eCommerce: Payments

Online Payments in Brazil: Pix Might Soon Surpass Credit Cards

As eCommerce evolves in Brazil, so do payment preferences. Data shows that Pix may surpass credit cards in popularity for online payments sooner than expected.

Article by Cihan Uzunoglu | September 11, 2024

Online Payments in Brazil: Key Insights

Pix to Lead eCommerce Payments: By 2025, Pix is set to surpass credit cards as Brazil’s dominant eCommerce payment method, fueled by its free and instant transaction capabilities.

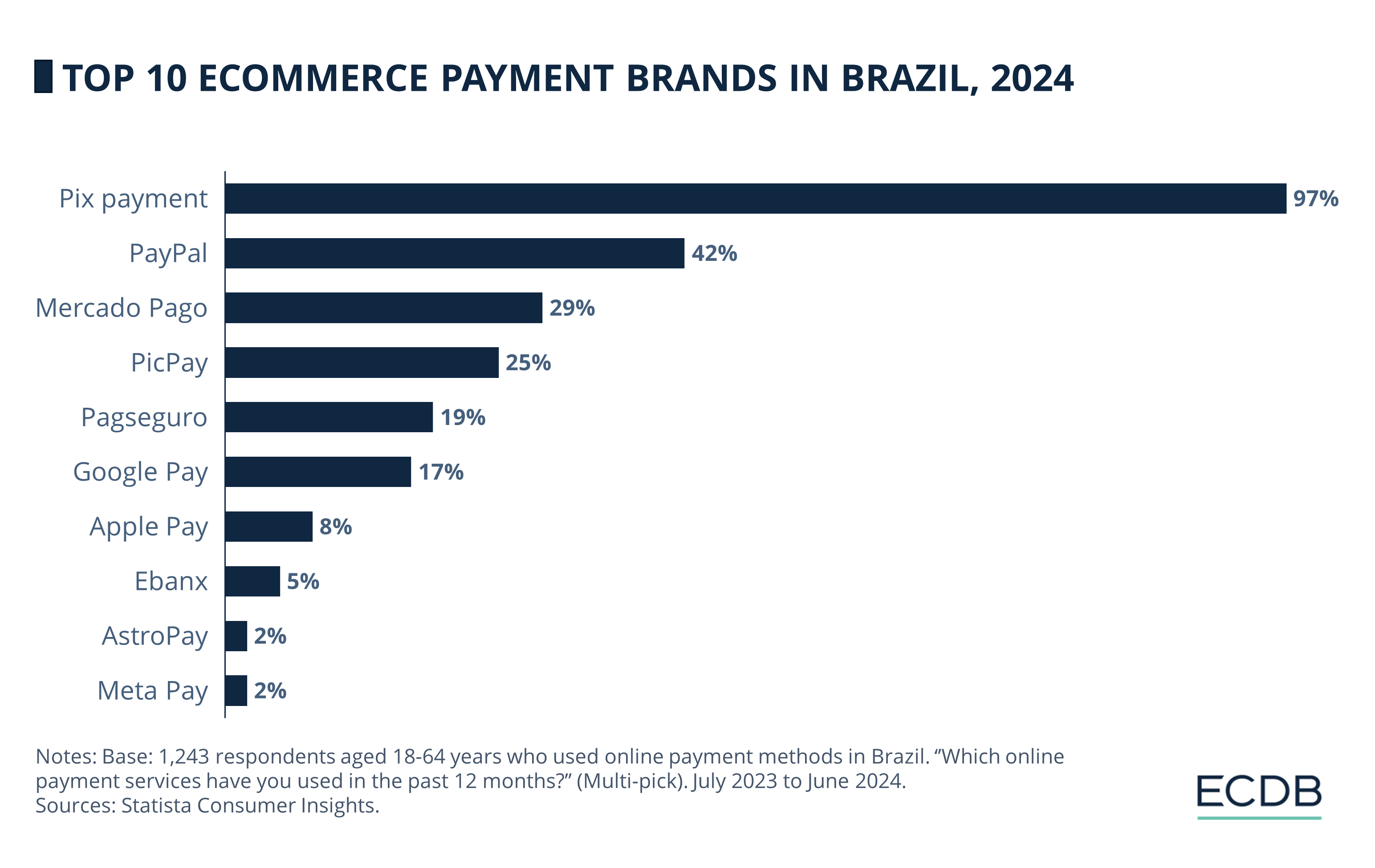

Market Superiority: With 97% of respondents using Pix, the platform has established itself as Brazil's leading eCommerce payment solution, leaving competitors like PayPal and Mercado Pago trailing behind.

Coexist with Credit Cards: New features like installment payments will strengthen Pix’s position against credit cards, though both systems are likely to coexist as credit cards adapt to remain competitive.

Brazil's instant payment system, Pix, is on track to surpass credit cards as the leading payment method in Brazil's eCommerce sector by 2025, earlier than previously expected, according to a study by payments firm Ebanx.

Launched by Brazil's central bank in late 2020, Pix has quickly become one of the most widely used payment tools for money transfers and online purchases due to its free, instantly-settled transactions. By the end of 2025, Pix is expected to account for 44% of the local online payment market, surpassing credit cards, which are projected to hold 41% of the market.

Pix's Growth in Brazil's eCommerce Market

This rapid growth is notable as an earlier study by Ebanx predicted Pix would nearly match credit cards in the online purchase market only by the end of 2026. The new forecast highlights Pix's accelerated rise in popularity, driven by its ability to offer merchants an accessible, instant payment option.

Pix's growth is credited to its ability to promote financial inclusion, allowing more merchants and consumers to adopt the system for transactions. Data from Statista showcases the brand’s dominance in the market:

Used by almost all (97%) of respondents, Pix is the top eCommerce payment brand in Brazil. Payment giant PayPal follows with only 42%.

