eCommerce: Top Markets

Largest eCommerce Markets Worldwide: Indonesia and India on the Rise

Discover what makes the top 5 eCommerce markets thrive. Explore their unique dynamics, revenue trends, and key players shaping global online retail.

Article by Cihan Uzunoglu | May 23, 2024Download

Coming soon

Share

Largest eCommerce Markets Worldwide: Key Insights

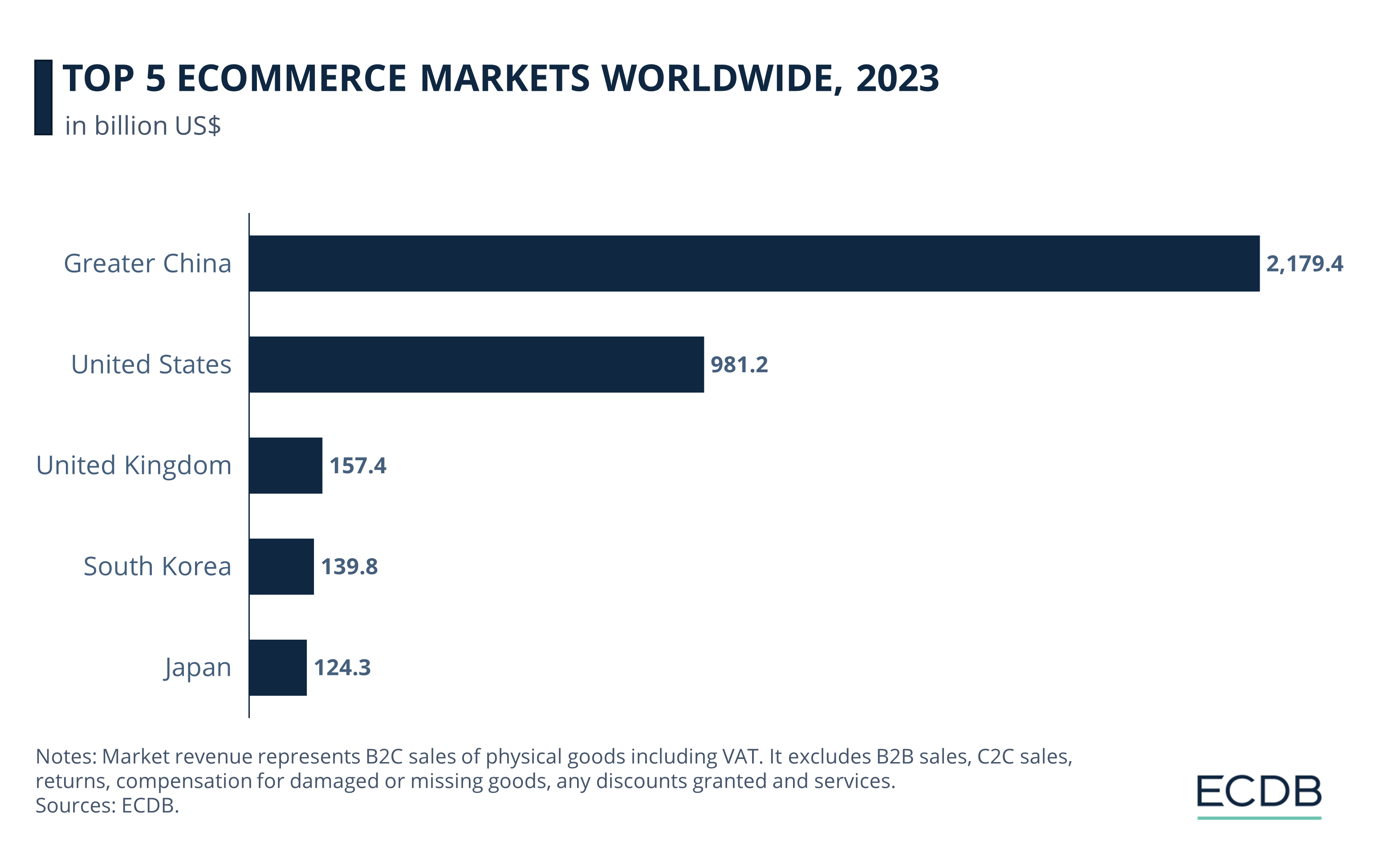

China & U.S. Domination: eCommerce markets of China and the United States outsize the other countries in the top 5, generating respective revenues of US$2.17 trillion and US$981 billion.

