eCommerce: Top Companies by Market Cap

Top eCommerce Companies by Market Cap 2024

Which are the most valuable eCommerce companies worldwide by market capitalization? ECDB has the top 10 companies by market cap for you.

July 01, 2024

Most Valuable eCommerce Companies 2024: Key Insights

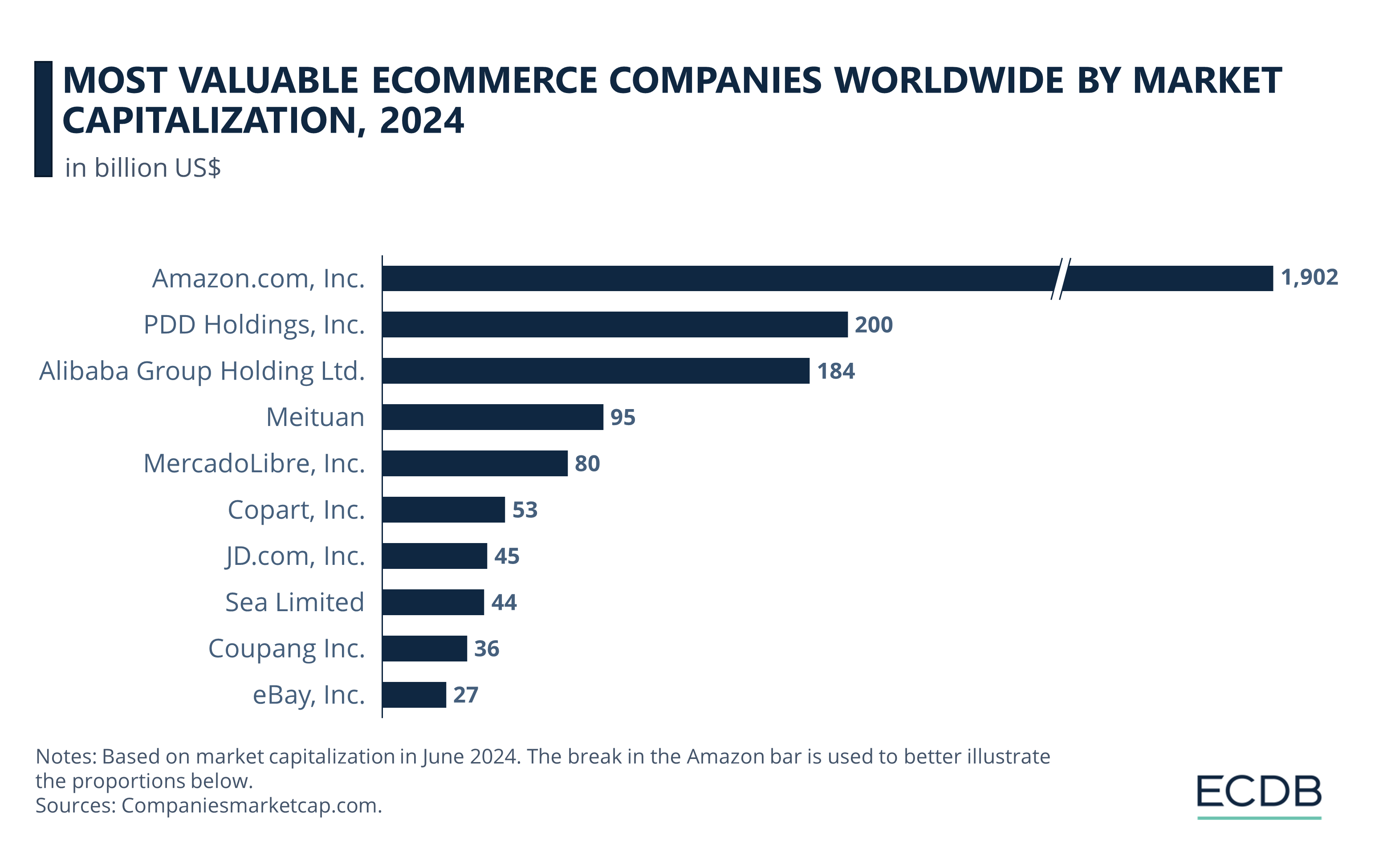

Amazon Remains on Top: Amazon, rebounding from a low market cap in 2022, folded its value to US$1.9 trillion. The U.S. eCommerce giant outpaces its closest Chinese competitors, Pinduoduo and Alibaba, which hold the 2nd and 3rd spots.

