eCommerce: Most Valuable Companies

Most Valuable European eCommerce Companies 2024: Market Cap, Revenue & Growth

Check out the leading eCommerce businesses in Europe based on their market value. We examine the top players, what drives their success, and how their market worth measures up to their sales figures.

Article by Cihan Uzunoglu | February 06, 2024Download

Coming soon

Share

Most Valuable European eCommerce Companies 2024:

Key Insights

UK's Leadership: The UK stands out as Europe's leading hub for valuable eCommerce companies. With PDD Holdings Inc. at the forefront, at a market value of US$188.8 billion, it underscores the strong standing of major players within a competitive industry.

Revenue Rankings: At the helm of revenue within the top 10 most valuable European eCommerce firms, PDD Holdings Inc. leads, with Zalando SE and Allegro.eu SA trailing closely. Prosus N.V. and Next Plc round out the top five, emphasizing the sector's competitive dynamics.

Looking Ahead: PDD Holdings Inc. demonstrates remarkable growth, leading the charge in Europe's eCommerce sector. Meanwhile, companies like Zalando SE and Allegro.eu SA grapple with challenges, a testament to the intense rivalry from American and Chinese firms. In contrast, Redcare Pharmacy N.V. emerges as a beacon of growth.

Ever thought about which companies are at the forefront in Europe's online shopping scene? Could it be the wide range of items they offer, how smart their advertising is, or maybe just how big they are that makes one stand out from the rest?

Having already covered the global and the U.S. markets, we will now take a close look at the major names in Europe's online shopping world, focusing on more than just how big they are. We explore the important differences between their overall value and their sales figures.

