DIY & Home Improvement

Top Online Do-it-Yourself (DIY) Home Improvement Retailing Market in the UK

Do you love upgrading your home with your own two hands? Then you have come to the right place. Explore the digital world of do-it-yourself home improvement in the United Kingdom.

Article by Antonia Tönnies | July 30, 2024Download

Coming soon

Share

Top Online Do-it-Yourself (DIY) Home Improvement Retailing Market in the UK: Key Insights

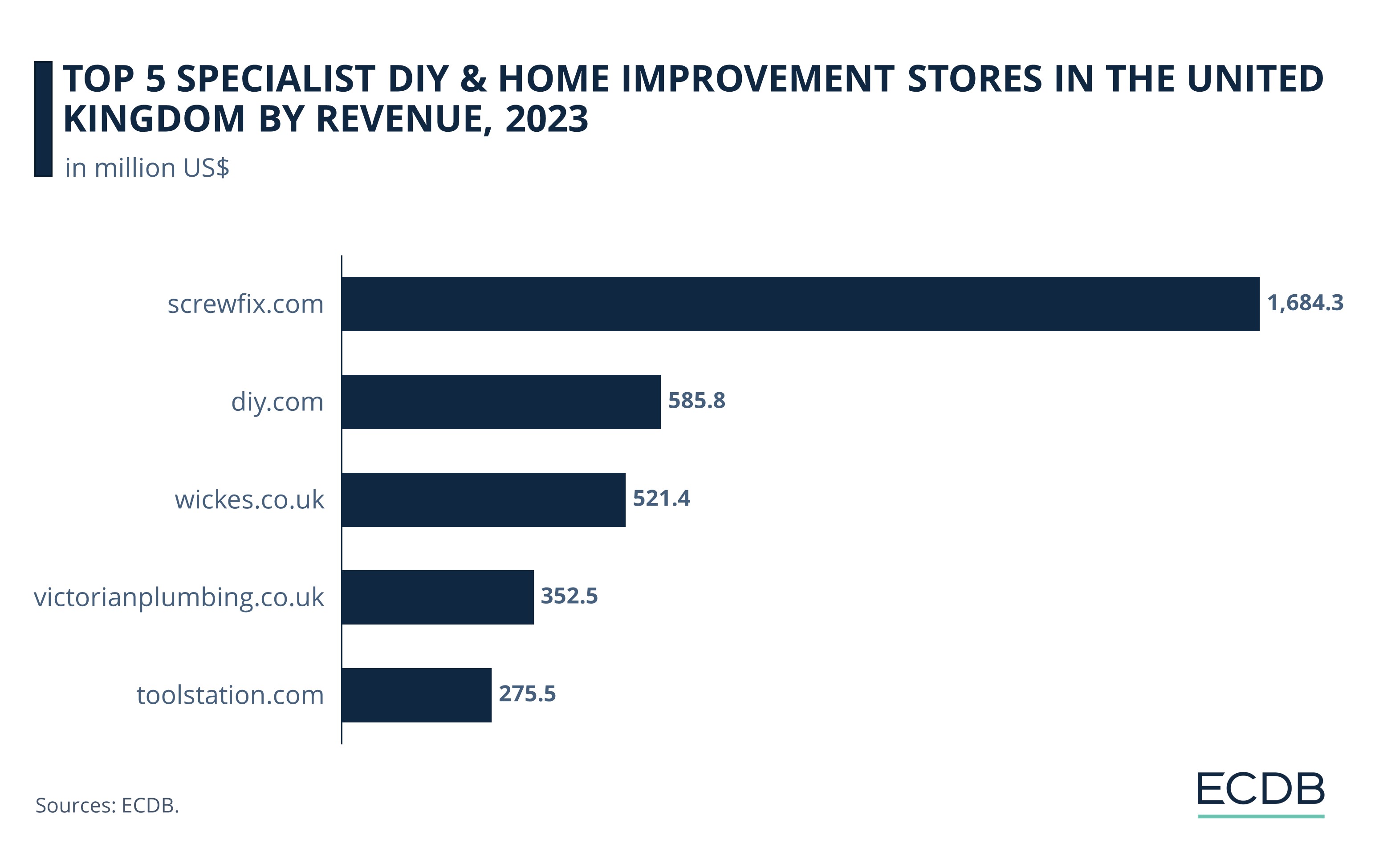

Leading Online Retailer: Screwfix.com is the leading online DIY store in the UK, achieving nearly US$1.7 billion in net sales in 2023.

