ECOMMERCE: FASHION IN ASIA

Fashion eCommerce in Asia: Top 5 Countries by Revenue

Curious about the biggest players in Asia’s Fashion eCommerce market? ECDB data reveals which Asian countries recorded the highest online revenues in fashion, their growth, and online shares.

Article by Nashra Fatima | August 28, 2024Download

Coming soon

Share

Asia Fashion Ecommerce Top Markets: Key Insights

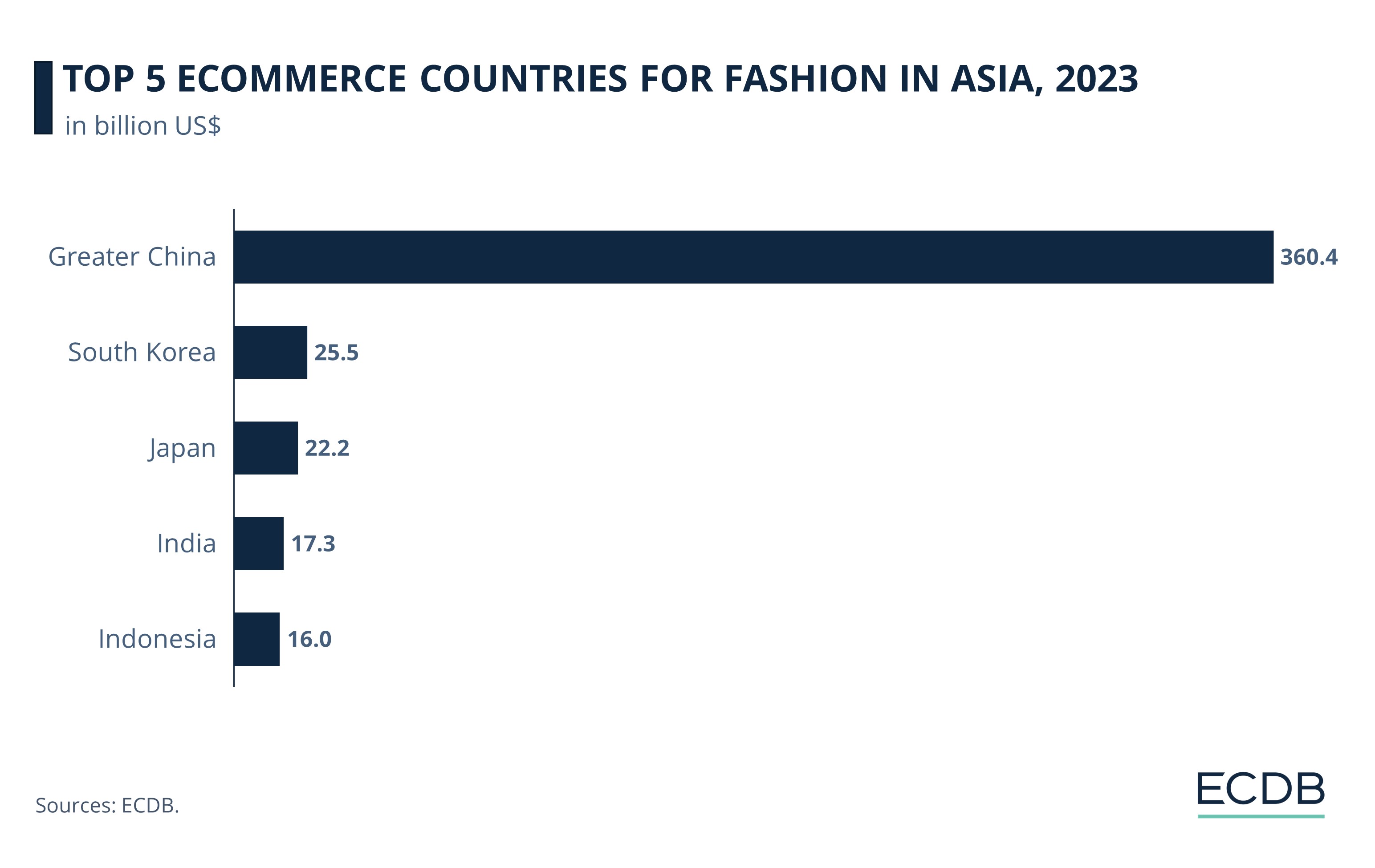

Revenue: China is the top fashion eCommerce market in Asia in 2023. Its online fashion revenues were US$360.4 billion. South Korea and Japan rank second and third, with much smaller revenues.

