eCommerce: Fashion Ranking

Top 5 eCommerce Marketplaces in Global Fashion: Chinese Platforms Dominate

Global fashion eCommerce is thriving, as new players enter the market and revenues grow. Marketplaces are particularly successful, generating billions of dollars in transactions on key platforms. But which are the marketplaces on top of the game? Find out in our newest ranking.

Article by Nadine Koutsou-Wehling | June 05, 2024Download

Coming soon

Share

Top 5 Online Marketplaces in Global Fashion: Key Insights

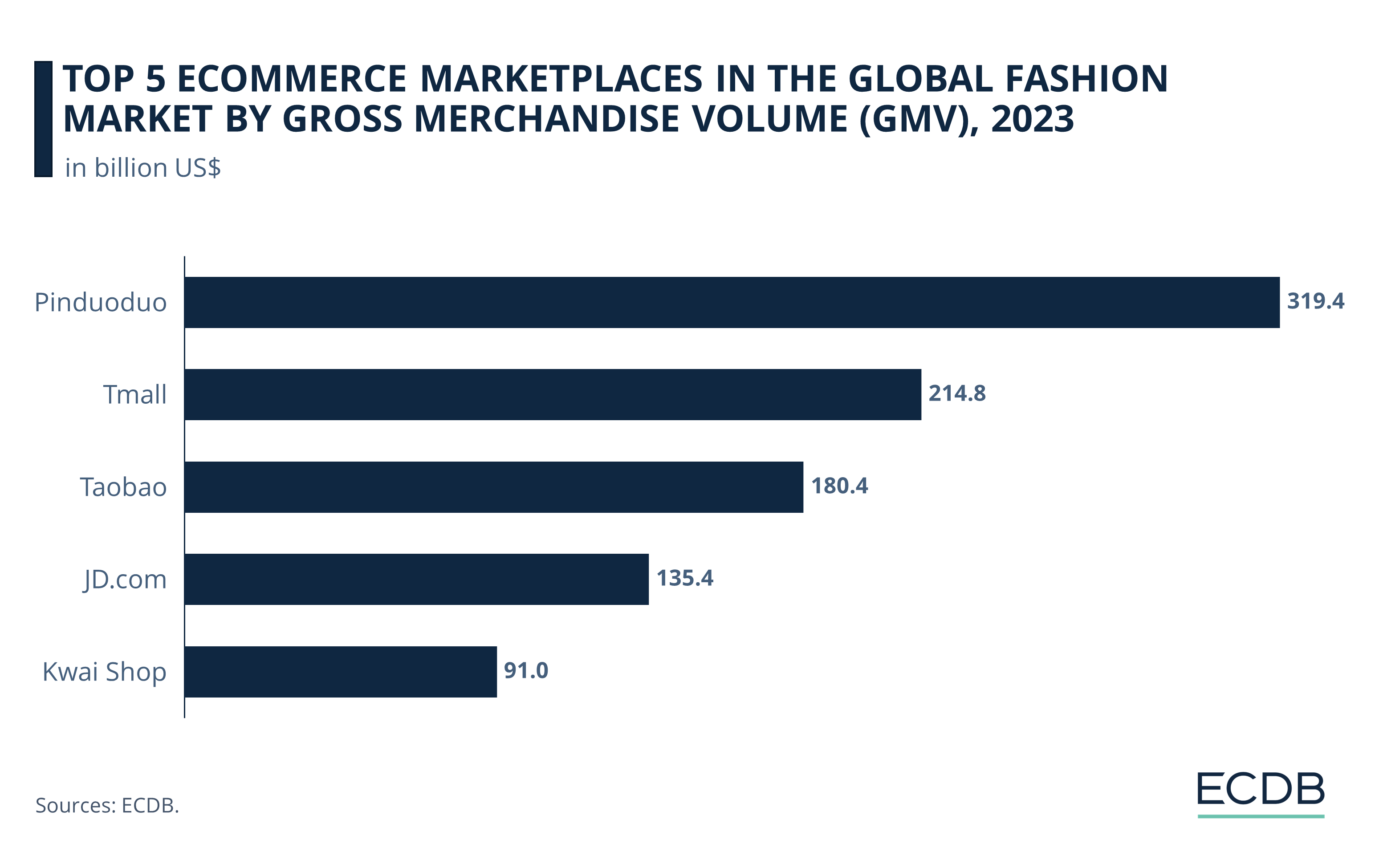

Pinduoduo Leads the Way: With a GMV of US$319.4 billion in 2023, Pinduoduo's eCommerce marketplaces hosted the highest value of fashion sales. Following are Tmall (US$215 bn), Taobao (US$180 bn), JD (US$135 bn), and Kwai Shop (US$91 bn).

