eCommerce: Baby Products

Baby Products Market in China: Domestic Brands Gain Ground

Learn how domestic brands are gaining ground in China's baby products market. What factors are driving their success and challenging international players?

Article by Cihan Uzunoglu | September 03, 2024Download

Coming soon

Share

China's Baby Products Market: Key Insights

Domestic Market Success: Chinese baby brands, such as Babycare, are making strong inroads with budget-conscious consumers, leading sales on major platforms like Tmall in categories like diapers and baby food.

International Growth: As domestic growth slows, Chinese baby product brands are reaching global markets through cross-border eCommerce, leveraging digital marketing on Xiaohongshu (RED).

Chinese baby product brands are gaining momentum. Amid China's slowing economy, price-sensitive consumers in regional cities are increasingly turning to domestic brands that offer value for money.

Brands like Babycare, which led sales during the “618” shopping festival on Alibaba’s Tmall platform, are leveraging this trend by expanding their product lines beyond traditional baby goods.

Surge in Domestic Baby Product Sales

in China

At a major baby and toddler product exhibition in Shanghai, Chinese brands such as Babycare showcased a wide range of products, from disposable diapers to toys, attracting significant attention from both domestic and international visitors.

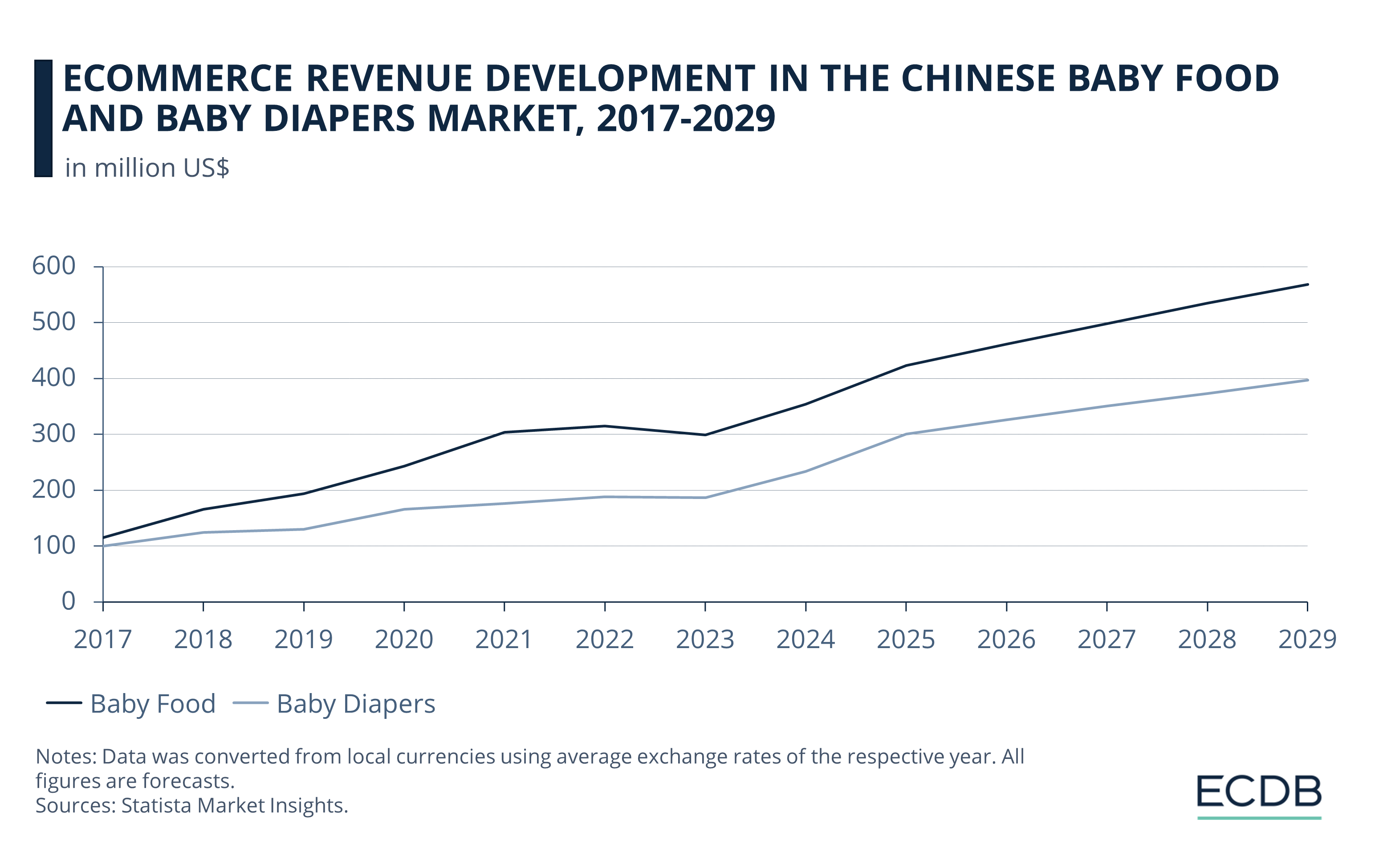

The market is expected to grow in the next few years:

Statista data shows that the online baby food market in China closed last year at nearly US$200 million.

The baby diaper market had an even larger eCommerce revenue of around US$300 million.

Nielsen data also reveals a sharp increase in the market share of domestically produced baby products, with disposable diapers and baby bottles now dominating the local market.

Role of Cross-Border eCommerce for Chinese Baby Product Brands

As China’s birthrate continues to decline — dropping by 6% in 2023 — the growth potential in the domestic market is slowing. This has prompted some Chinese baby product companies to explore international markets through cross-border eCommerce.

As exports through cross-border eCommerce surge, Chinese baby product brands are positioning themselves as emerging global players, capitalizing on their growing domestic success and expanding international reach.

The rise of social media platforms like Xiaohongshu (RED) has also played a crucial role in promoting Chinese baby brands. With online shopping becoming more prevalent, digital sales promotion is becoming increasingly vital.

Valuable Insights: Our data-driven rankings are regularly refreshed to provide you with crucial insights for your business. Find out which stores and companies are performing will in the eCommerce space and which categories are topping the sales charts. Stay ahead of the market with our rankings for companies, stores, and marketplaces.

Baby Products Market in China:

Closing Thoughts

The Chinese baby product market is set to grow globally, driven by strong domestic brands and expanding cross-border eCommerce. The pandemic pushed more consumers online, a trend that will likely continue.

However, the declining birthrate and economic challenges may limit domestic growth. Chinese brands will need to innovate and adapt as they expand internationally, positioning themselves to shape the future of the global baby products market.

Sources: Nikkei, Statista, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Jumia Business Analysis: Top Markets, Revenue, GMV & eCommerce in Africa

Deep Dive

Largest Product Categories in German eCommerce: Fashion Tops the List

Largest Product Categories in German eCommerce: Fashion Tops the List

Deep Dive

Trends in German eCommerce: Germans Like What They Know

Trends in German eCommerce: Germans Like What They Know

Deep Dive

Walmart Expands Pet Care Services

Walmart Expands Pet Care Services

Deep Dive

eCommerce in the United States: Best Product Categories

eCommerce in the United States: Best Product Categories

Back to main topics