Working in the eCommerce Industry

The Employee Growth Development of Alibaba, Amazon, and eBay

Alibaba, eBay, Amazon – three big players in eCommerce that have been around for over 20 years. How many people are behind these businesses, the backbone of the company?

Article by Antonia Tönnies | June 26, 2024Download

Coming soon

Share

Employee Growth Trends: Key Insights

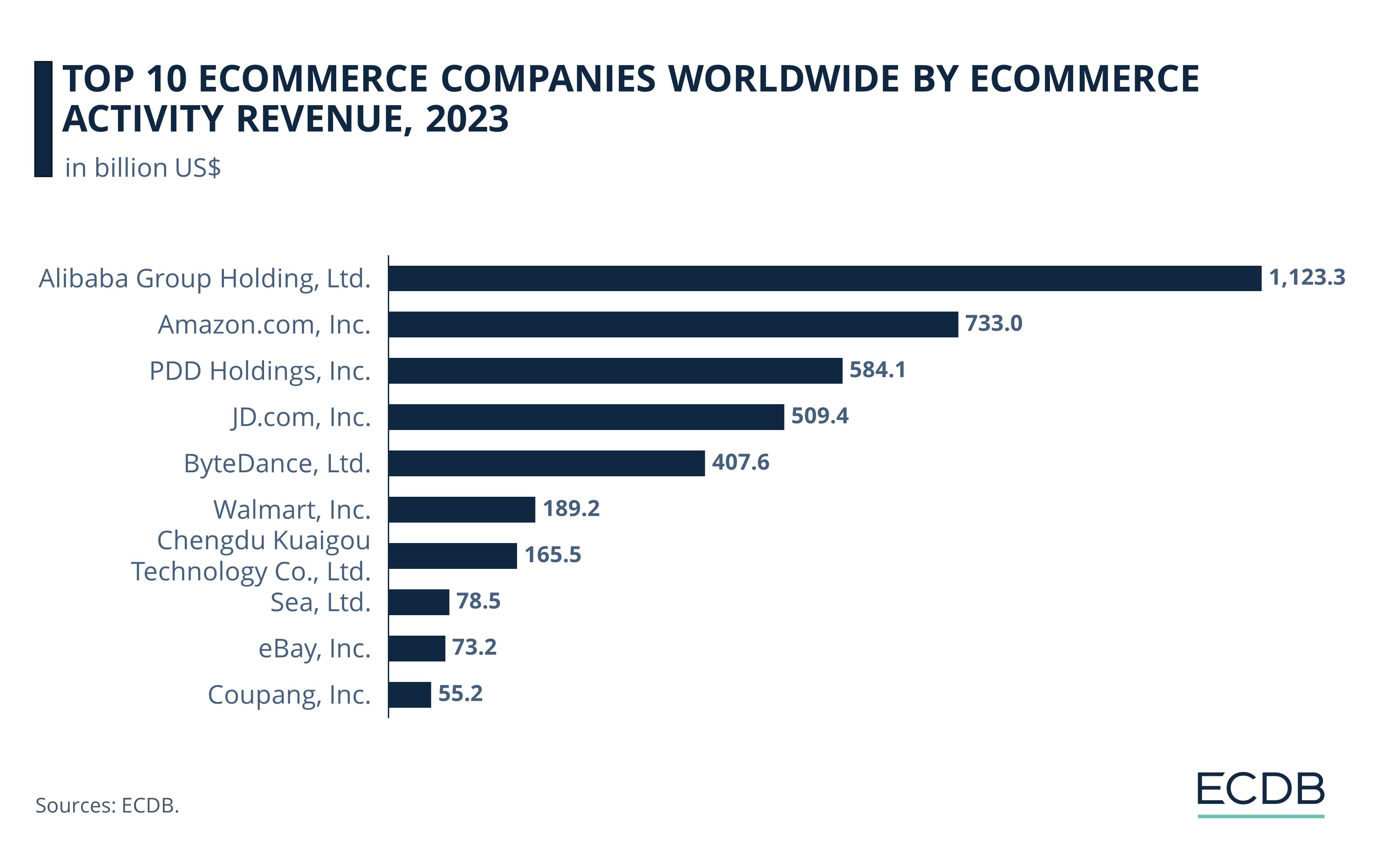

Alibaba's Revenue Leadership: In 2023, Alibaba led global eCommerce activity with a remarkable US$1.1 trillion in revenue, surpassing Amazon's US$733 billion by a significant margin.

