eCommerce: Market Trends

The 5 Largest eCommerce Markets in Europe and What Makes Them Special

Europe's eCommerce market is shaped by 5 countries in particular. Can you guess who's leading?

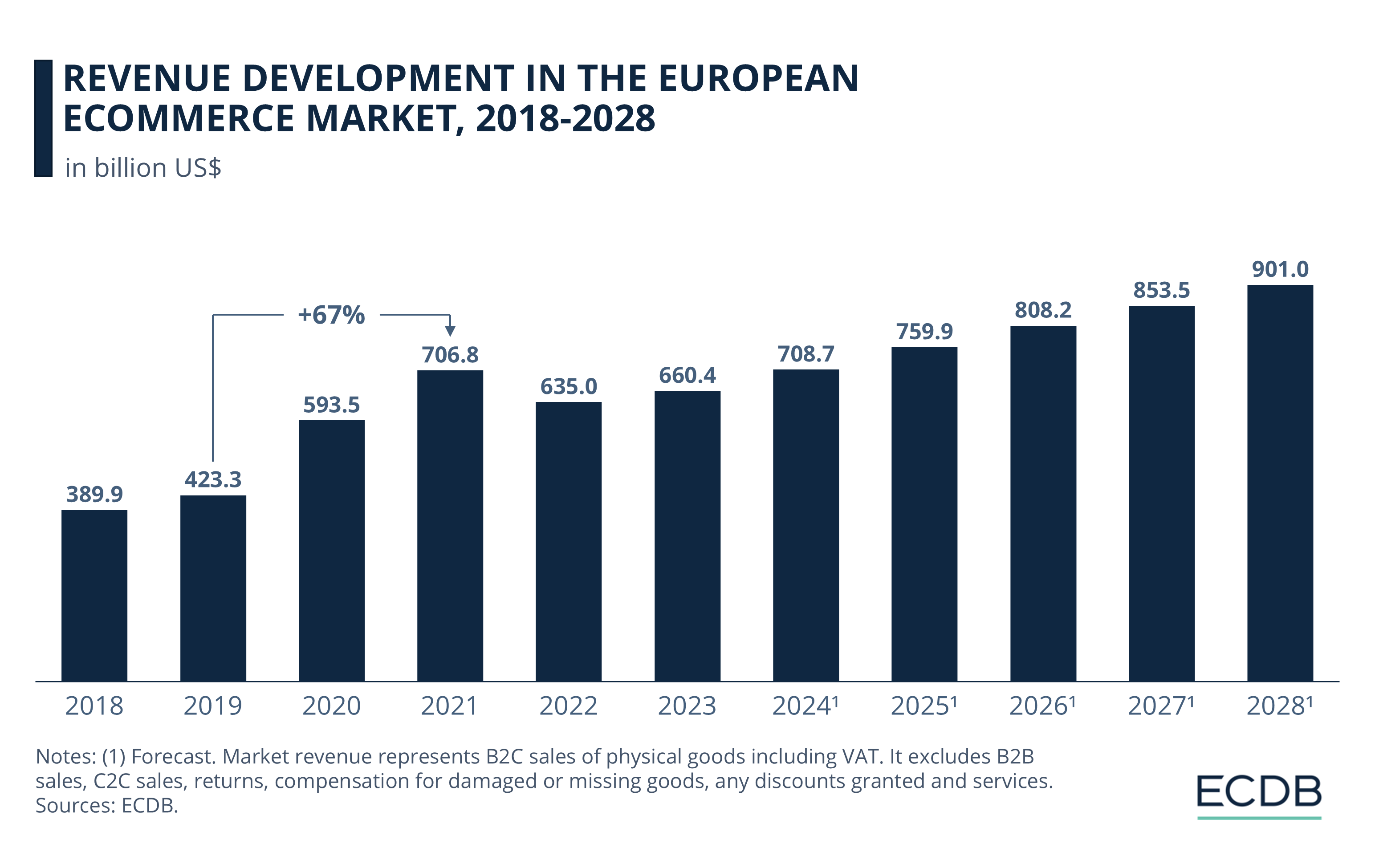

October 23, 2024Europe, despite its relatively small geographic size, boasts one of the largest and most dynamic eCommerce markets in the world. In 2023, the European eCommerce market reached a total sales volume of US$708 billion. Projections indicate steady growth over the coming years, with the market forecast to reach US$900 billion by 2028.

This growth is fueled by high eCommerce penetration in leading economies such as the UK, Germany, and the Netherlands, where rates already surpass 80%. Additionally, smaller but rapidly expanding markets in Southern and Eastern Europe, such as Greece, Portugal, and Poland, present substantial opportunities for future growth.

What are the largest eCommerce markets in Europe? How do sales trends, top product categories, and popular payment and shipping providers vary across these countries?

1. United Kingdom

The largest eCommerce market in Europe, the United Kingdom ranks as the 3rd largest eCommerce market worldwide – behind China and the U.S. Online retail represents 26% of the UK's retail market, expected to rise to 31% by 2028. The market is dominated by Amazon.co.uk with US$16.1 billion in revenue in 2023.

Growing by 7%, the UK market is projected to reach a revenue of US$152.5 billion by the end of the year. Looking forward, the market is expected to grow at a compound annual growth rate (CAGR) of 6% from 2024 to 2028, reaching US$192.6 billion.