Top 10 Most Valuable European

eCommerce Companies

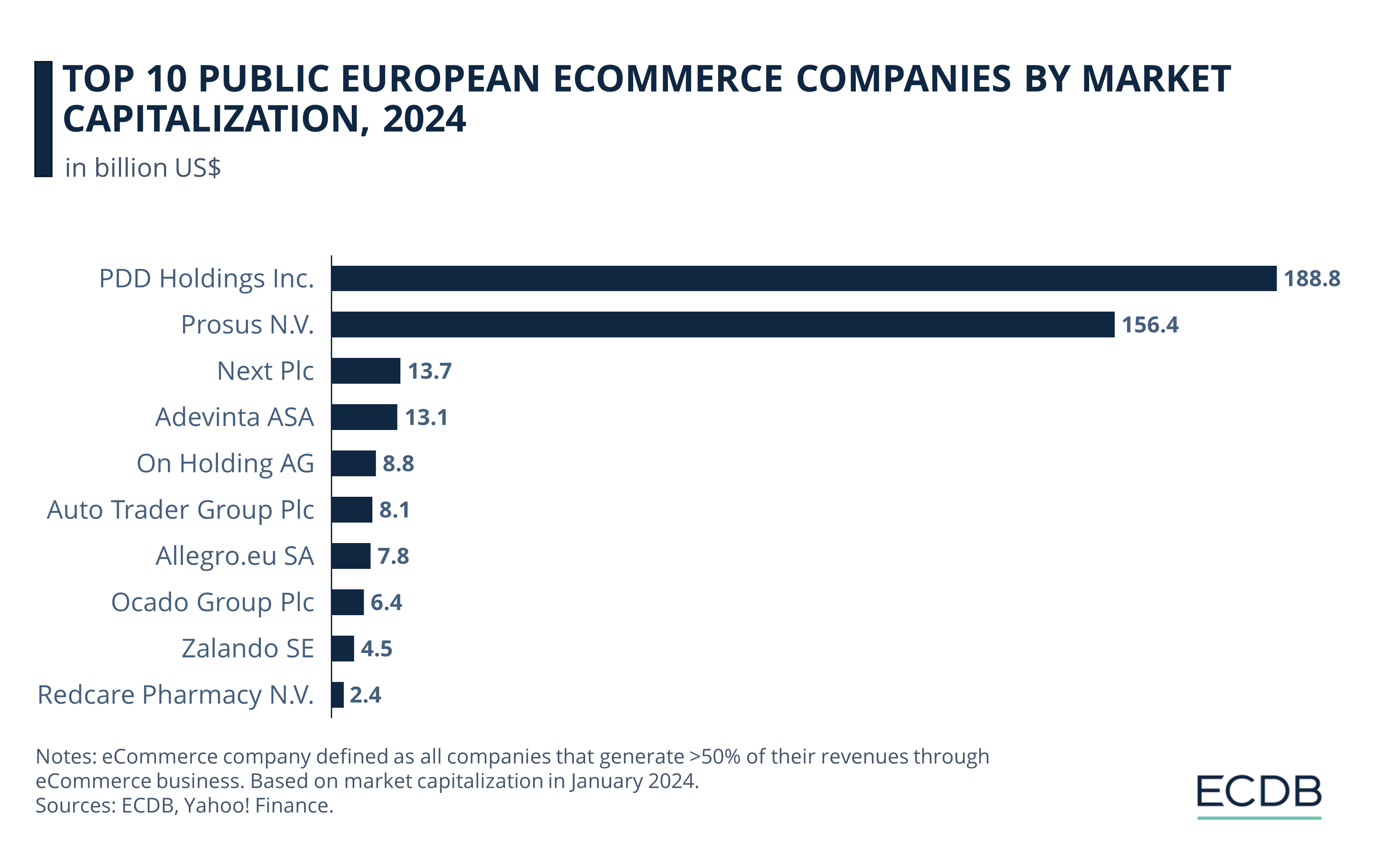

Among Europe's 10 most valuable eCommerce companies, the UK leads with three top companies calling it home. Following closely, the Netherlands hosts two of these leading firms. Meanwhile, a diverse spread of countries each house one company within this elite group: Germany, Ireland, Luxembourg, Norway, and Switzerland.

As of January 2024, PDD Holdings Inc. leads the pack in Europe with a staggering market capitalization of US$188.8 billion, setting a high standard for its competitors. Following closely is Prosus N.V., another major force in the industry, with a market capitalization of US$156.4 billion. These two companies significantly outpace others in terms of financial size, indicating their dominant positions in the market.

The remaining companies, although not matching the financial might of the top two, still show impressive figures. Next Plc and Adevinta ASA are in a close race, with market capitalizations of US$13.7 billion and US$13.1 billion respectively. They are followed by On Holding AG and Auto Trader Group Plc, with US$8.8 billion and US$8.1 billion in market capitalization. The list also includes Allegro.eu SA at US$7.8 billion, Ocado Group Plc at US$6.4 billion, Zalando SE at US$4.5 billion, and lastly, Redcare Pharmacy N.V. at US$2.4 billion.

But it's not just the total value of a company that matters. At the end of the day, total revenue is key for understanding a company's financial health.

