eCommerce: Market Insights

eCommerce Marketplace Trends 2024: Common Strategies and Patterns of Leading Online Businesses

Online marketplaces connect sellers with a wide audience of shoppers. Recent marketplace shifts reveal the most common trends among the leading platforms. Find out which strategies are a surefire way to generate eCommerce buzz.

Article by Nadine Koutsou-Wehling | July 30, 2024Download

Coming soon

Share

eCommerce Marketplace Trends 2024: Key Insights

China and the U.S. Host Top Marketplaces: While Amazon is still the number one eCommerce marketplace in the world, Chinese platforms are closing the gap. Most notable is Alibaba, whose two platforms Taobao and Tmall together generate higher GMVs than Amazon. Pinduoduo is also a strong contender for the top spot.

A Modern Production Mode Makes Headlines: The C2M (consumer-to-manufacturer) model is responsible for the intense price competition among the platforms with the most hype. Cutting out intermediaries in the production process saves costs, but leaves no capacity for quality control.

The Three Marketplace Trends in 2024: These aspects are closely tied to the C2M production model, but can also occur without it. They include pricing, AI/personalization, and social commerce.

eCommerce marketplaces are digital shopping platforms where various sellers reach an online consumer base. Online marketplaces are more accessible for sellers of all shapes and sizes to set up shop, as the platform provider is responsible for building and maintaining the marketplace’s digital infrastructure.

With the emergence of online marketplaces boasting innovative features that are making waves in the eCommerce market, it pays to know what the most notable trends are on the scene right now. Here are the top 3 eCommerce marketplace trends to watch in 2024.

What Is an Online Marketplace?

An online marketplace links sellers to a wide audience. The platform is managed by marketplace providers who operate the digital infrastructure. Marketplaces can specialize in specific products or offer a wide range.

GMV (Gross Merchandise Value) tracks sales on a marketplace over a period of time. It differs from revenue because the provider earns a commission on each sale.

At ECDB, we identify two types of marketplaces: hybrid and third-party-only (3P) marketplaces. Hybrid marketplaces, like Amazon or JD.com, sell products from both the platform provider and third-party sellers. 3P marketplaces, such as eBay or MercadoLibre, solely facilitate listings for sellers.

More Insights? We keep our rankings up to date with the latest data, offering you valuable information to improve your business. Want to know which stores and companies are leading the way in eCommerce? Which categories are achieving the highest sales? Check out our rankings for companies, stores, and marketplaces. Stay one step ahead with ECDB.

eCommerce Marketplace Trends 2024

The most notable development in recent years has been the escalating competition between major U.S. and Chinese eCommerce platforms, which operate highly profitable marketplaces.