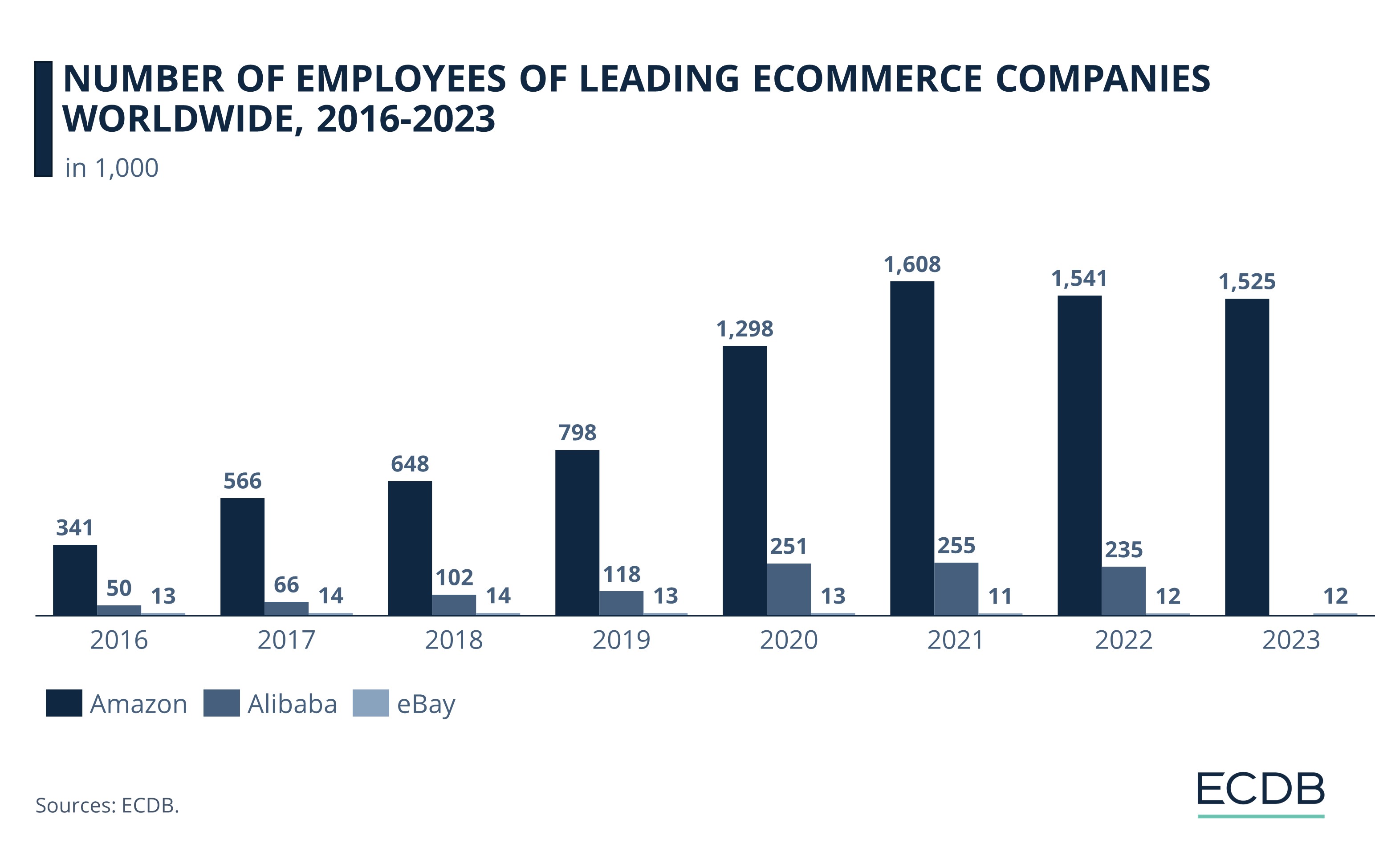

Employee Growth Patterns: Both Amazon and Alibaba saw substantial increases in their employee counts from 2016 to their peaks in 2021, with growth rates of 340% and 370%, respectively, before experiencing slight declines.

eBay's Stability: Unlike Amazon and Alibaba, eBay's workforce remained relatively stable, with minor fluctuations and a slight overall decline from 2016 to 2023. This workforce development reflects its stagnant growth in the eCommerce sector.

Diverse Strategies to Succes in eCommerce: There is no single key to success. The three companies show: It is possible to thrive in eCommerce with varying staff sizes.

In 2024, global eCommerce sales are expected to surpass the US$5 trillion mark. This surge in digital commerce and the importance of online shopping in people's lifestyles has propelled industry leaders such as Amazon, Alibaba and eBay into the global spotlight.

For your information: We regularly update our rankings with the latest data from our models, providing valuable insights to help improve your company. Which stores and companies are leading eCommerce? Which categories are driving bestsellers and high sales? Find out for yourself on our rankings for companies, stores, and marketplaces. Stay a step ahead of the market with ECDB.

One aspect that is often overlooked is the workforce behind the big tech giants - the people who keep the business running. How important is the number of employees for big players in the eCommerce industry like Amazon, eBay, Alibaba? How has the number of staff evolved over the past few years?

Amazon: A Phenomenal Growth Trajectory

Amazon's relentless expansion into multiple industries, including cloud computing (Amazon Web Services) and streaming services (Amazon Prime), has facilitated remarkable employee development. Its ability to adapt and diversify its offerings has not only boosted its workforce, but also solidified its position as a global eCommerce powerhouse.

