eCommerce: De Minimis Rule

De Minimis Rule: How Will It Impact U.S. eCommerce Market and Consumers?

As the United States gears up to reform its de minimis rule, its eCommerce market stands on the brink of change. The outcome threatens successful Chinese platforms like Shein and Temu and would also affect American consumers. ECDB examines the de minimis law and its impact on U.S. eCommerce.

Article by Patrick Nowak | August 19, 2024Download

Coming soon

Share

De Minimis Rule & United States eCommerce: Key Takeaways

De minimis Rule: A tax rule, de minimis allows packages valued under US$800 (per person and per day) to enter the U.S. without paying import duties.

Chinese Platforms: The current de minimis threshold allows Chinese eCommerce platforms to flourish, as they ship small batches of goods to American consumers often at lower prices than local retailers.

De minimis Amendment: A bill in the U.S. Senate proposes to degrade de minimis. While the act claims to target goods that are harmful or illegal, it can be located in the context of the U.S.-China trade conflict.

Impact: Rolling back de minimis may spell the end of low-cost imports, in the process weakening China-owned cross-border shopping platforms. But it would also have implications for U.S. consumers and small businesses that benefit from duty-free imports.

The days of U.S. online shoppers buying ultra-affordable products off Shein or Temu may be numbered.

As the clarion call for eliminating de minimis rings in the U.S. Senate, among big losers could be Chinese-origin platforms that have built a young consumer base while rising to the top echelons of the U.S. eCommerce market.

But what is the de minimis rule and its connection to eCommerce? And how would it impact Chinese eCommerce platforms?

What is the De Minimis Rule?

De minimis, meaning “the smallest”, is a tax rule. It is also known as Section 321 of the 1930 Tariff Act.

When imported products pass through U.S. customs, they are compared against the de minimis limit. If an item’s value falls below it, no taxes apply, whereas items above it incur additional charges.

In 2016, the de minimis threshold was increased from US$200 to US$800, permitting all cross-border packages below this new limit (per person and per day) to pass through customs without taxes, duties, and screenings.

Since 2018, the volume of packages entering the United States under the de minimis rule has grown consistently, with the exception of 2022. From 411 million packages in 2018, the number reached a pandemic high of 772 million in 2021. By 2023, it had hit the 1 billion mark.

De minimis is seen by many as a facilitator of global trade as through it:

Small businesses can save money on imports, face fewer custom delays and less paperwork, and ultimately offer more competitive prices.

Customers can purchase products online from international brands without paying import fees.

As a result, de minimis provided a big boost to eCommerce.

The De Minimis Rule and eCommerce

De minimis was set for traditional trade – to reduce the administrative work and expenses that went towards regulating small-value cargo. But it has come to shape eCommerce, particularly as global cross-border eCommerce intensified in and after the pandemic.

In its current form, de minimis allows for the free entry of low-cost products to the U.S. from international eCommerce platforms. But the U.S. government is inching closer to changing tax exemptions under de minimis.

Purportedly, the call to modify de minimis is in defense of U.S. trade laws as well as local manufacturers and retailers who are unable to compete with international brands. But it may also be seen as a new step in the notorious U.S.-China trade rivalry.

What is the End China’s De Minimis Abuse Act?

Trade between the U.S. and China is far from balanced. In the entire 10-year period from 2014 to 2023, imports from China have outweighed exports to it. For example, in 2023, exports to China were US$148 billion while imports from China were worth US$427 billion.

This trade deficit continued even after former U.S. president, Trump, imposed tariffs on Chinese imports in 2018, sparking a trade dispute between the two countries.

And now, a bipartisan coalition has introduced a new bill titled the De Minimis Reciprocity Act of 2023. Also called End China’s De Minimis Abuse Act, it targets Chinese corporates that use the de minimis privilege to ship low-value items like apparel and shoes to the U.S. without paying tariffs.

The new bill aims to close what it calls the de minimis loophole, allegedly abused by China and other foreign entities to send goods that are low-cost, harmful, counterfeit, or produced by forced labor.