Higher Competition in Lower Ranks: The United Kingdom, South Korea and Japan in the 3rd, 4th and 5th spots are of more similar market sizes in comparison to the top 2.

Indonesia & India Upcoming: Our forecasts show that the top 5 might change in the next few years, witnessing the rise of Indonesia and India, as well as the fall of South Korea and Japan.

What does it take for a country to be at the top of the global eCommerce market? Large population, strong economy, good infrastructure, online shopping habits, government incentives for eCommerce? The right answer is all of the above - and more.

According to our analysis, all of the world's top 5 eCommerce markets meet these criteria to varying degrees. With their unique dynamics, revenue trends, product splits, top payment and shipping providers, these markets give us a good overview of the global online shopping market.

Largest eCommerce Markets Worldwide

Our country ranking shows that China is by far the largest eCommerce market in the world. The U.S. follows with less than half of China's revenues, while the UK, South Korea and Japan are in close competition at the bottom of the top 5, but well below the top two contenders.

1. China

Greater China is the largest eCommerce market globally, with a projected revenue of US$2.41 trillion by 2024, ahead of the United States. From 2024 to 2028, a compound annual growth rate (CAGR) of 8% is anticipated, resulting in a market volume of US$3.29 trillion by 2028.

Online retail accounts for 28% of China’s retail market, expected to grow to 33% by 2028. JD.com dominates the online market with US$115 billion in revenue in 2023.

For context, eCommerce market revenues of China are comparable to the GDP of Canada, while the U.S. eCommerce market is close to Switzerland’s GDP. Similar comparisons can be drawn between the eCommerce market revenues of the UK, South Korea and Japan with the respective GDPs of Kuwait, Slovakia and Dominican Republic.

Fashion is the largest eCommerce segment in China, accounting for 35% of market revenues. Following are Electronics (26%), Care Products (11%), Grocery (9%), Furniture & Homeware (7%), Hobby & Leisure (7%), and DIY (5%).

Payment methods in China are diverse, with Ali Pay leading at 72%, followed by WeChat at 62%. VISA and Mastercard are each accepted by 31% of online stores, and bank transfers are also at 31%.

SF Express dominates shipping, used by 64% of retailers, with EMS, own delivery services, Yuantong Express, and ZTO Express also playing significant roles in the market.

2. United States

Ranked as the second-largest eCommerce market globally, the United States is predicted to reach a revenue of US$1.06 trillion by 2024, surpassing the United Kingdom. The market is expected to grow at a compound annual growth rate (CAGR) of 7.4% from 2024 to 2028, reaching US$1.41 trillion.

In the U.S., online retail makes up 27% of the retail market, with expectations to rise to 38% by 2028. Leading the market is Amazon.com, which generated US$135 billion in revenue in 2023.

The top eCommerce segment in the U.S. is Fashion, making up 22% of market revenues. Other significant segments include Electronics (21%), Hobby & Leisure (20%), DIY (11%), Furniture & Homeware (11%), Care Products (9%), and Grocery (7%).

Payment options in the U.S. are varied, with VISA and Mastercard both holding a 96% share, followed by American Express at 91% and Discover at 82%. PayPal is the most commonly used e-wallet, accepted by 77% of online stores.

UPS leads the shipping services, utilized by 58% of retailers. USPS, FedEx, DHL, and own delivery services also play important roles in the sector.

For your information: We regularly update our rankings with the latest data from our models, providing valuable insights to help improve your company. Which stores and companies are leading eCommerce? Which categories are driving bestsellers and high sales? Find out for yourself on our rankings for companies, stores, and marketplaces. Stay a step ahead of the market with ECDB.

3. United Kingdom

The United Kingdom, positioned as the third-largest eCommerce market worldwide, is set to achieve a revenue of US$169 billion by 2024, ahead of South Korea. The market is projected to grow at a compound annual growth rate (CAGR) of 6.4% between 2024 and 2028, reaching US$218 billion.