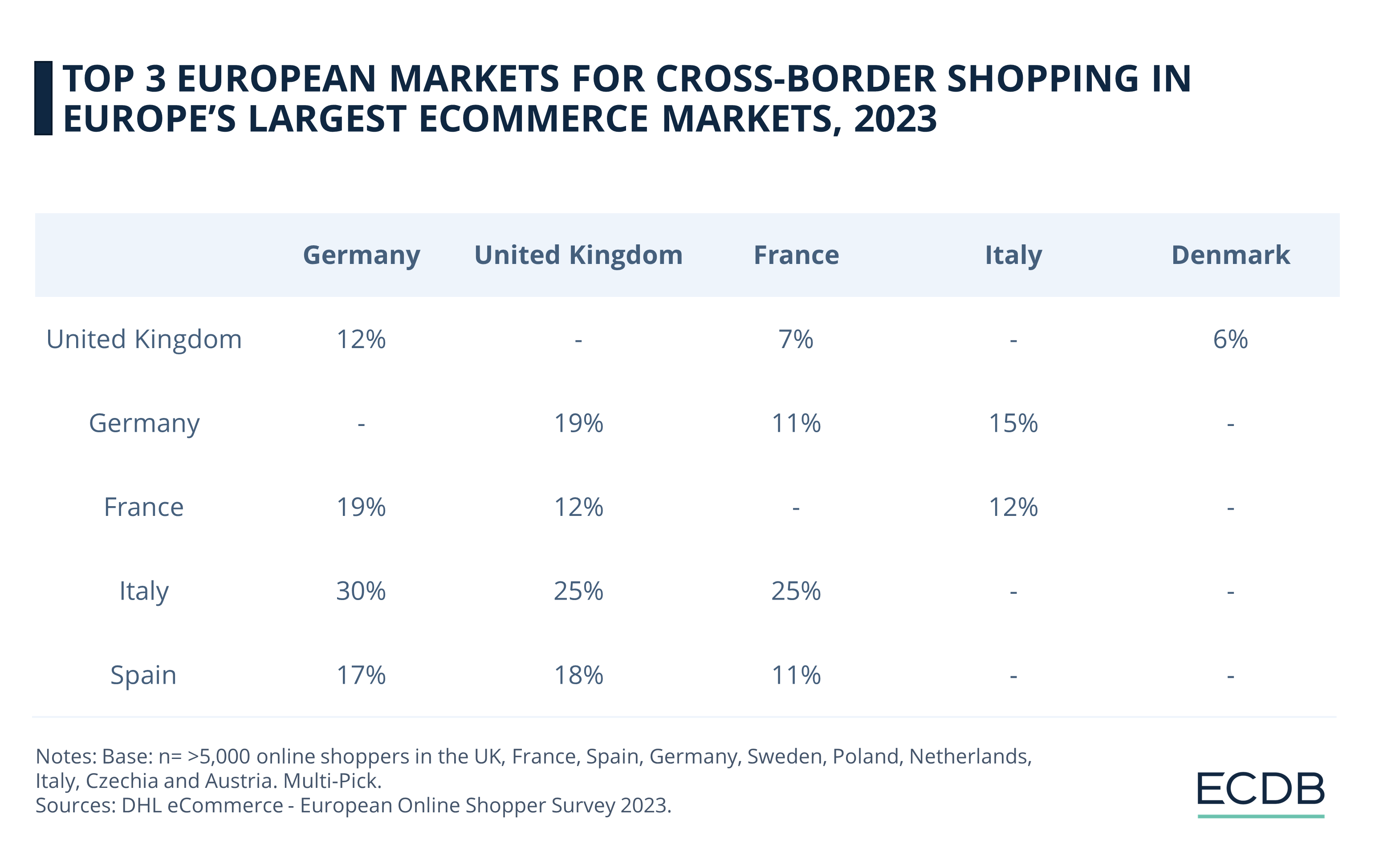

The UK is also a key country for cross-border shopping in Europe. It is the top destination for Germany (with 19% of consumers shopping cross-border from the UK) and Spain (18%), while it is the second most popular destination for cross-border shoppers in France (12%) and Italy (25%).

Fashion is the top eCommerce category in the country, making up over a quarter (28%) of the 2023 revenues. This is followed by Electronics (16%), Hobby & Leisure (15%), Grocery (12%), Furniture & Homeware (9%), Care Products (9%), and DIY (7%).

Payment preferences are led by VISA and Mastercard, both at 97%, and American Express at 62%. E-wallets like PayPal (82%) and Apple Pay (20%) are also popular. While Royal Mail handles 54% of eCommerce shipping in the country, DPD, DHL, UPS, and Parcel Force also play key roles in the diverse market.

2. Germany

Germany, the second-largest eCommerce market in Europe, ranks 6th globally. Online retail accounts for 17% of Germany's retail market, projected to grow to 21% by 2028. Amazon.de leads with US$15.8 billion in revenue in 2023.

The German market, expected to rise by 2.4% in 2024, will reach US$110.6 billion by year-end. From 2024 to 2028, a compound annual growth rate (CAGR) of 4.5% is anticipated, pushing the market to US$131.9 billion.

Like in the UK, Fashion leads the German eCommerce sector, accounting for 25% of 2023 revenues. Next are Hobby & Leisure (24%), Electronics (21%), Furniture & Homeware (10%), Care Products (8%), Grocery (6%), and DIY (5%).

Payment methods in Germany are diverse, with PayPal leading at 93%, followed by VISA and Mastercard with 82%. Bank transfers are used by 77% of stores, and Sofortüberweisung by 53%. DHL dominates shipping services, handling 85% of deliveries, with DPD, UPS, GLS, and Deutsche Post also significantly contributing to the market.

3. France

France, the third-largest eCommerce market in Europe, ranks 10th globally. Online retail makes up 17% of France's retail market, expected to rise to 21% by 2028. Amazon.fr leads with US$6.5 billion in revenue in 2023.

The French market is set to grow by 5.9% in 2024, reaching US$70 billion by year-end. From 2024 to 2028, a compound annual growth rate (CAGR) of 4.6% is anticipated, resulting in a market volume of US$83.9 billion.