Most Valuable European eCommerce Companies: PDD Also Leads in Revenue

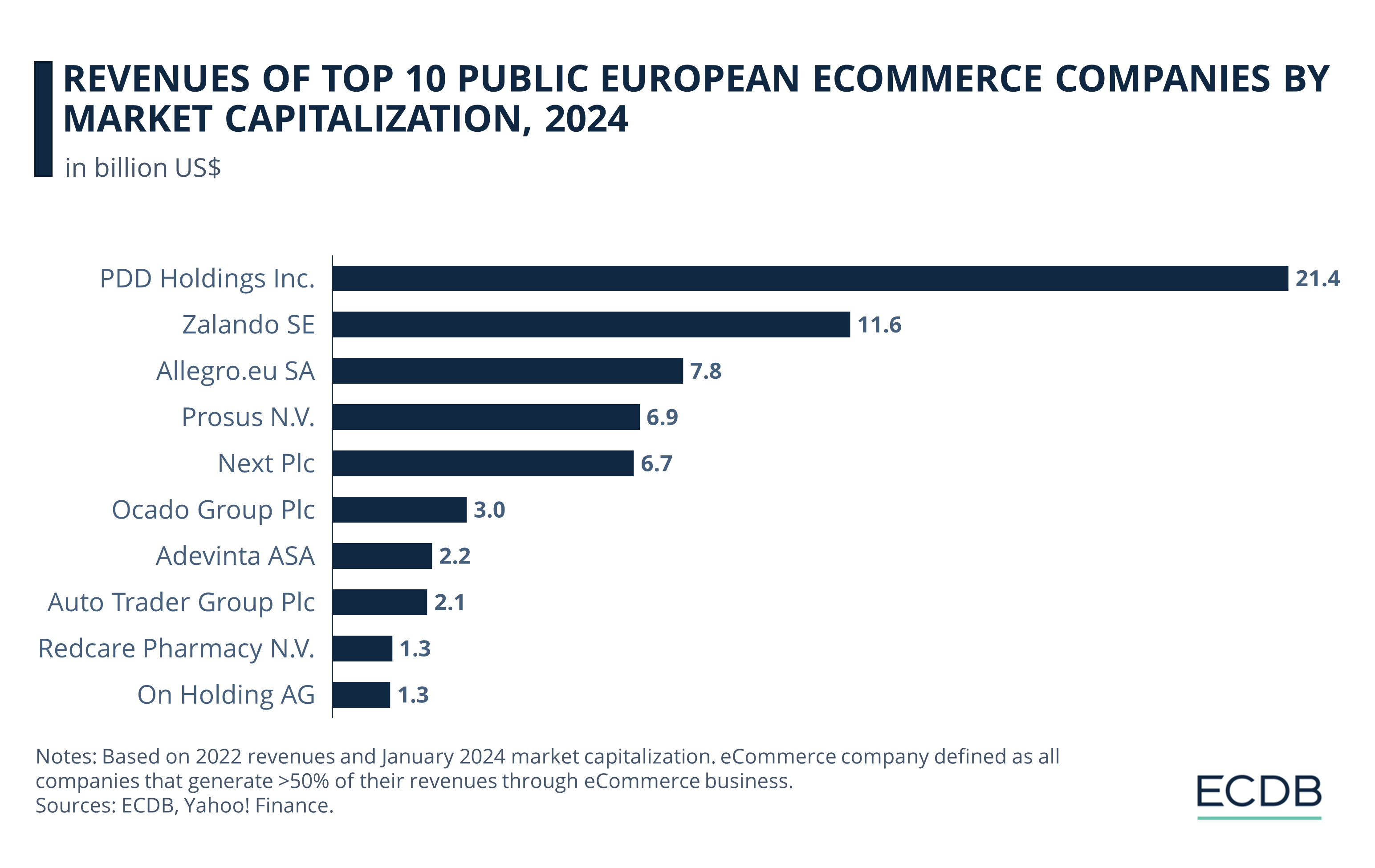

In terms of revenue, PDD Holdings Inc. still leads the top 10. It is closely followed by Zalando SE, the German retail giant. Allegro.eu SA secures the third position, demonstrating its strong position in the industry. Prosus N.V. and Next Plc also make it into the top five.

Further down the list, Ocado Group Plc, Adevinta ASA and Auto Trader Group Plc demonstrate their relevance in the eCommerce landscape, while Redcare Pharmacy N.V. and On Holding AG are ranked ninth and tenth in terms of revenue among top 10 most valuable European eCommerce companies.

After looking at how the top online shopping companies in Europe compare in sales, let's dive deeper into each of these companies. We'll give a quick overview of each one and track how their sales have changed in the last few years.

1. PDD Holdings Inc.

PDD Holdings Inc. is a multinational commerce group that has made a significant mark in the eCommerce industry. Established in 2015 and headquartered in Dublin, Ireland, the company operates Pinduoduo, an extensive eCommerce platform offering a diverse range of products including agricultural produce, apparel, electronics, and household goods. Additionally, PDD Holdings runs Temu, an online marketplace, further expanding its reach in the digital commerce sector.

PDD Holdings Inc. experienced consistent growth in revenue over the last four years. In 2019, the company's revenue was US$4.36 billion. The following year, 2020, saw a notable rise to US$8.62 billion, almost doubling from the previous year. This upward trend continued in 2021, with revenues jumping to US$14.57 billion, marking a 68% increase from 2020. The growth persisted into 2022, with PDD Holdings Inc. reaching a revenue of US$21.38 billion, a further 46% increase from 2021.

2. Prosus N.V.

Prosus N.V. is a global investment group, primarily known for its vast array of internet platform investments. The company's involvement in the tech sector spans since the 1990s, encompassing a diverse portfolio that includes stakes in notable companies like Tencent. Prosus has a strong focus on various segments such as social media, classifieds, fintech, food delivery, edtech, and notably, eCommerce. Their eCommerce investments are extensive, featuring companies like eMAG and Meesho.

Prosus N.V. demonstrated a steady increase in its annual revenues from 2019 to 2022. The company scored revenues of US$2.65 billion in 2019. In 2020, there was a growth to US$3.33 billion, reflecting a 25% rise. This positive trend gained momentum in 2021, with revenues climbing to US$5.12 billion, which is a significant 53% increase from the previous year. The growth trajectory continued in 2022, with revenues reaching US$6.87 billion, marking a 34% increase from 2021.

3. Next Plc

Next Plc is a leading British retailer known for selling clothes, shoes, accessories, beauty, and home items. In 2022, well over half (57%) of its sales came from its online business, showing its strength in online retail. Next has grown by buying brands like Lipsy and running online sales for big names like Victoria's Secret in the UK.

