Blog

The ECDB Blog turns data from the Tool into eCommerce insights that illustrate which use you can make of our comprehensive data. It elaborates on relevant eCommerce news to help your brand gain a broader perspective on current retail trends and their effects. Our articles are carefully crafted to present to you the latest market trends, including retail, payment, shipping, transactions, cross-border and more.

All Articles

China and the U.S. Digitally Minded in Payment: E-Wallets, PayPal, AliPay

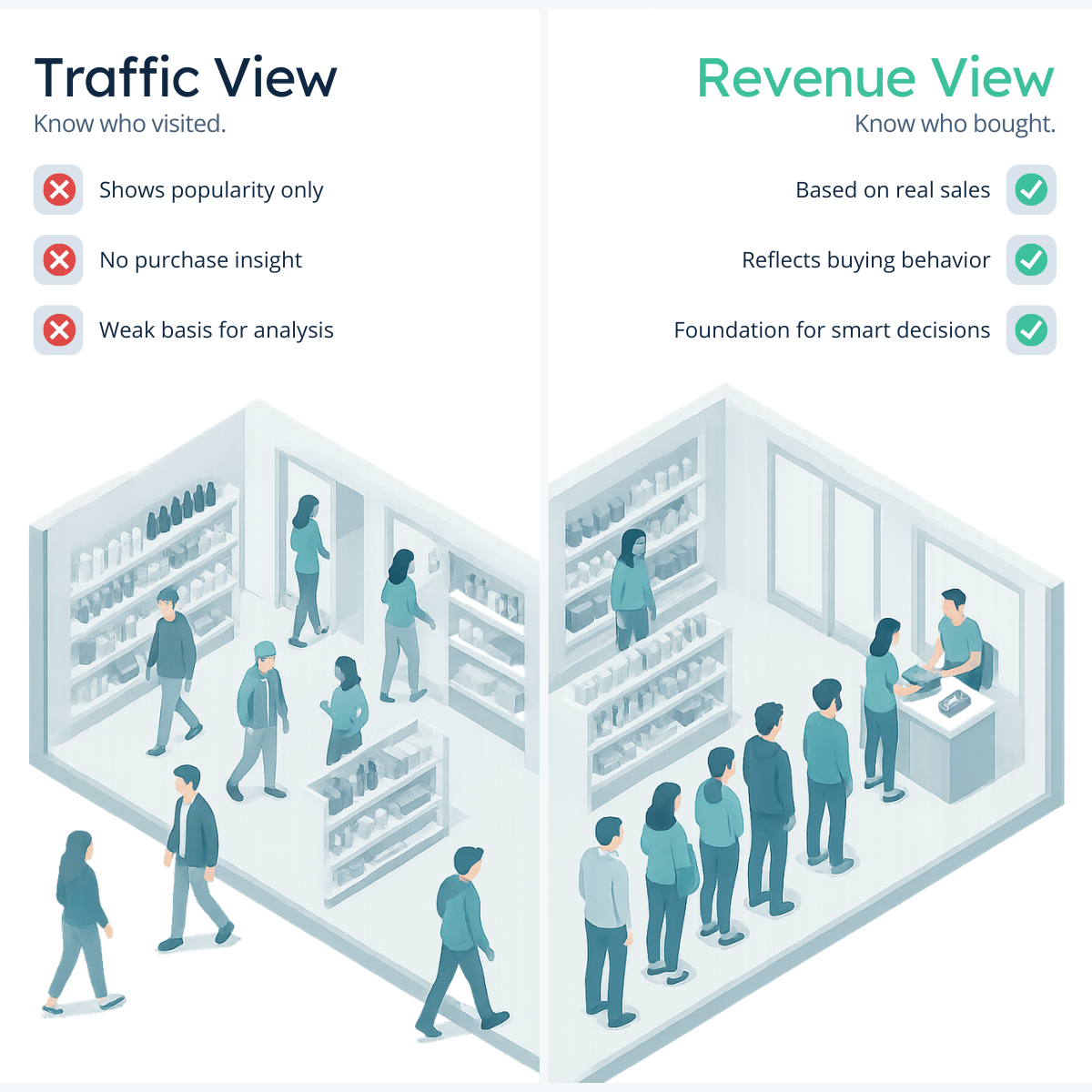

Amazon Prime Day Months Relevance Grows as Years Go By

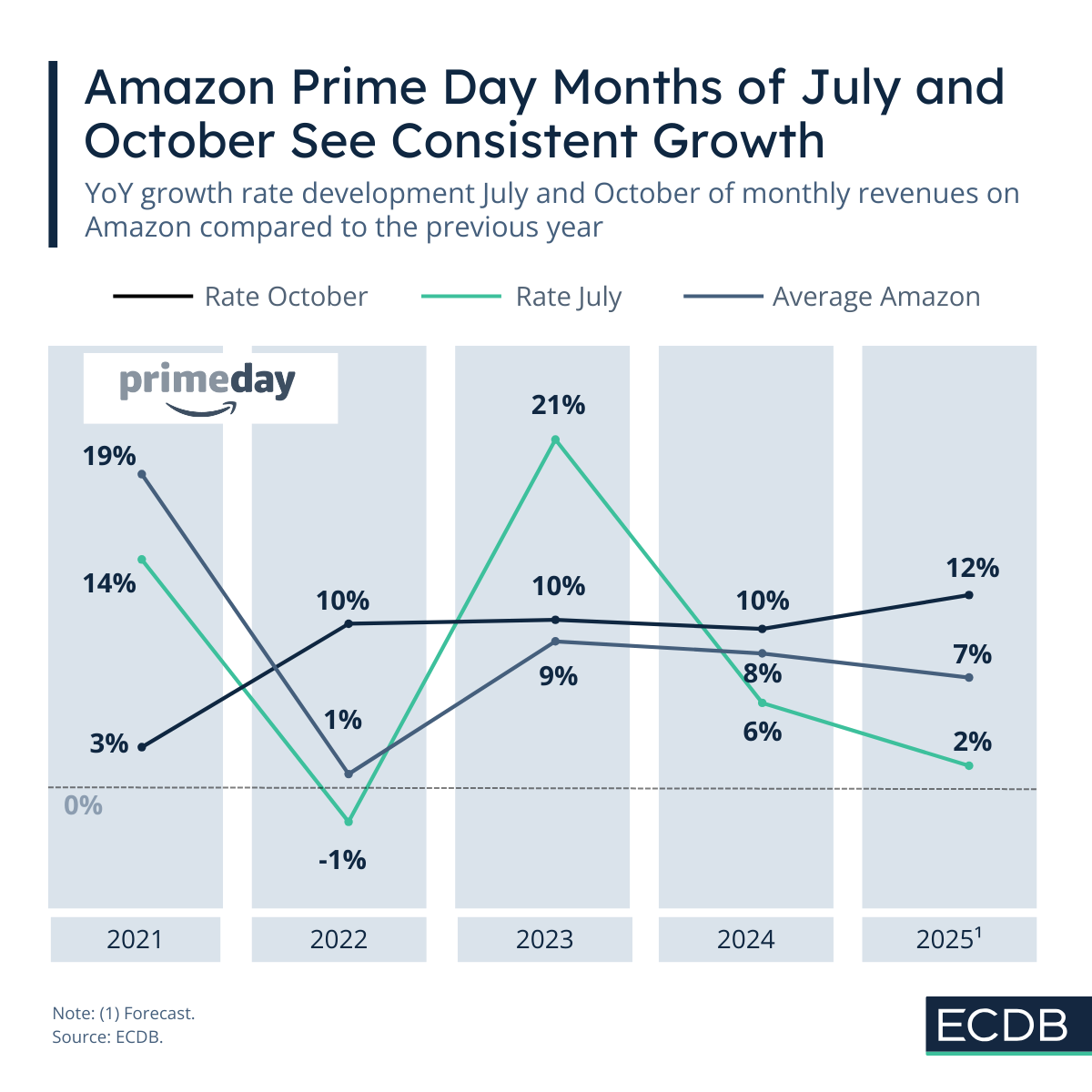