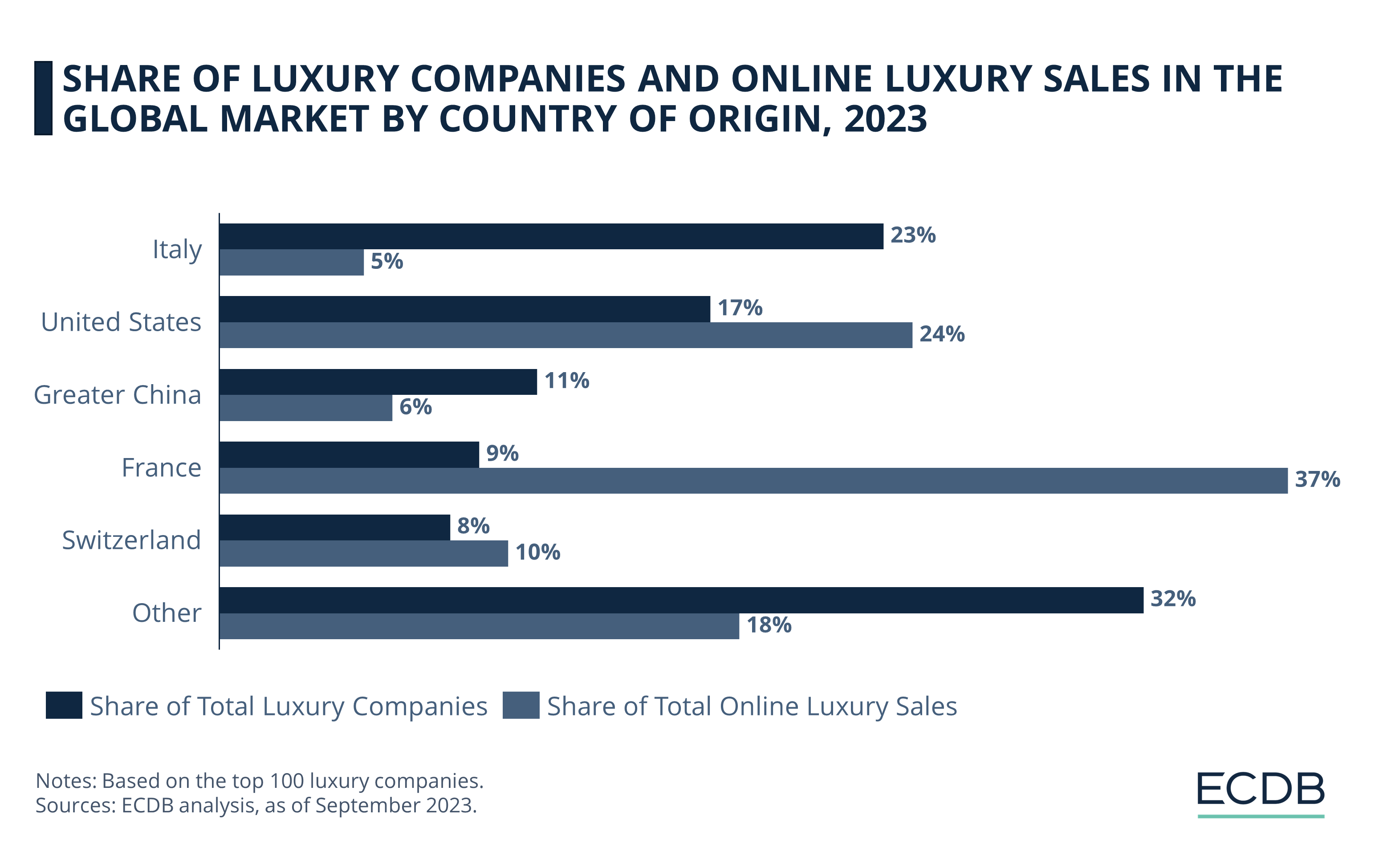

Despite accounting for a relatively small share of the global luxury market (9%), French luxury companies make up the largest share of total online luxury sales (37%).

In France, Hobby & Leisure is the largest eCommerce segment, comprising 22% of 2023 revenues. This is followed by Grocery (19%), Fashion (17%), Electronics (13%), DIY (12%), Care Products (9%), and Furniture & Homeware (6%).

In France, VISA and Mastercard are the top cards, each used by 96% of online stores, followed by CB at 64%. PayPal is also widely used, at 79%, and bank transfers at 51%. Chronopost handles 40% of shipments, while La Poste (34%), Colissimo (33%), DPD (20%), and GLS (12%) also have notable shares in the shipping market.

4. Russia

Russia, the fourth-largest eCommerce market in Europe, ranks 9th globally. Online retail accounts for 9% of Russia's retail market, projected to rise to 12% by 2028. Wildberries.ru leads with US$5.9 billion in revenue in 2023.

The Russian market is set to grow by 9% in 2024, reaching US$76.5 billion by year-end. From 2024 to 2028, a compound annual growth rate (CAGR) of 5.3% is anticipated, resulting in a market volume of US$94.1 billion.

Electronics is the leading category in Russia’s eCommerce market, making up 23% of 2023 revenues. Following are Hobby & Leisure (21%), Fashion (19%), Furniture & Homeware (11%), Care Products (9%), DIY (8%), and Grocery (7%).

VISA and Mastercard are the most common card payment options in Russia, each at 84%, with MIR at 64%. Cash on delivery is used by 71% of stores, and bank transfers by 46%. Russian Post is the leading shipping provider, used by 49% of retailers, followed by CDEK, Boxberry, and DPD, which also hold significant portions of the market.

