Trend Report

“E-Commerce Market Germany 2023” – Amazon Leads the Top 10 Stores With €14.4 Billion in 2022

The following contains the executive summary of our annual study in cooperation with the EHI Retail Institute, “E-Commerce Market Germany 2023”.

Article by Nadine Koutsou-Wehling | October 02, 2023Before you explore the comprehensive 60+ page report, which includes sales statistics, GMV analysis, market metrics and many other features, you can get a glimpse of the initial findings here.

Following last week’s snippet on the top 1,000 stores’ sales and distribution in 2022, we now provide a more granular perspective by introducing the top 10 stores by net sales in Germany. This preview also includes the best-selling segments and sales share of the top 3 online stores in each category.

Without further ado, which are the top 10 online stores in Germany by net sales in 2022?

Amazon.de Generated €14.4 Billion in 2022

Online retail giant Amazon outperforms all other online stores in the German market. With net sales of €14.4 billion in 2022, amazon.de ranks first by a wide margin, despite losing 8% of its previous year’s sales¹.

In fact, most of the online stores in the top 10 have lost a share of their previous year’s net sales in Germany. Otto.de and zalando.de, which rank second and third, are far behind Amazon’s German domain, with 2022 revenues of €4.5 billion and €2.6 billion, respectively. Both have also lost net sales compared to last year, with otto.de down 12% and zalando.de down 4%.

Electronics retailer mediamarkt.de’s net sales have fallen by a whopping 29% since 2021, but the electronics store still manages to rank fourth in 2022 with revenues of €1.8 billion.

Apple.com, on the other hand, managed to increase its net sales in the German market, generating €1.4 billion in 2022, which represents an 18% year-over-year growth. Ikea.com was less fortunate. While the company ranks sixth with €1.3 billion in sales, this figure is down by more than a quarter (-26%) from its 2021 value.

On a more positive note, lidl.de managed to increase its net sales by 7% to almost €1 billion, while hm.com grew by 2% to net sales of over €900 million in 2022.

Saturn.de is the store among the top 10 with the highest year-on-year decline, losing 33% of its 2021 net sales. Ranked 9th, the electronics retailer generated net sales of around €900 million in 2022. Finally, fashion retailer aboutyou.de rounds out the top 10 online stores in Germany, with net sales of around €890 million and a 9% year-over-year increase.

Now that we know the top-performing online stores in German eCommerce, which product segments generate the highest net sales?

Top 3 Stores in Dominant Product Segments

The largest product segment in the Top 1,000 ranking of the German online market is the generalist segment, which includes online stores that offer a wide range of products as opposed to those that focus on a specific category.

It is important to note that we only considered the stores that generate most of their revenues in the product segments we examine in this section. This means that even though Amazon, for example, generates sales in the fashion category as well, we have not included Amazon as a player in the fashion market, as Amazon’s largest sales share is generated by products in the generalist segment. The reason for this is the methodology of this study, which has the intention to examine specialized players in their field of expertise. As Amazon dominates most product categories due to its wide reach in the German market, other specialized players would fall behind in the analysis which aims at illustrating the reach of a wider range of online stores.

Moving on with the analysis, the following chart illustrates which three online stores dominate the generalist segment. Of all revenues in 2022, the generalist segment accounted for 30.4% of them.

Without a doubt, amazon.de leads the generalist segment with a 61% revenue share. Otto.de follows further behind, but still accounts for a substantial 19% of the generalist segment’s revenues. Lidl.de, as the third-largest online generalist, is less relevant with only 4% of the segment’s net sales. All other stores in this category together account for 16% of net sales.

