eCommerce: Alibaba Partnerships

Alibaba Boosts Partnership with GoTo in Indonesia

Alibaba continues to expand its reach: The retail giant is now strengthening its ties with GoTo. But Alibaba isn't the only retail giant investing in the region.

Article by Cihan Uzunoglu | September 19, 2024Download

Coming soon

Share

Alibaba and GoTo Partnership: Key Insights

Rising Competition: GoTo's digital infrastructure will be enhanced by Alibaba’s partnership, while Shopee, with 27% of its US$70 billion GMV from Indonesia in 2023, faces growing competition from TikTok and YouTube.

Strategic Investments in Indonesia: Indonesia is a key focus for Chinese and Western tech giants, with TikTok acquiring 75.01% of Tokopedia and Alibaba partnering with GoTo, while Google and Meta invest in emerging markets.

Chinese tech giant Alibaba has deepened its ties with Indonesia's GoTo Group, committing to the use of Alibaba Cloud services and holding its GoTo shares for at least five years. This partnership will provide GoTo with advanced cloud technologies, including database, security, and AI-powered analytics, to enhance its digital infrastructure.

GoTo stands to benefit from Alibaba’s technological expertise as it pushes for innovation in Indonesia’s expanding digital economy.

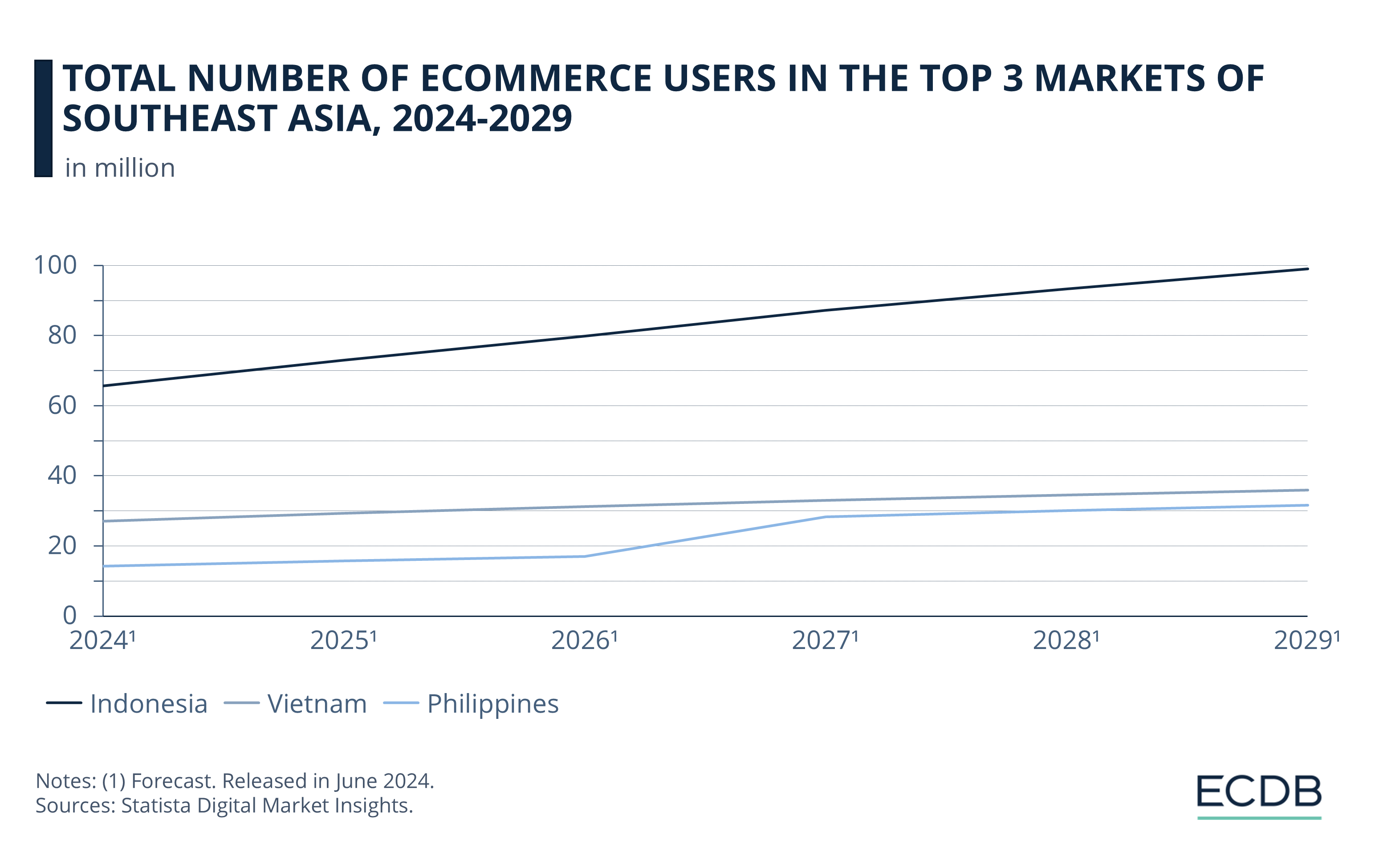

Indonesia as a Promising eCommerce Market

Chinese investment has been flowing into Indonesia for some time. For instance, in January 2024, TikTok, owned by China's ByteDance, completed its acquisition of a 75.01% stake in Tokopedia for US$840 million. This deal allowed TikTok to integrate its eCommerce business into Tokopedia, following Indonesia’s ban on social media-based online shopping.

These developments position Indonesia as a focal point for Chinese tech companies, as both TikTok and Alibaba extend their influence in the region's digital space.

High Competition in the Region

Shopee has also played a pivotal role in shaping Southeast Asia’s eCommerce market. The largest market of the company, Indonesia contributed nearly 27% of Shopee's US$70 billion gross merchandise volume (GMV) in 2023.

The recent YouTube-Shopee partnership, launched to capitalize on the region's growing online shopping sector, further intensifies competition with TikTok. The Chinese company's eCommerce effort, TikTok shop, generated $16.3 billion in GMV in the same year.

Money Flow from the West

These developments mirror similar moves by Western tech companies investing in emerging markets. For instance, Google’s US$4.5 billion investment in India’s Jio Platforms and Meta’s eCommerce venture via WhatsApp show the growing global focus on rapidly expanding markets like Indonesia.

More Insights? We keep our rankings up to date with the latest data, offering you valuable information to improve your business. Want to know which stores and companies are leading the way in eCommerce? Which categories are achieving the highest sales? Check out our rankings for companies, stores, and marketplaces. Stay one step ahead with ECDB.

Despite challenges, Alibaba and GoTo are betting on Indonesia’s digital future to reverse recent financial struggles and drive sustained growth in the region.

Sources: Reuters, The Register, Statista, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

European Retailers Return to Physical Stores to Compete with Online Giants

European Retailers Return to Physical Stores to Compete with Online Giants

Deep Dive

YouTube Partners With Flipkart and Myntra to Launch YouTube Shopping in India

YouTube Partners With Flipkart and Myntra to Launch YouTube Shopping in India

Deep Dive

Inflation's Impact on eCommerce

Inflation's Impact on eCommerce

Deep Dive

Older Consumers Drive Growth in the Chinese eCommerce Market

Older Consumers Drive Growth in the Chinese eCommerce Market

Deep Dive

Online Shopping in China: Where Chinese Consumers Shop Online

Online Shopping in China: Where Chinese Consumers Shop Online

Back to main topics