U.S. Senator Sherrod Brown states: “Countries like China are exploiting the de minimis loophole to cheat our trade laws and flood our country with packages containing fentanyl and other illicit substances.”

But Brandon Lord, U.S. Customs and Border Protection (CBP) Trade Policy Director, explains: “There’s a misconception that we don’t target or screen de minimis—it’s not true. People throw around the phrase ‘loophole.’ It’s not a loophole. De minimis is not a loophole.”

It is to be noted that the new bill is hot on the heels of a crackdown on TikTok, the social commerce powerhouse which faces a U.S. ban if it does not break ties with its Chinese parent company ByteDance.

The question arises: how did de minimis benefit Chinese eCommerce companies in the first place?

De Minimis Rule and Chinese eCommerce Platforms

De minimis has been a boon for Chinese marketplaces, which can ship small batches of goods directly to American consumers without paying import duties. It allows them to offer lower prices than traditional retailers, who typically import large batches of goods and pay higher duties.

According to CBP, 94% of all import transactions make their way to the U.S. through de minimis. And per the House Select Committee, Temu and Shein alone make up for one-third of all shipments under de minimis, with allegations that those goods are being manufactured by forced labor.

Temu and Shein both reject the claims. In any case, their rise in the U.S. eCommerce market is undeniable and a cause of concern for local brands.