Online retail in the UK comprises 27% of the retail market, expected to rise to 31% by 2028. Amazon.co.uk is the dominant player, with a revenue of US$16 billion in 2023.

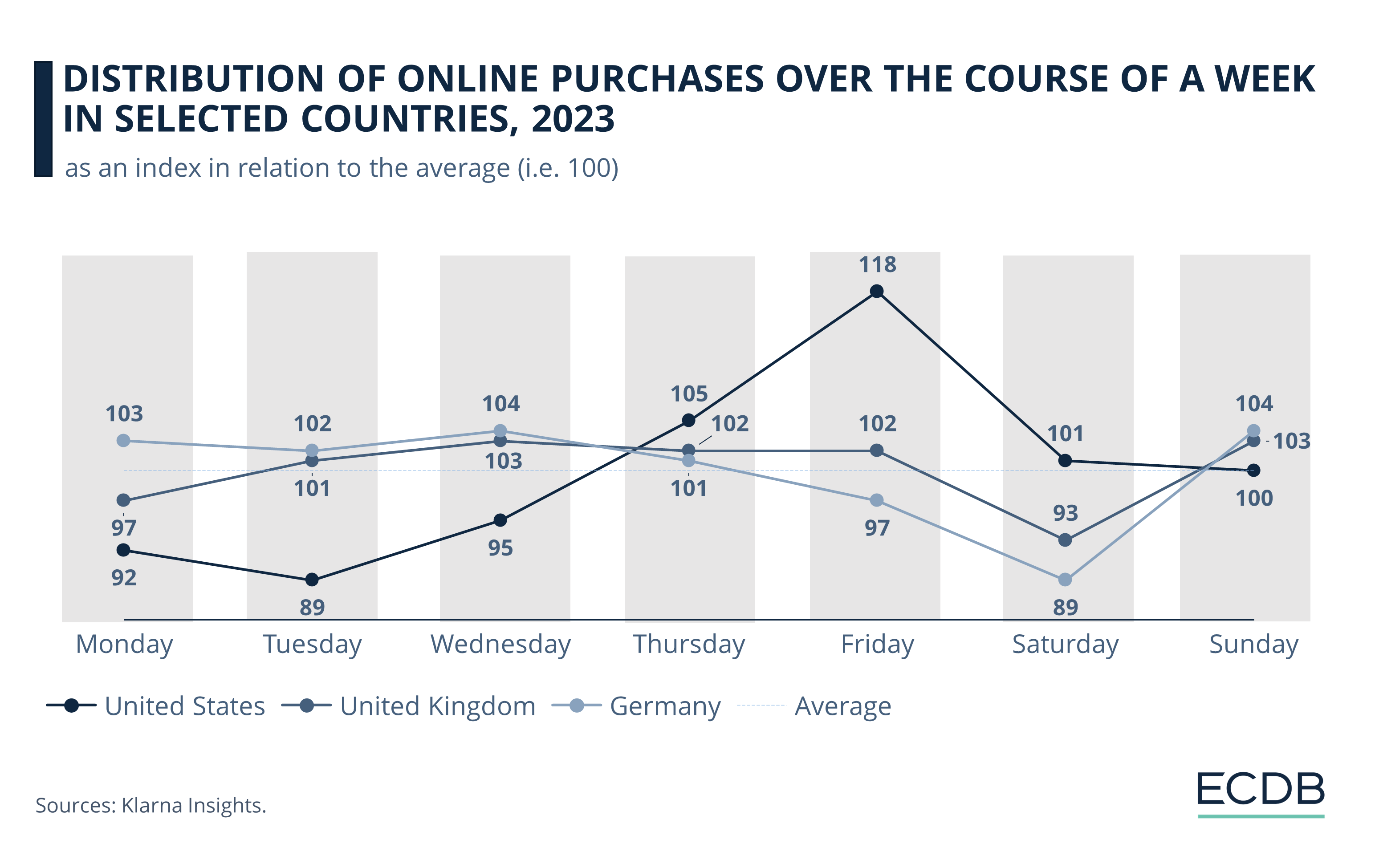

In the UK, online shopping is steady from Sunday to Friday, peaking on Thursday and Friday, with a decline over the weekend. This pattern contrasts with the U.S., where shopping activity varies more significantly throughout the week. Germany shows a similar trend to the UK, with consistent shopping rates.