Next Plc's revenue journey from 2019 to 2022 shows a mix of decline and recovery. In 2019, their revenue was at US$5.45 billion. However, in 2020, there was a decrease to US$4.53 billion, a drop of 16%. This downturn was followed by a strong rebound in 2021, with revenues surging to US$6.36 billion, a significant recovery with a 40% increase. The upward trend continued modestly into 2022, with revenues reaching US$6.74 billion, showing a further 6% increase from the previous year.

4. Adevinta ASA

Adevinta ASA, a subsidiary of Schibsted ASA, operates as a provider of online and digital marketplaces. Founded in 2019 and headquartered in Oslo, Norway, the company plays a pivotal role in connecting local communities through its digital platforms. The company offers a variety of online classifieds catering to different sectors, including generalists, real estate, cars, jobs, and other internet marketplaces.

Adevinta ASA's revenue pattern from 2019 to 2022 shows significant growth. The company began with US$760 million in 2019. In 2020, there was a modest increase to US$780 million, marking a 2% rise. The real jump came in 2021, with revenues soaring to US$1.31 billion, representing a substantial 68% increase from 2020. The upward momentum was even more pronounced in 2022, as revenues reached US$2.23 billion, showing a striking 70% rise from the previous year.

5. On Holding AG

On Holding AG, based in Zurich, Switzerland, has been steadily growing in the sports products market. Established in 2010, the company specializes in athletic footwear, apparel, and accessories. They distribute their products through various channels, including independent retailers, distributors, online platforms, and physical stores. On Holding AG made its debut on the New York Stock Exchange (NYSE) in 2021.

On Holding AG's revenue trends from 2019 to 2022 depict a strong and consistent growth. 2019’s revenues of US$275.38 million saw a considerable increase in 2020, reaching US$492.35 million, which is a notable 78% jump from the previous year. This positive growth trajectory continued into 2021, with revenues climbing to US$780 million, a 58% increase from 2020. The growth trend didn't stop there; in 2022, revenues further escalated to US$1.29 billion, marking a substantial 65% increase over 2021.

6. Auto Trader Group Plc

Auto Trader Group Plc operates in the online car market, providing products and services to retailers and home traders to support their online activities. Their product portfolio includes various vehicles such as cars, bikes, vans, motorhomes, caravans, trucks, and more, both new and used. Auto Trader's online marketplace allows consumers to buy and sell these vehicles, while dealerships advertise their stock.

Auto Trader Group Plc's revenue from 2019 to 2022 presents a pattern of growth followed by a recent decline. The company's revenue in 2019 was US$1.71 billion. In 2020, there was an increase to US$2.06 billion, indicating a 20% rise. The growth continued into 2021, with revenues reaching US$2.47 billion, a further 20% increase from the previous year. However, in 2022, revenues dropped to US$2.12 billion, a decrease of 14% from 2021.

7. Allegro.eu SA

Allegro.eu SA, an eCommerce company based in Poland, has experienced remarkable growth over the years. Founded in 1999 to compete with eBay in Europe, it initially focused on online auctions. Today, it's the fifth most popular website in Poland with approximately 16 million active customers, selling around 70 million items annually.

Allegro's primary business involves selling physical products, mainly new, and it serves as a platform for over 120,000 other companies to sell their products. Additionally, Allegro offers financial services, including installment financing and leasing.

Allegro.eu SA's revenue from 2019 to 2022 shows an impressive and steady rise. Starting with US$2.48 billion in 2019, the company saw its revenue increase to US$3.16 billion in 2020, marking a 27% growth. This upward trend gained more momentum in 2021, with revenues jumping to US$4.85 billion, reflecting a substantial 53% increase from the previous year. The growth reached new heights in 2022, as Allegro.eu SA's revenue soared to US$7.84 billion, a remarkable 61% increase from 2021.

8. Ocado Group Plc

Ocado Group Plc is a significant player in the online grocery market with a diverse product portfolio, including health products, personal care, beauty products, clothing, bakery, frozen foods, and more. The company operates in multiple countries, providing IT platforms, customer fulfillment centers, and end-to-end online retail solutions.

Ocado Group Plc's revenue pattern from 2019 to 2022 shows initial growth followed by a recent dip. In 2019, the company's revenue was US$2.26 billion. The next year, 2020, saw an increase to US$3.1 billion, marking a 37% growth. The upward trend continued, albeit at a slower pace, in 2021 with revenues reaching US$3.32 billion, a 7% increase from 2020. However, in 2022, there was a shift in this pattern as revenues decreased to US$3 billion, showing a 10% decline from the previous year.