5. Italy

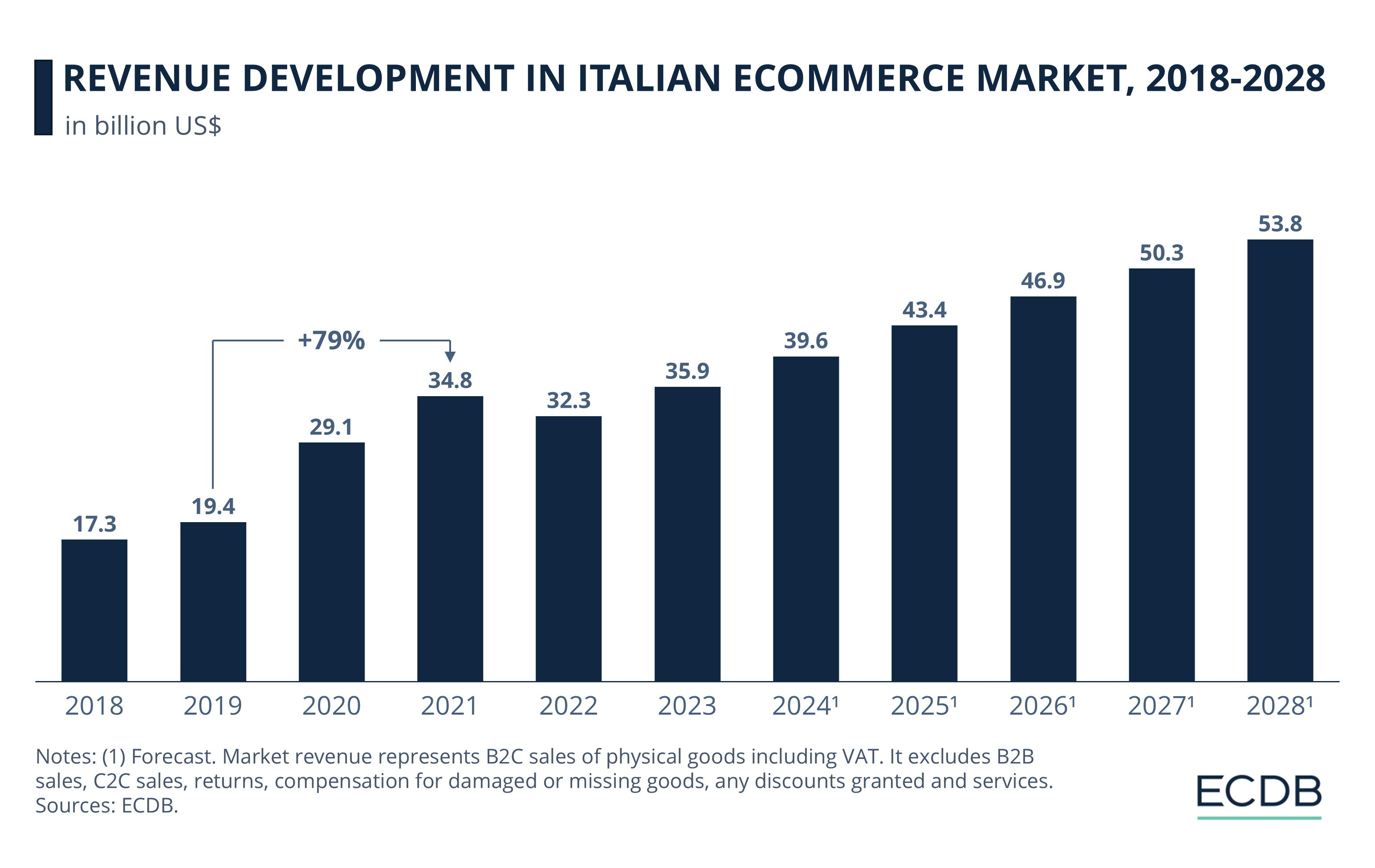

Italy, the fifth-largest eCommerce market in Europe, ranks 13th globally. Online retail accounts for 12% of Italy's retail market, projected to rise to 17% by 2028. Like in most top eCommerce markets in Europe, the Italian Amazon domain Amazon.it leads with US$6.3 billion in revenue in 2023.

The Italian market is set to grow by 10% in 2024, reaching US$39.5 billion by year-end. From 2024 to 2028, a compound annual growth rate (CAGR) of 8% is anticipated, resulting in a market volume of US$53.8 billion.

Hobby & Leisure tops Italy’s eCommerce market, contributing 24% to 2023 revenues. It is followed by Electronics (22%), Fashion (18%), Furniture & Homeware (11%), Care Products (9%), DIY (9%), and Grocery (5%).

In Italy, VISA and Mastercard are each accepted by around 95% of online stores, with PayPal at 91% and bank transfers at 65%. Cash on delivery is used by 52% of retailers. Bartolini (BRT) dominates the shipping sector, handling 45% of deliveries, while GLS, DHL, UPS, and SDA (Poste Italiane) also play important roles in the competitive market.

European eCommerce Market on Its Way to US$1 Trillion

It's no secret at this point that the pandemic was a huge boost for eCommerce in many regions of the world. Europe was no exception:

Market sales of US$423 billion in 2019 rose to US$593 the following year, before jumping to an even more impressive US$706 billion in 2021. That's a 67% increase between 2019 and 2021.

Due to factors like market saturation and inflation, the next year wasn't as impressive. With a decline of 10%, the market dropped to US$635 billion in revenue - still above pre-pandemic levels.

Since last year, however, the market has been picking up speed and is not expected to decline again.

Our forecasts show that the European eCommerce market will reach US$708 billion in sales by the end of the year. This figure is expected to rise steadily to US$901 billion by 2028.

But where does all this money go? In other words, what products do Europeans buy online?

What Do Europeans Buy Online?