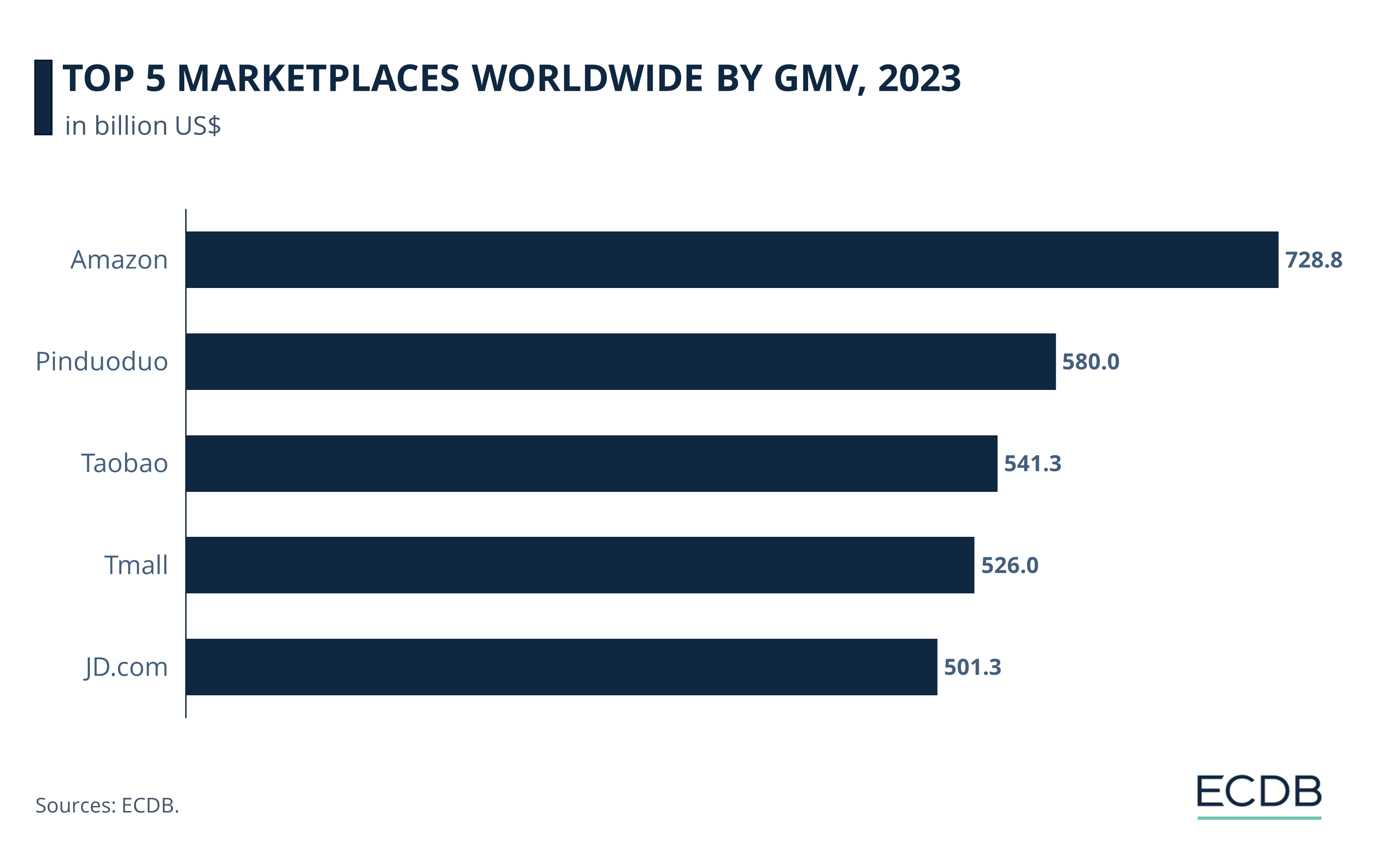

A look at the top 5 marketplaces in the world measured by GMV shows that Amazon is number one. It generated US$728.8 billion in online sales across all its domains in 2023.

Pinduoduo ranks second. It is operated by the Chinese eCommerce conglomerate PDD Holdings, which also operates the trending online marketplace Temu, making it Pinduoduo’s sister company.

Ranks 3 through 5 are also Chinese eCommerce platforms, the first two of which are operated by Alibaba.

Observe how Amazon’s global leadership is being contested by Chinese platform providers with a similar business concept. But their strategy is centered around lower costs, higher engagement through gamification and pervasive social media promotion.

