eCommerce: Top Markets in the World

The World's Fastest Growing eCommerce Markets: Revenues & Forecasts

Which eCommerce markets have the largest growth potential? Several factors come together that enable rising eCommerce revenues. Find out what these are and which markets businesses should watch in 2024.

Article by Nadine Koutsou-Wehling | July 10, 2024Download

Coming soon

Share

Fastest Growing eCommerce Markets: Key Insights

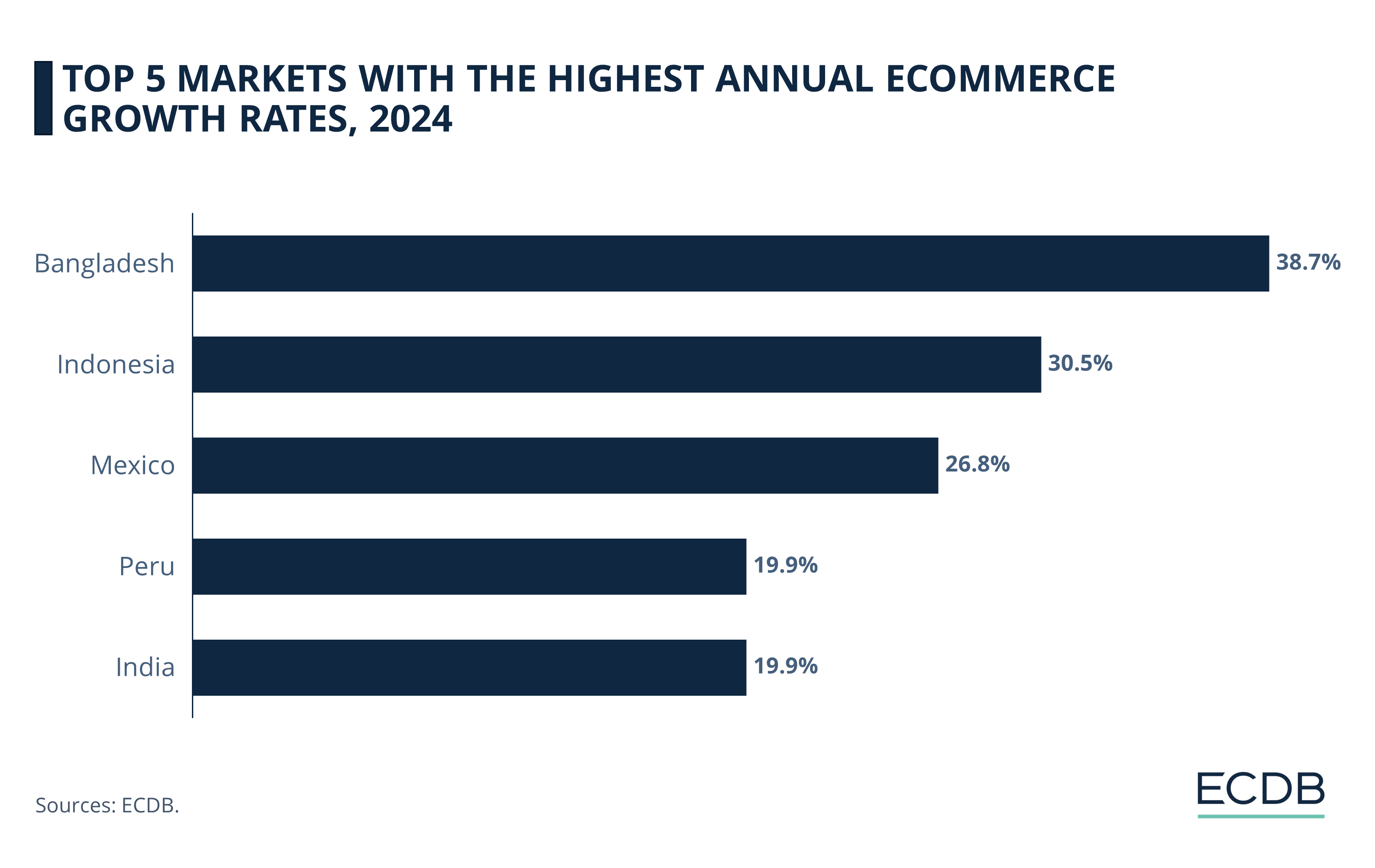

Markets in Asia and Latin America Grow Fastest: Considering markets with annual eCommerce revenues over US$1 billion, Bangladesh is the fastest growing market, with a 2024 growth rate of 38.7%. Indonesia ranks second (30.5%), followed by Mexico (26.8%). Fourth and fifth places are Peru and India, each with 19.9%.