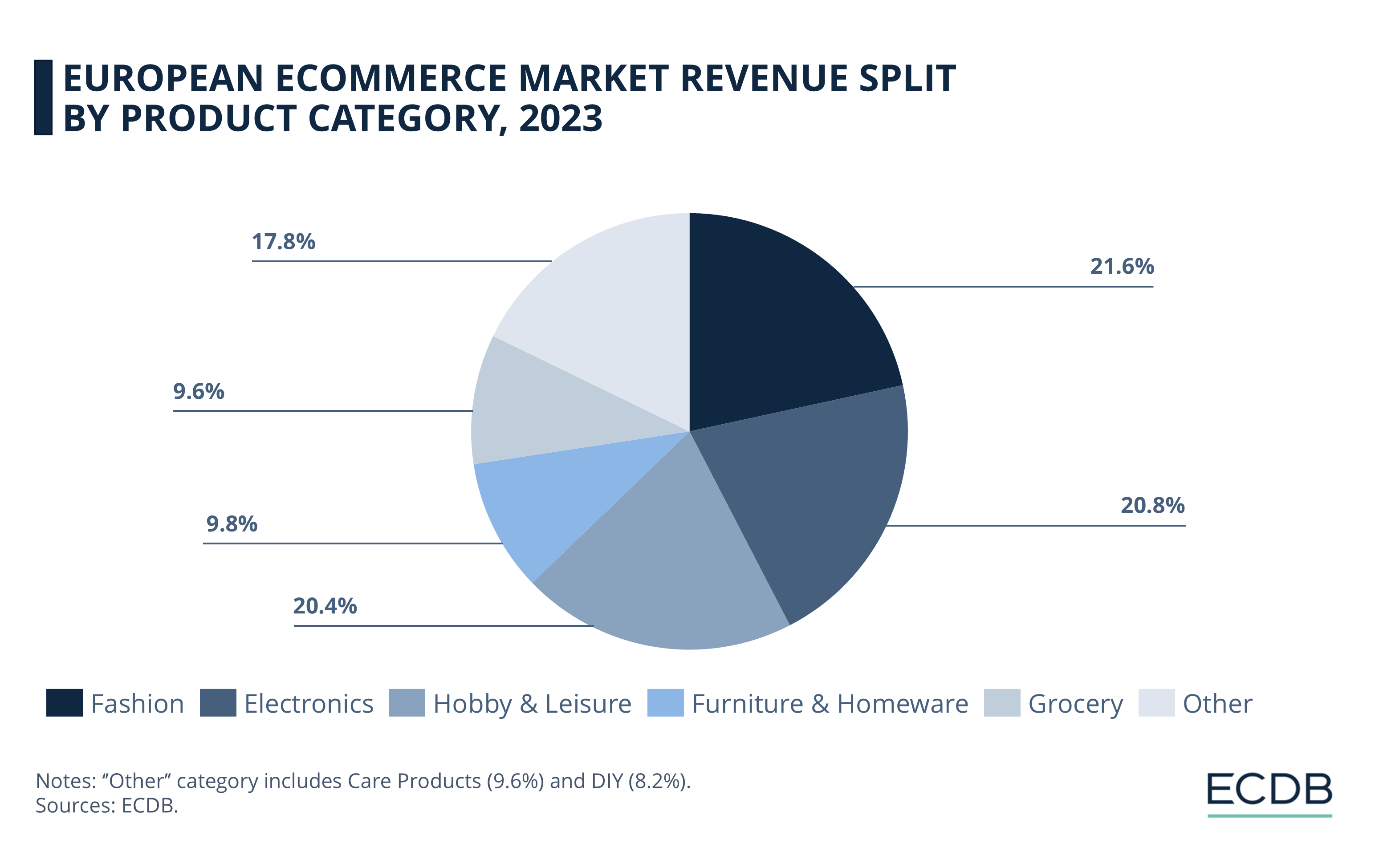

Our revenue split data shows what online shoppers in Europe buy the most.

Fashion leads the way with 21.6% of market revenue. This doesn't come as much of a shock, as Fashion is also the largest category worldwide (27%).

The top category is closely followed by Electronics and Hobby & Leisure, each with around 20% of the market.

While Furniture & Homeware, Grocery and Personal Care have similar market shares ranging from 9.8% to 9.6%,

The DIY category represents a smaller portion of the market at 8.2%.

Main product categories, however, only tell part of the story.