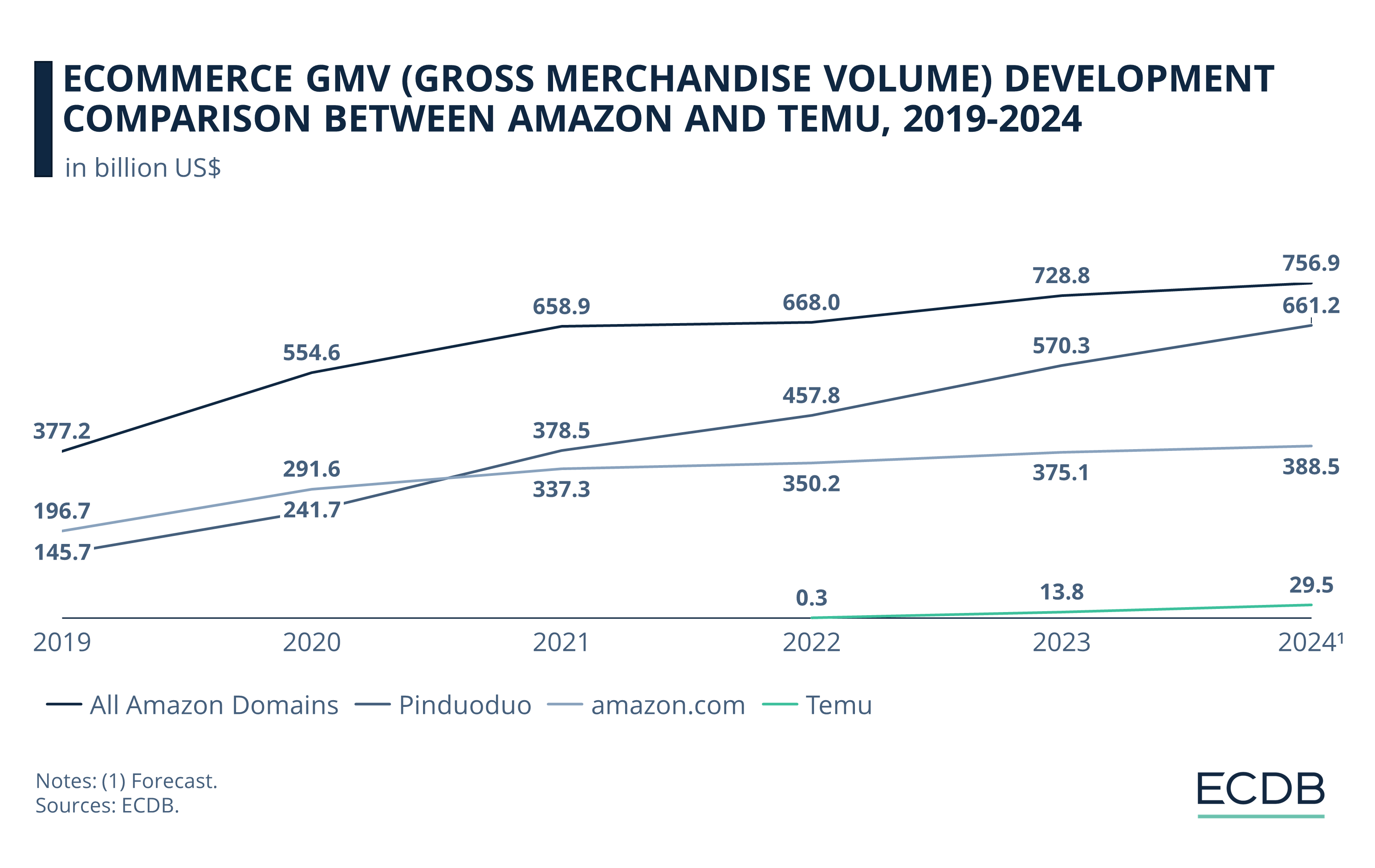

A look at the recent performance of Pinduoduo, Temu's sister company, shows why Amazon is currently taking precautions to compete with Asian platforms for the foreseeable future.

Pinduoduo’s progress in recent years has been nothing short of amazing: From a GMV of US$145.7 billion in 2019, it climbed to approach Amazon’s lead in 2023, with US$570.3 billion in GMV.

By 2024, Pinduoduo is forecast to close the gap: ECDB analysts expect its GMV to reach US$661.2 billion by 2024. This figure even exceeds the current GDP of a wealthy European economy such as Belgium.

Clearly, Asian eCommerce marketplace providers are doing something right. What are the three trends that ECDB identifies for this year, which are sure signs of marketplace success?