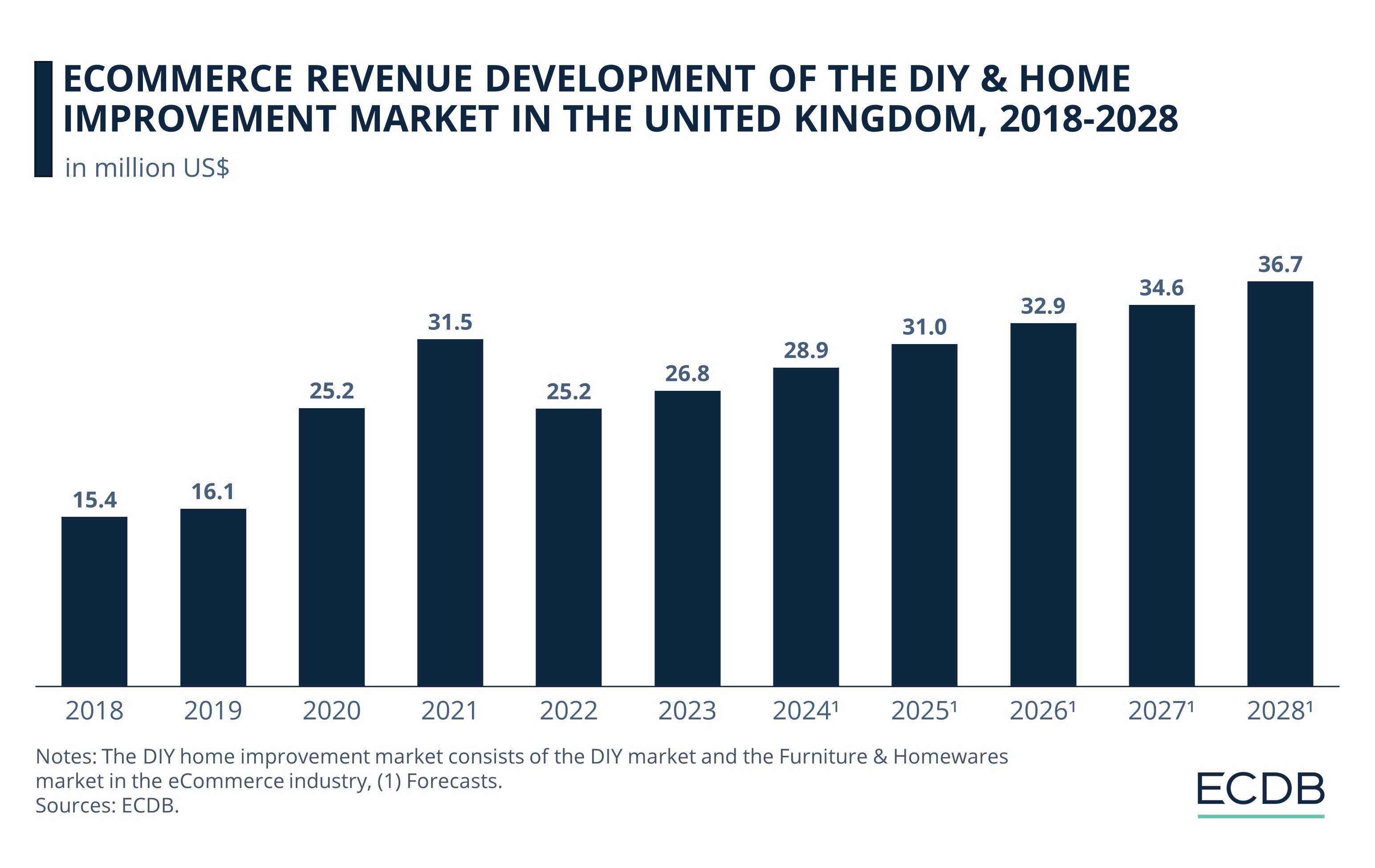

Revenue Trends in the UK: The DIY and Furniture & Homeware markets experienced a substantial growth surge during the COVID-19 pandemic. The sector peaked in 2021 but faced a decline in 2022 before stabilizing and recovering slightly in 2023.