Shein and Temu’s Rising Position in U.S. eCommerce

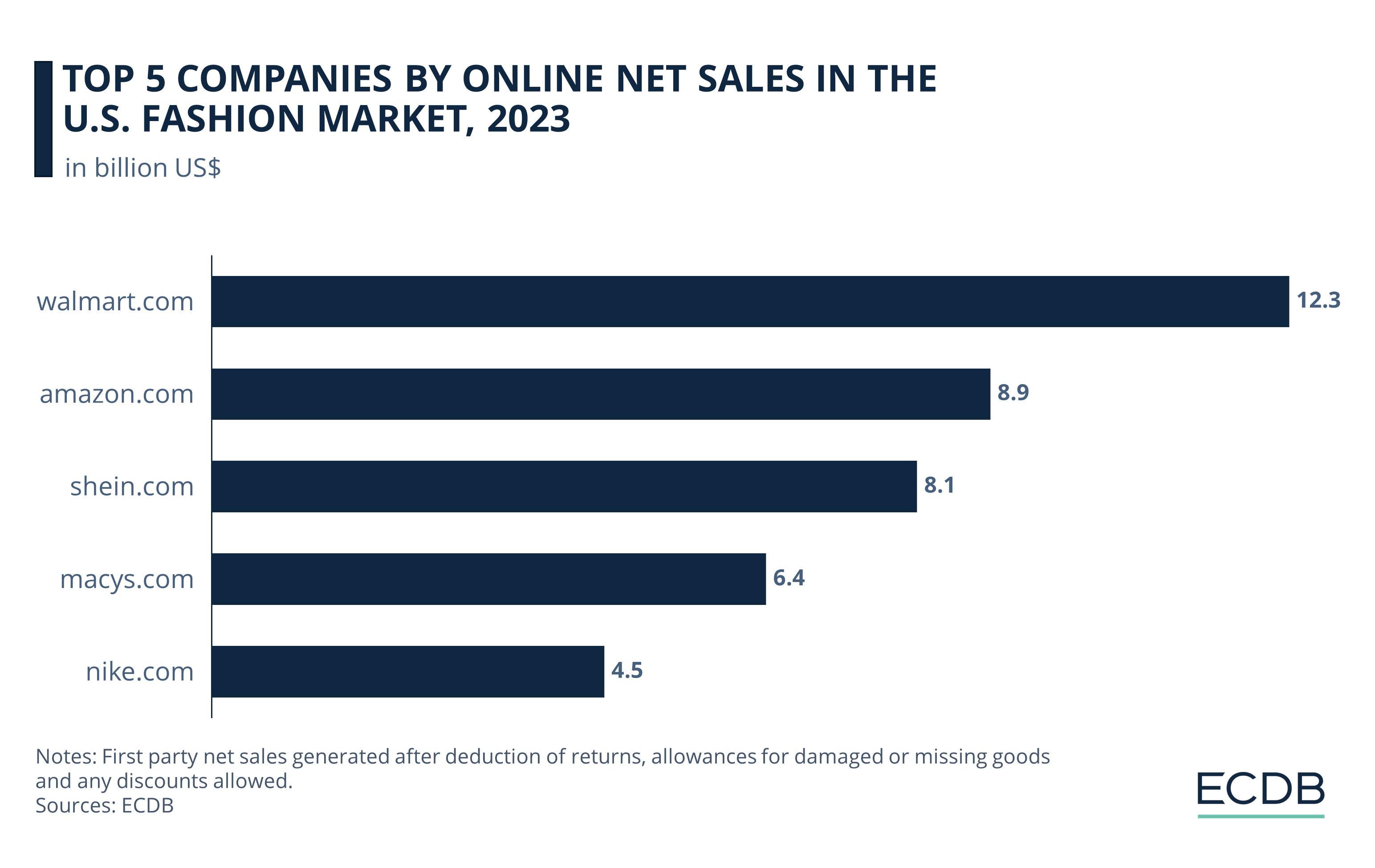

Shein’s current footprint in the U.S. online market is enormous. It rose through the ranks to become the best-selling online store in the U.S. Fashion market in 2023.

In the product category of Fashion, Shein.com generated revenues worth US$14.4 billion, beating giants like Walmart.com (US$12.3 billion) and Amazon.com (US$8.9 billion) on their home territory.