1. Pricing

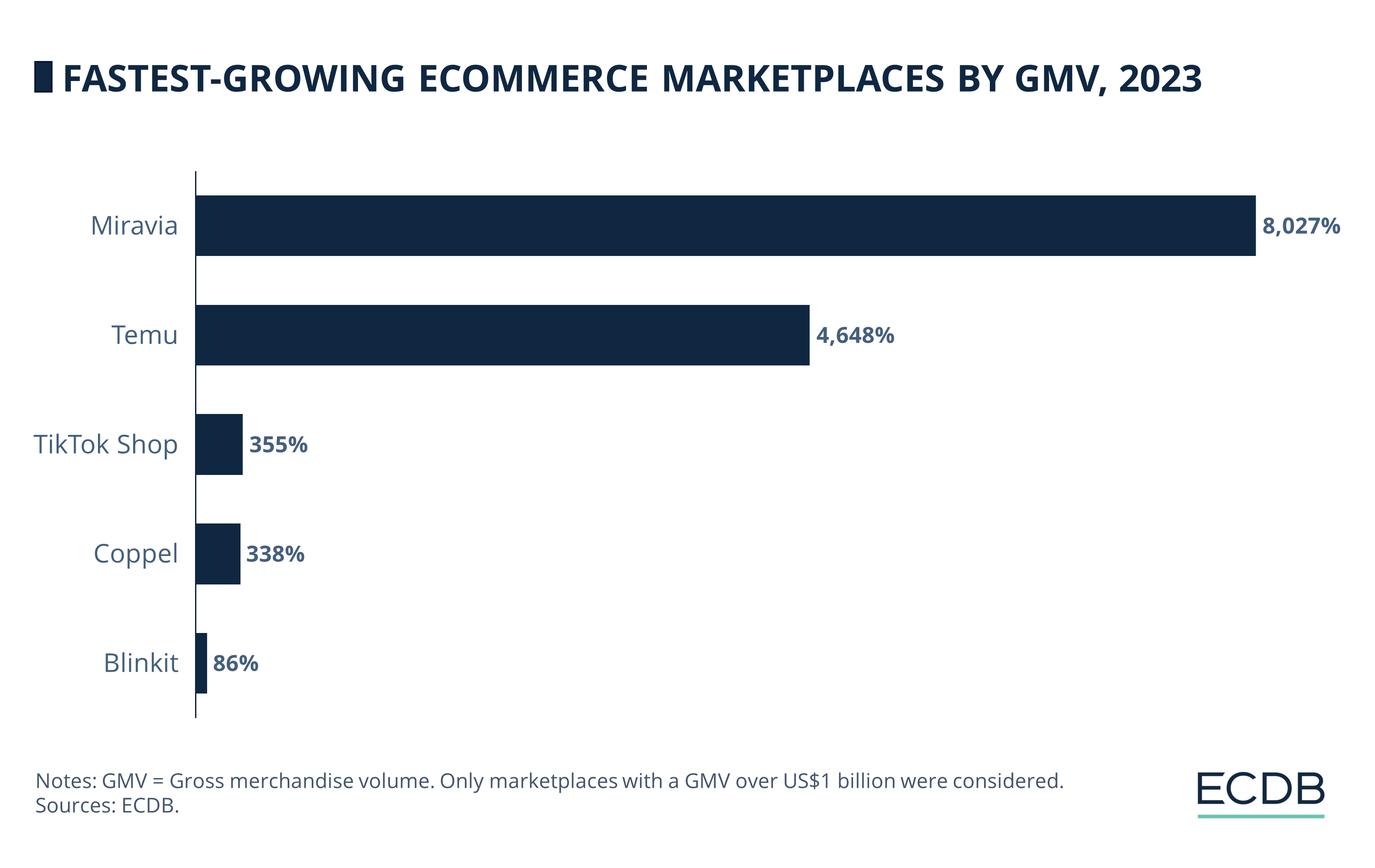

Perhaps the most obvious marker of success for emerging marketplaces is their low-cost model. In the ranking of the fastest-growing eCommerce marketplaces over a GMV of US$1 billion in 2023, see how the top two follow an extensive discounting strategy:

Miravia is Alibaba’s eCommerce platform in Spain that offers well-known brands at competitive prices to gain recognition in the market. Temu has also entered the global eCommerce scene with incredibly low prices.