Success Factors: Pinduoduo built its competitive advantage in the market from the very start and fosters audience loyalty through engaging platform features, Tmall and JD serve as a gateway for international brands into the Chinese market, while Taobao and Kwai offer low-cost and easily accessible products to customers.

Global Market Dynamics: Since 2021, the top 5 online marketplace ranking in global fashion contains exclusively Chinese players. The vast size of the Chinese market surely contributes to this fact.

Fashion is the largest product category in global eCommerce. It is particularly suited to online shopping, because consumers can find a wide variety of styles and sizes online from a multitude of retailers. Technological innovations enable virtual try-ons and personal assistants to help online shoppers find the right fit and style for any occasion.

Here at ECDB, the Fashion category comprises the subcategories Apparel, Footwear, and Bags & Accessories. Fashion eCommerce revenues are projected to reach US$1.4 trillion by 2024, and market growth is expected to continue steadily. By 2028, our ECDB forecast predicts fashion eCommerce revenues of around US$2 trillion.

Here are the eCommerce marketplaces that capture the largest market shares in global fashion. Learn about their strategies for success and which other marketplaces did not make the top 5 list.

What Is a Marketplace? How Does It Apply to Fashion eCommerce?

In an eCommerce marketplace, multiple sellers offer their products to consumers. The platform provider operates the digital infrastructure and often provides additional services to connect sellers and buyers with each other.

Operators typically earn money by charging a commission on each transaction and/or a platform usage fee. Popular platforms like Amazon and Walmart function as hybrids, selling both third-party and first-party products. There they act as a marketplace provider and retailer at the same time.

Fashion marketplaces can feature established brands selling on extra channels, wholesale retailers distributing third-party products, or private individuals reselling used items or cheaper items for redistribution.

The Top 5 Marketplaces in Global Fashion eCommerce

Which eCommerce marketplaces are leading the way in selling fashion on a global scale? Measured by GMV (gross merchandise volume), a metric that calculates the value of products sold through a given platform, all of the top 5 online marketplaces are based in China:

Pinduoduo ranks first among online marketplaces selling fashion. The Chinese platform with a generalist category focus saw transactions worth US$319.4 billion for fashion products alone in 2023. This figure is equivalent to the GDP of a medium-sized European economy such as the Czech Republic or Finland.

Two Alibaba-owned marketplaces are ranked second and third: Tmall is second, with a GMV of US$214.8 billion for fashion products in 2023. Taobao follows, with US$180.4 billion.

JD.com ranks fourth, with a US$135.4 billion GMV in online fashion.

Fifth place is Kwai Shop. Kwai generated a GMV of US$91 billion with fashion products in 2023.

See the success factors for each marketplace in the global fashion top 5.

1. Pinduoduo

Pinduoduo ranks first as the eCommerce marketplace with the highest fashion GMV in 2023.

The platform was founded in 2015 in a competitive environment dominated by China’s two largest eCommerce companies, Alibaba and JD. Pinduoduo entered this market by carving out its own niche, more specifically by selling perishable goods like fruits and vegetables and incorporating social commerce elements into its platform. Unlike Alibaba and JD, which had a different product category focus, Pinduoduo created a need for customers to rely on its marketplace early on, because of several reasons:

The novelty of an eCommerce marketplace for perishable goods.

The high-frequency nature of vegetables and fruits, which encourages repeat purchases.

Team purchases that enable discounts for groups of buyers: This increases Pinduoduo’s visibility on the one hand and leverages the power of social recommendation for consumers on the other.

Games and challenges with various intent. These include features like daily check-in, where users receive redeemable credit for visiting the site each day, price chop, where consumers collect discounts by sharing links to their social network, mini games that are mostly tied to purchases on the platform, and more.