Common Growth Factors: Growing internet penetration, improving digital infrastructure and a young population with rising income account for high eCommerce growth rates.

Grocery on the Rise: In all five eCommerce markets under consideration, grocery is the driving category for online growth, especially when it comes to projections for the coming years.

In addition to fastest-growing eCommerce product categories (in our article eCommerce growth champions categories), certain countries are also experiencing remarkable revenue increases in digital retail. The top 5 countries with the highest eCommerce revenue growth rates have massive eCommerce potential due to market development opportunities.

To clarify, this analysis includes only countries with eCommerce market revenues over US$1 billion. As you can see on the ECDB Country Ranking, a lot of African markets like Ethiopia, Niger and Togo boast growth rates around 60% or above that. However, because their market revenues are very low, which means they sometimes don’t even pass US$100 million, the growth conditions and trajectory of other countries are more relevant here.

So, which markets are growing highest in 2024? Learn about the ECDB Top 5 growth champions by country and find out why they are soaring.

Top 5 Fastest Growing Markets in eCommerce: Bangladesh Ranks First

Our ECDB Markets data reveals the countries with the highest annual growth rates of their total eCommerce market in 2024:

Bangladesh is the number one growth champion, with an annual growth rate of 38.7% in 2024.

Indonesia ranks second, with an annual growth of 30.5% in 2024.

In third place is Mexico, with eCommerce market revenue increase of 26.8% in 2024.

The same growth rate of 19.9% is found in the fourth and fifth places, Peru and India.

Obviously, Asian and Latin American markets dominate this ranking. What factors favor their development?

1. Bangladesh (38.7%)

Bangladesh is the eCommerce growth champion in 2024, with an annual market revenue increase of nearly 40%. The surge is due in no small part to Bangladesh’s accelerated development of the infrastructure necessary for eCommerce, as the country has built widespread internet access over the past two decades.

Part of the market’s eCommerce development has been the penetration of online payments. Cash is still the most common payment method in Bangladesh, which significantly slows the industry’s growth. As the digital payment infrastructure in Bangladesh is now being implemented on a large scale, eCommerce growth is coming along with it.