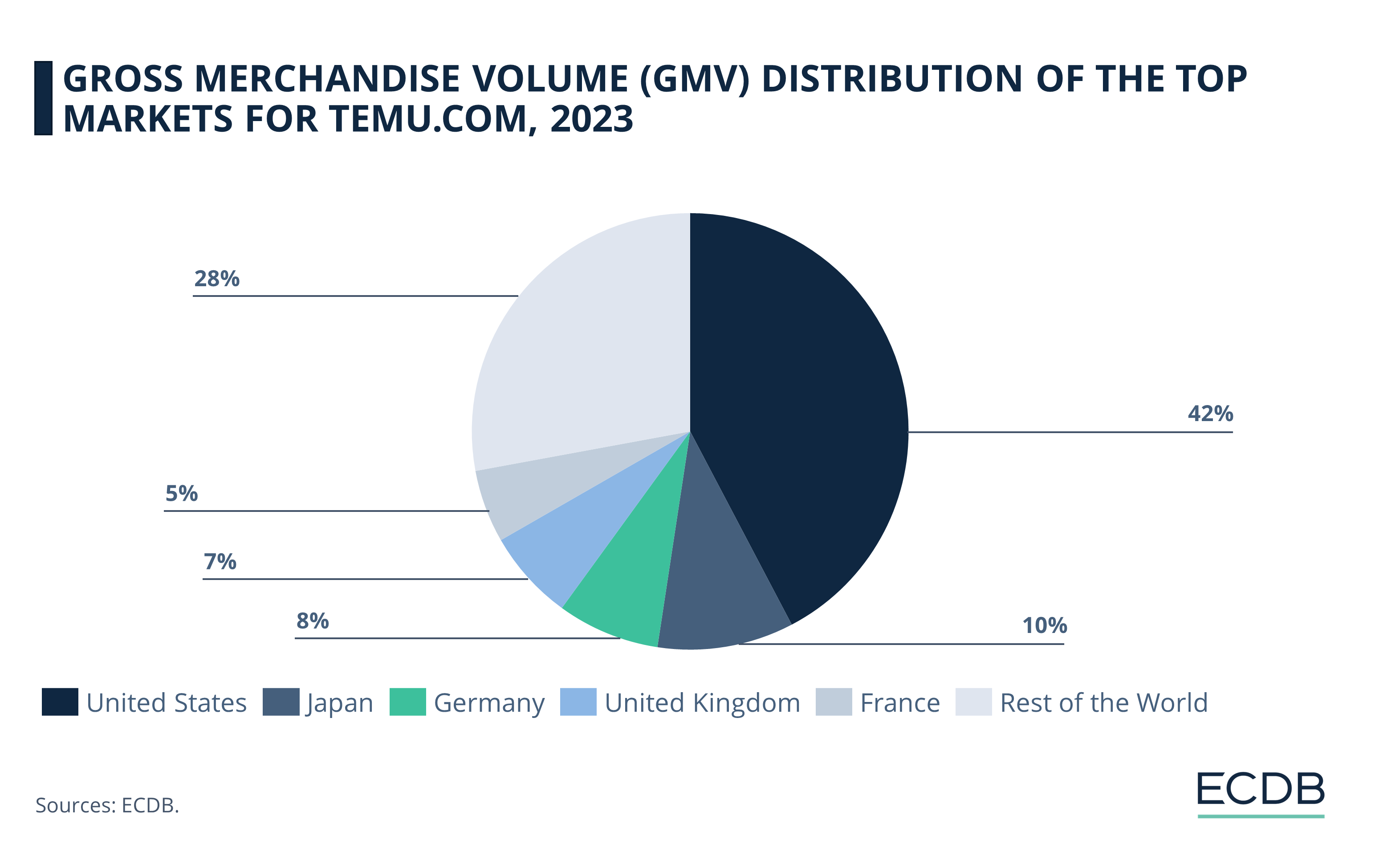

On the other hand, Temu is a rising star in the U.S. eCommerce market. Per our ECDB data, it drew 43.3% of its total GMV from the United States in 2023 – meaning the U.S. is Temu’s most valuable market.

Far behind in second position is Japan, with 10.3%. The GMV shares of all remaining countries are in the single digit.