Consumer Electronics and Apparel with the Largest Market Shares

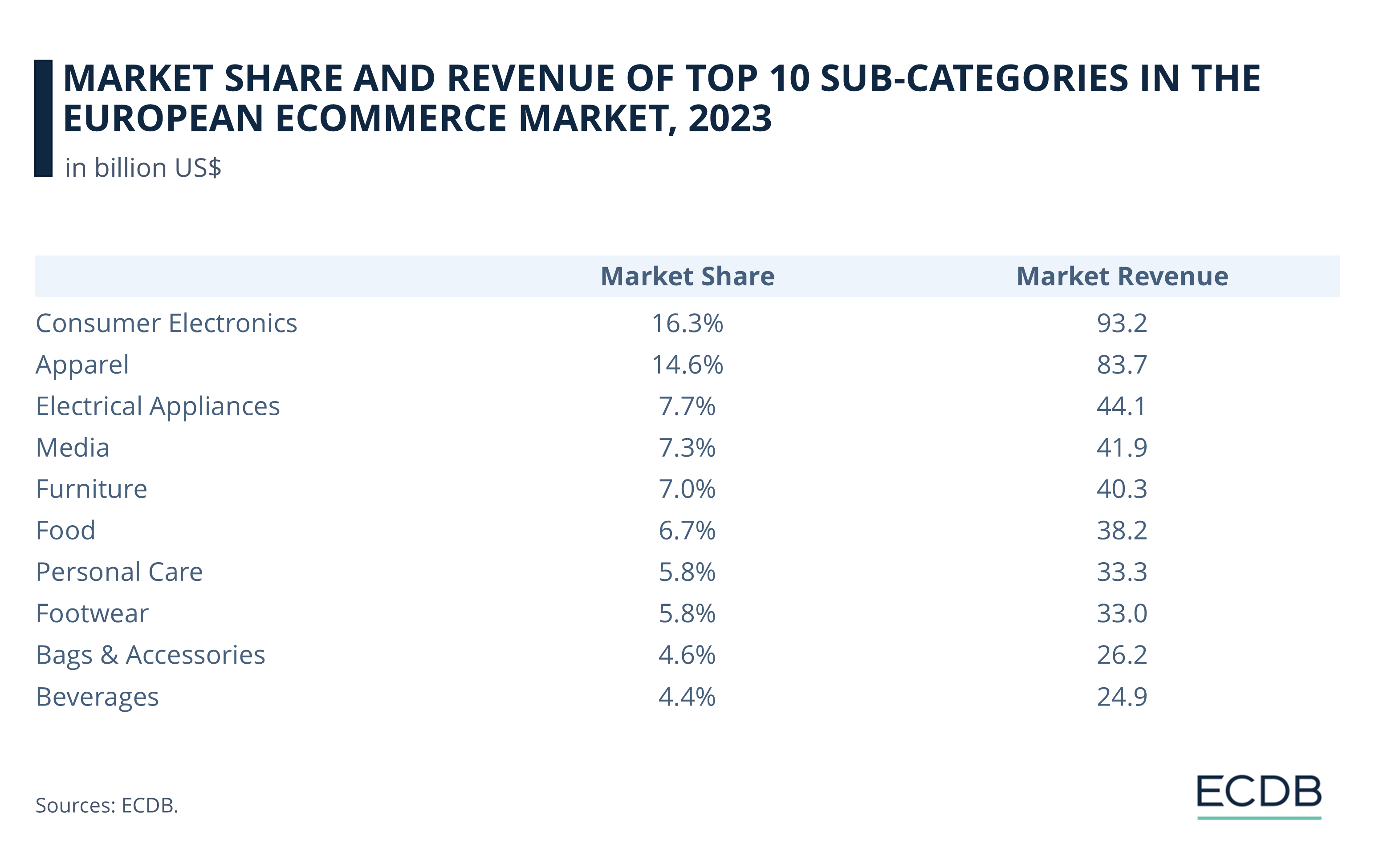

To go more granular, we have to take into account the sub-categories. Sorting these sub-categories by market share, we see Consumer Electronics and Apparel at the top.

While Consumer Electronics makes up 16.3% of the European eCommerce market, Electrical Appliances (the other Electronics sub-category) isn't too far down at 7.7%. With 14.6%, Apparel is the product category with the second largest market share in Europe. Its sister sub-categories Footwear and Bags & Accessories are at 5.8% and 4.6% respectively.

Other top sub-categories for online shopping in Europe include Media, Furniture, Food, Personal Care and Beverages, with market shares ranging from 4.4% to 7.3%.

Digital Wallets are the Top Payment Method for Most Europeans

As well as what Europeans buy online, knowing what they pay with is just as important.

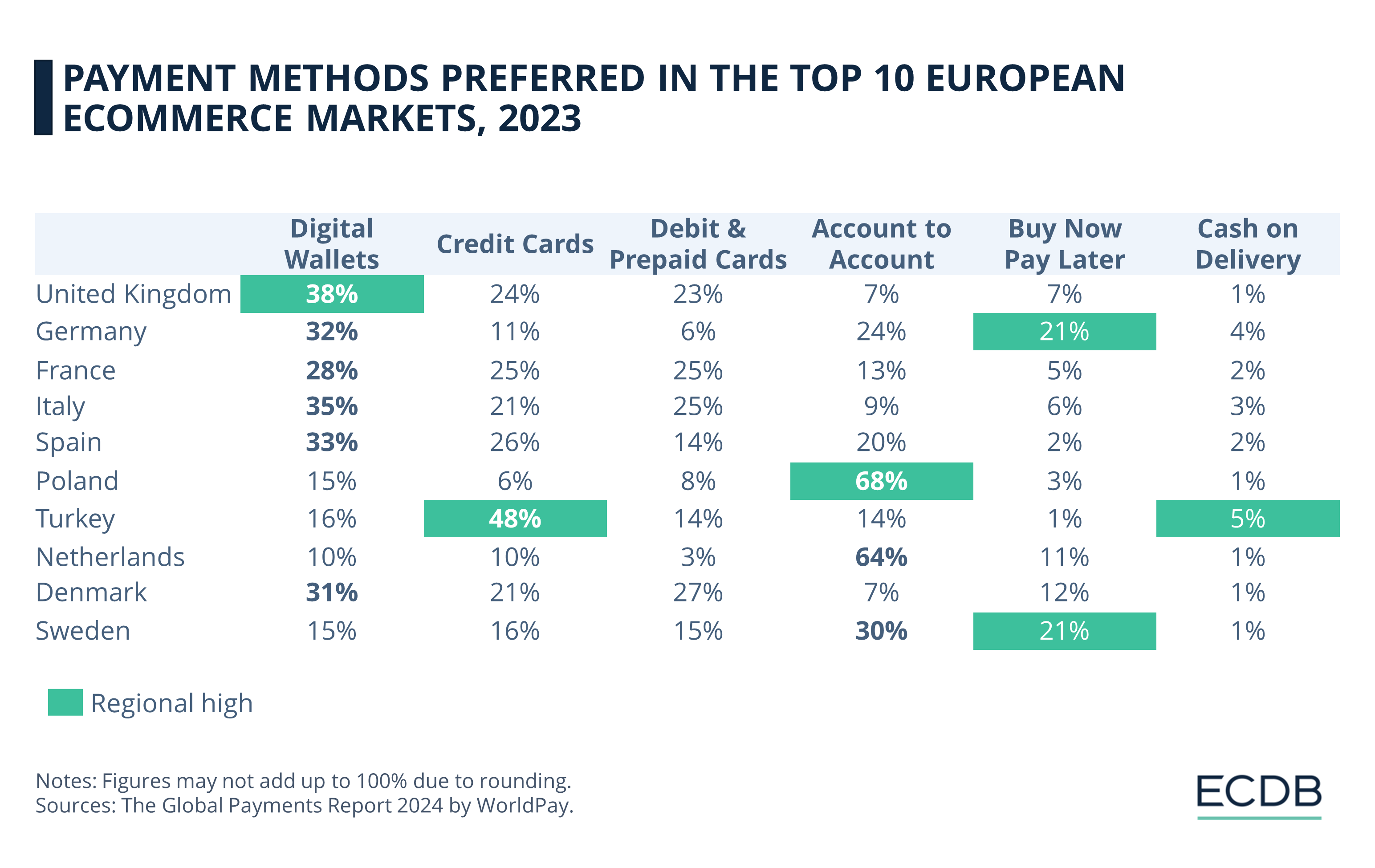

A report from WorldPay paints a clear picture. As shown in the chart below, digital wallets are the most popular payment method for online shopping in most of the European countries included in the study, with the UK having the largest share (38%) of shoppers using this payment method.