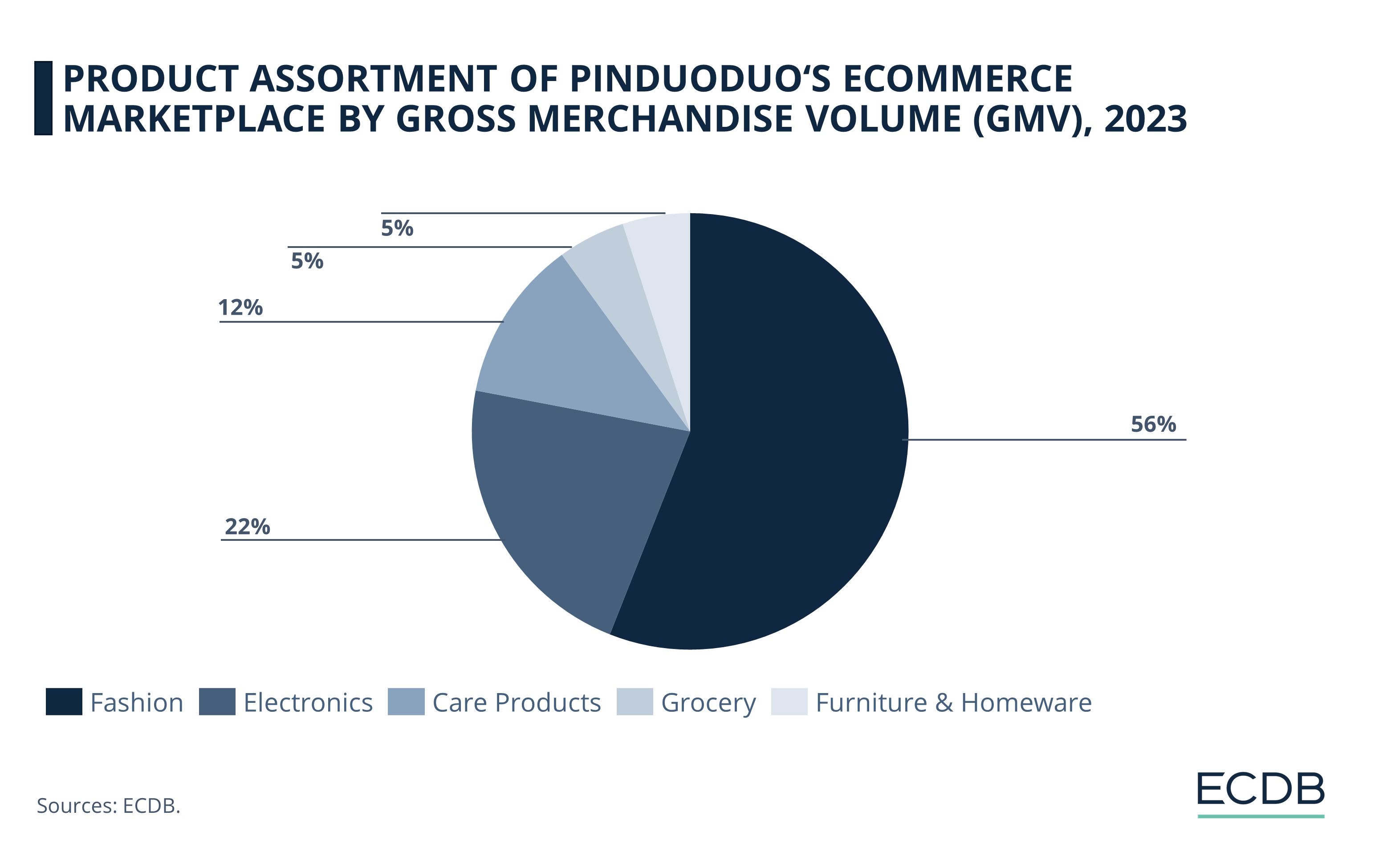

Meanwhile, Pinduoduo’s focus has expanded far beyond food and beverages, which now account for only a small share of the marketplace’s GMV.

In 2023, fashion was the product category with the highest share of GMV generated on Pinduoduo’s marketplace. 56% of GMV is accounted for by fashion.

In second place is electronics, with 22% of GMV.

Care products accounted for 12% of GMV in 2023.