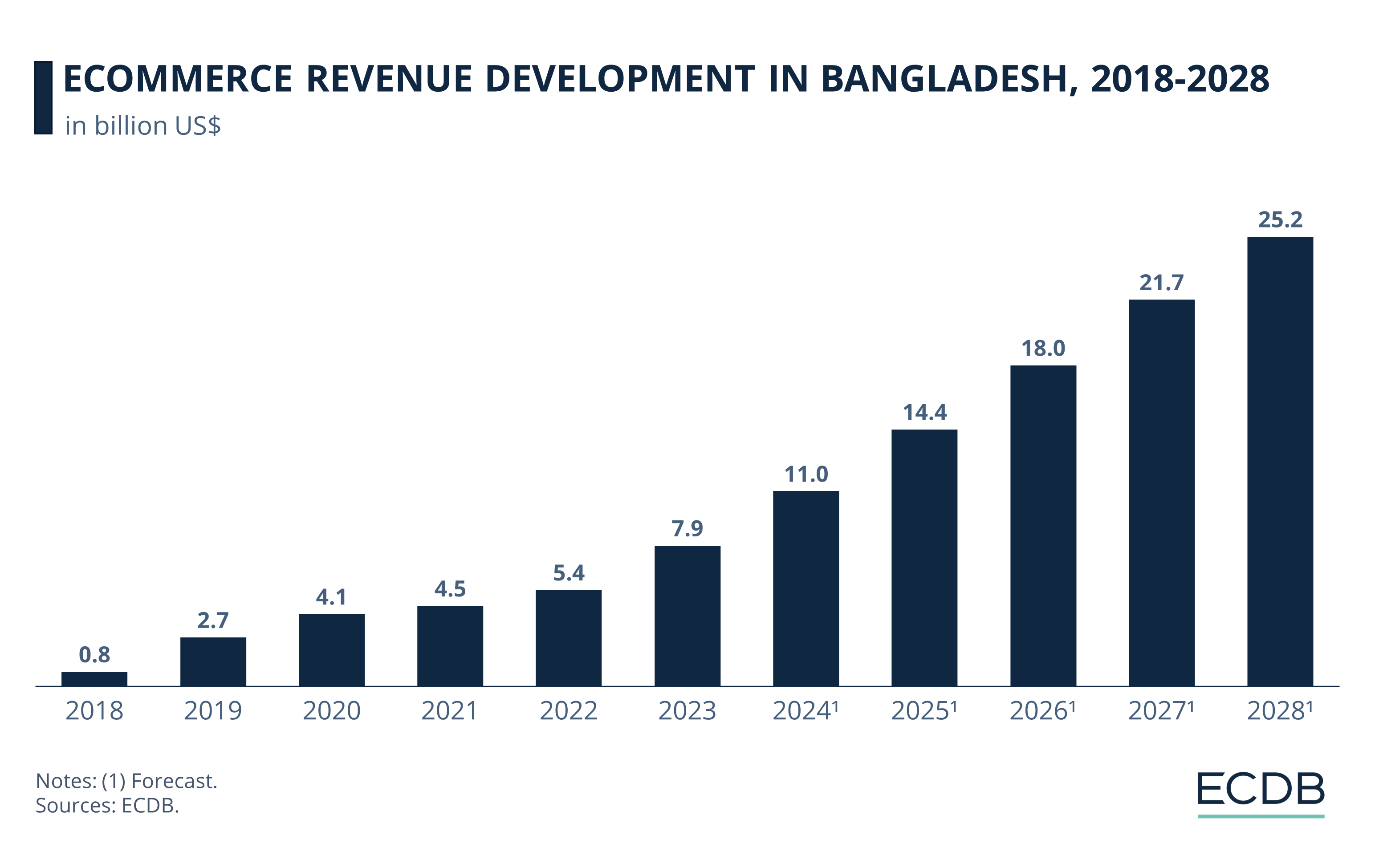

This development is reflected in the growing market revenues for eCommerce:

Bangladesh’s eCommerce market revenues were at a low level in 2018, generating US$800 million. In the following years, market revenues increased.

While the pandemic acted as a revenue accelerator, market revenues are continuing to surge in 2024. They are projected to reach US$11 billion this year.

In the following years, Bangladesh’s eCommerce revenues are expected to grow by large leaps each year. By 2028, total market revenues are forecast to exceed US$25 billion.

The categories in Bangladesh’s burgeoning eCommerce market are Grocery (especially meal kits and beverages), Hobby & Leisure (driven by bullion & precious metals and toys), and Furniture & Homeware.

2. Indonesia (30.5%)

Indonesia’s eCommerce development is nothing short of amazing. The Southeast Asian country’s eCommerce market is booming, and projections indicate that its growth will likely continue surging in the coming years.

The reasons for Indonesia’s highly positive eCommerce growth are the increasing penetration of online payments, as well as the rising prevalence of internet and smartphone usage.

This is also why Indonesia is considered a mobile-first eCommerce scene, as a large portion of the population does not use a computer on a regular basis. Indonesia’s population has a young median age, which means consumers are digitally savvy and quick on their feet to adopt online shopping trends like live shopping.