Major Players: China's Meituan ranks fourth with a market cap of US$95 billion, while the Argentinian marketplace MercadoLibre and American Copart follow at fifth and sixth places with market caps of US$80 billion and US$53 billion, respectively.

Rounding out the Top 10: JD.com as the 7th largest eCommerce company is followed by Singapore's Sea, with Coupang and eBay completing the top 10 list.

What is Market Cap? Market Capitalization Explained

Market capitalization, or market cap, is the overall value of all a company's shares. Market cap matters because it helps investors see how big one company is compared to another.

To find it, you multiply the price of one share by the total number of shares. For instance, if a company has 20 million shares priced at US$50 each, its market cap would be US$1 billion.

Top eCommerce Companies by Market Cap

The ranking of the top 10 eCommerce companies by companiesmarketcap.com currently includes players from the U.S., China, Argentina and Singapore. The undisputed number 1 is, of course, the U.S. eCommerce giant Amazon.

To understand what makes these companies so valuable and influential, let's take a detailed look at the top 5 eCommerce companies by market cap.

1. Amazon

With a stunning market cap of US$1.9 trillion, Amazon leads the top 10 global eCommerce companies.

Amazon is enhancing its AI-driven recommendations, making shopping more personalized and intuitive by considering broader user behavior. The company's "Climate Pledge Friendly" program also boosts visibility for eco-friendly products, aligning with rising consumer demand for sustainability. Amazon's social commerce efforts include platform updates to mimic social media and partnerships with platforms like Facebook and Instagram.

Additionally, Amazon is expanding globally through its Amazon Global Selling program, simplifying cross-border transactions with new tools. Lastly, advancements in advertising, such as Amazon DSP, provide sellers with more targeted and automated ad campaigns.

Like this insight? It is based on our regularly updated rankings. With our retailer and country rankings, you can learn valuable information about your specific market. Our product category rankings and benchmarks allow you to see where various businesses are currently evolving. This information can aid in your decision-making, whether you are a business developer, shop owner, or CEO of a large eCommerce brand. Stay a step ahead of the market with ECDB.

2. PDD

Amazon is followed by the Chinese company PDD at number 2, with a market cap of US$200 billion.

The parent company of Pinduoduo and Temu is rapidly expanding its global presence. Temu, PDD’s cross-border eCommerce platform, has launched in several new markets including France, Germany, Italy, and various countries in Europe, Africa, and the Middle East. This expansion has driven Temu to become one of the top downloaded apps in multiple regions.

In China, PDD's grocery delivery service, Duoduo Maicai, is also contributing to growth and is expected to reach profitability soon. The company has been investing heavily in technology to combat counterfeit goods and improve its service offerings.

3. Alibaba

Alibaba, another Chinese company, comes in the third spot with a market cap of US$184 billion.