Other popular payment brands, Mercado Pago, PicPay, Pagseguro and Google Pay, have usage rates between 17-29%.

While Apple Pay and Ebanx are at 8% and 5% respectively, AstroPay and Meta Pay are only used by 2% of respondents.

Future Features and Pix's Impact

on Credit Cards

Pix’s integration into Brazil's retail and travel sectors has further fueled its growth, as consumers increasingly opt for the convenience of immediate transactions. By May 2023, over 150 million persons and companies were using Pix in Brazil.

Like this insight? It is based on our regularly updated rankings. With our retailer and country rankings, you can learn valuable information about your specific market. Our product category rankings and benchmarks allow you to see where various businesses are currently evolving. This information can aid in your decision-making, whether you are a business developer, shop owner, or CEO of a large eCommerce brand. Stay a step ahead of the market with ECDB.

In addition to its current capabilities, new features are expected to be added to Pix in the coming years, including the ability to pay through installments, a feature that could further challenge credit cards' dominance.

While credit cards are expected to decline from their 49% market share in 2023, it is not anticipated that Pix will eliminate credit cards altogether. Both payment methods are expected to coexist, with credit card companies continuing to innovate to remain competitive.

Sources: Reuters, Statista, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Klarna, Afterpay, or PayPal: Which Is the Most Widely Used Payment Installment?

Klarna, Afterpay, or PayPal: Which Is the Most Widely Used Payment Installment?

Deep Dive

Apple Pay or Google Pay? Finding Out Which FinTech Service Rules Europe

Apple Pay or Google Pay? Finding Out Which FinTech Service Rules Europe

Deep Dive

Klarna’s Impact Is Strongest in Sweden and Norway

Klarna’s Impact Is Strongest in Sweden and Norway

Deep Dive

eCommerce in Canada: Top Stores, Market Development & Trends

eCommerce in Canada: Top Stores, Market Development & Trends

Deep Dive

eCommerce Payments in China: Alipay, WeChat & Top Payment Methods

eCommerce Payments in China: Alipay, WeChat & Top Payment Methods

Back to main topics