The company, however, is repeatedly criticized for its working conditions. There have been claims of workplace surveillance, physical injury – especially for those who pack and ship boxes in its warehouses – and mental stress for low wages.

Why Is Amazon so Successful?

The U.S. tech giant is one of the pioneers of online retail, founded in 1994 as an online bookstore. Today, Amazon.com, Inc. can undoubtedly be considered the most successful western eCommerce company, with total global company revenues of US$733 billion in 2023.

The number of Amazon’s employees have mirrored its phenomenal growth:

2016, Amazon had a total of 341,400 employees.

Over the years, the number of Amazon employees grew rapidly, more than doubling between 2016 and 2019 with 798,000 employees.

The company reached a peak in 2021 with 1.6 million laborers.

After the rapid increase, the number of Amazon employees decreased two years in a row, losing 83,000 workers by 2023 (1.5 million employees) after the peak in 2021.

Despite the losses of the last two years, the U.S. company has achieved an eye-popping growth of over 340% in its workforce.

Alibaba: China's eCommerce Giant

Surpasses Amazon

Alibaba Group Holding, Ltd. ranks among the ECDB's top eCommerce companies worldwide, taking the number one spot with US$1.1 trillion in activity revenue for 2023. Often referred to as the "Amazon of China," Alibaba does not have to hide in terms of employee growth, either:

In 2016, the Chinese eCommerce leader employed 50,097 people.

By 2019, Alibaba's workforce has grown by 33%, reaching 117,600 staff members.

Between 2019 and 2020, that number suddenly more than doubled, reaching a new high of 251,462 employees.

By 2021, this number peaks at 254,941, followed by a smaller decline to 235,216 in 2022.