Yearly Growth: Indonesia recorded the highest growth in Asian fashion eCommerce. Its online market for fashion saw a yearly increase of 23%.

Online Share: South Korea has the largest online share in fashion across Asia, with over 60% of all its fashion retail sales taking place online.

CAGR (2024-2028): Indonesia has the highest projected CAGR (2024-2028) on our list, at 21%. In comparison, the expected CAGR (2024-2028) for Japan is only 0.2%, hinting at the shifting dynamics of Asia’s online fashion market.

Fashion is the third-largest eCommerce category in the world. In 2023, it generated over US$857 billion globally, just behind Hobby & Leisure. Among all regions, Asia is the largest continent for Fashion eCommerce, with total revenues crossing US$468 billion in 2023.

But which Asian countries are the largest in Fashion eCommerce? Find out their ranking, projections for their growth and online share in total fashion retail.

Top 5 Fashion eCommerce Markets: China Dominates, South Korea Second

The top fashion eCommerce market in Asia towers over others, thanks to its sheer size. But other countries also leave their mark, with a larger online share or a higher yearly growth rate.

In 2023, Asia's fashion eCommerce top markets include:

China leads, with revenues over US$360 billion.

South Korea is second, with US$25.5 billion.

Japan ranks third, with US$22.2 billion.

India stands fourth, with US$17.3 billion.

Indonesia rounds off the list, with US$16 billion.

Our ECDB data shows the development of revenue and online share, as well as growth projections, of the above five markets.