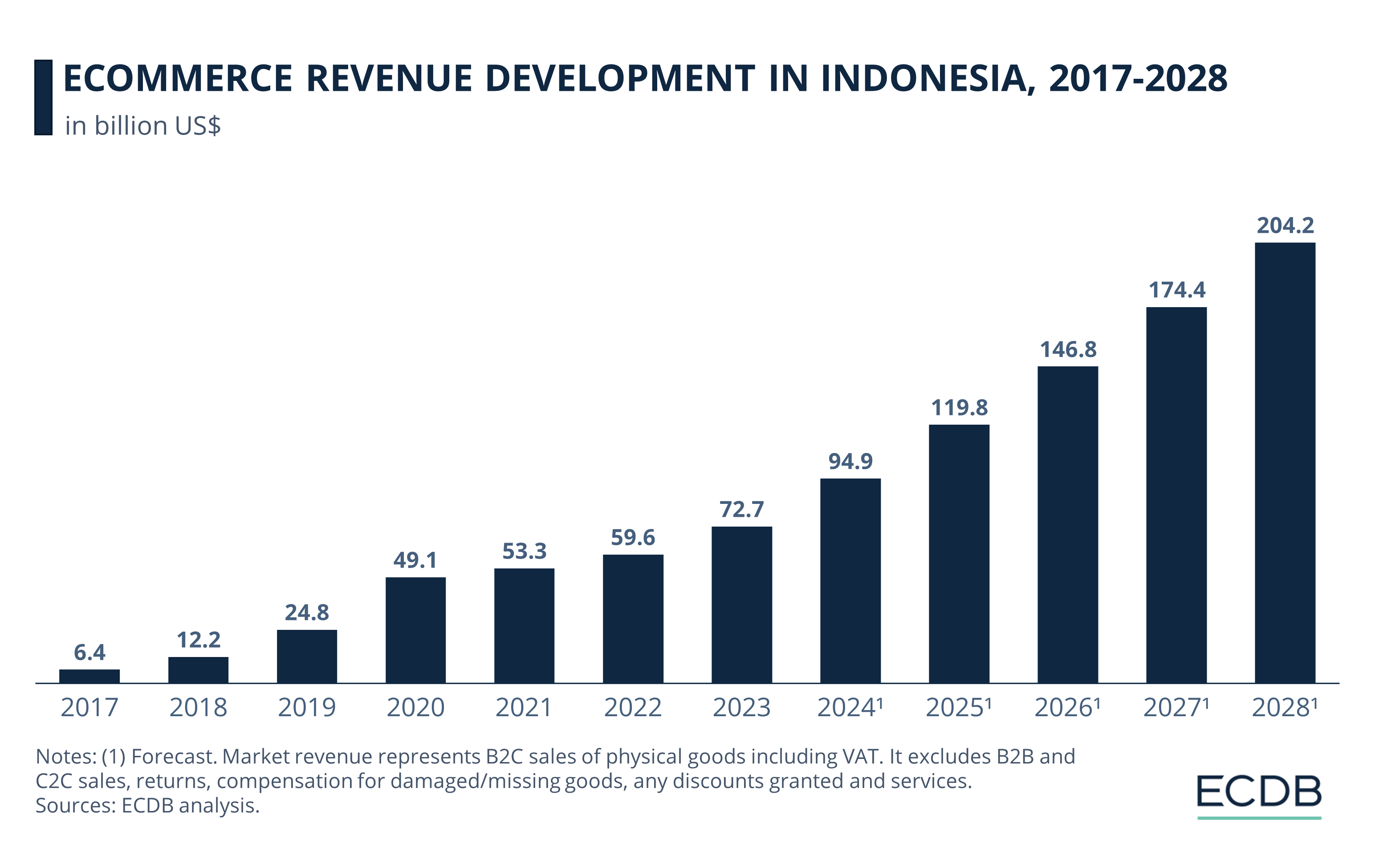

The first spike in eCommerce revenues came during the pandemic, when market revenues increased by 98% year-over-year. In other words, revenues doubled in 2020.

During the pandemic and after, revenues remain relatively stable with a positive trend. By 2024, however, growth rates are picking up pace again.

Thus, market revenues are projected to reach US$204.2 billion in 2028. The fact that this figure was only US$12.2 billion just ten years earlier reflects Indonesia’s astonishing eCommerce growth.

The categories contributing the highest shares to India’s eCommerce market revenues are Electronics (29.8%) and Fashion (22.6%). Grocery, especially fresh fruits, is the category with the highest projected growth in the coming years, with a CAGR (2024-2028) of 32.8%.

3. Mexico (26.8%)

Like the previous two markets in this ranking, Mexico is a country that had a very low eCommerce penetration just a few years ago. While the pandemic certainly contributed to Mexico’s eCommerce growth, the market had already seen a dramatic increase in online sales in the year prior to the global health crisis. This can be attributed to rising internet penetration and widespread use of social media.

Mexico’s establishment of basic infrastructure and digital adoption make it a particularly receptive country for innovative services that help the general population access vital resources, like online pharmacies.

