eCommerce: PDD

PDD Holdings Misses Quarterly Revenue Estimates

PDD Holdings saw a 15% drop in shares as lower-than-expected revenue highlights challenges from rising competition and economic pressures in China’s eCommerce market.

Article by Cihan Uzunoglu | August 26, 2024

PDD Quarterly Results: Key Insights

Revenue Shortfall: PDD Holdings reported disappointing revenue as reduced consumer spending in China contributed to a 15% drop in shares, despite the company's plans for further investments.

Competitive Pressures: Pinduoduo's appeal to budget-conscious shoppers through low prices and discounts is now facing challenges from rising competition and increased costs, revealing vulnerabilities in PDD Holdings' business model.

PDD Holdings, the parent company of the popular Chinese eCommerce platform Pinduoduo, reported lower-than-expected quarterly revenue, as economic challenges in China led to reduced consumer spending.

The company's shares dropped 15% in pre-market trading following the announcement.

Pinduoduo Faces Competitive Pressure

In the recent quarter, PDD reported revenue of 97.06 billion yuan (US$13.64 billion), falling short of the 100 billion yuan expected by analysts. Operating expenses surged 48% as the company ramped up marketing, advertising, and promotions to attract shoppers, with general and administrative costs more than tripling due to staff-related expenses.

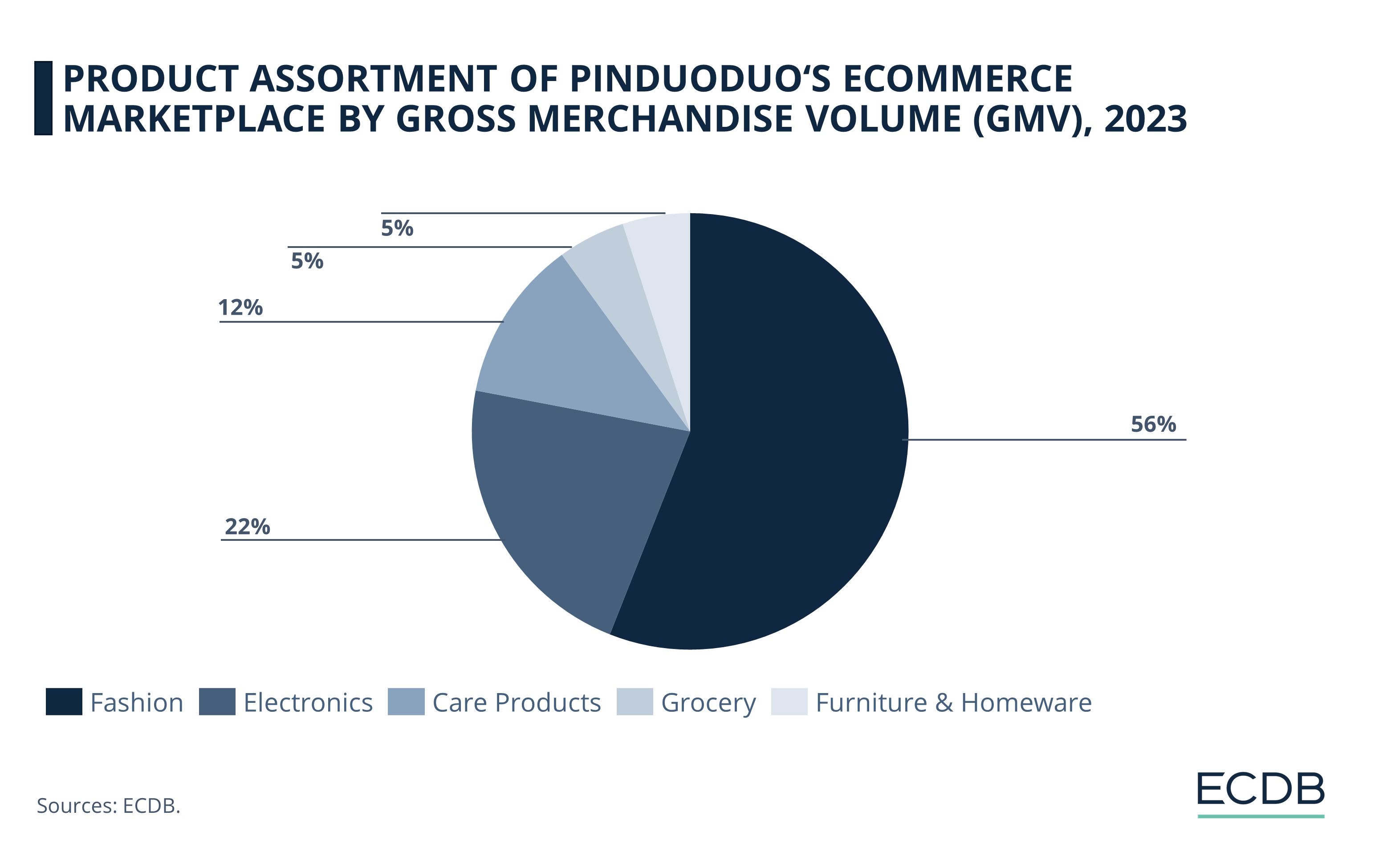

Pinduoduo generates most of its GMV (gross merchandise volume) in the fashion category, but electronics and personal care products are also popular.

Pinduoduo's low prices and steep discounts have attracted cost-conscious shoppers, but the company faces increasing pressure as rivals offer their own competitive shopping deals.

Jun Liu, Vice President of Finance at PDD, noted that revenue growth will likely face continued pressure due to competition and external challenges, with profitability impacted by ongoing investments.

Stay Informed: Our rankings are continuously updated with the newest data from our models, offering valuable insights to enhance your business strategy. Curious about which stores and companies are at the forefront of eCommerce? Want to know which categories are leading in sales and popularity? Discover the answers in our rankings for companies, stores, and marketplaces. Keep ahead of the competition with ECDB.

Economic Challenges Impact

Chinese Consumer Spending

A fragile economy, ongoing issues in the property sector, and high unemployment rates have led Chinese consumers to cut back on spending, affecting the country’s retail and eCommerce sectors.

Our previous analysis highlighted the potential vulnerabilities in PDD Holdings' structure and business model. The latest revenue shortfall and the company's acknowledgment of impending challenges underscore the risks we anticipated, particularly in the face of intensified competition and economic pressures in China.

PDD plans to invest heavily in platform trust and safety, support high-quality merchants, and improve its merchant ecosystem, even if it means short-term sacrifices and potential declines in profitability.

Sources: Yahoo Finance, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Deep Dive

Why Did Amazon Fail in China: Local Competition Defeats the Retail Giant

Why Did Amazon Fail in China: Local Competition Defeats the Retail Giant

Deep Dive

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

Deep Dive

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Deep Dive

Online Ticketing 2024: Event Pricing, Market Size, & Trends

Online Ticketing 2024: Event Pricing, Market Size, & Trends

Back to main topics