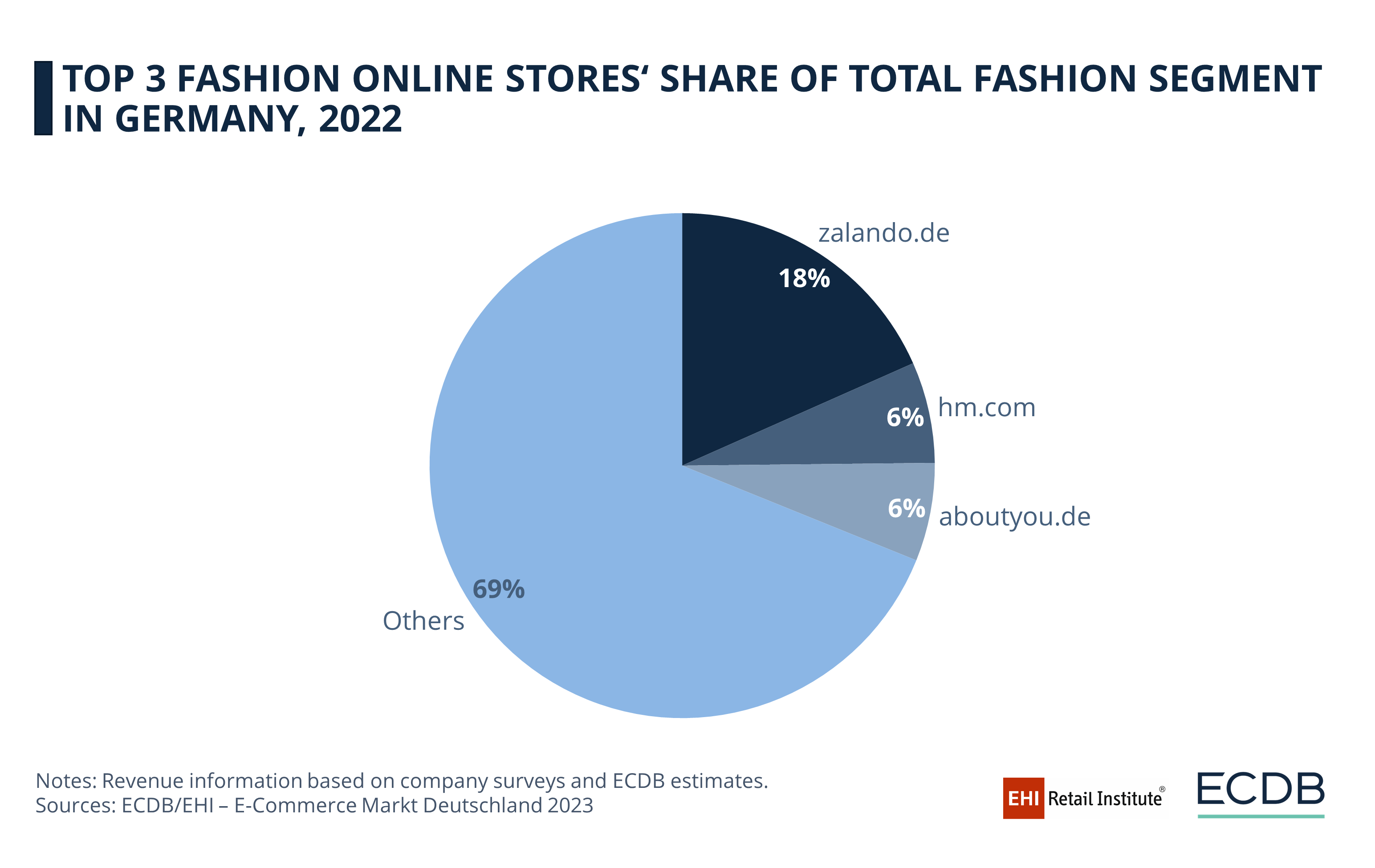

The second largest product segment in the German eCommerce market is fashion, representing18.3% of the net sales of the top 1,000 stores. This market is more diversified, i.e. not as dominated by one player as the previous segment.

Zalando.de is the largest fashion retailer in Germany, accounting for 18% of German online fashion revenues. Hm.com and aboutyou.de both contribute 6% to the German online fashion market, with hm.com generating slightly more revenues in absolute terms (€920 million) than aboutyou.de (€894.5 million). However, the majority of revenues (69%) is generated by other fashion retailers.