Future Projections: The UK’s online DIY and Furniture & Homeware markets are projected to continue expanding with a compound annual growth rate (CAGR) of 6%. It has the potential to reach US$36.7 million in revenue by 2028.

Imagine transforming your living room into a world of coziness or giving your home office the perfect makeover for productivity – where would you look for inspiration and supplies? Online shopping sites for home and DIY improvements such as wickes.co.uk and screwfix.com are making many home improvement enthusiasts' hearts beat faster in the UK.

Where do these DIY enthusiasts prefer to shop? Who are the key players in this market? How is it influencing the online do-it-yourself home improvement market? We bring you the answers to all your aesthetically pleasing home needs.

What Is the Online DIY Home Improvement Retailing Market?

An important part of the DIY and Home Improvement industry takes place online. In this case, we are talking about two eCommerce sectors, the DIY market and the Furniture & Homeware market, which make up the DIY & Homeware Improvement section.

What is the online Do-it-Yourself (DIY) Market?

The DIY or Do-it-Yourself market is one of the most important categories in eCommerce, along with Care Products, Electronics, Fashion, Furniture & Homeware, Grocery, and Hobby & Leisure. The category encompasses, according to ECDB, an extensive selection of products for garden (e.g. plants, fertilizers, shovels, lawn mowers), vehicle parts (e.g. car tires, car parts, motorcycle parts), and tools & construction supplies (e.g. hammers, screwdrivers, nails, faucets, lumber, paints, laminate). Excluded from the DIY market are stationary, crafts & art supplies, gardening services, vehicle repair services, and construction services.

What Is the Online Furniture & Homeware Market?

Next to the DIY market is the equally important category for Furniture & Homeware. This section comprises digital sales of furniture (e.g. tables, chairs, beds, cabinets) and homeware (e.g. lamps, tableware, carpets, blinds, decorations) for the private end user (B2C). Not covered are unmovable objects (e.g. sinks, bathtubs, faucets), interior finishes (e.g. floorings, paints, wallpapers) or household appliances.

eCommerce Revenue Development in the UK Do-it-Yourself (DIY) Home Improvement Retailing Market

Like many other markets, DIY, along with Furniture & Homewares, benefited from the eCommerce boom during the COVID-19 pandemic. Let's take a closer look at the latest developments in this eCommerce sector and how it has performed and may perform in the future:

2018 to 2019: This year has been marked by Brexit negotiations, but it hasn't yet impacted UK eCommerce, with a 4.9% increase between 2018 (US$15.4 million) and 2019 (US$16.1 million).

2020 to 2021: The pandemic now reaches the United Kingdom, and while everyone has to stay home, the online shopping boom begins. In 2020, sales rise to US$25.2 million and peak at US$31.5 million in 2021, for a total increase of 95.2% from 2019 to 2021.

2022 to 2023: The post-corona period begins, and with it, online revenue shrinks to US$25.4 million in 2022, a 20% loss compared to 2021. Nevertheless, the DIY and Furniture & Homeware market recovers quickly, with revenues growing by 6.5% in 2023 to reach US$26.8 million.

2024 to 2028: According to our forecast, the market is entering a new phase of expansion with a compound annual growth rate (CAGR) of 6%. By 2028, the market could reach a revenue of US$36.7 million.