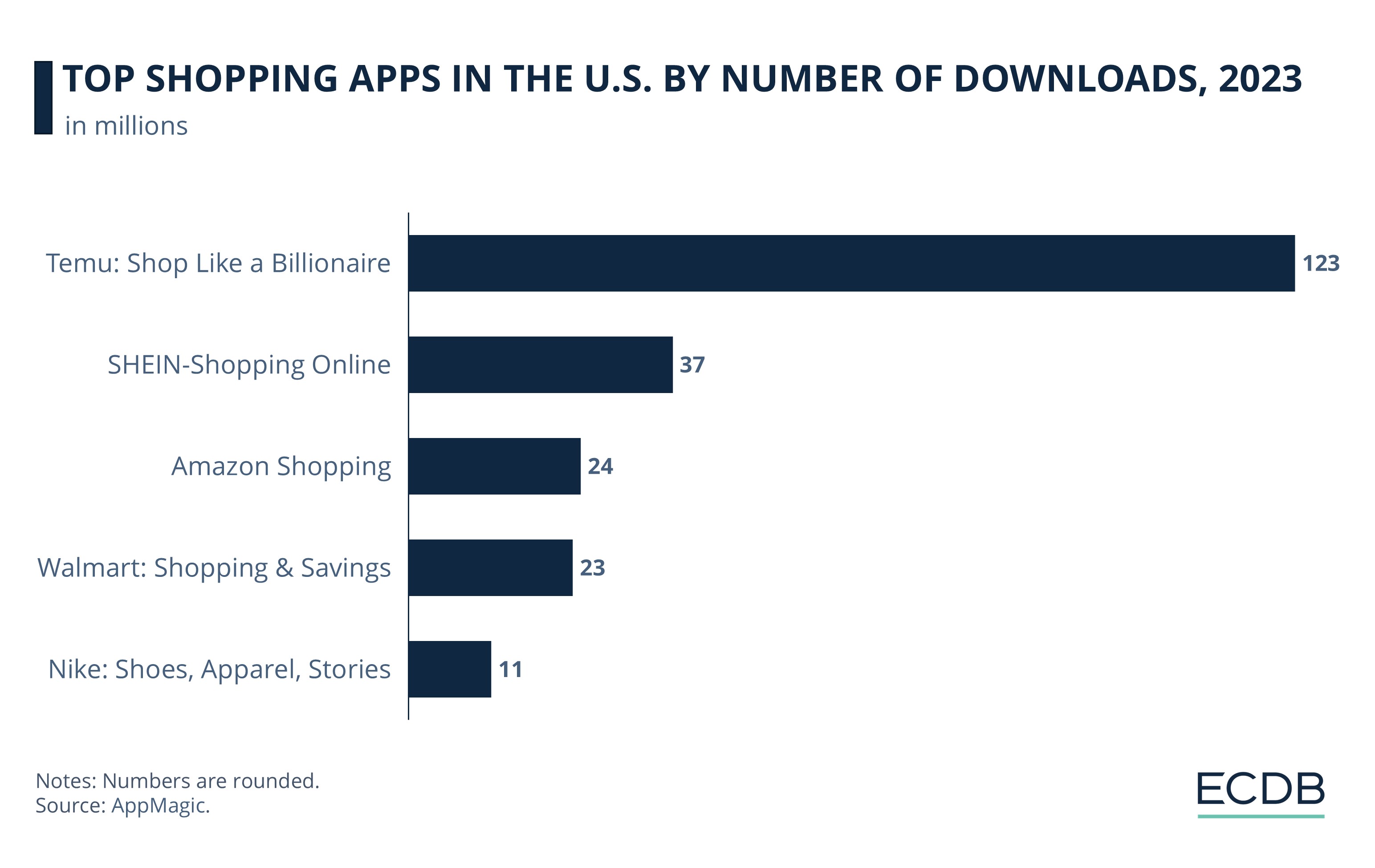

According to AppMagic, Temu was also the most downloaded eCommerce app in the U.S. in 2023, with a whopping 123 million downloads. Shein ranked second with 37 million downloads.

In the same year, established platforms like Amazon and Walmart saw comparatively fewer downloads – 24 million and 23 million respectively.

The data underscores the hold of these China-origin platforms on the U.S. online market. Although both Shein and Temu insist that their success does not depend on the de minimis rule, it is quite likely that changes to de minimis won’t bode well for their future in the U.S.

The U.S. Market Post De Minimis

Rolling back de minimis will have far-reaching implications for U.S. eCommerce – and not just for China-owned platforms.

On the one hand, limiting Chinese fast fashion brands could be an opportunity for local U.S. brands to increase their online market share, but they must maintain competitiveness, minimize costs, and promote sustainability in production.

On the other hand, cross-border eCommerce platforms are staring at tariffs in the U.S., alongside higher cart abandonment rates and loss of a consumer base who may no longer find their prices appealing once tax exemptions are gone. Many U.S. retailers also depend on imports from China and may have to adjust their business models to meet the new customs regulations.

Furthermore, a recent study by Yale and UCLA economists discovered that eliminating de minimis would lead to a loss of US$14 billion for Americans. Low-income and minority consumers will be disproportionately impacted, as their purchasing power may weaken. This is similar to the Trump era change: recent research concludes that Trump’s trade policies with China hurt the U.S. economy and cost 245,000 jobs.

And so, several American business, logistics, and manufacturing associations are calling to improve, not degrade, de minimis. While the proposed amendment can benefit the textile market and some manufacturers, the outcome will likely be detrimental to U.S. shoppers and import-dependent businesses, who will ultimately shoulder the burden of additional costs.

Sources: International Trade Today, CCP, U.S. Congress, WSJ

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Deep Dive

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

Deep Dive

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Deep Dive

eCommerce Market in China: A Maturing Market & Unsustainable Price Wars

eCommerce Market in China: A Maturing Market & Unsustainable Price Wars

Deep Dive

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Otto: Can the German Retail Company Maintain Relevance and Drive Revenue in eCommerce?

Back to main topics