Already in 2019, eCommerce revenues in Mexico grew by 138% compared to the previous year. Relative to this tremendous rate, the market’s revenue growth during the pandemic was moderate. Widespread investment in building digital infrastructure is a key component of this development.

Growth accelerated further when the Covid-19 restrictions ended. By 2024, eCommerce revenues are projected to be US$32.6 billion.

In the coming years, Mexico’s eCommerce market is expected to reach even greater heights. As a result, eCommerce revenues will likely generate US$69 billion by 2028.

Currently, Electronics and Hobby & Leisure account for the largest shares of market revenue, with 23.4% and 21.1%, respectively. Looking ahead, grocery is likely to take a higher percentage of the eCommerce market, with a CAGR (2024-2028) of 30.4%. The presence of household names like Amazon, Mercado Libre, and Walmart (through its subsidiary Bodega Aurrera) contributes to these positive expectations. Low-cost players such as Temu are also expected to influence the development of eCommerce in Mexico.

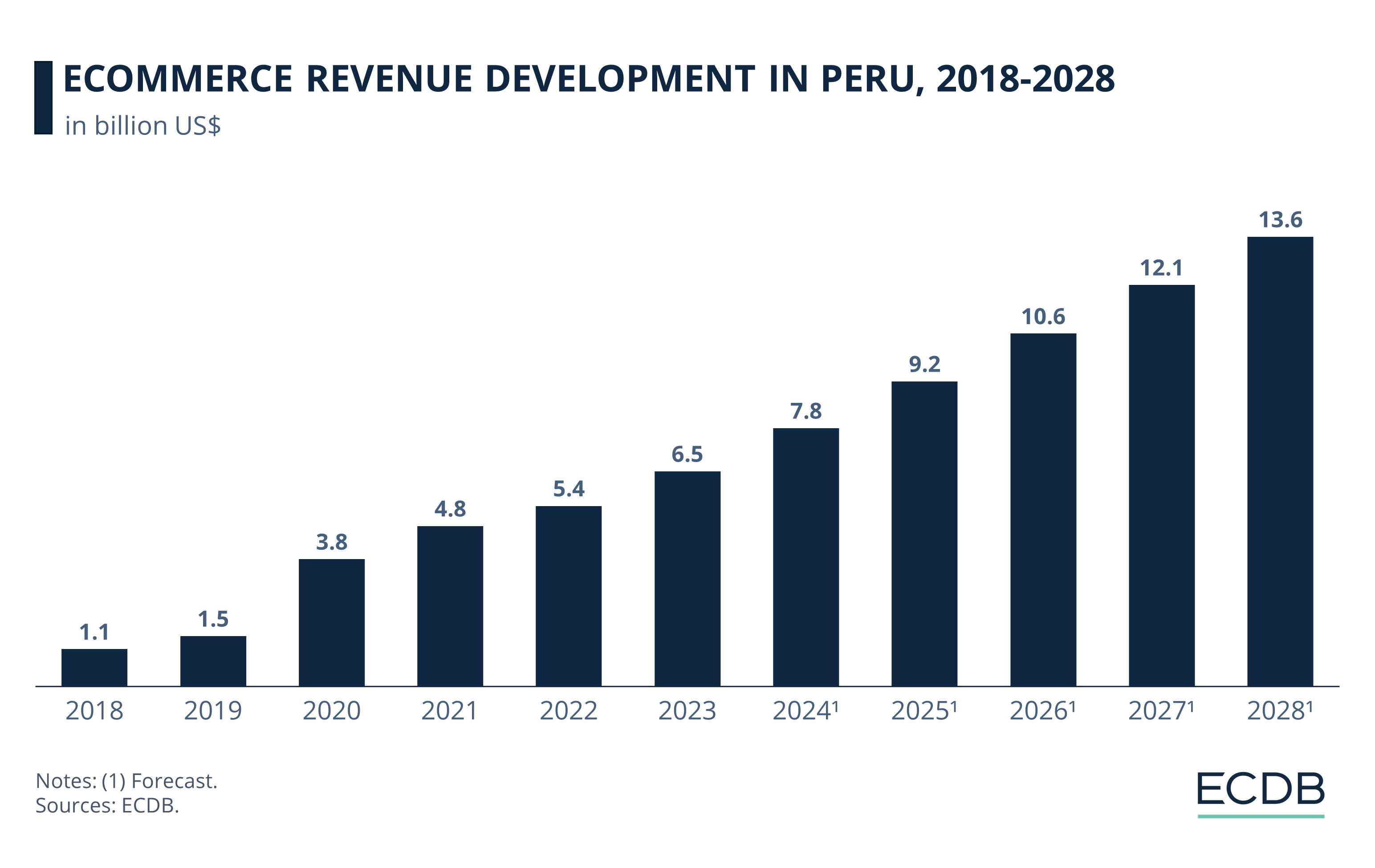

4. Peru (19.9%)

Typical of Latin American countries, Peru’s eCommerce market is still adapting to the requirements needed to make online shopping more accessible and seamless. An important factor in this adaptation is the online payments infrastructure: As recently discussed in our insight on Digital Payments in Latin America, a sizable portion of Peru’s population does not have a bank account and therefore prefers to pay for their purchases (whether online or offline) in cash.

While the share of consumers in Peru with a bank account and the willingness to make transactions with a credit card or eWallet is growing, so is Peruvian eCommerce. Once again, the pandemic is seen as a contributing factor to eCommerce growth:

In 2018 and 2019, eCommerce revenues revolved around US$1.3 billion, and surged in 2020: With an annual growth rate of 153%, the Peruvian eCommerce market accumulated revenues of US$3.8 billion in 2020.

Since then, revenues have continued to grow from a higher level. By 2024, they are projected to generate US$7.8 billion.

Forecasts predict continued growth in the coming years, with revenues of US$13.6 billion in 2028. Compared to the 2018 figure, this represents a growth of 1,136%.

The two most profitable product categories in Peruvian eCommerce are Electronics, with a market share of 24.6% and Fashion with 21.5%. Once again, Grocery is the category that is expected to drive eCommerce growth in Peru, at a CAGR (2024-2028) of 24.4%. Other categories with promising development are DIY and Furniture & Homeware.