1. China

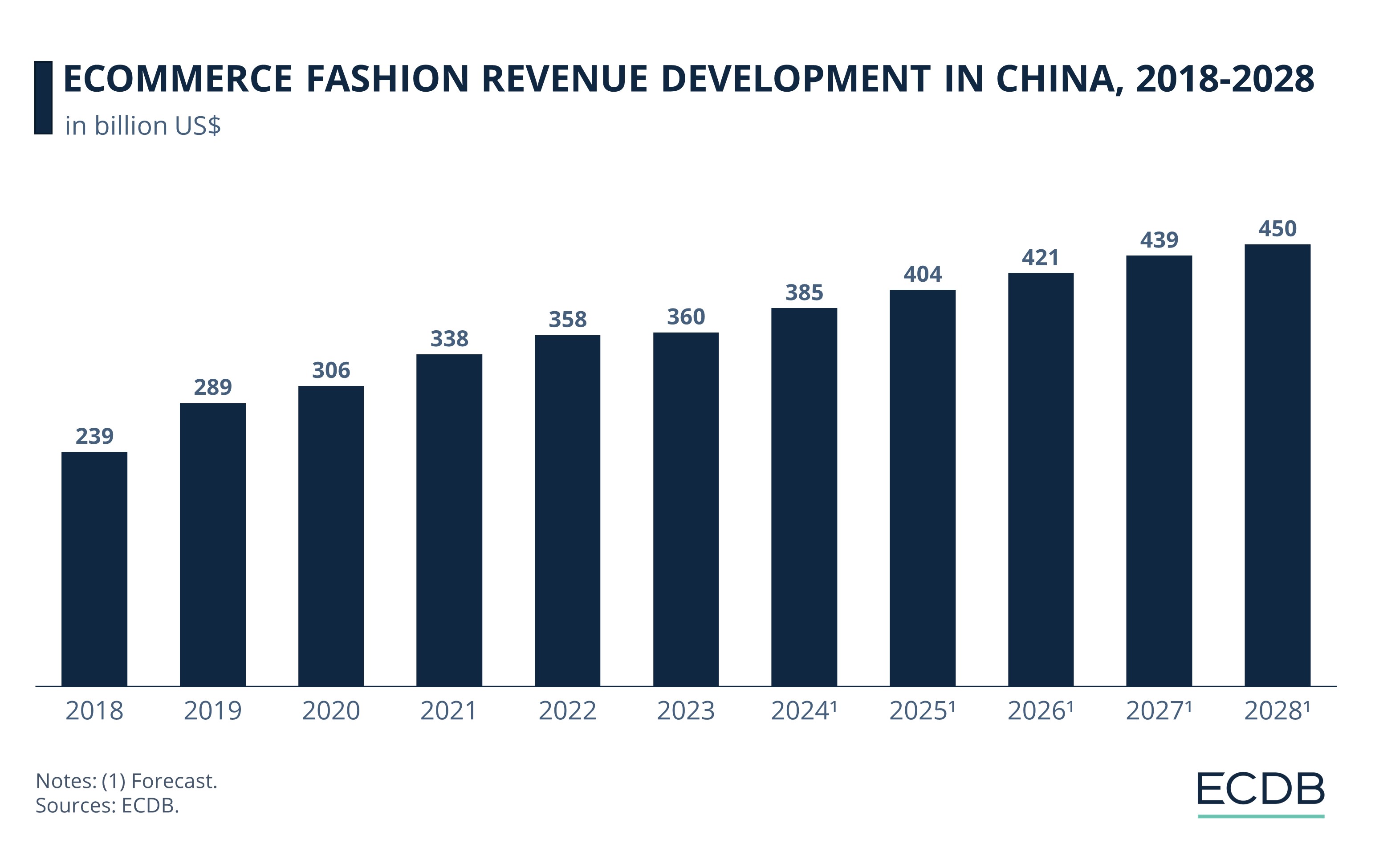

China, the largest eCommerce market in the world, is also king in fashion eCommerce in Asia. Its 2023 revenues in this category were US$360.4 billion – higher than Egypt’s current GDP. It is also more than four times the combined revenues of the remaining four countries on our list.

Growth: In 2023, yearly growth of the Chinese fashion eCommerce market dipped to 0.7% from the 5.8% increase seen in 2022. But the market is already sizeable in terms of revenue. In 2024, faster growth of 6.9% is expected, with revenues projected to reach US$385 billion. By 2028, this figure will likely hit the US$450 billion mark, at a CAGR (2024-2028) of 4%.

Online share: 37.7% of all fashion retail in China occurred online. This is lower than the peak pandemic period, when over 40% of fashion products were bought online. But it is higher than the current share, for example, of the second-largest fashion eCommerce market worldwide, the United States (27.4%). China’s online fashion market is slated to expand, helped by its fashion oriented female shoppers. Over 45% of all fashion retail is expected to take place online in China by 2028.