Grocery comes last, along with furniture & homeware at 5%.

Like this insight? It is based on our regularly updated rankings. With our retailer and country rankings, you can learn valuable information about your specific market. Our product category rankings and benchmarks allow you to see where various businesses are currently evolving. This information can aid in your decision-making, whether you are a business developer, shop owner, or CEO of a large eCommerce brand. Stay a step ahead of the market with ECDB.

Following the first place at a GMV difference of a little over US$100 billion is Tmall:

2. Tmall

Alibaba’s Tmall had a GMV for fashion products of US$214.8 billion in 2023, ranking second globally. Tmall is the B2C platform for established brands to sell their goods to consumers. For years, Tmall has been the platform of choice for fashion retailers.

The plethora of brands offering their products on the site include both domestic and international providers. Tmall’s international division has been consciously fostered by Alibaba, and its global reputation shifted from dubious to absolutely vital for brands looking to reach a wider audience in China.

The number of international brands selling on Tmall also increasingly includes luxury companies like Bulgari, Tifanny & Co. and Chaumet, among many others.

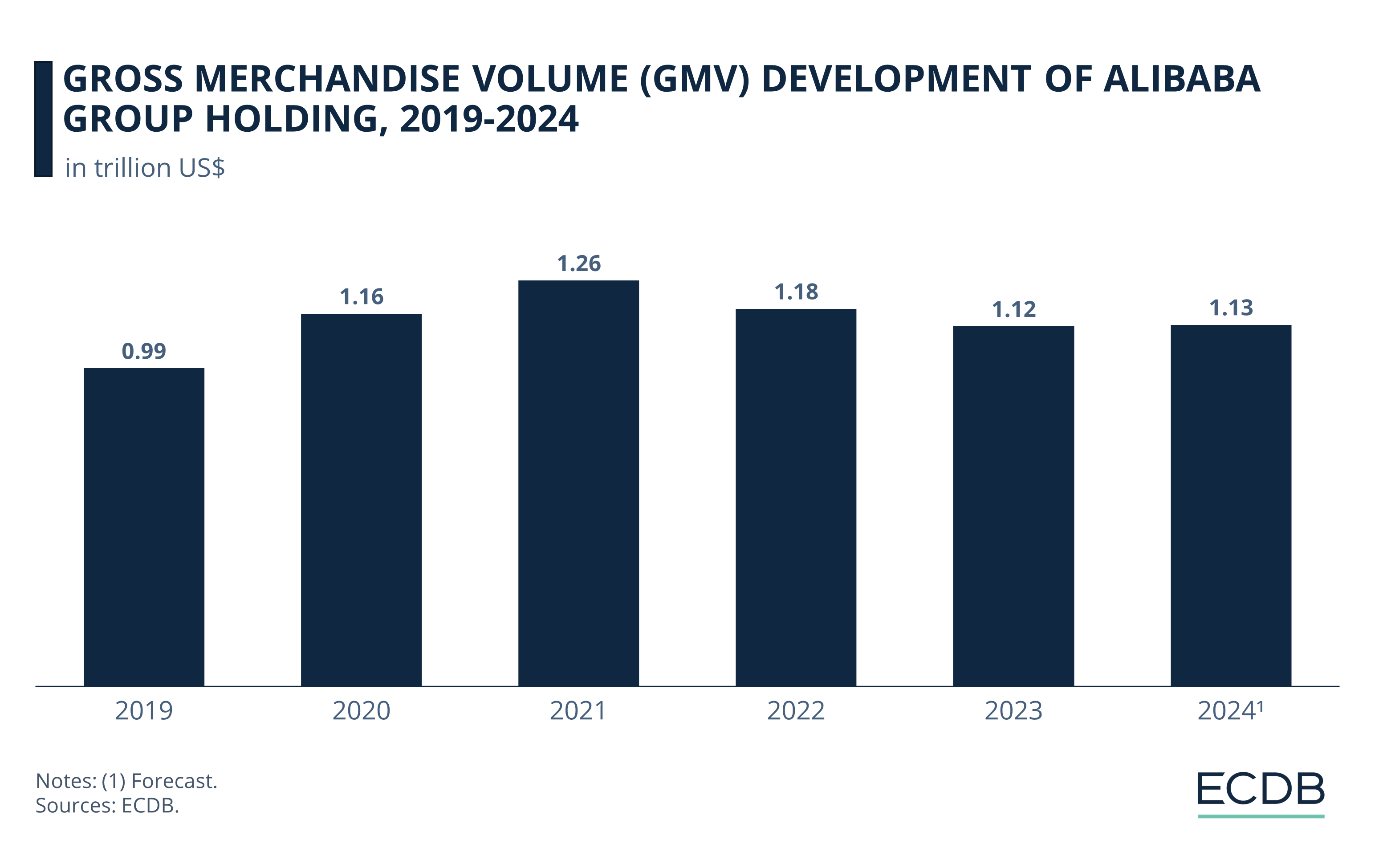

In 2023, GMV on tmall.com accounted for 46.2% of Alibaba’s total GMV in 2023. This does not include Tmall’s Hong Kong domain, which increases Tmall’s total share to 47%.

Taobao, Alibaba’s C2C marketplace, made up 48.3% of the total US$1.12 trillion in GMV generated by all domains of the Alibaba Group Holding in 2023. The other domains are AliExpress and Trendyol.

3. Taobao

Taobao is the original online marketplace launched by Alibaba, which was split into Taobao (C2C) and Tmall (B2C) in 2011. Taobao ranks third in global fashion eCommerce with a GMV of US$180.4 billion in 2023.