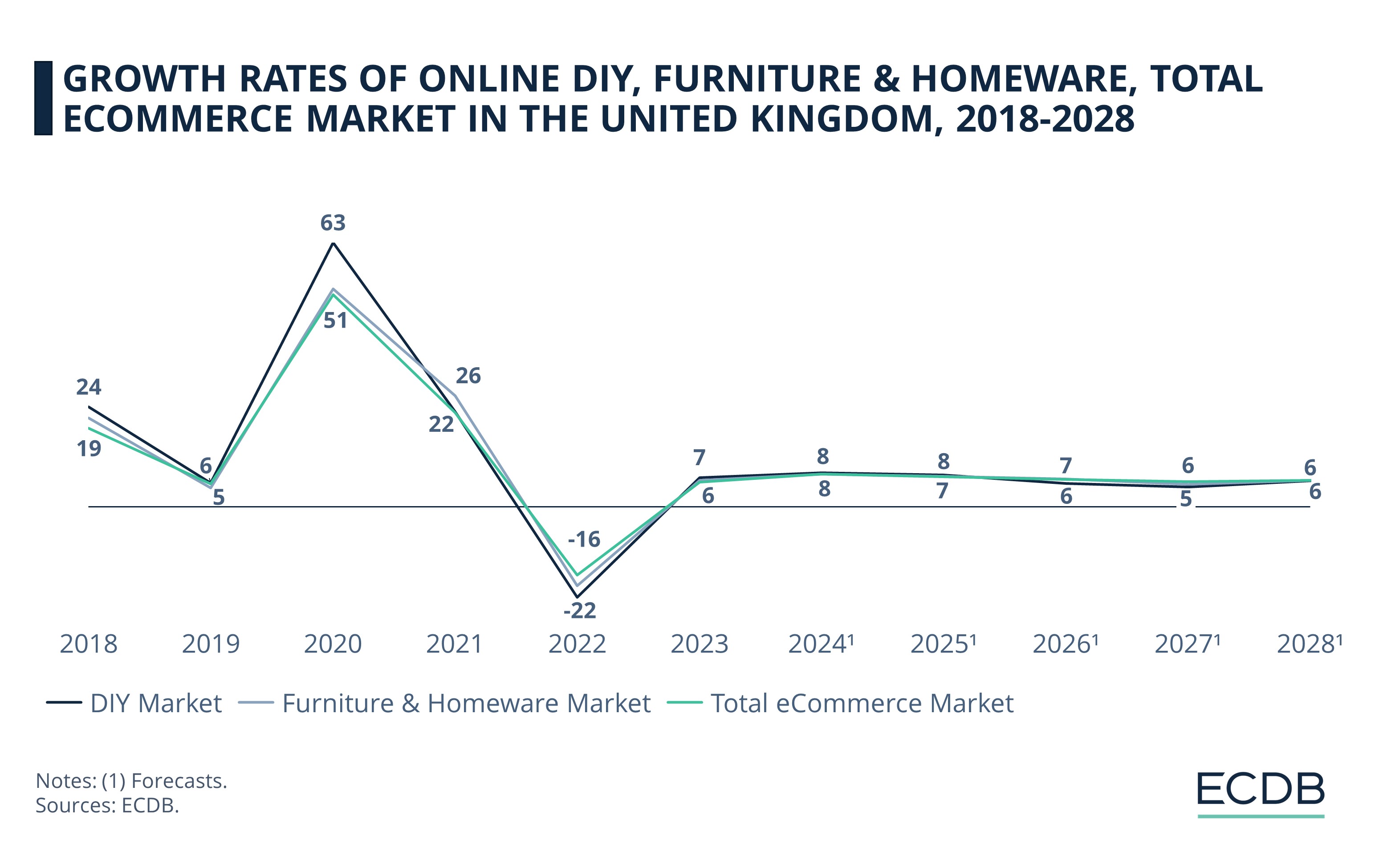

DIY vs. Furniture & Homeware vs. Total eCommerce Market in the United Kingdom

The DIY and Furniture & Homeware markets show a similar trend, as well as UK eCommerce in general. Some sectors have had stronger or weaker ups and downs in recent years, but the similarities are still more pronounced here. Of course, this is because the markets are all based in the UK and are partly interconnected.

Just before the pandemic, all three industries experienced a decline in their annual growth rate between 4.5% and 5.6%, before surging by at least 50% in 2020, with the DIY market even hitting 62%. The eCommerce boom lasts until the three UK markets reach their low point in 2022 at 16.3% to 21.6%.

At present, the online DIY, Furniture & Homeware and overall, UK eCommerce markets appear to be stabilizing at a year-on-year growth rate of between 5% and 8%, with small fluctuations.

Who Is the Leading Online Do-it-Yourself (DIY) Home Improvement Store in the UK?

The DIY market represents 7.4% of the total UK eCommerce industry, while the Furniture & Homeware eCommerce market represents 9.6%. Who are the main drivers of the market? Who are the top 5 specialist DIY & home improvement stores in the United Kingdom?

1. Screwfix.com

At the top of this ranking is screwfix.com, which is operated by Screwfix Direct, Ltd. the online store is fully focused on the UK eCommerce market with products mainly in the DIY category (95%), but also in the fashion category (5%). With an eCommerce net sales of nearly US$1.7 billion in 2023, the online store secures the number one position in the long term.