2. South Korea

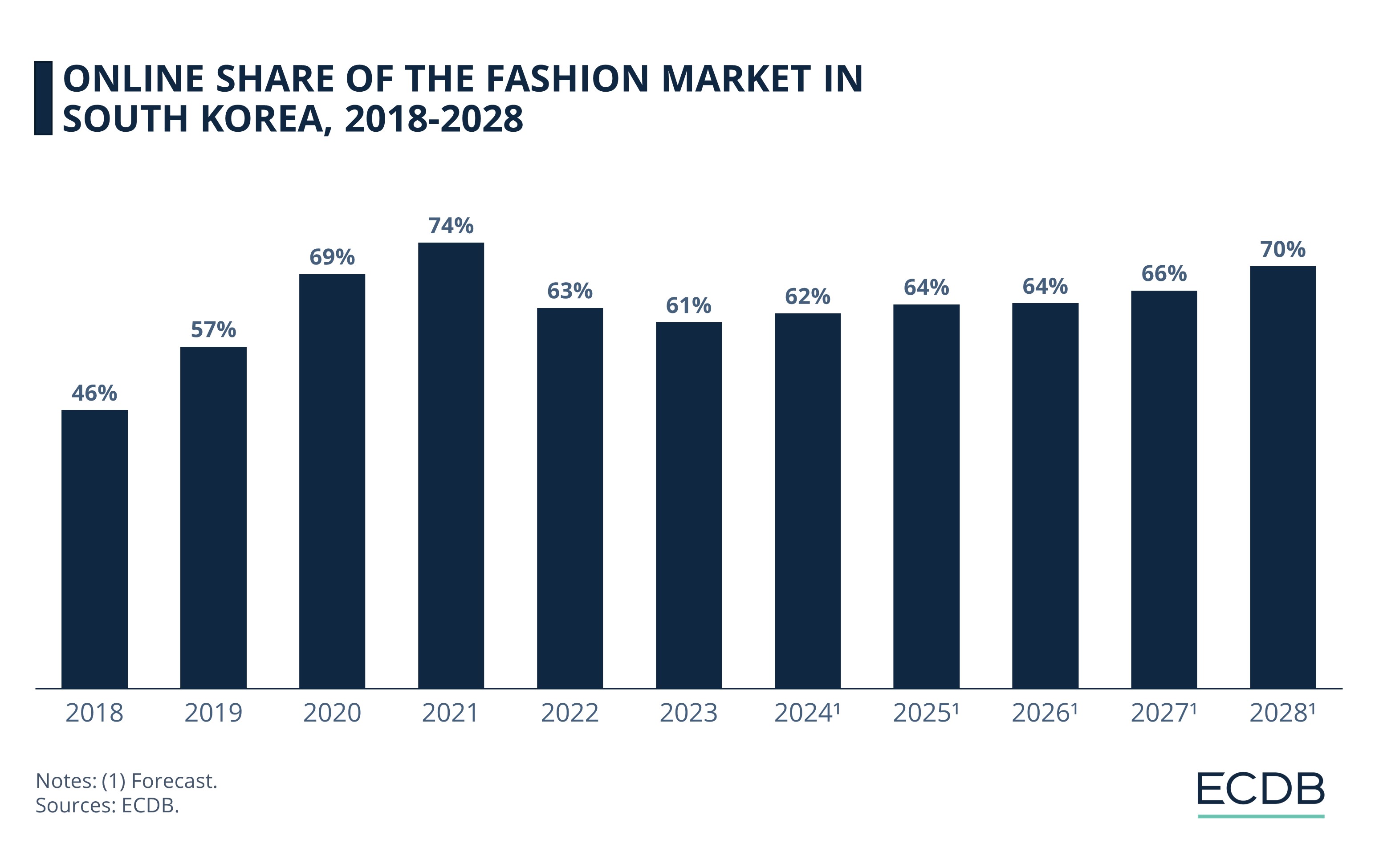

South Korea is the second-largest eCommerce market for fashion in Asia, with revenues of US$25.5 billion in 2023. An overwhelming share of fashion shopping in the country occurs online.

Growth: The South Korean online Fashion market recovered from a 2022 decline of 6.6% and recorded an increase of 7.3% in 2023. Although lower than the growth rates seen during the pandemic years (around 14%), the market is now on a path of expansion. Revenues are expected to cross US$26 billion in 2024. A CAGR (2024-2028) of 2.6% puts projected market volume at US$29.5 billion by 2028.

Online share: In 2023, 61% of all fashion retail in South Korea took place online. This is the largest online share on our list, hinting that the fashion eCommerce industry in South Korea is already advanced. Reasons include high internet penetration, a tech-savvy population, and strong shift towards mobile shopping. This share is only expected to increase going forward, with over 70% of all fashion retail likely to shift online by 2028.

Business Intelligence: Our rankings, updated regularly with fresh data, offer valuable insights to boost your performance. Which stores and companies are the leaders in eCommerce? What categories are generating the most sales? Explore our detailed rankings for companies, stores, and marketplaces.