Fashion leads the UK’s eCommerce segments, accounting for 28% of market revenues. Following this are Electronics (17%), Hobby & Leisure (16%), Grocery (13%), Furniture & Homeware (10%), Care Products (9%), and DIY (7%).

The UK offers diverse payment methods, with VISA and Mastercard each at 97%, followed by American Express at 62%. PayPal is the leading e-wallet, used by 82% of stores, while Apple Pay is utilized by 20%.

In the shipping sector, Royal Mail is the leading service provider, used by 56% of retailers. Other significant players include DPD, DHL, UPS, and Parcel Force.

4. South Korea

South Korea stands as the fourth-largest eCommerce market globally, with a projected revenue of US$151 billion by 2024, surpassing Japan. The market is expected to grow at a compound annual growth rate (CAGR) of 6.4% from 2024 to 2028, resulting in US$193 billion.

In South Korea, online retail represents 24% of the retail market and is predicted to increase to 25% by 2028. Coupang.com leads the market, with a revenue of US$21 billion in 2023.

The leading eCommerce segment in South Korea is Grocery, which makes up 29% of the market revenues. Other key segments include Electronics (20%), Fashion (18%), Furniture & Homeware (9%), DIY (9%), Hobby & Leisure (9%), and Care Products (7%).

Payment methods in South Korea are varied, with bank transfers leading at 86%. E-wallets such as Kakao Pay, Naver Pay, and Payco have significant shares of 40%, 36%, and 34%, respectively.

CJ Logistics is the primary shipping service, used by 59% of retailers, followed by Korea Post, Lotte, Hanjin, and Rosen Courier, all contributing to the competitive market.

5. Japan

Japan, the fifth-largest eCommerce market globally, is projected to have a revenue of US$132 billion by 2024. The market is set to grow at a compound annual growth rate (CAGR) of 4.9% from 2024 to 2028, reaching US$159 billion.