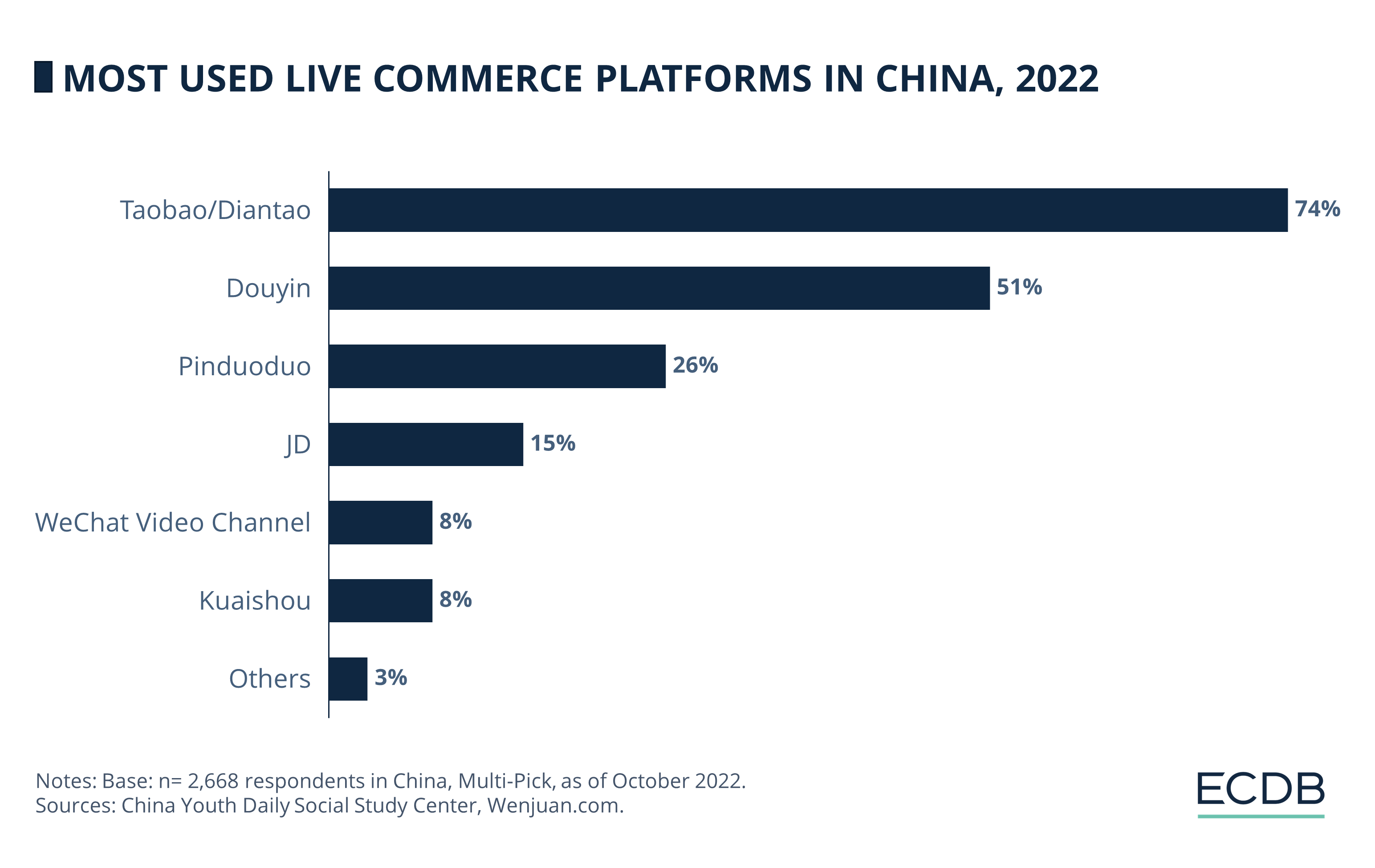

Taobao is not only known for its competitive prices and vast product assortment, but is also widely known for its popular live shopping features. Leveraging the influence of so-called KOLs (key opinion leaders), Taobao/Diantao is by far the most used live shopping app for Chinese consumers:

Pinduoduo is less relevant, at 26%, while JD follows with 15%.

4. JD.com

JD is Alibaba’s closest rival. Both launched their first major eCommerce marketplaces around the same time, JD in 2004 and Alibaba’s Taobao in 2003, both have a generalist product category assortment, and similar relevance in Chinese eCommerce.

More precisely, JD.com’s GMV for fashion products was US$135.4 billion in 2023. JD thereby ranks fourth in the global fashion market. While this is lower than what Tmall and Taobao generated, fashion is less of a focus for JD.com, making up 27% of its total GMV (compared to 41% at Tmall and 35% at Taobao).