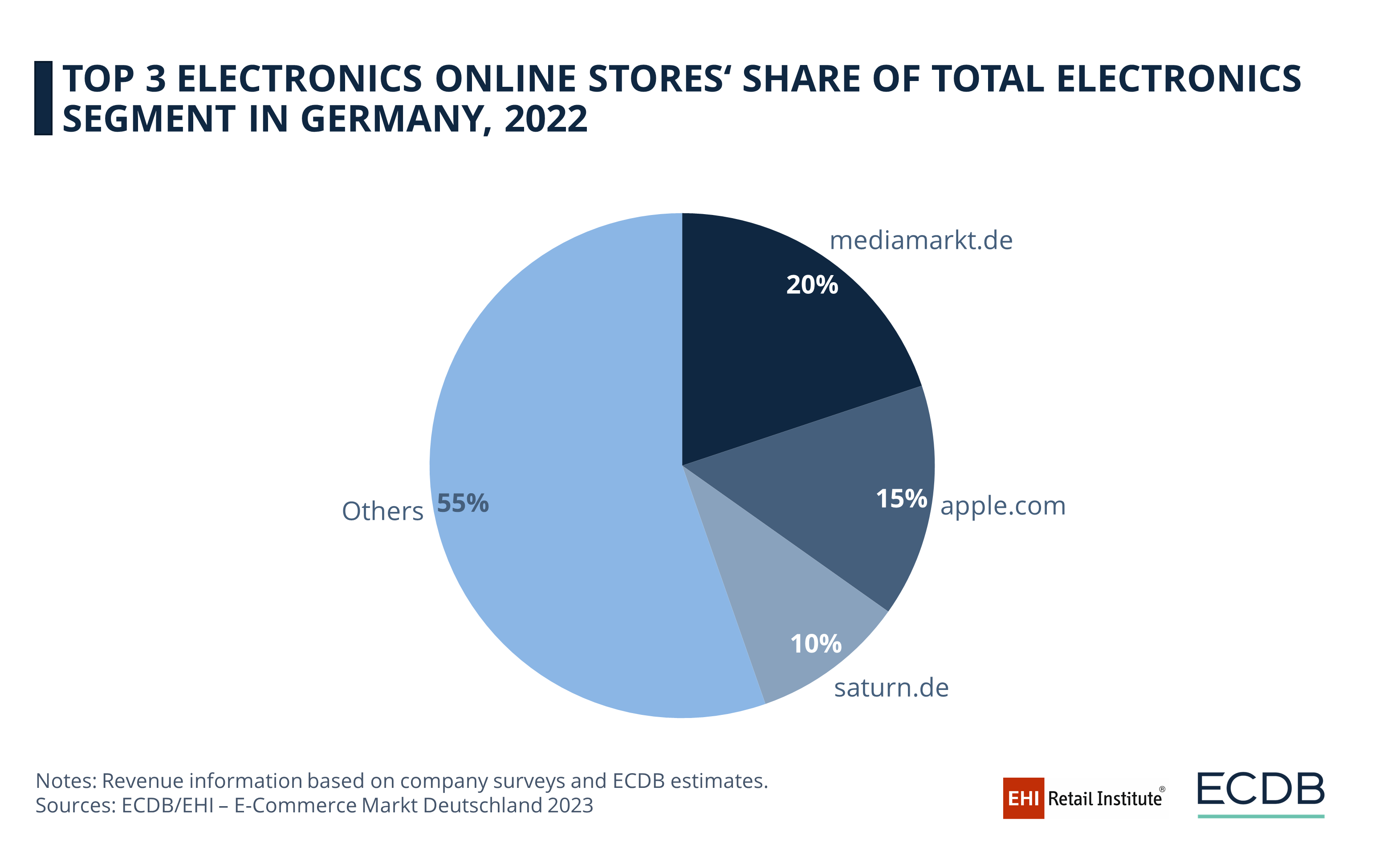

The third largest segment of the German online market is Electronics & Media, which accounts for 11.7% of the net sales of the top 1,000. Mediamarkt.de is the largest player in this product category, accounting for 20% of revenues.

Apple.com is not far behind with a 15% share of net sales and saturn.de is the third largest electronics retailer with a 10% share. The remaining electronics retailers together account for 55% of net sales, suggesting a less diversified market than the fashion segment, but still less concentrated than the generalist market.

Study "E-Commerce Market Germany 2023" - Order Now

Are you interested in more details about the German eCommerce market, its top players, product segments, and revenue shares? Order the 2023 report here. ECDB and the EHI Retail Institute have included these and many other relevant metrics to measure the development of German eCommerce throughout 2022.

If you want to stay informed about the latest eCommerce trends and news around the world, follow us on LinkedIn.

Footnote: 1: It is important to note that for online stores that generate revenues in a currency other than euros, such as Amazon or Apple in US$, revenues are not adjusted for currency effects. The growth rate of the stores shown in euros is therefore different in US$. This is due to currency fluctuations in 2021 and 2022.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Deep Dive

Why Did Amazon Fail in China: Local Competition Defeats the Retail Giant

Why Did Amazon Fail in China: Local Competition Defeats the Retail Giant

Deep Dive

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

Deep Dive

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Deep Dive

Online Ticketing 2024: Event Pricing, Market Size, & Trends

Online Ticketing 2024: Event Pricing, Market Size, & Trends

Back to main topics