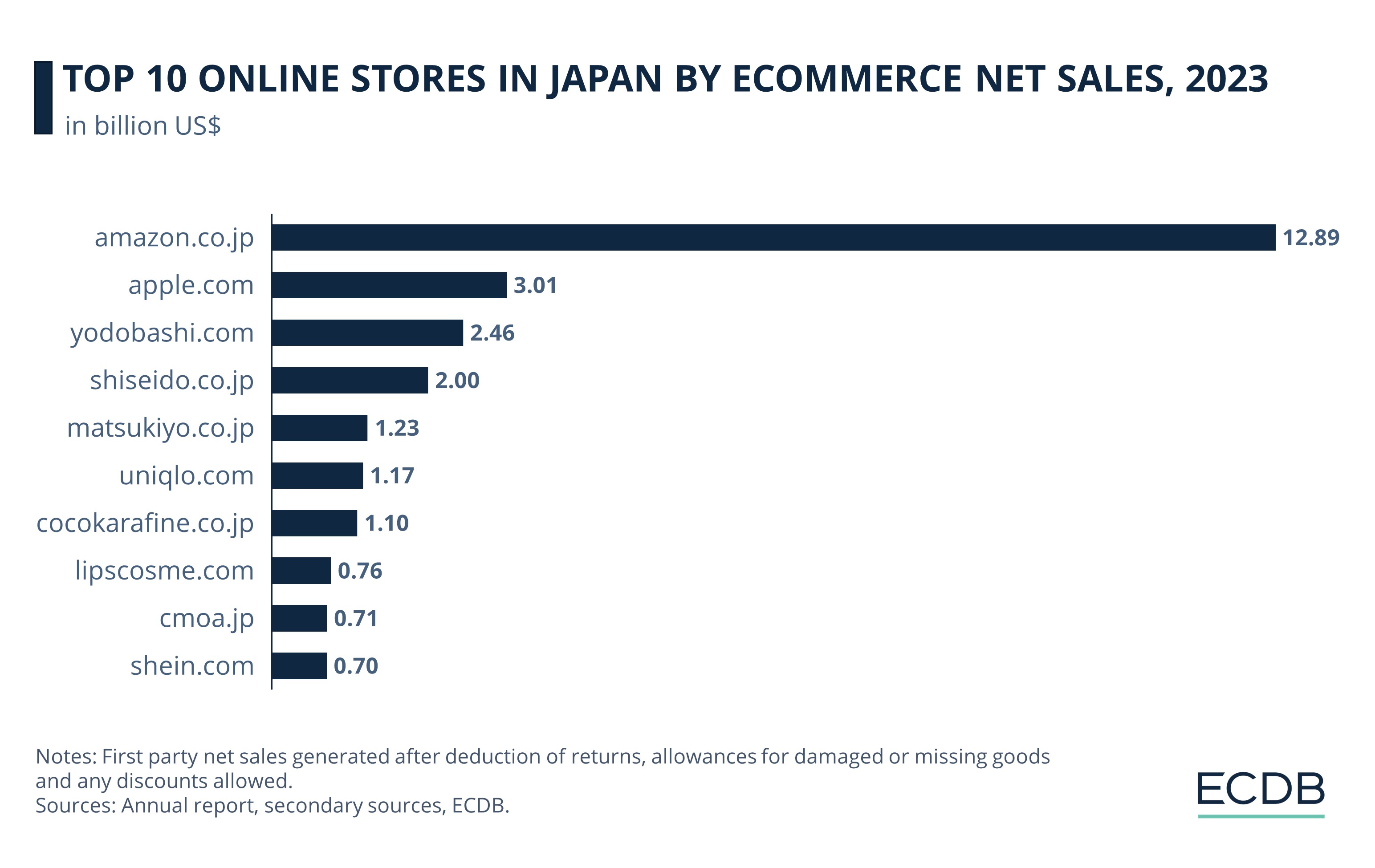

Online retail in Japan accounts for 14% of the retail market, expected to increase to 19% by 2028. Amazon.co.jp dominates the market with a revenue of US$13 billion in 2023.

As in many eCommerce markets around the world, Amazon dominates the Japanese market. While Apple, Yodobashi, and Shiseido follow with similar sales to each other, their combined net sales are a little above half of Amazon's net sales in Japan.

The largest eCommerce segment in Japan is Grocery, contributing 20% of market revenues. This is followed by Electronics (19%), Hobby & Leisure (18%), Fashion (18%), Furniture & Homeware (17%), Care Products (7%), and DIY (2%).

Japan's payment methods are diverse, with VISA leading at 96%. Mastercard (96%), JCB (92%), American Express (89%), and Diners Club (76%) are also widely used.

Yamato is the leading shipping service provider, used by 57% of retailers. Other significant providers include Sagawa Express, Japan Post, EMS, and Seino Transportation.

Largest eCommerce Markets Worldwide: Indonesia and India Replace

South Korea and Japan?

The eCommerce landscape is poised for significant shifts over the next few years. While China, the United States, and the United Kingdom are expected to maintain their positions as the top three eCommerce markets globally from 2024 to 2028, there are notable changes on the horizon for the 4th and 5th positions.

Indonesia, which is currently ranked 8th, is expected to climb to 6th place by 2026, before improving to 5th and 4th place by 2027 and 2028, respectively. Similarly, India's eCommerce market is expected to hold the 5th spot globally by 2028, and climb steadily in the next few years.

In addition, current #4 South Korea and #5 Japan are projected to drop to #6 and #7, respectively, by 2028.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

European Retailers Return to Physical Stores to Compete with Online Giants

European Retailers Return to Physical Stores to Compete with Online Giants

Deep Dive

YouTube Partners With Flipkart and Myntra to Launch YouTube Shopping in India

YouTube Partners With Flipkart and Myntra to Launch YouTube Shopping in India

Deep Dive

Inflation's Impact on eCommerce

Inflation's Impact on eCommerce

Deep Dive

Older Consumers Drive Growth in the Chinese eCommerce Market

Older Consumers Drive Growth in the Chinese eCommerce Market

Deep Dive

Online Shopping in China: Where Chinese Consumers Shop Online

Online Shopping in China: Where Chinese Consumers Shop Online

Back to main topics