5. Kwai Shop

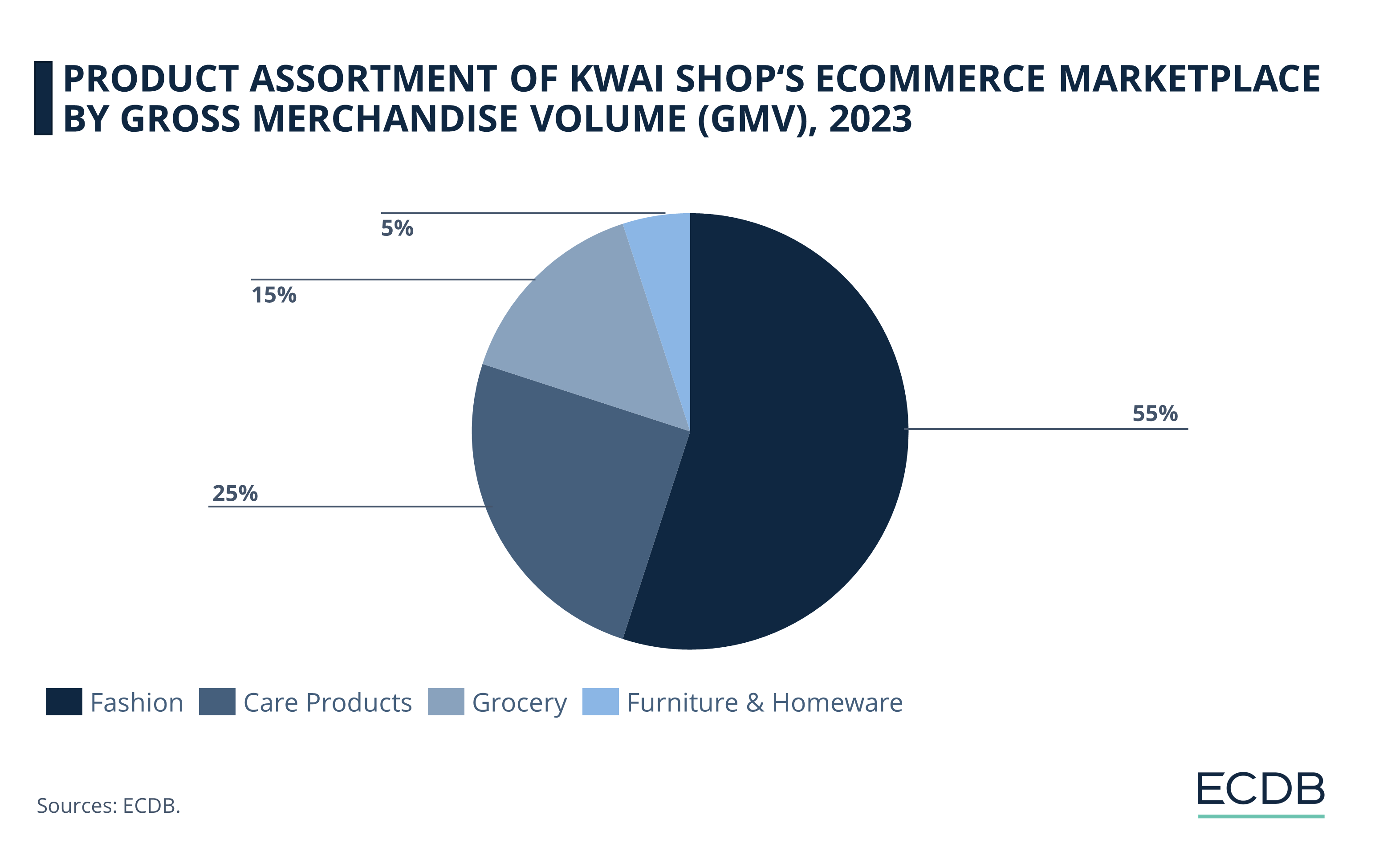

Kwai Shop, also known as Kuaishou, is primarily a short video platform considered a rival to Bytedance’s Douyin. But to improve its value creation, Kuaishou has not only its livestreaming and short video branch, but a steadily growing eCommerce marketplace on top of that. Fashion is the category accounting for the largest share of Kwai’s GMV:

Kwai Shop’s primary focus is fashion and beauty, which together make up 67% of GMV. 12% of care products include personal care, the remainder of 13% belongs to health care and household care.

15% of Kwai Shop’s GMV is generated by grocery.

The remaining 5% is furniture & homeware.

Kuaishou’s GMV for fashion products of US$91 billion places it fifth in global fashion.

Chinese Platforms Reign Supreme: Past to Present Development

Extending the present ranking to include the top 10 eCommerce marketplaces in global fashion and their development since 2020, it becomes apparent that Kwai Shop took Amazon’s spot in 2021:

The first three spots saw shifts between Pinduoduo, Tmall and Taobao. Pinduoduo emerged as first from third rank in 2022, while Tmall fell to number 2 and Taobao dropped from second to third spot.

Amazon has since 2021 remained just outside the top 5 in 6th place.

Walmart alternated between spots 7 and 8.

VIP.com placed ninth consistently since 2020.

Coupang made the widest leap, rising from 17th in 2020 to 10th in 2023.