The strategy used by the new players to undercut their direct competitors on price and turnaround time is the C2M (consumer-to-manufacturing) model. While this model is related to the following aspects, an immediate consequence of adopting a C2M strategy is lower overall prices.

By cutting out the middleman in the manufacturing process, items are shipped directly from the manufacturing facility to the consumer. This means that the products are packed into their final packaging at the manufacturing facilities. But because of their direct forwarding to the end-user, final quality control is removed from the equation, often resulting in inferior product quality.

Another inherent aspect of the C2M model follows suit: Personalization, or the use of AI for big data analysis of consumer preferences.

2. Personalization / AI

The times of standardization and scale in eCommerce are being replaced by a prioritization of big data intelligence, leading to personalization through product customization. What exactly does that mean?

Instead of producing products in bulk based on designs pre-determined by a handful of product developers, real-life consumer demand is shaping the supply. This individualized production process is made possible by big data.

In the case of C2M it is called “on-demand production”: Initially, only small batches of new products are being offered on the eCommerce platform and then expanded or discontinued, depending on consumer response.

In a more general sense, AI is being used to analyze big data properties, leading to more refined knowledge of consumer preferences. Not only that, but general pattern analysis makes it easier to predict future trends and decisions about product features.

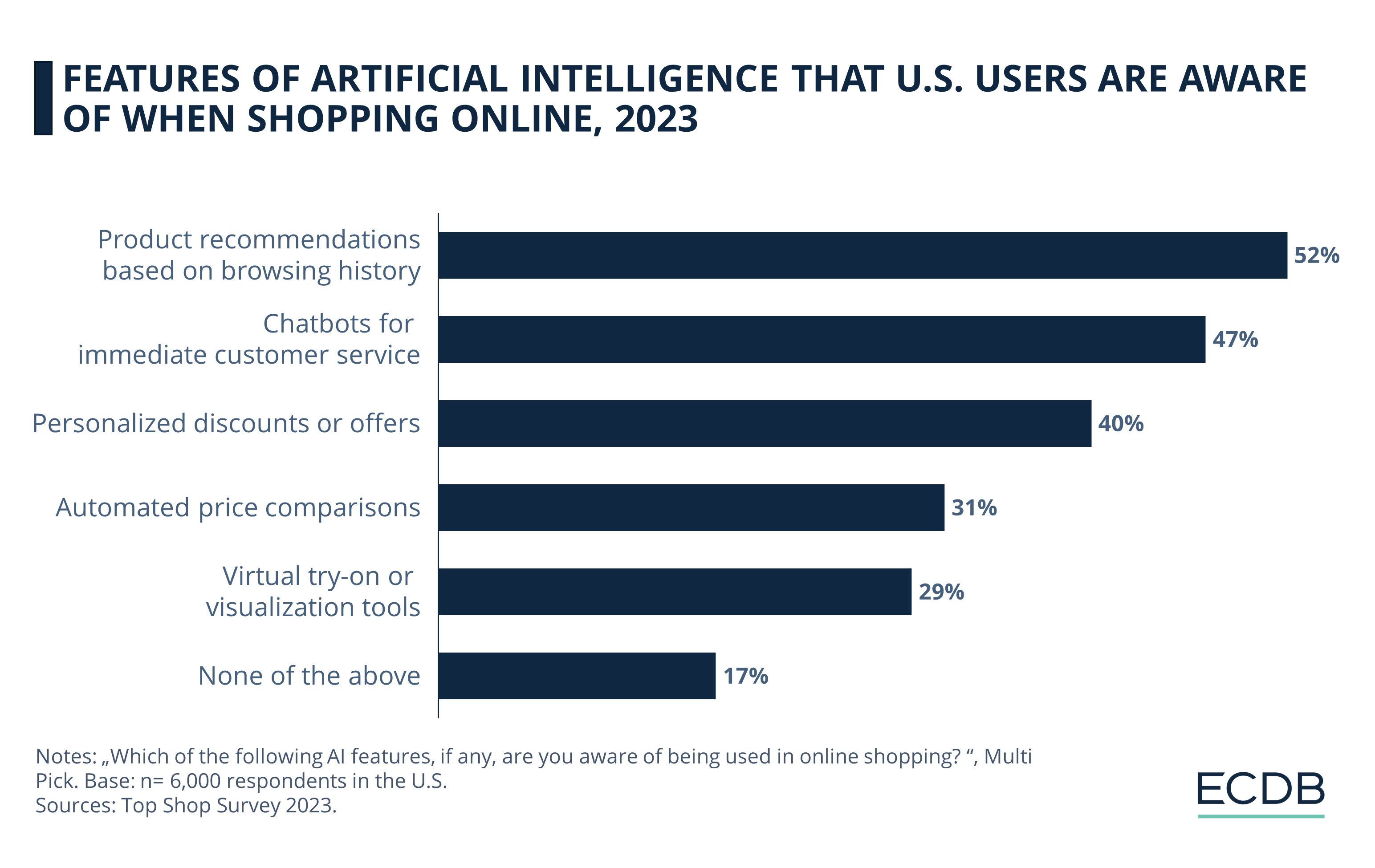

AI is commonly referred to as this cutting-edge future technology, but it is already an integral part of current operations. In part, consumers are already aware of it:

The personalization aspect (40%) certainly refers to the offers that consumers receive. But with the growth of the C2M production model, it even encompasses what is produced in the first place.