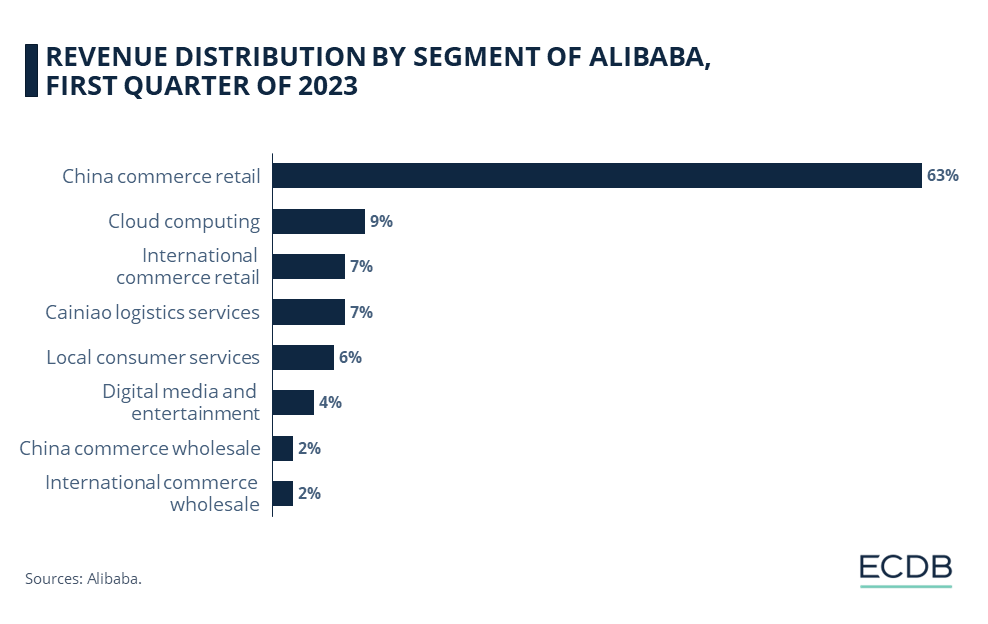

The retail giant has been focusing on enhancing its international commerce and AI capabilities. In Q4 2023, Alibaba's International Digital Commerce Group saw a 45% year-over-year revenue growth, driven by cross-border initiatives and platforms like AliExpress. This growth highlights Alibaba's commitment to expanding its global footprint and improving logistics through partnerships with companies like Cainiao for faster delivery times.

Additionally, Alibaba has been investing heavily in AI. The company’s Cloud Intelligence Group recorded significant growth, with AI-related revenues increasing by triple digits. These advancements are part of Alibaba’s strategy to leverage generative AI for enhancing supply chain efficiency and customer experience.

4. Meituan

Meituan, the last Chinese company in the top 5, ranks fourth with US$95 billion.

Aiming to rival giants like Alibaba and JD, the company is actively expanding its eCommerce offerings. Recently, Meituan launched a new direct sales model, opening several "self-operated stores" to sell various products, ensuring better control over product quality and delivery. They have also relaunched its shopping review feature, now called Guangguang, to tap into content-driven eCommerce trends. This feature, similar to Taobao’s review platform, aims to boost traffic and conversion rates by leveraging user-generated content and recommendations.

Additionally, Meituan is enhancing its cross-border eCommerce operations with a global shopping channel offering products from countries like the U.S., Japan, and Australia. This move aligns with its strategic shift towards broader retail and technology integration.

5. MercadoLibre

MercadoLibre, an important player in Latin America, holds the fifth position at US$80 billion.

The company is significantly expanding its operations in Latin America, with substantial investments planned for 2024. The company announced it will invest US$4.6 billion in Brazil, its largest market, marking a 21.1% increase from the previous year. Additionally, MercadoLibre is set to hire 6,500 people in Brazil and 18,000 across Latin America to bolster its growth efforts.

The company's growth strategy also includes significant investment in Mexico, where it plans to spend US$2.5 billion in 2024, up from US$1.6 billion in 2023. This investment will help enhance its eCommerce platform and Fintech services, which include digital payments and financial solutions through MercadoPago.

Other Companies in the Top 10

While the U.S. company Copart is sixth, having a cap of US$53 billion, JD.com from China is seventh at US$45 billion, followed by Singapore's Sea with US$44 billion.

The South Korean company Coupang, in the ninth place, has a cap of US$36 billion, and the list is rounded out by eBay at number 10 with a value of US$27 billion.

Top eCommerce Companies: Wrap-Up

Despite recent questions about Amazon's viability, the U.S. eCommerce leader remains on top of all the others in terms of market cap, which reflects consumer sentiment and investor confidence.

The fact that the following eCommerce companies on the list operate two of China's largest marketplaces is certainly no coincidence. Rather, their favorable positioning demonstrates the enormous reach and profitability of the business model when applied correctly.

As the distance between the bottom ranks is shrinking, it will be interesting to see which emerging players will make the list the next time. Are Temu and Shein worthy of the top spots?

Sources: companiesmarketcap.com, ECDB

Related insights

Deep Dive

Adidas AG Business Strategy: Why It Lags Behind Its Main Competitor Nike

Adidas AG Business Strategy: Why It Lags Behind Its Main Competitor Nike

Deep Dive

Shein Business Model: Growth, Target Audience, Marketing Strategy

Shein Business Model: Growth, Target Audience, Marketing Strategy

Deep Dive

Jumia Business Analysis: GMV, Top Markets & eCommerce in Africa

Jumia Business Analysis: GMV, Top Markets & eCommerce in Africa

Deep Dive

Miravia Business Analysis: Alibaba's New Platform & Fastest Growing Online Marketplace in 2023

Miravia Business Analysis: Alibaba's New Platform & Fastest Growing Online Marketplace in 2023

Deep Dive

Top Online Stores in Europe: Leading eCommerce Retailers, Net Sales & Market Share

Top Online Stores in Europe: Leading eCommerce Retailers, Net Sales & Market Share

Back to main topics