Screwfix.com is definitely one of the winners of the pandemic. While the online shop generated net sales of US$770 million in 2019, the business soared to almost US$2 billion in 2020 - representing a year-on-year growth of 158%. By 2022, the upward trend was over, and the growth trajectory shrank by 20%. Despite this decline, revenues remain high, especially compared to its competitors.

2. Diy.com

It takes a while to get to second spot in this ranking, with diy.com as Screwfix's closest competitor. The online store generated sales of US$585.8 million last year, a third of the DIY leader Screwfix. Diy.com has a national focus operated by B&Q, Ltd. and generates 65% of its eCommerce net sales in the DIY category.

After peaking at US$614.2 million in 2021, thanks in part to COVID-19, the growth rate shrank by 20% in 2022. But the online store quickly regained its footing, increasing its net sales by 19.3% in 2023. Additionally, by 2025, diy.com is expected to reach US$674.8 million, surpassing its Corona peak.

3. Wickes.co.uk

In third place is wickes.co.uk, operated by Wickes Building Supplies, Ltd., leaving little room for number two. Like the stores above, the online store is 100% focused on eCommerce in the UK, particularly in the DIY sector (75.3%).

After peaking in 2021 with eCommerce net sales of US$694.9 million, growth has declined each year. Nonetheless, if we compare the pre-pandemic figures in 2019 with net sales of US$311.8 million to the current value of US$521.4 million, it is a positive development that brought the store among the top 5.

4. Victorianplumbing.co.uk

Victorianplumbing.co.uk ranks fourth, with eCommerce net sales of US$352.5 million in 2023. The online store is operated by Victorian Plumbing, Ltd. and both are fully focused on the United Kingdom, particularly the DIY (83%) and furniture and homeware (17%) sectors.

The online store has a history with some ups and downs. The most recent rise and fall was during the pandemic, when revenue soared from US$192.4 million in 2019 to a peak of US$368.5 million in 2021. In 2022, the annual rate dropped by 10.4%, but the online store caught itself.

5. Toolstation.com

The last eCommerce shop among the top 5 DIY & Home Improvement specialists in the United Kingdom is toolstation.com. Operated by Toolstation, Ltd., it generated net sales of US$275.5 million in 2023. All four leading online stores are heavily focused on the DIY market, while this player among the top 5 is more of an exception, focusing to 41.9% on the UK Furniture & Homeware sector.

However, toolstation.com is following a YoY growth trend that most online stores have experienced in the past: After peaking in 2021 with sales of US$314.9 million, revenue shrank by 6% each in 2022 and 2023. For 2024, Toolstation is projected to grow again a bit, bringing it out of the declining cycle.

Top Online DIY & Home Improvement Stores in the UK: Closing Thoughts

In the past, the United States market for DIY & Home Improvements fluctuated. If the trend for the coming annual sales remains as predicted, the market growth rate will stabilize.

One reason for this may be that the majority of potential customers are already online shoppers, making it more difficult to attract new customers. On the other hand, many consumers prefer to shop offline, directly in stores, which may explain why online sales declined immediately after the pandemic. DIY & Home Improvement is all about touching the material, personalized advice and guidance from in-store staff.

Online stores now need to focus more on staying competitive to avoid losing customers to their rivals. This can be achieved, for example, by using loyalty programs and personalized offers. But also by jumping into the field of social commerce, solutions can be found. Here, online inspiration can be combined with a direct click to the products.

Sources: ECDB, secondary sources in the referenced articles.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

Largest Product Categories in German eCommerce: Fashion Tops the List

Largest Product Categories in German eCommerce: Fashion Tops the List

Deep Dive

Reverse Logistics: Market Development, Top Returned Product Categories, eCommerce Returns

Reverse Logistics: Market Development, Top Returned Product Categories, eCommerce Returns

Deep Dive

Top Online Garden Stores in Germany

Top Online Garden Stores in Germany

Deep Dive

Top Online DIY & Home Improvement Stores in the United States

Top Online DIY & Home Improvement Stores in the United States

Deep Dive

What Are the Fastest Growing Product Categories in UK’s Online Market?

What Are the Fastest Growing Product Categories in UK’s Online Market?

Back to main topics