3. Social Commerce

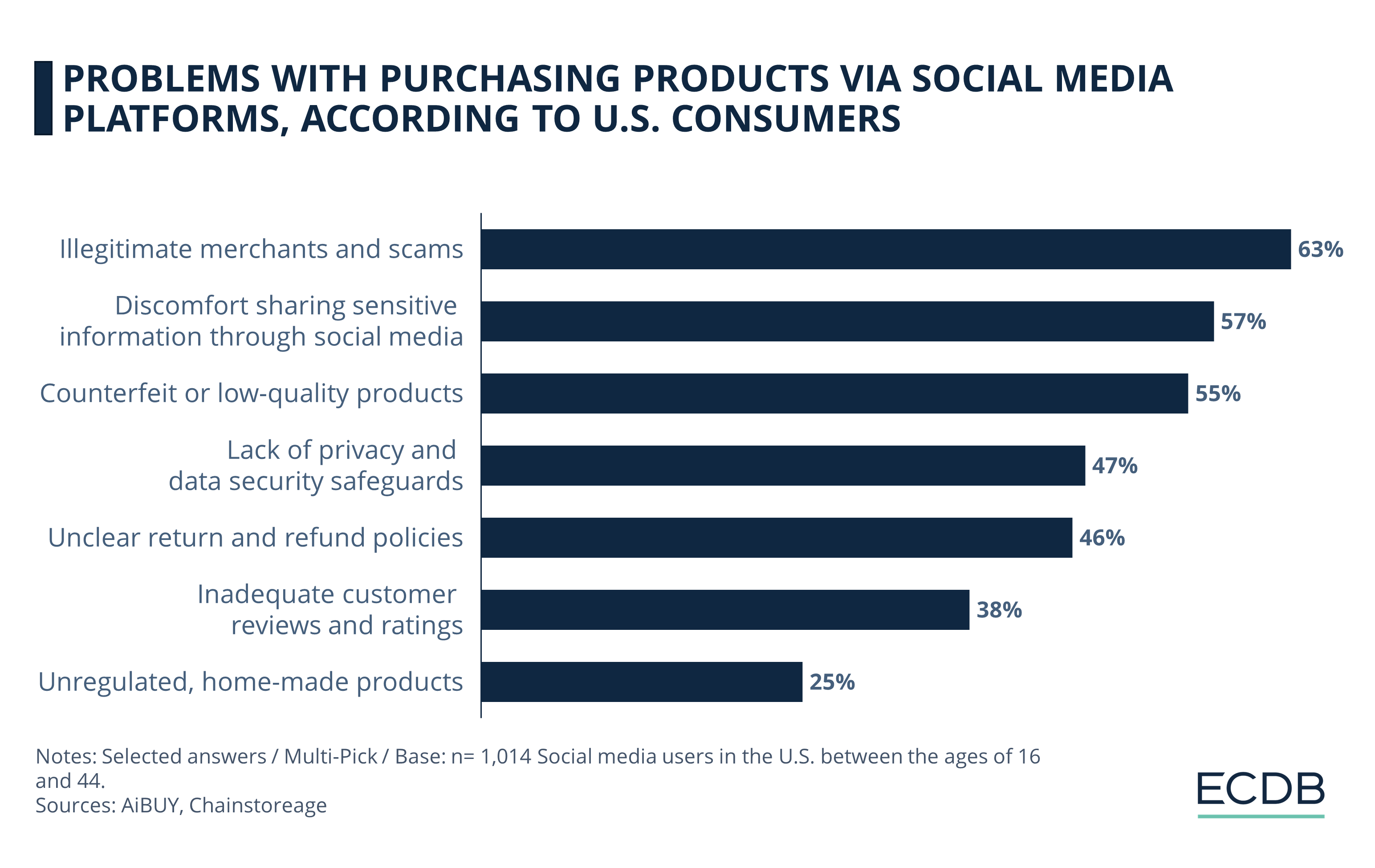

One of the most notable trends of this year has been the launch of TikTok Shop in Western markets, as it was previously only available in Southeast Asian markets. TikTok Shop is particularly well suited to introducing social commerce into markets where it has previously been eyed with suspicion: Buying products through social media seemed like a surefire way to get scammed.