3. Japan

The third-largest Asian eCommerce market for Fashion in 2023 is Japan. Worldwide, it ranks sixth in Fashion eCommerce. Its revenues were US$22.2 billion.

Growth: The Japanese market shrunk by a notable 12.2% in 2022. Although it recovered in 2023, the growth rate was modest at 2.2%. Going forward, growth is expected to remain sluggish, with the market unlikely to expand demonstrably. The projected CAGR (2024-2028) is also just 0.2%, putting revenues at US$22.7 billion in 2024 and US$23 billion by 2028.

Online share: 24% of all Japanese fashion retail occurred online in 2023. This was a drop from nearly 31% seen in 2022 and even more compared to 2021, when online share was well over 36%. Consumers in Japan are still inclined towards in-store shopping. Online sales are anticipated to account for 33.5% of all fashion retail in Japan by 2028.

4. India

India, hosting the world’s largest population, ranks fourth in Asian Fashion eCommerce. It generated US$17.3 billion in 2023.

Growth: India has recorded strong growth in its Fashion eCommerce market consistently since 2017. An unprecedented increase of 60% was seen in 2020. In 2023, the yearly growth was 17.6%, notably with no negative growth occurring in the intervening years. Going forward, the market is expected to grow at a CAGR (2024-2028) of 13.2%. Revenues are projected to cross US$20 billion in 2024 and US$33 billion by 2028.

Online share: Although India ranks high by online fashion revenue, only a very small percentage of total fashion retail occurs online currently. The online share was just 4.5% in 2023 – it is lower than all the countries in our ranking but with the biggest opportunity for growth. The small online share is due to lower internet and eCommerce penetration rate in India, factors that may shift as the country pushes for digitalization and a young consumer class rises. By 2028, online share for fashion in India is likely to increase modestly, reaching 6.2%.