Although this is only a fraction of Amazon's total workforce, the trajectory is remarkably similar. Alibaba's growth of 370% over these six years, between 2016 and 2022, is equally indicative of its growing influence on the global eCommerce stage.

Nevertheless, the declining headcount confirms what analysts have been saying for some time: The Chinese eCommerce pioneer's growth is slowing.

eBay: A Tale of Stability or a Tragic Failure?

In contrast to the explosive growth of Amazon and Alibaba's employee count, eBay, Inc. has maintained a relatively stable employee count over the years, but with constant fluctuations:

Comparing 2016 and 2023, eBay's headcount stayed almost the same at 12,600 and 12,300, a 2.4% reduction. But there were ups and downs between those years.

In 2017, the number of employees peaked at 14,100, an uptick of 11% from 2016.

After that, eBay's workforce declined until 2021, when the number of employees reached its lowest point in that period at 10,800, representing a -23% decrease.

By 2023, the number of eBay employees increased by 14%.

Overall, eBay is the only company in this comparison without a significant positive development between 2016 and 2023.

What Are the Problems That eBay Is Currently Facing?

Fluctuation and stagnation are nothing new in the history of eBay. The eCommerce world is used to seeing them in many of its KPIs. For example, eBay, Inc.'s total global revenue has followed a similar trajectory to the number of employees. After eBay’s ups and downs over the years, eBay’s global revenue activity was slowing down at US$73.2 billion in 2023.

Alibaba Company Has the World's Highest eCommerce Activity Revenue

Last year's hard work paid off for Alibaba Group Holding, Ltd. In terms of eCommerce activity, the Chinese company leads by a wide margin with US$1.1 trillion in sales – the only company to surpass the trillion-dollar mark so far.

eCommerce activity revenue includes all gross first-party sales and/or third-party GMV generated on all online platforms operated by a company or its subsidiaries which are in-scope following the methodology of ECDB.

Amazon.com, Inc. follows at a greater distance with US$733 billion, 35% less than Alibaba's first place. PDD Holdings, Inc. and JD.com, Inc. follow in third and fourth place with US$584.1 billion and US$509.4 billion, respectively. Last but not least comes ByteDance, Ltd. with US$407.6 billion, rounding out the top 5 eCommerce companies worldwide by eCommerce activity revenue in 2023. At the bottom ranks:

6. Walmart, Inc.: US$189.2 billion,

7. Chengdu Kuaigou Technology Co., Ltd.: US$165.5 billion,

8. Sea, Ltd.: US$78.5 billion,

9. eBay, Inc.: US$73.2 billion,

10. Coupang, Inc.: US$55.2 billion.

With less than 1% of Amazon's workforce, eBay ranks ninth in the world. eBay is proof that it is not always necessary to have a large number of employees like Alibaba and Amazon in order to be successful.

Employee Growth Trends: Closing Thoughts

The numbers prove it: success doesn't come with an increasing number of employees. While Amazon has a huge number of employees and plans to create 3,000 jobs in France by 2024, eBay is less focused on growth in this area.

eBay's unique approach reminds us that different strategies can lead to success in this continually changing industry. Whether through rapid expansion like Amazon, strategic innovation like Alibaba, or stability through volatility like eBay, these eCommerce giants are collectively shaping the future of online retail on a global scale.

Sources: ECDB, secondary sources in the referenced articles.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

eCommerce Payments in China: Alipay, WeChat & Top Payment Methods

eCommerce Payments in China: Alipay, WeChat & Top Payment Methods

Deep Dive

Top eCommerce Companies by Market Cap 2024

Top eCommerce Companies by Market Cap 2024

Deep Dive

Tinaba Partners with Alipay+ to Launch European Super App

Tinaba Partners with Alipay+ to Launch European Super App

Deep Dive

Alibaba Leverages AI and Promotions to Boost Singles' Day Sales

Alibaba Leverages AI and Promotions to Boost Singles' Day Sales

Deep Dive

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Back to main topics