Valuable Insights: Our data-driven rankings are regularly refreshed to provide you with crucial insights for your business. Find out which stores and companies are performing will in the eCommerce space and which categories are topping the sales charts. Stay ahead of the market with our rankings for companies, stores, and marketplaces.

In addition to digital wallets, account-to-account (A2A) payments - simply transferring money directly from one bank account to another without using a debit or credit card - are also growing in popularity. In fact, A2A is the most popular eCommerce payment method in Poland, the Netherlands and Sweden, with 68%, 64% and 30% of shoppers respectively preferring this method.

Looking at other payment methods used in European eCommerce, Buy Now Pay Later (BNPL) stands out. With 21% in both Germany and Sweden, BNPL is also popular in Denmark (12%) and the Netherlands (11%).

Turkey is also an interesting case: It's by far the leading country in Europe for using credit cards for online purchases, with almost half (48%) of shoppers using this payment method. Cash on delivery is also very popular, with 5% of Turkish shoppers paying by cash on delivery, the highest in the region.

But what about the financial aspects of eCommerce in the continent: how big a role does eCommerce play in the economies of European countries?

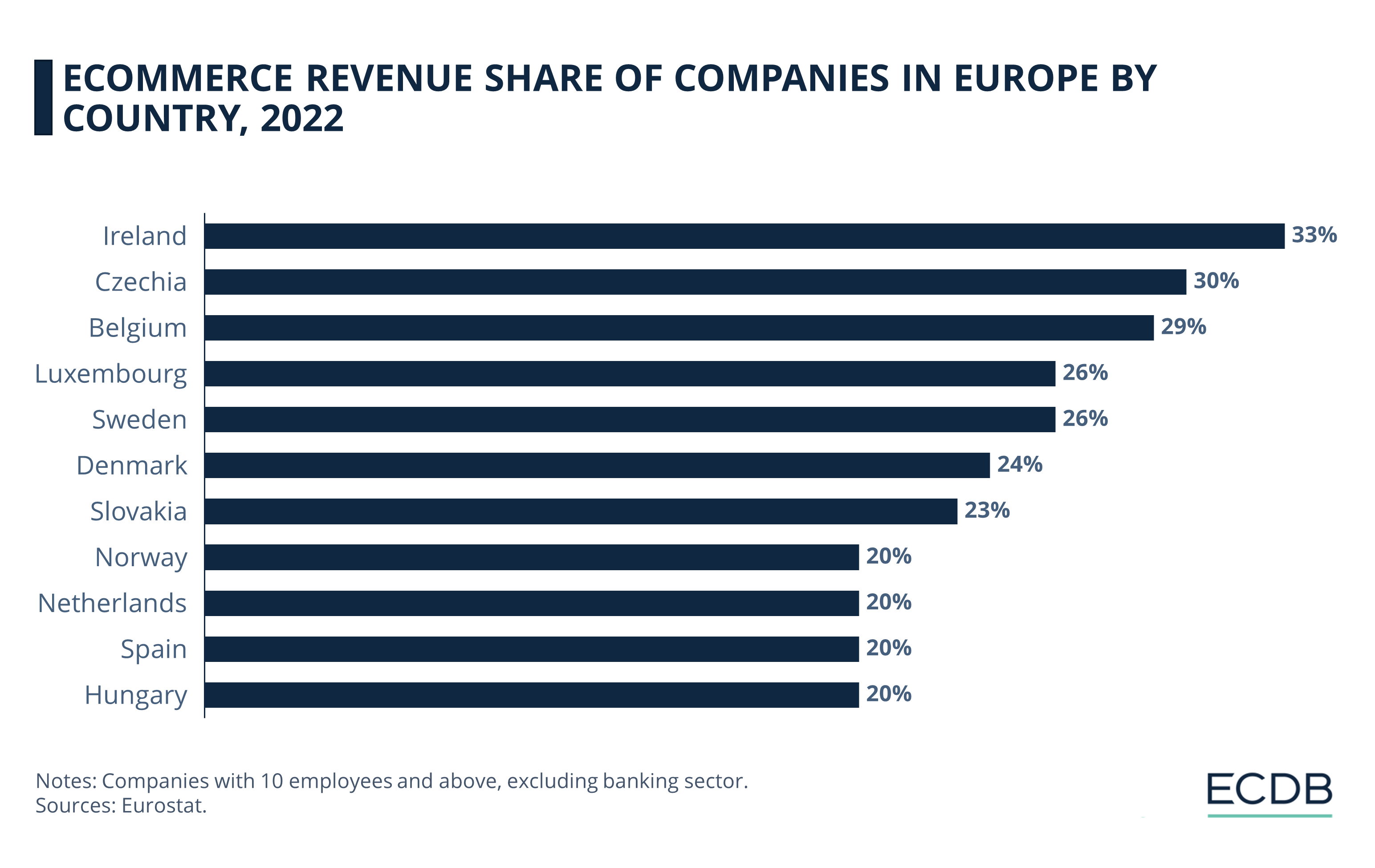

Ireland, Czechia, and Belgium Lead in eCommerce Revenue Share in Europe

Taking the distribution of eCommerce revenue shares by companies in various European countries, Ireland stands out with a 33% share, followed by Czechia at 30% and Belgium at 29%. Luxembourg and Sweden both capture a 26% share, with Denmark slightly behind at 24% and Slovakia at 23%.

A cluster of countries—Norway, the Netherlands, Spain, and Hungary—all hold a 20% share, underscoring a more evenly distributed eCommerce environment in these countries.