Bullion eCommerce Gains Traction With India and Russia Leading the Way

Top eCommerce Conferences & Events With ECDB in 2025

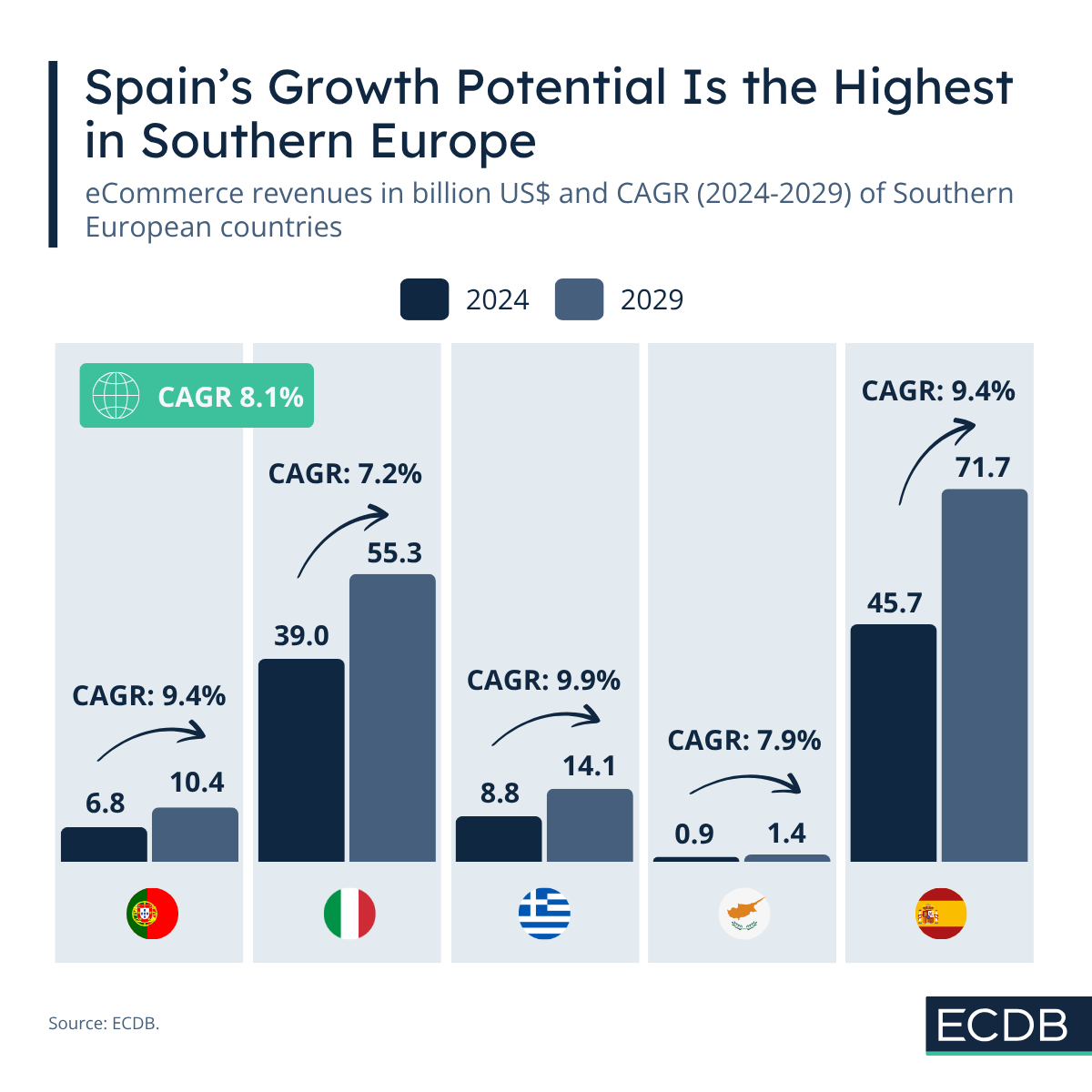

Spain, Portugal and Greece Exceed Predicted Global Growth Rates Until 2029

Ready To Get Started?

Find your perfect solution and let ECDB empower your eCommerce success.