9. Zalando SE

Zalando SE is an online platform for fashion and lifestyle products, headquartered in Berlin, Germany. Operating in multiple European countries, the company offers a wide range of lifestyle products, including shoes, apparel, accessories, and beauty products for women, men, and children under various private-label brands.

Zalando has a history of accumulating losses until it became profitable in 2014, with a focus on cost management and expansion into additional markets. In 2021, the company aimed to achieve a gross merchandise volume (GMV) of over €30 billion (US$32.2 billion) by 2025.

Zalando SE's revenue trends from 2019 to 2022 reveal initial growth followed by a recent downturn. The company started with a revenue of US$7.26 billion in 2019. In 2020, there was a significant increase to US$9.11 billion, which translates to a 25% rise. The positive momentum continued into 2021, with revenues soaring to US$12.25 billion, a notable 34% increase from the previous year. However, 2022 marked a change in this trend, with revenues decreasing to US$11.57 billion, a 5% drop from 2021.

10. Redcare Pharmacy N.V.

Founded in 2001, Redcare Pharmacy N.V. is a public company headquartered in the Netherlands. This multinational company primarily generates its eCommerce activity in Germany, with Belgium accounting for the second-largest share. Redcare Pharmacy N.V. specializes in the Care Products category within its eCommerce platforms and also offers products from the Hobby & Leisure category. Notably, in 2022, eCommerce net sales contributed to approximately 95% of the company's revenue.

Redcare Pharmacy NV's revenue from 2019 to 2022 shows a consistent pattern of growth each year. In 2019, the company's revenue was US$784.8 million. The following year, 2020, saw an increase to US$1.1 billion, representing a 40% rise. This growth trajectory continued in 2021, with revenues reaching US$1.25 billion, a 13% increase from the previous year. The upward trend persisted into 2022, with revenues further climbing to US$1.35 billion, showing a 7% increase over 2021.

Most Valuable European eCommerce Companies: Future Trends

Concluding our dive into Europe's eCommerce giants, it's clear that PDD Holdings Inc. has emerged as a powerhouse, showcasing an extraordinary ascent. Throughout 2023, the company saw its market capitalization surge by nearly US$100 billion. With all indicators—be it price ratios, earnings forecasts, or expert opinions—leaning towards even further gains, PDD stands out. Yet, it's not without its challenges, as recent fears over its app Temu potentially peaking in the U.S. market have led to a notable decline in its stock price.

On the other end of the spectrum, Zalando SE represents the challenges faced by European eCommerce firms in a market increasingly dominated by American and Chinese players. With a staggering loss of over 80% of its market value since 2021, Zalando's struggle is emblematic of the broader issue. Despite analysts' optimism about its stock being undervalued, the company has consistently fallen short of earnings expectations, reflecting a persistent struggle to regain its footing.

Allegro.eu SA's story isn't much different, with a 60% drop in value and earnings that didn't hit the mark. Its stock is also seen as undervalued, but recovery signs are slow, making investors wary. In contrast, Redcare Pharmacy N.V. looks set to do well, with its value more than tripling in the last year thanks to rising sales, showing a more positive outlook compared to its rivals.

Learn More About ECDB

What is Market Cap?

Market cap, which stands for market capitalization, is a method to figure out how much a company is worth. It's straightforward — just take the current price of a company's stock and multiply it by the total number of shares the company has issued. This figure gives us a snapshot of a company's size from the perspective of investors.

For instance, if a company has 1 million shares and each one is priced at US$50, then the market cap is US$50 million. This figure is important in the stock world. It makes it easier for people to compare companies, regardless of the number of shares they have. While it's not without its flaws, it offers a quick way to gauge a company's size and its significance in the stock market.

Sources: PDD Holdings, Stock Analysis: 1, 2, GlobalData: 1, 2, 3, Adevinta, Yahoo! Finance, Allegro, Ocado Group, Redcare Pharmacy, ECDB

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

The Global B2B eCommerce Market: Why It Is Beneficial to Sell to Other Businesses

Deep Dive

Why Did Amazon Fail in China: Local Competition Defeats the Retail Giant

Why Did Amazon Fail in China: Local Competition Defeats the Retail Giant

Deep Dive

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

eCommerce in Indonesia: Revenues Projected to Cross US$100 Billion in 2025

Deep Dive

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Top 10 Online Shopping Sites in the USA: Amazon, Walmart, Apple

Deep Dive

Online Ticketing 2024: Event Pricing, Market Size, & Trends

Online Ticketing 2024: Event Pricing, Market Size, & Trends

Back to main topics