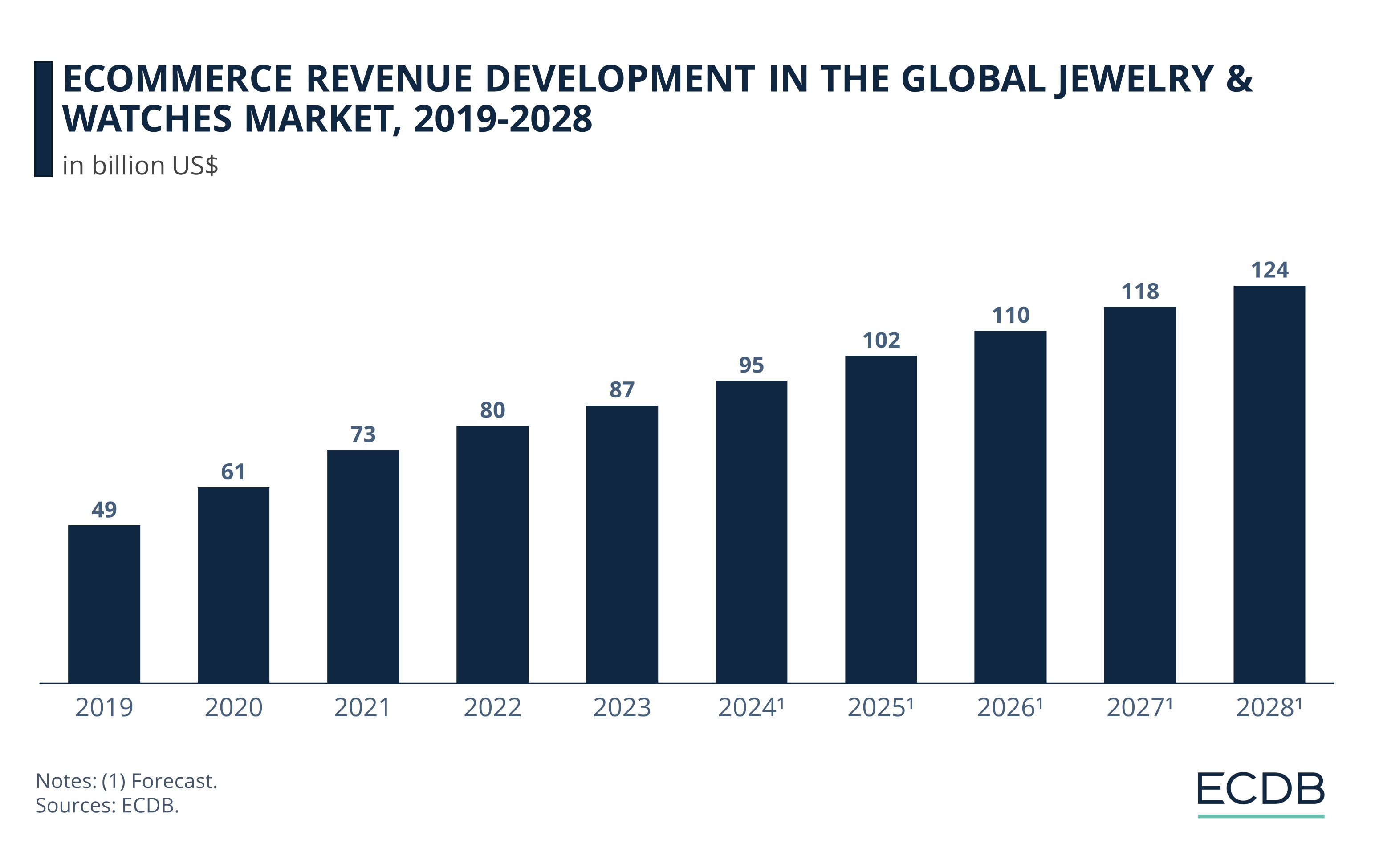

Growth Projection: The global Jewelry & Watches eCommerce market generated revenues of US$87 billion in 2023. It is expected to grow at a compound annual growth rate (CAGR 2024-2028) of 7.1% to reach a market size of US$124 billion by 2028.

Top Online Stores: In the Jewelry & Watches eCommerce market, ctfmall.com is the top store in 2023, with net sales of US$873 million. Pandora.net is a close second with sales of US$820 million, followed by bluenile.com with US$595 million.

Industry Trends: As a young and digital-first consumer base comes of age, the Jewelry & Watches market is adapting. Trends shaping the industry include fast fashion, sustainability, and artificial intelligence.

Since the pandemic, the global Jewelry & Watches online market has grown steadily. As online revenues increase, consumer trends and technological innovation continue to impact the industry’s evolution.

How has the Jewelry & Watches market developed in recent years and what are its growth projections? Which stores rank at the top, setting industry trends?

Global Jewelry & Watches: Market Development, 2019-2028

While traditional brick-and-mortar stores are still relevant, eCommerce is changing the way customers shop for Jewelry & Watches.