5. Indonesia

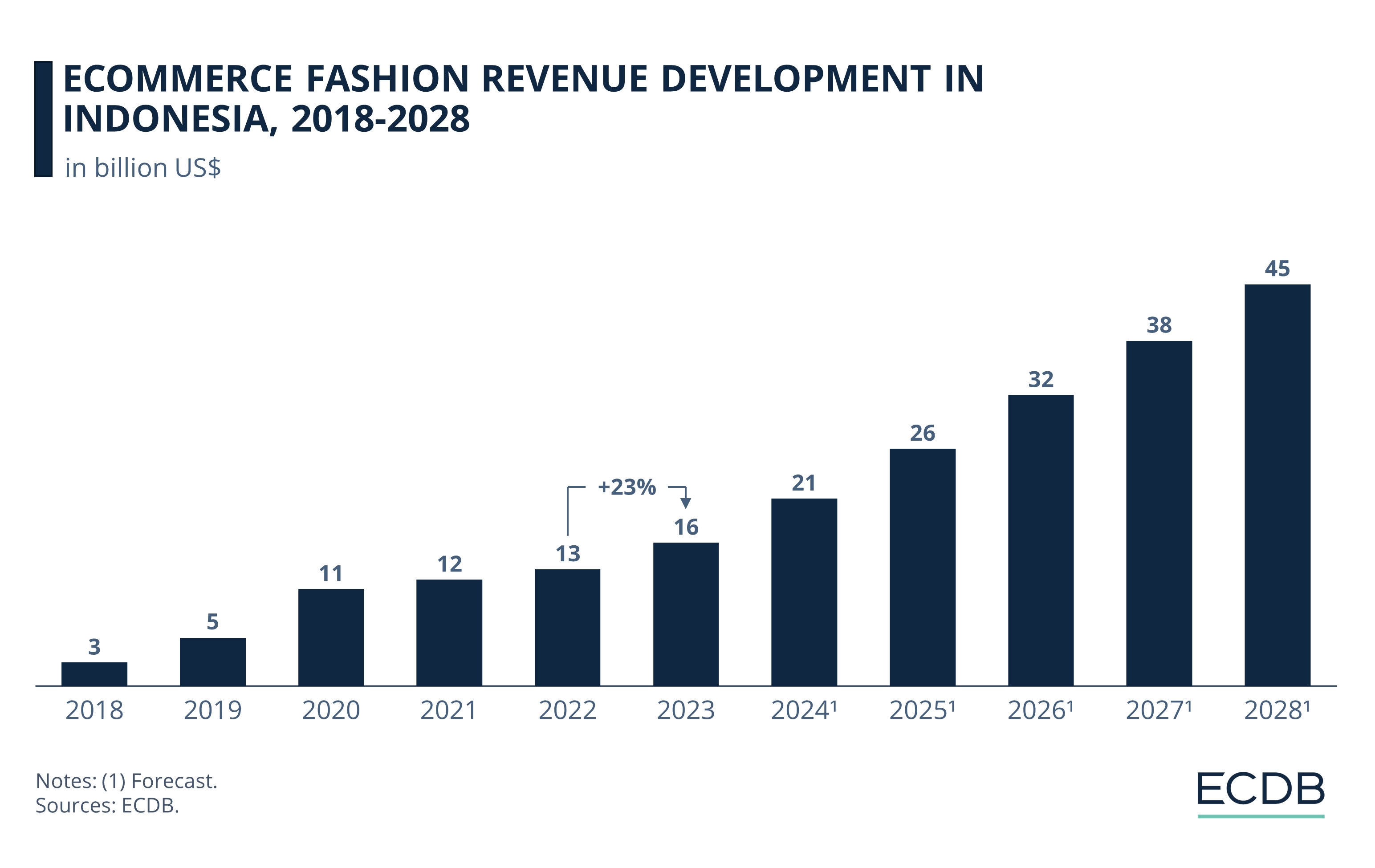

Indonesia ranks last on our top five list, with 2023 online fashion revenues of US$16 billion. It is a vibrant market, showing the highest yearly growth as well as the biggest CAGR (2024-2028) compared to other markets on our list.

Growth: Between 2019 and 2020, the fashion eCommerce market in Indonesia doubled. Growth dropped to single digits in the next two years, but without any market regression recorded. In 2023, the market grew by a tremendous 23%. Indonesia also has the highest projected CAGR (2024-2028) for fashion at 21%, with revenues expected to reach US$21 billion in 2024 and around US$45 billion in 2028 – which will put it ahead of South Korea, Japan and India in terms of market size.

Online share: 19.6% of all fashion retail in Indonesia took place online in 2023. The country has seen a large shift towards online shopping in recent years. In the fashion market specifically, the online share is increasing and is likely to cross 21% by 2028.

Asia Fashion eCommerce Top Markets: Closing Remarks

The Fashion eCommerce market in Asia is driven by diverse countries. Some of them like China are mature online markets and contribute heavily to the total fashion eCommerce revenue in the region at present. Others yet like South Korea are powerhouses when it comes to internet usage, which spurs online shopping in popular categories like Fashion.

Importantly, many markets in the region are global up-and-comers – for instance, both India and Indonesia are not only large by population but projected to be growth winners in eCommerce. With improving digitalization, a younger consumer base, and digital awareness, the future of Fashion eCommerce in Asia is in secure hands.

Sources: World Population Review; Statista: 1, 2.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Birkenstock Business Model: Marketing Strategy & eCommerce Sales

Deep Dive

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Fast Fashion Online Market: Fast Fashion Is Not Fair Fashion

Deep Dive

Shein Business Model: Growth Strategy, Audience, Marketing & Competition

Shein Business Model: Growth Strategy, Audience, Marketing & Competition

Deep Dive

Fanatics Launches New NHL Collection in Cooperation with Lululemon

Fanatics Launches New NHL Collection in Cooperation with Lululemon

Deep Dive

South Korean Online Fashion 2024: Revenue, Stores & Trends

South Korean Online Fashion 2024: Revenue, Stores & Trends

Back to main topics