Top 5 Fashion Marketplaces: Wrap-Up

The top 5 fashion marketplaces are all Chinese companies with a generalist focus. Their success is further underlined by the international expansion of these players: Pinduoduo’s sister company Temu, Alibaba’s AliExpress, Trendyol and Miravia, and other ventures.

Coupang’s quick ascend in recent years leads to the assumption that it may take over one of the upper spots in the not too distant future. But because the incumbents have a loyal customer base in the extensive Chinese market, it will be a very difficult feat posing any kind of competition to their dominance.

Sources: Alizila: 1 2 – Excitingcommerce – QZ – Ycommerce

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

eCommerce Payments in China: Alipay, WeChat & Top Payment Methods

eCommerce Payments in China: Alipay, WeChat & Top Payment Methods

Deep Dive

Top eCommerce Companies by Market Cap 2024

Top eCommerce Companies by Market Cap 2024

Deep Dive

Tinaba Partners with Alipay+ to Launch European Super App

Tinaba Partners with Alipay+ to Launch European Super App

Deep Dive

Alibaba Leverages AI and Promotions to Boost Singles' Day Sales

Alibaba Leverages AI and Promotions to Boost Singles' Day Sales

Deep Dive

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Alibaba Competitors: Which Companies Are Alibaba’s Biggest eCommerce Rivals?

Back to main topics