The global Jewelry & Watches eCommerce market is worth US$87 billion in 2023. The trend in this market is that of consistent growth. Notably, no dips have been recorded since 2019.

In the period under study, the Jewelry & Watches market grew the fastest between 2019 and 2020, when revenues climbed by nearly 25%. At the same time, the online sales share also increased – from 21.5% to 28% – likely as more consumers turned to online platforms to shop for Jewelry & Watches when lockdowns were imposed.

In 2022, while online revenues increased again, the growth rate of the online market had adjusted to 10%. At this time, lockdown mandates were loosened, and global travel resumed. This may have led to comparatively lower online sales for Jewelry & Watches – a segment where shoppers generally prefer to shop in brick-and-mortar stores, as explored in ECDB’s report on the Luxury eCommerce Market, which hints that this customer preference is a likely cause behind the still-low online share in Jewelry & Watches.

Going forward, the global Jewelry & Watches eCommerce market is projected to expand. ECDB predicts that revenues will grow at a compound annual growth rate (CAGR 2024-2028) of 7.1% to reach US$124 billion by 2028.

Top Online Stores in Jewelry & Watches: Ctfmall.com Leads, Followed by Pandora.net

Among eCommerce platforms that have dedicated their entire business model to the sale of Jewelry & Watches, many stores compete for the top spot, but the ranking has remained fairly consistent in the past three years.

In 2023, ctfmall.com is the top Jewelry & Watches online store, earning US$873 million. Operated by Chow Tai Fook Jewellery Group, it generates all its revenue in China. It first ascended to the top spot in 2021, from the third position that it held in both 2019 and 2020. The store has retained its leading rank since then.

Pandora.net ranks second in 2023, with sales of US$820 million. After a brief stint at the top in 2020, it was displaced by ctfmall.com in 2021. Since then, it has maintained the second position.

Bluenile.com follows next, with net sales of US$595 million in 2023. Despite holding the first position in 2019, revenues declined in the subsequent years. It currently ranks third, with net sales much lower than both ctfmall.com and pandora.net.

Other notable stores include brilliantearth.com and jamesallen.com, each with net sales between US$453 and 473 million in 2023. They have also seen shifts in their ranking, with the former ascending from the fifth spot in 2019 to the fourth rank in 2023, and the latter dropping from the fourth to the fifth ranking in the same period.

Further down the list, chowsangsang.com dropped to rank#8 in 2020, before rising to its current rank of #6. On the other hand, tiffany.com has held the ninth spot since 2019, while sunlight.net has seen a gradual rise, moving from the twelfth spot in 2019 to tenth in 2021, where it remains till now.

Despite shuffles within the top ten, no new stores have broken into the list since 2021. This suggests that the top players have strengthened their online presence in recent years and that the Jewelry & Watches market poses high entry barriers for new players seeking to gain top spots.

Sustainability and Technology Pave Way for Innovation in the Jewelry & Watches Market

Many factors drive change in the global Jewelry & Watches eCommerce market—younger consumers, fast fashion, sustainability, and technology, to name some of the important ones. Consumer attitudes and behaviors vary, however, which often allows for competing trends to influence the industry’s growth.

Fast fashion jewelry has become increasingly popular in recent years as it helps consumers stay on trend at a fraction of the cost of traditional luxury items. This model hinges on speedy trend turnover and affordable pricing. Central to many eCommerce success stories, it is also now reshaping the Jewelry & Watches industry.

A contrary trend to that is sustainability. Younger consumers, in particular, emphasize environmental consciousness when shopping for fashion items. Their concerns over sustainability have prompted brands in the Jewelry & Watches segment to recalibrate their production values and strategies. To appeal to the Gen Z market, companies are shifting towards recycled, sustainably mined, or alternative materials. They are also beginning to use artificial intelligence to reduce waste in their production processes.

Emergent technologies such as artificial intelligence, AR and VR are also disrupting the Jewelry & Watches market. Apart from design innovation and sustainability, renowned brands like Pandora now offer AI-driven immersive experiences, virtual try-ons, and concept stores to personalize and upgrade their customers’ online shopping experience.

Closing Remarks

The global Jewelry & Watches market has registered continuous expansion since 2019, and growth projections remain positive. While most of the retail sales still take place offline, the share of online sales is consistently climbing: in 2023, online sales accounted for nearly 30% of total retail sales in the worldwide Jewelry & Watches market.

With sustainability concerns as well as technology integration increasing, the ground is ripe for consumers – specifically those young, digital-first, and with expendable incomes – to turn more and more towards digital channels when shopping for Jewelry & Watches.

Sources: SCMP, Retail Dive

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Deep Dive

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

Deep Dive

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Deep Dive

eCommerce Market in China: A Maturing Market & Unsustainable Price Wars

eCommerce Market in China: A Maturing Market & Unsustainable Price Wars

Deep Dive

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Back to main topics