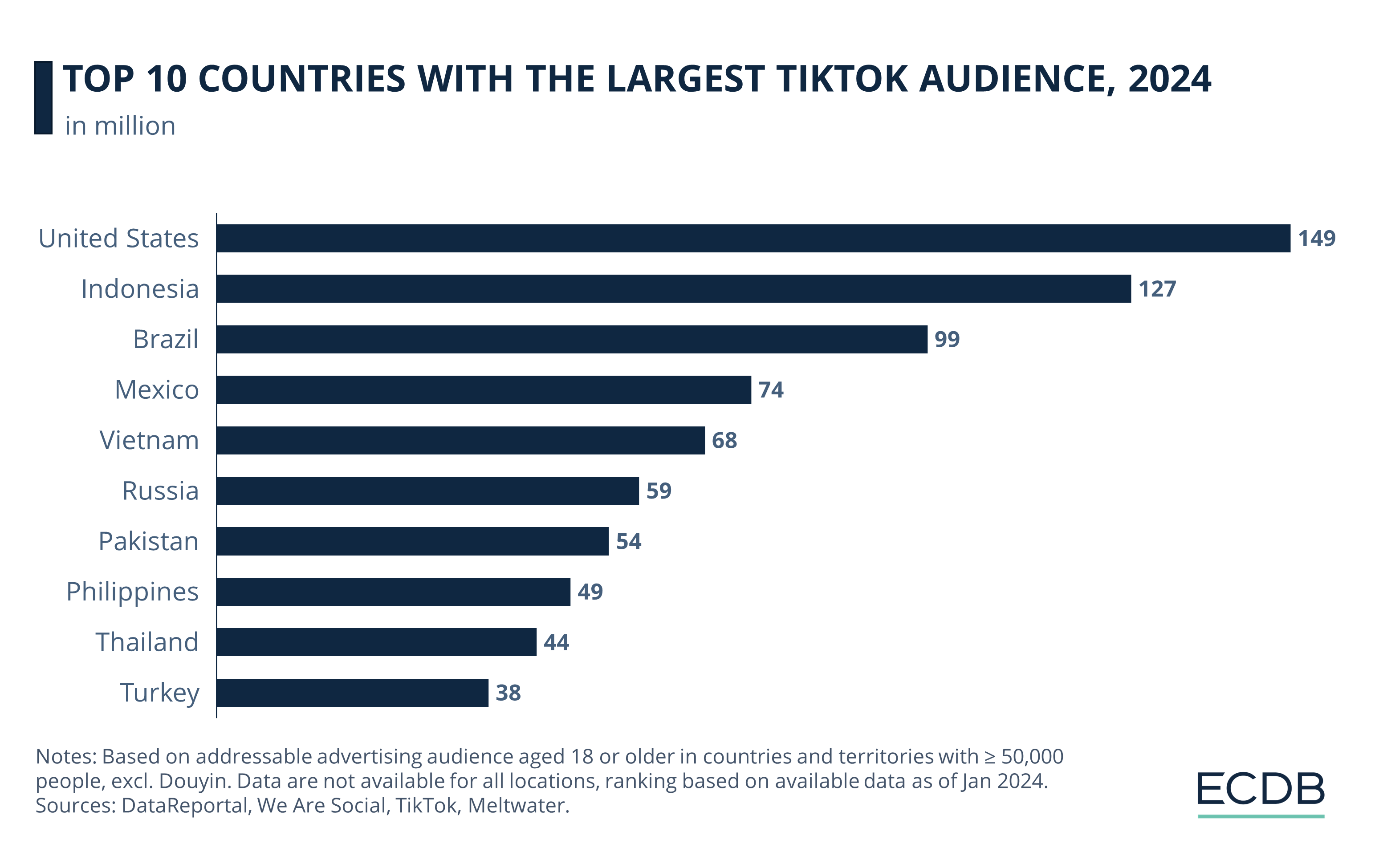

While the features of TikTok Shop do not change the problems consumers mention, the platform has one clear advantage: its wide reach and high engagement. This means that more users are exposed to products, and businesses can offer their merchandise to a wider audience. For small businesses, this provides greater brand visibility. For larger enterprises, TikTok Shop can potentially introduce the brand to a younger audience.

TikTok has the largest audiences in emerging eCommerce markets like Indonesia, Mexico and Brazil.

Apart from TikTok, or social commerce in general, integrating social commerce features like gamification and referrals into eCommerce platforms can motivate consumers to spend more time on the site.

Temu is a prime example of an eCommerce site that uses social commerce elements to engage consumers. Not only does this include gamification to give consumers the sense of winning discounts that can be redeemed for purchases on the site, but it also encourages social referrals to invite more users to the site.

Blending social with online shopping also allows for the collection of more data, ultimately providing the eCommerce site with additional insights and revenue.

Marketplace Trends 2024: Closing Remarks

eCommerce marketplaces connect sellers and online shoppers with each other. They facilitate the process of setting up shop and increasing brand visibility. With new marketplaces joining the scene and raking in excessively high growth rates, the competition for the top spots in the world is intensifying.

The three trends for eCommerce marketplaces in 2024 are pricing, AI / personalization and social commerce. They hint at the immense price competition in eCommerce, fueled by production modes that further decrease costs. The personalization aspect ties into more immediate production capabilities to gauge consumer demand in real-time, adjusting supply in the process. The third point, social commerce, is less about production and more about addressing consumers in a specific way that increases interest and engagement.

Sources: Sciencedirect – Substack

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Next Generation eCommerce: Key Trends Shaping the New Age of Online Retail

Deep Dive

Top Online Payment Methods: eWallets, Cards & Bank Transfer

Top Online Payment Methods: eWallets, Cards & Bank Transfer

Deep Dive

Secondhand Fashion Online Market in the UK: Categories, Preferences by Generation, Top Stores

Secondhand Fashion Online Market in the UK: Categories, Preferences by Generation, Top Stores

Deep Dive

FTC’s New Ban in Effect & How to Spot Fake Reviews in Online Shopping

FTC’s New Ban in Effect & How to Spot Fake Reviews in Online Shopping

Deep Dive

Gen Z Online Shopping Behavior: Consumer Habits, Preferences & Trends

Gen Z Online Shopping Behavior: Consumer Habits, Preferences & Trends

Back to main topics