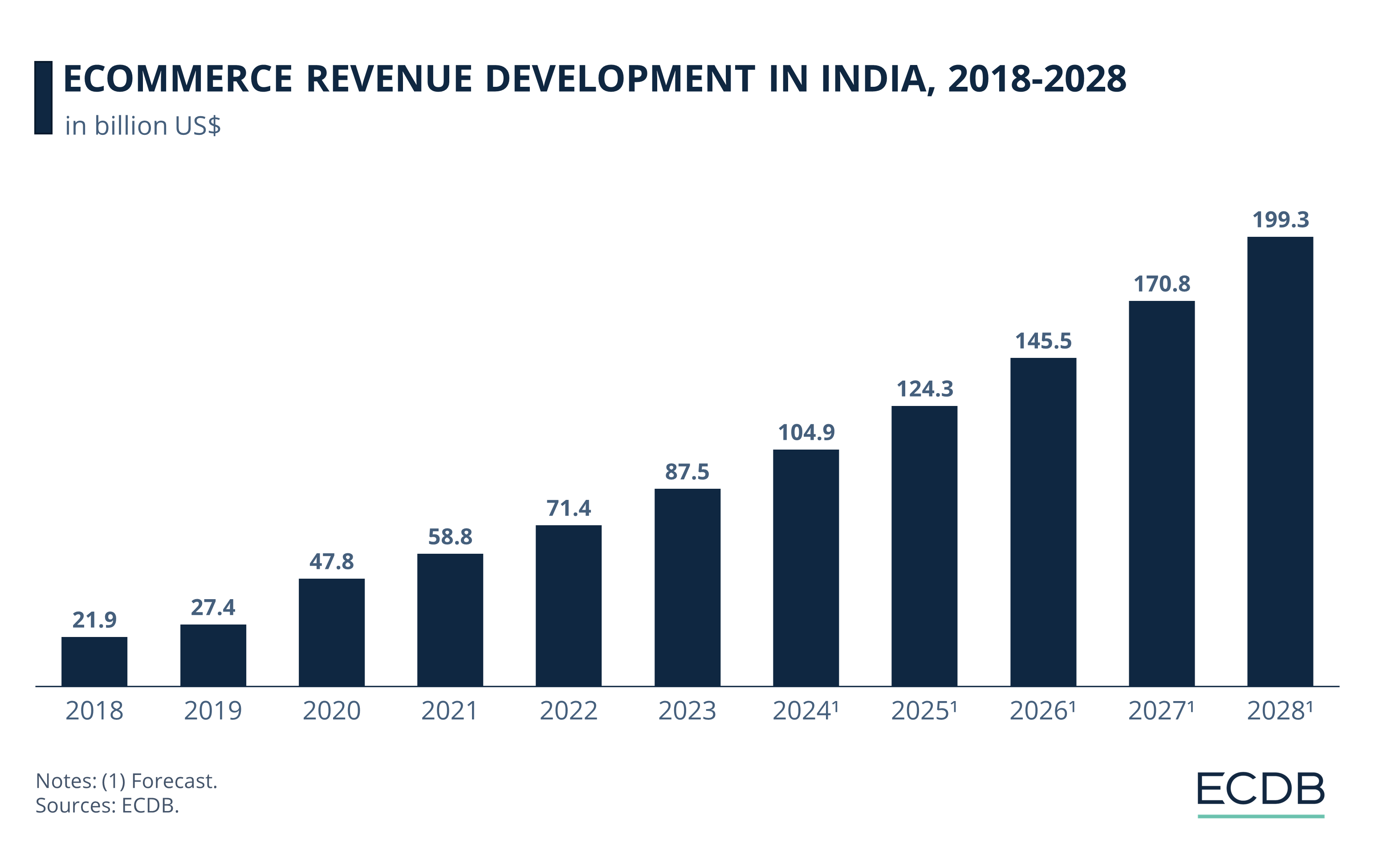

5. India (19.9%)

India is an interesting market to watch, for a number of reasons: Its young population, which has promising prospects for current and future growth, government efforts to increase India’s digital capabilities, and the sheer size of the market, which recently surpassed China as the world’s most populous country.

India’s eCommerce growth has been underway for some time, but was nonetheless fast-tracked by the pandemic. Positive expectations for India’s growth are why retailers are flocking to the country to invest and grab a share of the market while it’s still early.

In 2020, India’s eCommerce revenues increased by 74.5% year-on-year. While this rate is not as high as with the other markets in this ranking, one must consider India’s relatively high starting point.

Growth has been steady in the years since, and revenues are expected to exceed US$100 billion by 2024. More specifically, revenues are set to reach US$104.9 billion.

India’s positive economic outlook for the coming years is reflected in its eCommerce growth: By 2028, market revenues are forecast to approach US$200 billion.

In line with the other markets in the top 5, Grocery is India’s fastest growing category, with a CAGR (2024-2028) of 28.2%. This is followed by Hobby & Leisure, with a CAGR (2024-2028) of 19.8%. Amazon is the largest marketplace in India, but Walmart also has an impactful presence with Flipkart.

Fastest Growing Markets in eCommerce: Final Thoughts

Markets in Asia and Latin America dominate the ranking of eCommerce growth champions. This is clearly because these countries pose opportunities for infrastructure development, such as online banking and internet penetration, retailers that provide essential resources to the population, and young inhabitants.

While Household Care is the category growth champion in global eCommerce, Grocery is the leader among the countries included in this ranking. The high growth of grocery across all markets in this insight is likely driven by the widespread inclusion of rural and lower-income segments in the pool of online shoppers. Grocery, as a high-frequency, always-relevant purchase, is therefore expected to become more commonplace for online shoppers of all backgrounds.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

European Retailers Return to Physical Stores to Compete with Online Giants

European Retailers Return to Physical Stores to Compete with Online Giants

Deep Dive

YouTube Partners With Flipkart and Myntra to Launch YouTube Shopping in India

YouTube Partners With Flipkart and Myntra to Launch YouTube Shopping in India

Deep Dive

Inflation's Impact on eCommerce

Inflation's Impact on eCommerce

Deep Dive

Older Consumers Drive Growth in the Chinese eCommerce Market

Older Consumers Drive Growth in the Chinese eCommerce Market

Deep Dive

Online Shopping in China: Where Chinese Consumers Shop Online

Online Shopping in China: Where Chinese Consumers Shop Online

Back to main topics