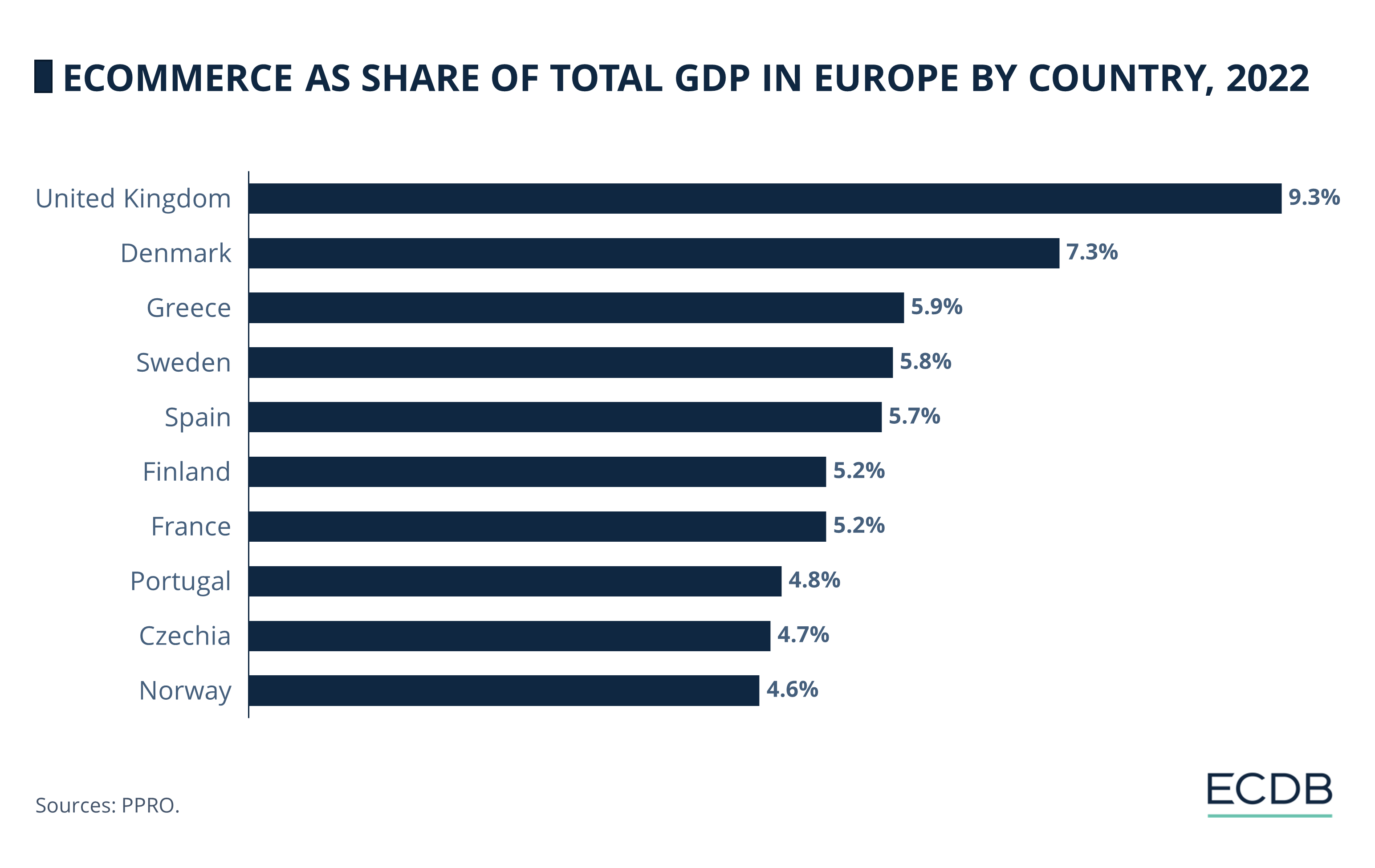

UK Leads in Online Shopping; Denmark and Greece Show Strong Adoption

As per data from PPRO on Europe's online shopping market:

The United Kingdom leads with its eCommerce market making up 9.3% of its GDP.

Denmark, Greece and Sweden, though smaller in market size, have significant eCommerce sectors comprising respective 7.3%, 5.9% and 5.8% of their GDPs.

Despite having a larger economy, Spain has an online shopping market that accounts for about 5.7% of its total GDP.

Spain is followed by Finland and France, both at 5.2%.

Portugal, Czechia and Norway round out the top 10 with shares varying between 4.6 and 4.8%.

The Future of European eCommerce

As Europe's eCommerce sector continues to grow, increased competition from low-cost online marketplaces, such as Temu, is shaping the landscape. While recovering consumer confidence has contributed to this year's growth, the surge of budget-conscious shopping has fueled platforms like Temu, owned by PDD Holdings, to capture a larger share of the market. With competitive pricing strategies, these platforms are especially popular among cost-conscious consumers, offering items like hiking boots and smart watches at significantly lower prices than traditional European retailers.

This intensifying competition has raised concerns among local eCommerce players. Industry leaders in countries like Germany and Denmark argue that platforms such as Temu benefit from fewer regulatory constraints compared to European webshops, creating an uneven playing field. Despite these concerns, Temu maintains that it complies with local regulations and is actively inviting European merchants to join its platform.

Click here for

more relevant insights from

our partner Mastercard.

Related insights

Deep Dive

The United States Takes the International Lead in eCommerce Revenue per Capita

The United States Takes the International Lead in eCommerce Revenue per Capita

Deep Dive

Valentine’s Day Drives eCommerce Revenues for Flowers & Gifts

Valentine’s Day Drives eCommerce Revenues for Flowers & Gifts

Deep Dive

Shopify Is the Most Used Shop Software Globally, But Magento Dominates in Europe

Shopify Is the Most Used Shop Software Globally, But Magento Dominates in Europe

Deep Dive

Why the Online Pharmacy Trend Has Continued Beyond the Pandemic

Why the Online Pharmacy Trend Has Continued Beyond the Pandemic

Deep Dive

Why eCommerce and Luxury Sales Are Tough to Unite

Why eCommerce and Luxury Sales Are Tough to Unite

Back to main topics